Are you feeling overwhelmed by the process of drafting a compulsory insurance demand notice? You're not alone! Many individuals and businesses find the task daunting, yet it's essential for ensuring compliance and protecting your interests. In this article, we'll break down everything you need to know to create an effective noticeâso let's dive in and explore the ins and outs of this important document!

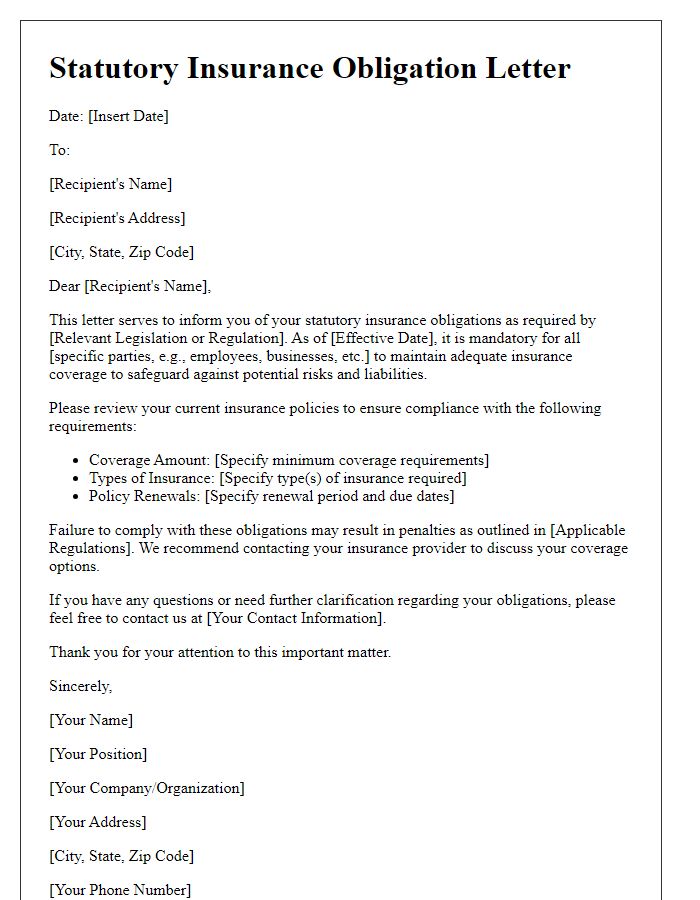

Header: Sender's contact information and logo

Compulsory insurance, mandated by law, requires individuals (or businesses) to maintain policies providing financial protection. In jurisdictions like the United States, healthcare insurance under the Affordable Care Act (ACA) outlines coverage types and penalties for non-compliance. The premiums for these policies can vary significantly, often influenced by factors such as age, health status, and geographic location. Failure to secure compulsory insurance may result in legal repercussions, including fines or legal proceedings, emphasizing the importance of maintaining adequate coverage. It's essential to review policy options promptly to ensure compliance with specific regulations set forth by governing bodies.

Date of notice issuance

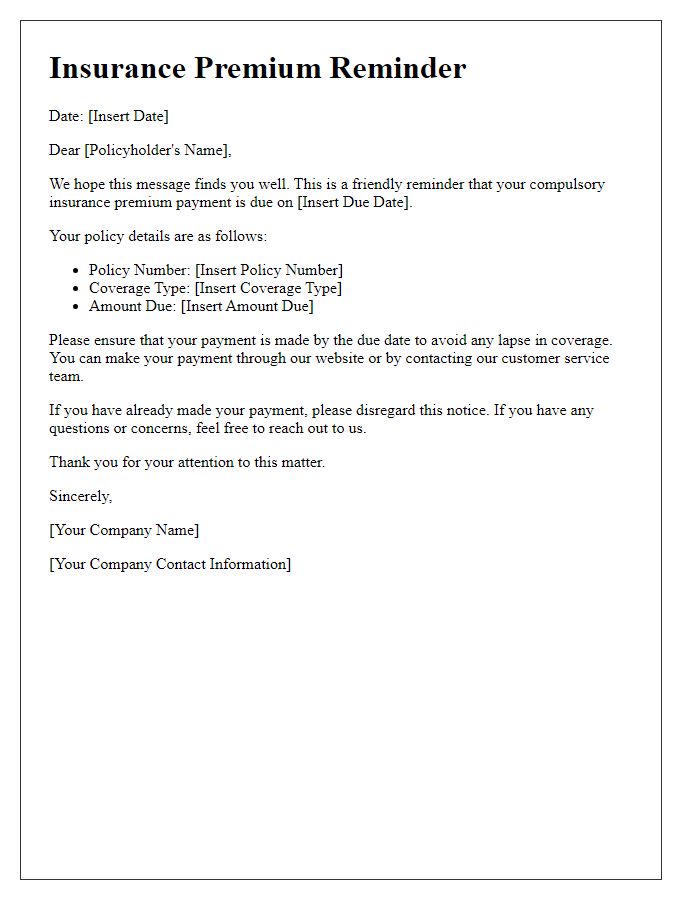

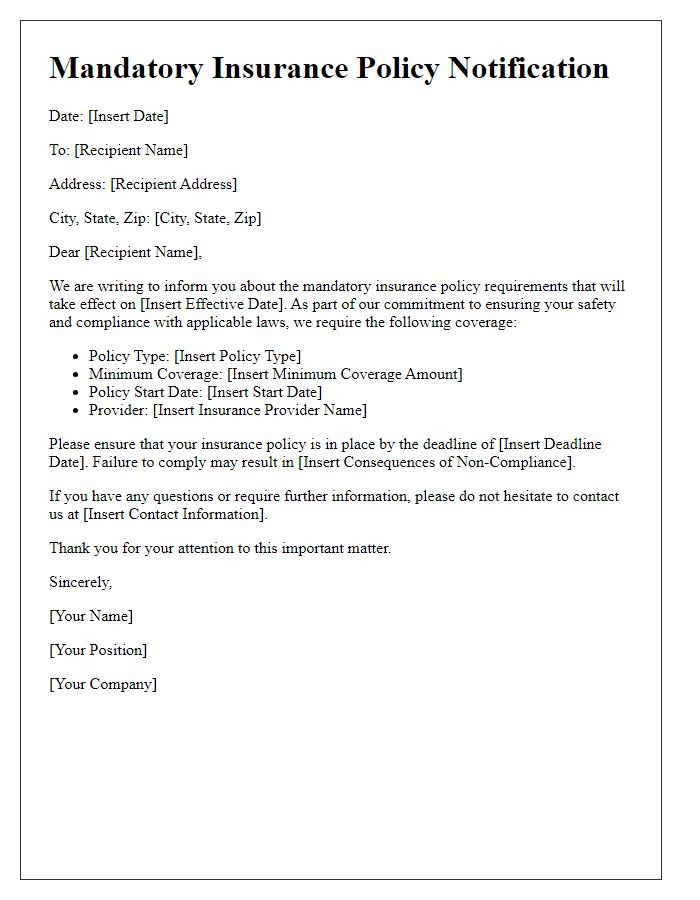

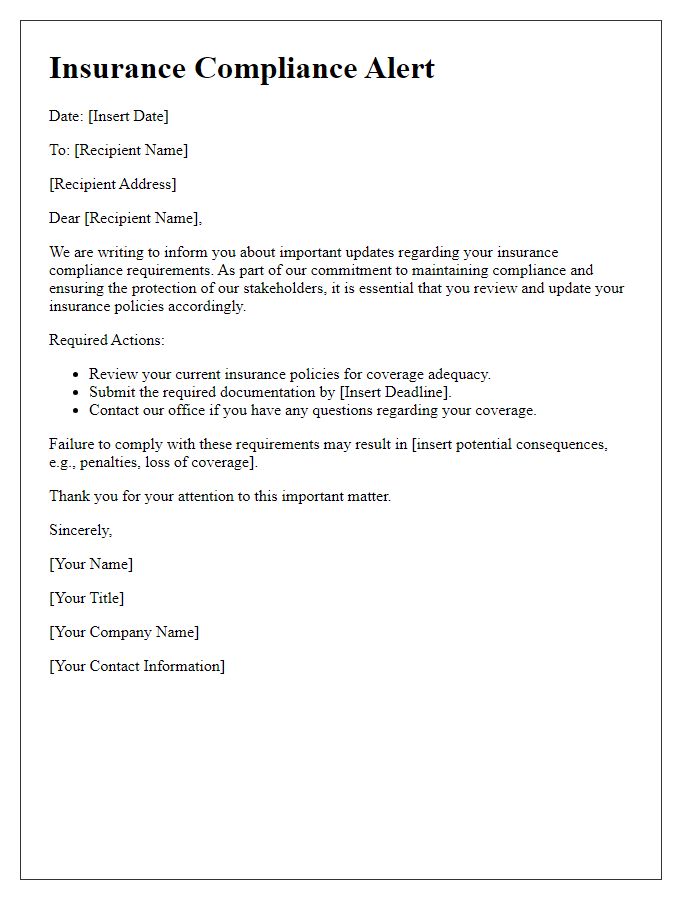

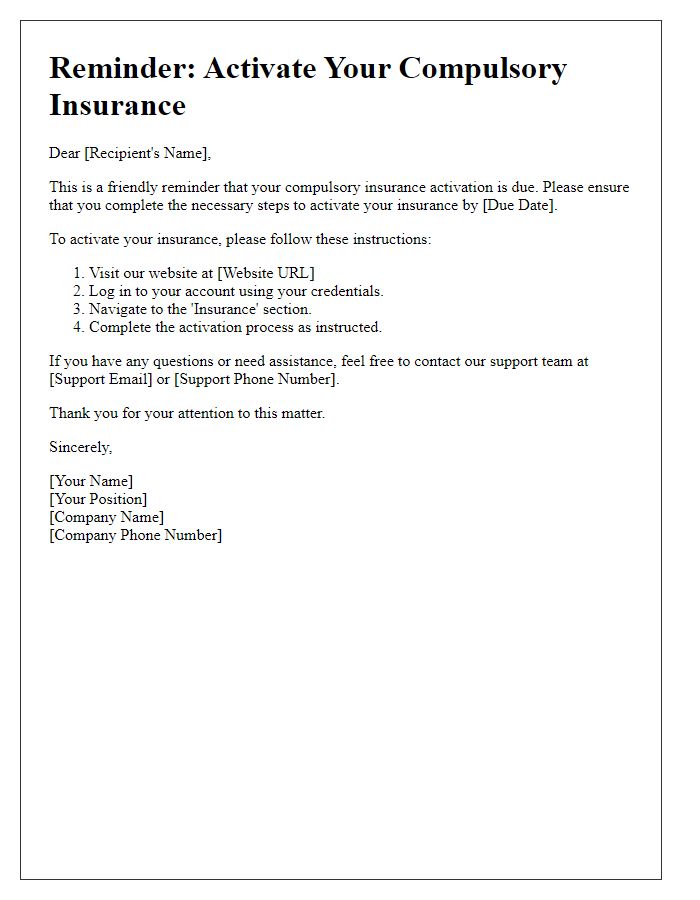

Compulsory insurance requirements play a crucial role in protecting individuals and businesses against various financial risks. The issuance of a compulsory insurance demand notice, dated for informative purposes, acts as an official reminder for policyholders regarding their essential coverage obligations. For example, motor vehicle insurance, mandated by law in many countries, ensures drivers maintain liability coverage to protect third parties in case of accidents. Non-compliance with these insurance mandates can lead to penalties, including fines or license suspension. These notices typically detail specific policy types required, deadlines for compliance, and relevant regulatory authority contact information for assistance.

Recipient's contact information

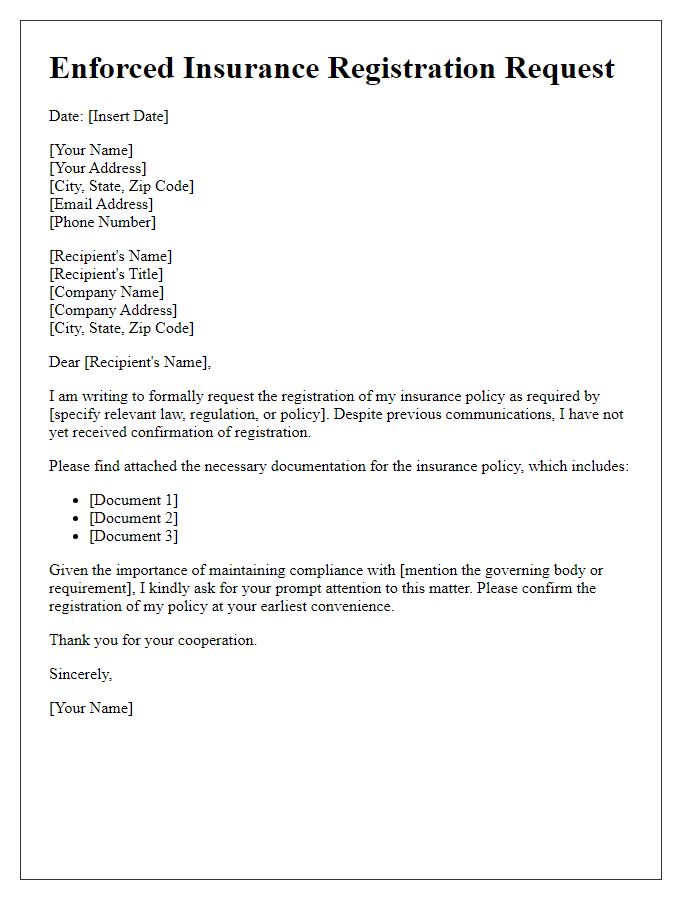

Compulsory insurance demand notices serve as formal communications to ensure compliance with legal insurance requirements. Recipients primarily include individuals or entities obligated to maintain specific insurance coverages, such as automobile insurance mandated by state laws or workers' compensation insurance required by federal regulations. Insurance providers often issue these notices, detailing the specific policy terms, expiration dates, and potential penalties for non-compliance. Clarity in the recipient's contact information, including full name, address, and phone number, is crucial for effective communication and ensures prompt resolution of any outstanding insurance obligations. Accurate records help in tracing the accountability of individuals or companies to prevent legal repercussions arising from lapses in mandatory insurance coverage.

Subject line specifying the demand for compulsory insurance

Compulsory insurance is a legal requirement for various sectors, including automotive, health, and workers' compensation industries. Entities such as policyholders and insurance companies must adhere to specific regulations set forth by government agencies. For instance, in the United States, states require car owners to maintain liability insurance that covers damages up to a minimum of $15,000 for bodily injury per person and $30,000 for total bodily injury per accident. Failing to secure mandatory insurance can lead to penalties, including fines and license suspension. Awareness of these legal obligations ensures compliance and protects individuals from unforeseen financial liabilities.

Clear statement of demand and consequences

In a compulsory insurance demand notice, a clear statement regarding the demanded insurance coverage is vital. The notice should specify the legal requirements under local statutes, mandating the insurance policy. Include details about the insurance type, coverage limits, and deadlines for compliance. Highlight potential consequences for non-compliance, such as fines, penalties, or legal action. The lack of insurance could lead to financial liabilities exceeding thousands of dollars, depending on the situation. It is essential to stipulate the date by which the policy should be provided, ensuring clarity for the recipient in [City Name, Country] to take immediate action.

Comments