In today's ever-evolving business landscape, corporate mergers are becoming increasingly common, presenting unique opportunities and challenges for organizations. Crafting an effective integration plan is crucial to ensuring a smooth transition and achieving synergies between the merging entities. This guide will provide you with essential letter templates and practical tips to navigate the intricacies of merger integration with confidence. Join us as we explore the key components of a successful integration strategy and invite you to read more for valuable insights and actionable steps.

Strategic Objectives and Goals

The successful integration of two companies following a merger requires clear strategic objectives and goals. Increasing operational efficiency aims to streamline processes across departments, reduce redundancies, and enhance productivity, targeting a 15% cost reduction within the first fiscal year. Maximizing market share involves leveraging the combined customer base to strengthen the brand presence in key regions, specifically in North America and Europe, with an expected growth of 20% in sales volume. Enhancing customer experience focuses on unifying customer support systems and improving satisfaction ratings by at least 30% in customer feedback surveys. Fostering a cohesive corporate culture emphasizes the importance of employee engagement initiatives and training programs to align values between merging organizations, aiming for a cultural integration score of over 75% in employee surveys conducted six months post-merger. Finally, driving innovation through collaborative research and development teams aims to launch three innovative products in the industry by the end of year two, leveraging the strengths and expertise of both organizations.

Key Stakeholders and Roles

Identifying key stakeholders is crucial for the successful integration of a corporate merger, as their roles significantly impact the process. Senior executives, such as the CEO and CFO, oversee the strategic alignment of both companies (ensuring coherent vision and financial stability). Integration managers facilitate cross-departmental collaboration, addressing operational harmonization. Human Resources personnel, responsible for managing employee transitions, benefit balance, and cultural cohesion, play a pivotal role in engagement strategies. IT teams provide technological integration, ensuring systems compatibility and data security, which is vital for seamless operations. Additionally, marketing representatives must align brand messaging, maintaining customer loyalty during the transition. Engaging legal advisors ensures compliance with regulations and addresses any contractual obligations that arise from the merger process. Each stakeholder's effective management and clear communication pave the way for a successful integration.

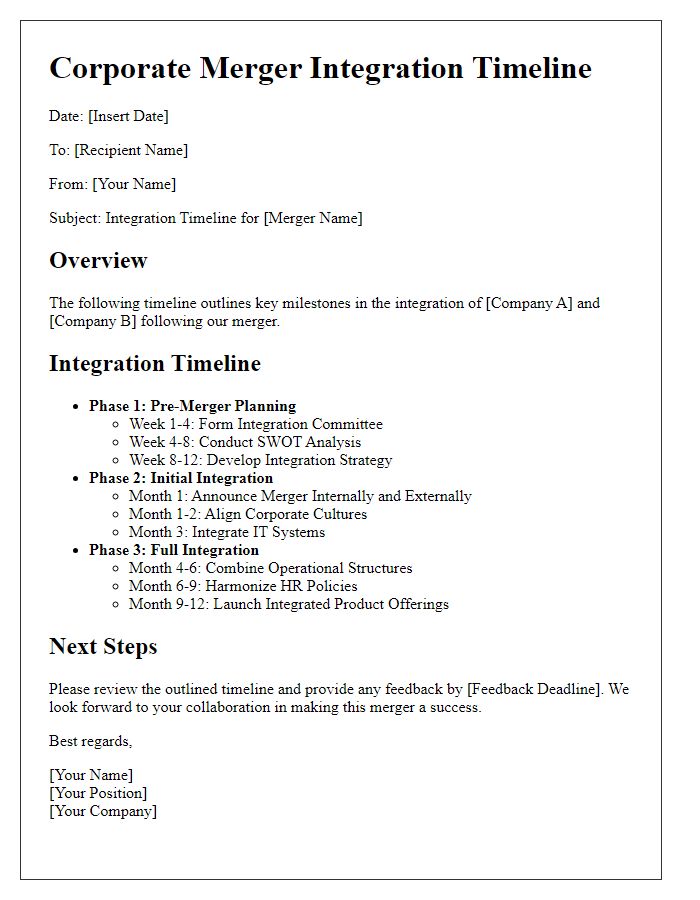

Timeline and Milestones

The corporate merger integration plan outlines a structured timeline and key milestones essential for a seamless transition following the merger of ABC Corporation and XYZ Enterprises. Starting with the initial phase in January 2024, the plan emphasizes conducting a comprehensive assessment of both companies' operational frameworks to identify synergies and integration opportunities. By March 2024, the integration steering committee will finalize alignment on organizational structures, guiding the development of new reporting hierarchies. The subsequent month of April 2024 is designated for comprehensive employee communication strategies, ensuring all staff understand their roles in the evolving corporate landscape. By June 2024, the implementation of unified IT systems will commence, consolidating software and hardware assets for streamlined operations. Key performance indicators (KPIs) will be established by August 2024 to measure the success of integration efforts. Finally, the completion of the full integration is projected for December 2024, with post-integration reviews scheduled for early 2025 to assess cultural alignment and operational efficiency.

Communication Plan

A corporate merger integration plan emphasizes the importance of clear communication strategies. Effective communication within merger scenarios, such as the 2021 merger between Salesforce and Slack, ensures alignment among stakeholders. Regular updates via emails, town hall meetings, and internal newsletters promote transparency throughout the integration process. Defined roles and responsibilities for communication channels help clarify the narrative for employees, mitigating uncertainties. Utilizing platforms like Slack or Microsoft Teams enhances collaboration and feedback opportunities, vital for employee morale. Tracking tools, like surveys or performance metrics, monitor communication effectiveness, ensuring engagement levels remain high during transitions.

Risk Management and Mitigation

A corporate merger integration plan's risk management and mitigation strategy must address potential challenges throughout the consolidation process. Identifying operational risks, including potential culture clashes, can prevent disruptions in workflow. Legal compliance must be monitored, especially regarding antitrust laws in jurisdictions like the United States, with penalties reaching millions of dollars. Financial risks, such as budget overruns during transition phases, should be tracked with established performance metrics. Integration of IT systems also presents cybersecurity threats, potentially affecting sensitive data; implementing robust security protocols is essential. Stakeholder communication strategies must be developed to mitigate reputational risks, particularly in public-facing markets, ensuring transparency during the merger process. Regular assessments and contingency planning will foster resilience against unforeseen circumstances, allowing for adjustments that safeguard the newly formed entity's stability and growth.

Comments