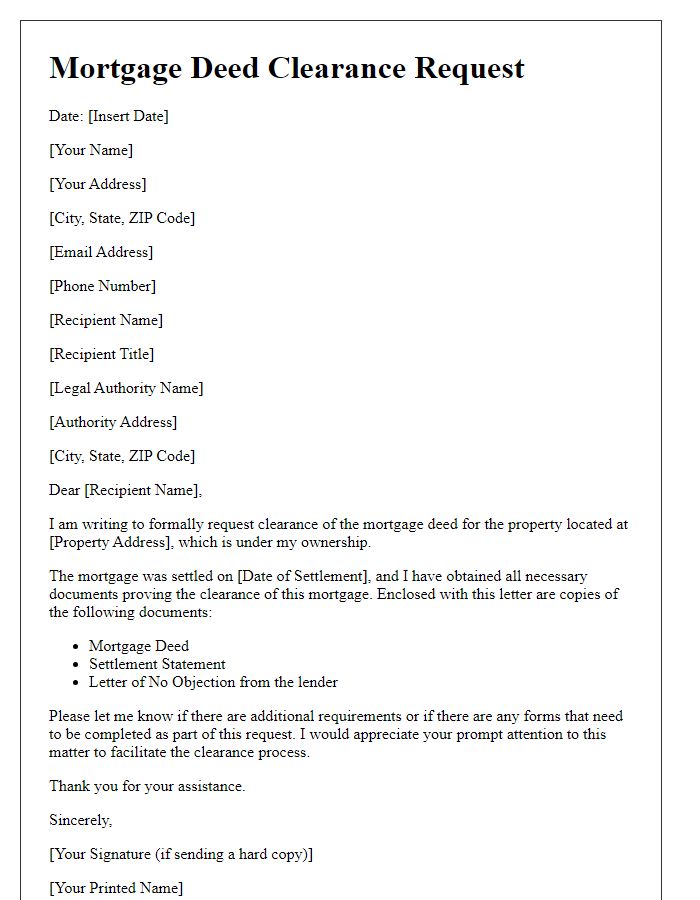

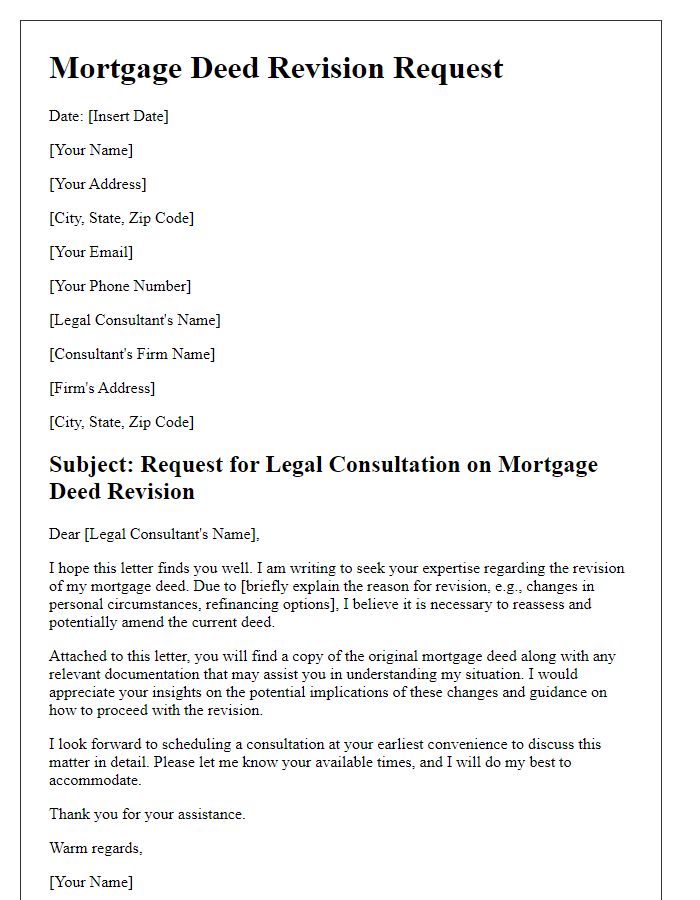

Are you navigating the maze of mortgage deed legal approvals? If so, you're not aloneâmany homeowners find this process daunting and filled with legal jargon. In this article, we'll break down the essentials you need to know to ensure your mortgage deed receives the green light without any hitches. So, grab a cup of coffee, sit back, and let's dive into the details that can simplify your journey.

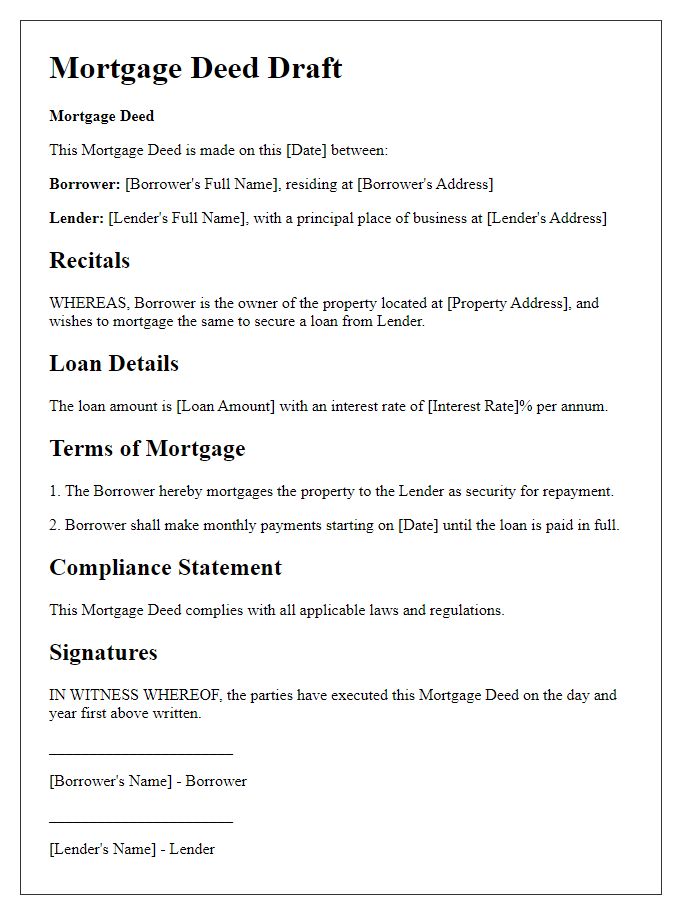

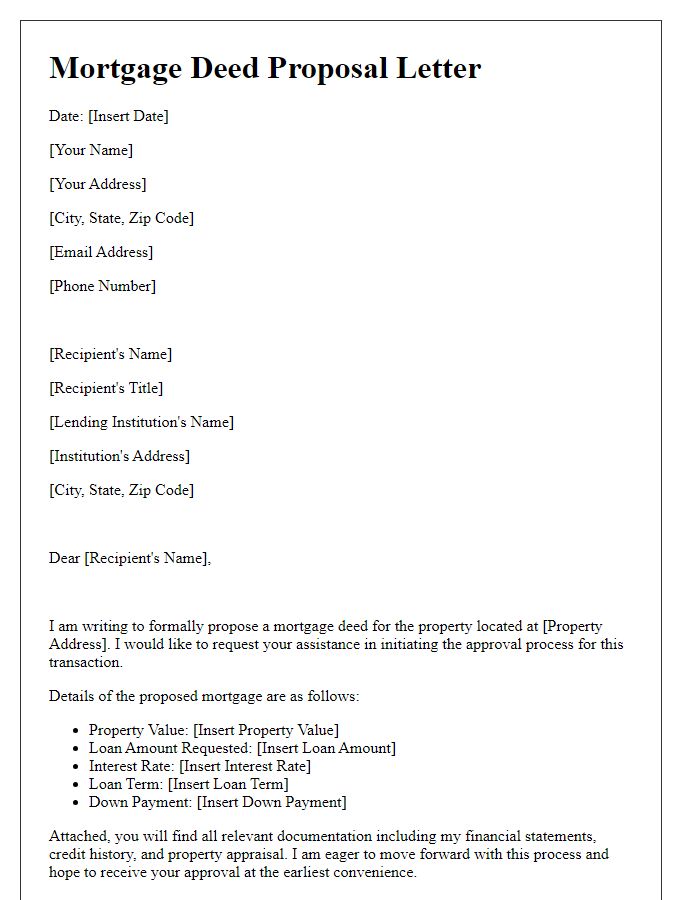

Clear identification of parties involved

In a mortgage deed, clear identification of parties involved is crucial for legal validity. This includes full names of the borrower (mortgagor) and lender (mortgagee), including their address, legal status (individual, corporation, etc.), and any relevant identification numbers like Social Security or Tax Identification numbers. Accurate identification ensures property rights are properly established and helps avoid potential disputes. Each party's role must be explicitly defined within the document, detailing the mortgage amount, interest rates, repayment terms, and the specific real estate property being mortgaged, often identified through its address and parcel number.

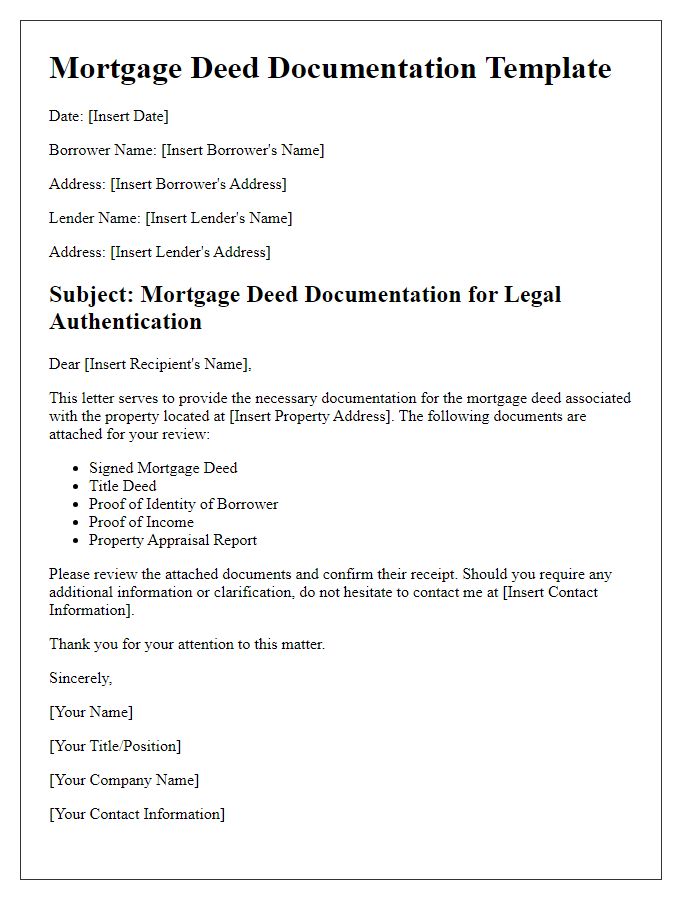

Accurate property description

Accurate property description is crucial for mortgage deed legal approval, ensuring clarity in real estate transactions. Each property must include identifiable details such as the full address, including street name and number, city, state, and zip code. Legal descriptions often incorporate boundaries by utilizing metes and bounds, identifying distances and angles. Additionally, inclusion of parcel numbers or tax identification numbers provided by local governing bodies can facilitate identification in public records. Specifics regarding lot dimensions, easements, and surrounding landmarks further enhance accuracy. This comprehensive description serves to protect all parties involved and streamline the closing process in property transfers.

Precise financial terms and conditions

A mortgage deed outlines the specific financial terms and conditions involved in securing a loan for real estate, typically detailing principal amounts, interest rates, and payment schedules. For example, a principal amount of $250,000 may be borrowed at a fixed interest rate of 4.5% over a 30-year term, requiring monthly payments of approximately $1,266. Additionally, clauses pertaining to property tax responsibilities, insurance requirements, and terms of default offer clarity on obligations. The deed also identifies the property itself, often referenced by its legal description, and may include contingency phrases for circumstances like property appraisals or buyer qualification metrics. Legal approval hinges on meeting all stipulated criteria as outlined by lending institutions and local regulations.

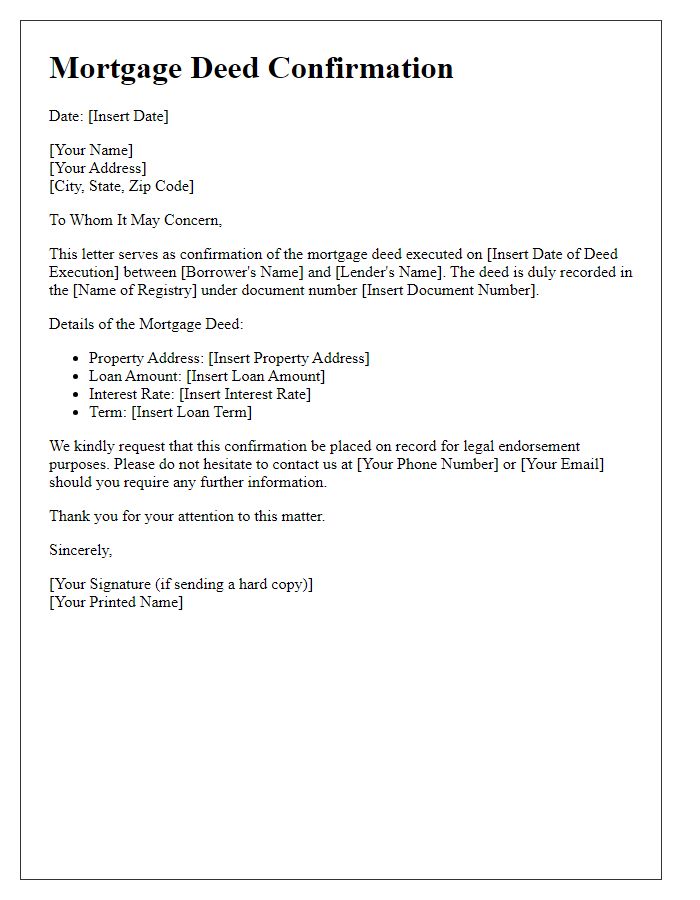

Compliance with legal statutes and regulations

Mortgage deeds must comply with legal statutes and regulations, encompassing entities such as local governing bodies. Key components include accurate documentation of property details, borrower information, and lender eligibility. Legal statutes, varying by jurisdiction, dictate necessary disclosures, which often include interest rates, repayment terms, and potential penalties for non-compliance. Additionally, regulations from agencies like the Consumer Financial Protection Bureau (CFPB) require adherence to clear and transparent communication regarding loan terms. It's crucial for legal approval that all parties sign the deed in front of a notary public, ensuring authenticity and legality. Consideration of state-specific laws, such as those in California or New York, is also paramount to prevent future disputes.

Signature and notarization requirements

A mortgage deed requires precise legal approval to ensure compliance with regulations. Signatures from all parties involved, such as borrowers (individuals or entities receiving the loan) and lenders (financial institutions or individuals providing the loan), must be obtained. Notarization (the official confirmation by a notary public who verifies the identity and willingness of the signers) is crucial, often requiring the presence of an unbiased third party. Each state in the United States may have specific requirements, typically including the notary's seal or stamp on the document, which validates the authenticity of the signatures. Proper documentation during this process diminishes the likelihood of future disputes regarding the mortgage agreement's legitimacy.

Comments