Are you considering an investment advisory agreement but unsure of how to get started? Crafting the perfect letter can set the tone for your professional relationship and ensure that all parties are on the same page. In this article, we'll explore essential elements to include in your letter template, making the process smoother and more effective. So, grab a cup of coffee and join us as we delve into the details of creating a solid investment advisory agreement!

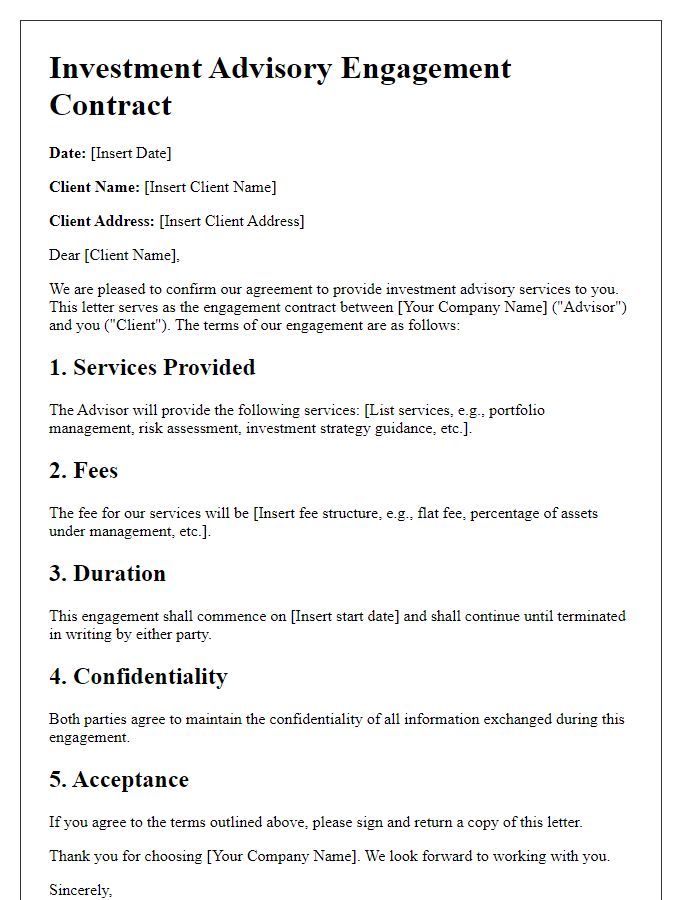

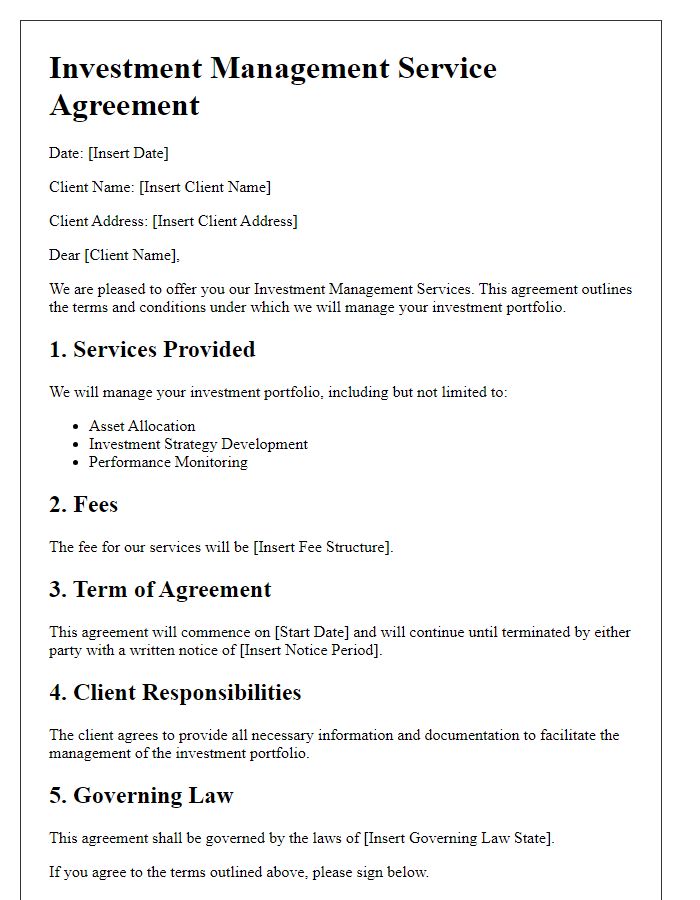

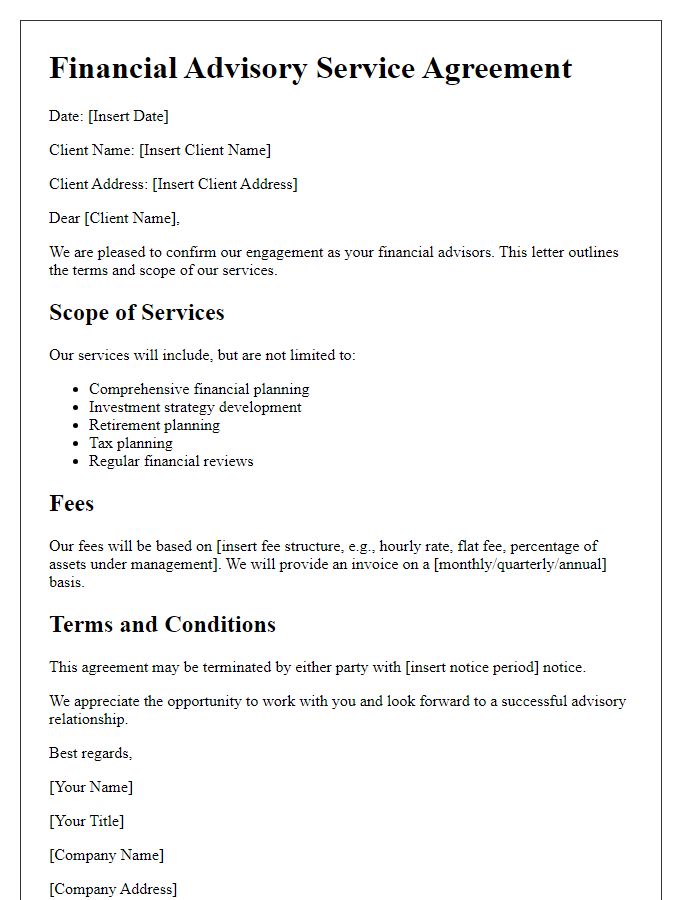

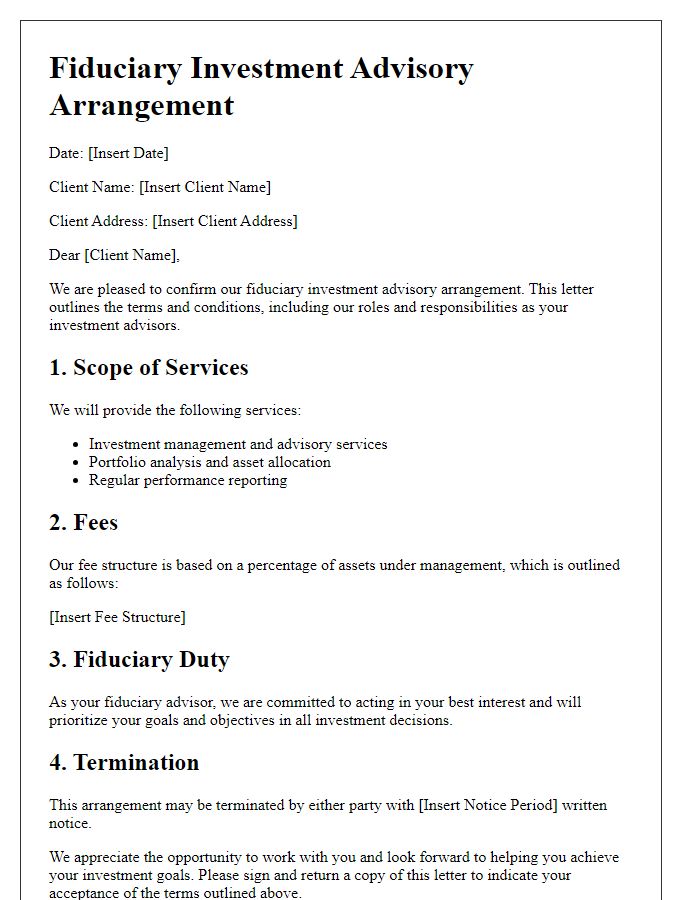

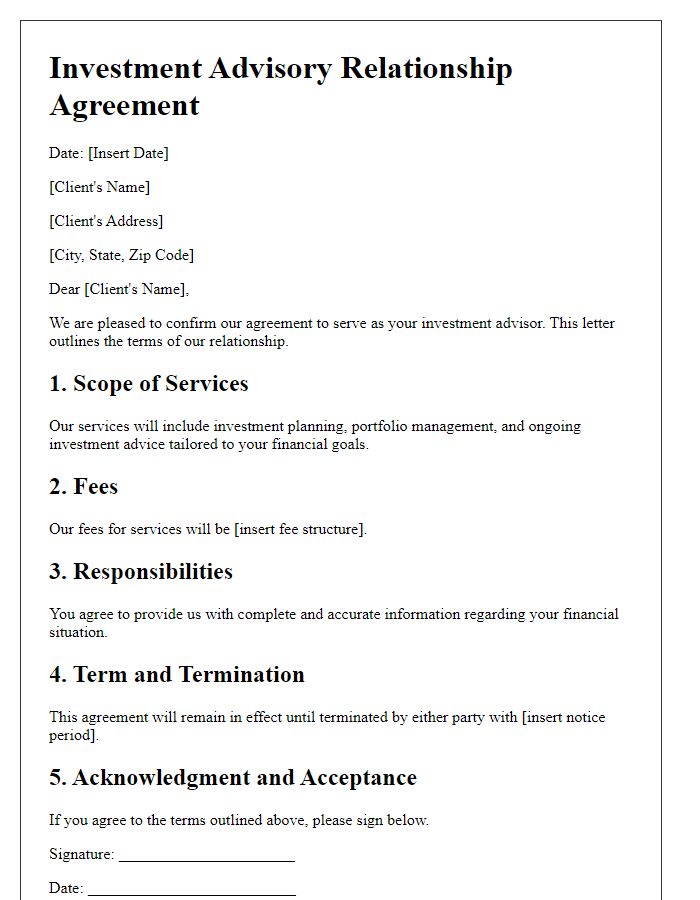

Client and Advisor Information

An investment advisory agreement outlines the roles and responsibilities between a client and an advisor, typically involving the management of financial portfolios. Key aspects include the names of both parties, often denoted as 'Client' and 'Advisor,' along with contact information, such as addresses and phone numbers. It specifies the investment strategy goals set by the client and the advisor's fiduciary duty to act in the client's best interest. Furthermore, terms related to fees, including a percentage of assets under management (commonly ranging from 0.5% to 2% annually) and performance bonuses, should be clearly defined. Important regulatory information may also be included, such as the advisor's registration status with entities like the Securities and Exchange Commission (SEC) or state regulatory bodies. Addressing dispute resolution mechanisms, like arbitration, is another essential element, ensuring clarity in communication for a successful advisory relationship.

Scope of Services

An investment advisory agreement typically outlines the scope of services offered by the advisor. Investment advisory services often include portfolio management, financial planning, and asset allocation tailored to individual client goals. Advisors may conduct market research, analyze financial data, and perform risk assessments to create customized investment strategies. Regular performance reports and updates on investment progress are usually provided, ensuring transparency and informed decision-making. The advisory relationship often involves continuous monitoring of market trends and adjusting strategies based on changes in the economic landscape. Compliance with regulations set by bodies such as the Securities and Exchange Commission (SEC) is crucial in maintaining ethical standards and client trust.

Investment Objectives and Risk Tolerance

Investment objectives serve as a critical foundation for an investment advisory agreement, guiding the strategy tailored to an individual's goals, such as capital appreciation or income generation. Risk tolerance reflects the client's comfort level with fluctuations in market value, encompassing categories ranging from conservative to aggressive. Understanding these parameters is essential for ensuring asset allocation aligns with the client's financial aspirations, whether targeting retirement savings, education funding, or wealth accumulation. Investment time horizons, crucial for shaping investment strategies, vary significantly; short-term goals (1-5 years) may necessitate different risk profiles compared to long-term objectives (10+ years). Furthermore, factors such as economic conditions, personal financial situation, and market trends play essential roles in shaping both objectives and tolerance levels within the advisory framework.

Fee Structure and Billing

Investment advisory agreements typically outline the fee structure and billing practices clearly to ensure transparency between the advisor and the client. These agreements may detail fee types, which could include asset-based fees, hourly rates, or flat fees. For instance, an asset-based fee might be set at 1% annually for managed assets, while an hourly rate could range from $150 to $500 depending on the advisor's experience and the complexity of the services provided. Additionally, billing practices may specify quarterly billing cycles, with payments due at the beginning of each quarter, or the potential for a retainer fee structure that secures ongoing advisory services. Clear descriptions of payment methods, such as electronic fund transfers or checks, and provisions for late payments, may also be included to avoid confusion and ensure smooth financial transactions.

Termination Conditions and Procedures

Termination conditions and procedures in an investment advisory agreement outline the specific scenarios and processes under which either party can end the contractual relationship. Common termination conditions include breach of contract, insolvency, or a significant change in ownership structure. The procedures often involve written notice requirements, typically 30 days, allowing the affected party to address the issues. Documentation should specify the return of all client materials, settling of unresolved transactions, and confirmation of termination in writing. Jurisdictional laws, such as those from the SEC or local financial authorities, may also govern the termination process, ensuring compliance and protecting both parties' rights.

Comments