Are you navigating the complexities of cross-border transactions? It can be a daunting task, but having the right guidance is essential to ensure compliance and avoid costly pitfalls. In this article, we'll explore key strategies and tips that can simplify the process and make your international dealings smoother. So, let's dive in and uncover the insights that could elevate your transaction game!

Clear Identification of Parties Involved

In cross-border transactions, clear identification of parties involved is crucial for ensuring a seamless process. Entities participating in such transactions may include individuals, corporations, or government agencies from different countries, each characterized by distinct legal frameworks and compliance requirements. Accurate documentation, such as valid passports for individuals or registered corporate documents for businesses, is essential to establish credibility and legality. Furthermore, international laws, treaties, and regulations, like the Foreign Corrupt Practices Act or the General Agreement on Tariffs and Trade (GATT), may influence identification protocols. Appropriate due diligence must be carried out to verify the identities of all parties, which can involve background checks and financial assessments, thereby mitigating risks associated with fraud or non-compliance. This level of identification not only bolsters trust among parties but also provides a solid foundation for future negotiations and transactions.

Detailed Transaction Description

Cross-border transactions can involve complex financial procedures, primarily influenced by varying regulations between countries. For instance, when conducting a transaction from the United States to Germany, entities must consider compliance with U.S. laws, including the Office of Foreign Assets Control (OFAC) regulations, while also adhering to the German Banking Act (KWG). Currency exchange rates hold significant importance, with fluctuations in the Euro (EUR) impacting overall costs. Payment methods may include wire transfers through international systems like SWIFT, typically taking 1-3 business days. Additionally, factors such as transaction fees, typically ranging from 0.5% to 2% depending on the service provider, and potential taxes like Value Added Tax (VAT) of 19% in Germany must be accounted for. Documentation required may involve invoices, contracts, and proof of identity to ensure transparency and adherence to Anti-Money Laundering (AML) regulations.

Compliance with International Regulations

Cross-border transactions require adherence to complex international regulations that vary by country and involve multiple legal frameworks. Businesses engaging in these transactions must navigate laws established by organizations such as the Organization for Economic Cooperation and Development (OECD) and the Financial Action Task Force (FATF), which provide guidelines to prevent money laundering and promote transparency. Additionally, specific regulations like the General Data Protection Regulation (GDPR) in the European Union affect how personal data must be handled across borders, particularly for companies operating in or with EU nations. Import/export regulations, including tariff classification and customs duties, also play a crucial role in ensuring compliance. Failure to comply can result in significant penalties or delays in the movement of goods, impacting financial performance and reputation in the global market.

Currency and Exchange Rate Specifications

Currency fluctuations can significantly impact cross-border transactions, especially in regions like the Eurozone or Southeast Asia. Exchange rates, determined by financial markets, can vary daily, influencing the final transaction amount. For instance, the Euro (EUR) to US Dollar (USD) exchange rate may fluctuate between 1.10 and 1.20, affecting the total cost of goods and services. Organizations engaged in international business should consider utilizing forward contracts to hedge against adverse currency movements. This strategy helps lock in exchange rates, providing budget certainty. Understanding local regulations regarding currency conversion and international transfers, especially in countries like India or Brazil, is crucial for ensuring compliance and minimizing transaction costs.

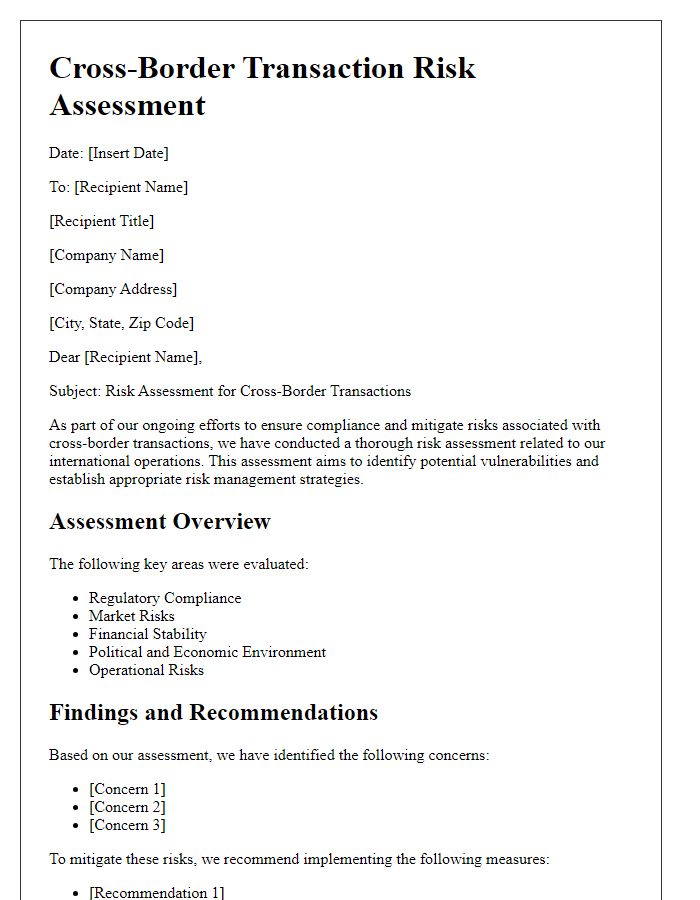

Risk Management Considerations

Cross-border transactions involve various risks that require careful management to ensure compliance and financial stability. Currency fluctuation risks can significantly impact the value of transactions, necessitating the use of hedging strategies to mitigate losses. Regulatory compliance is crucial, as different countries, such as the United States and the European Union, have distinct laws governing trade, taxation, and foreign investment mandates. Political risks, including instability in regions like Eastern Europe or the Middle East, can disrupt operations and should be assessed. Counterparty risks must be evaluated, particularly when dealing with unfamiliar companies; conducting thorough due diligence can prevent future complications. Additionally, cultural differences can affect negotiation tactics and business practices, making it essential to understand local customs and expectations in markets like Asia or Latin America.

Letter Template For Cross-Border Transaction Advice Samples

Letter template of cross-border transaction guidance for small businesses

Letter template of cross-border transaction support for corporate clients

Letter template of cross-border transaction recommendations for e-commerce

Letter template of cross-border transaction consultation for financial institutions

Letter template of cross-border transaction best practices for exporters

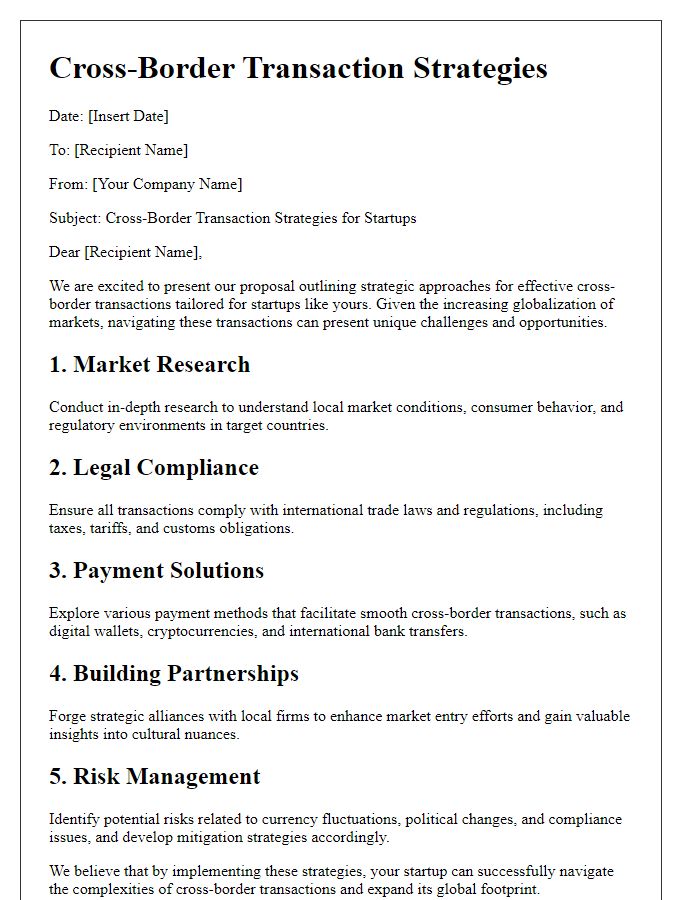

Letter template of cross-border transaction insights for mergers and acquisitions

Letter template of cross-border transaction compliance advice for legal entities

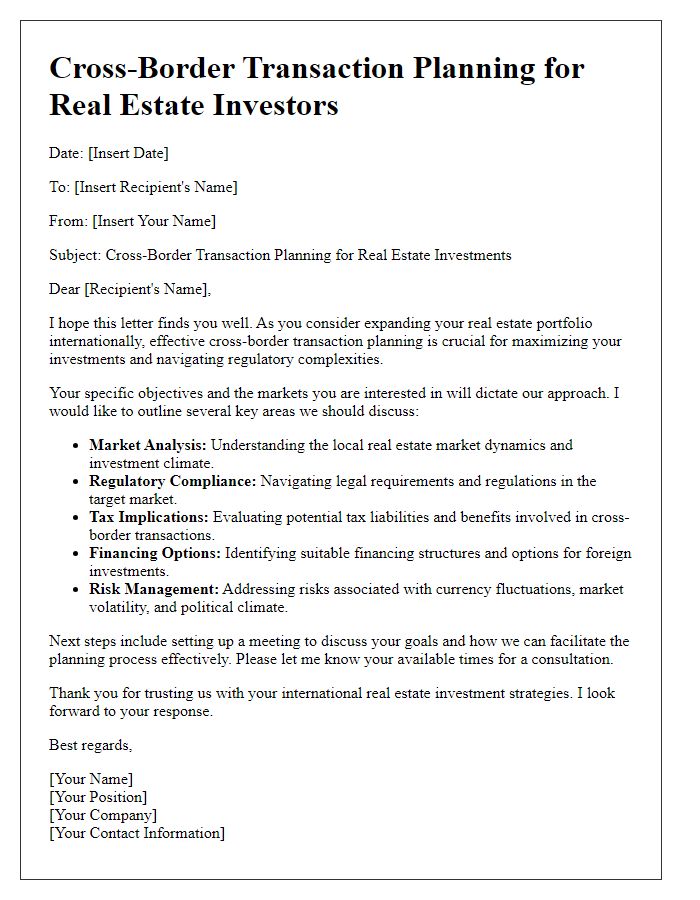

Letter template of cross-border transaction planning for real estate investors

Comments