Are you ready to dive into the world of executive compensation proposals? Crafting the perfect letter can make a significant difference in how your proposal is perceived, showcasing not only your professional expertise but also your understanding of the intricacies of compensation structures. In this guide, we will explore essential elements to include in your proposal letter, ensuring it resonates with its intended audience and aligns with industry standards. So, let's unravel the art of creating a compelling executive compensation proposalâkeep reading to discover more!

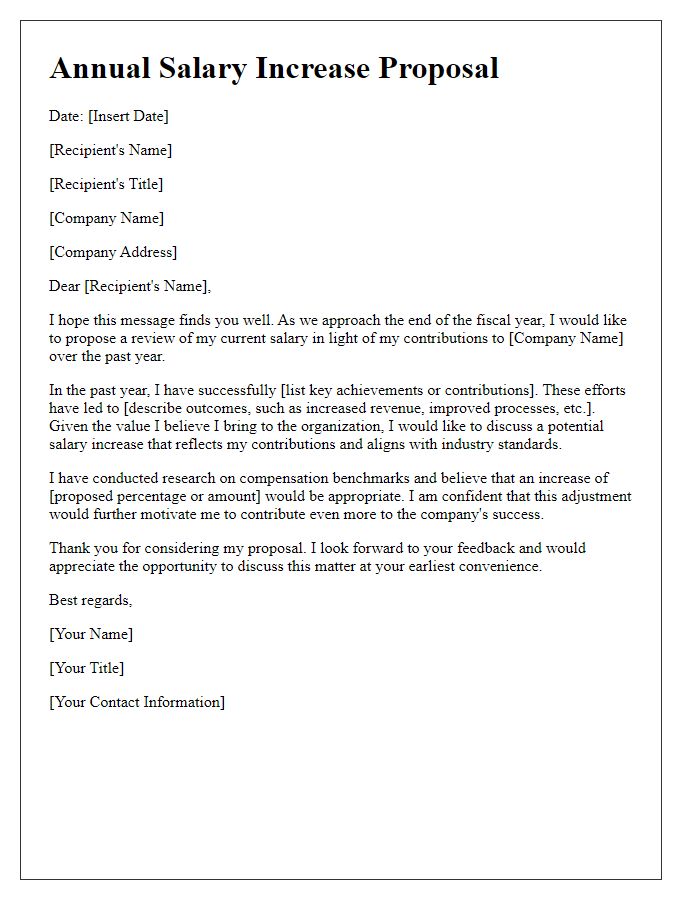

Introduction and Executive Summary

An executive compensation proposal outlines the structured remuneration plan for key leaders within an organization, emphasizing alignment with performance metrics and market standards. The introduction highlights the rationale behind the proposal, taking into account market competitiveness, retention strategies, and the need for incentivization to drive company growth. The executive summary encapsulates the objectives, methodologies, and anticipated outcomes of the proposed compensation package. It includes key details such as base salary benchmarks, bonus structures, equity incentives, and benefits, all set against industry data from sources like the National Compensation Data Survey. The proposal aims to attract top-tier talent and motivate executives to achieve strategic goals while ensuring transparency and accountability within the compensation framework.

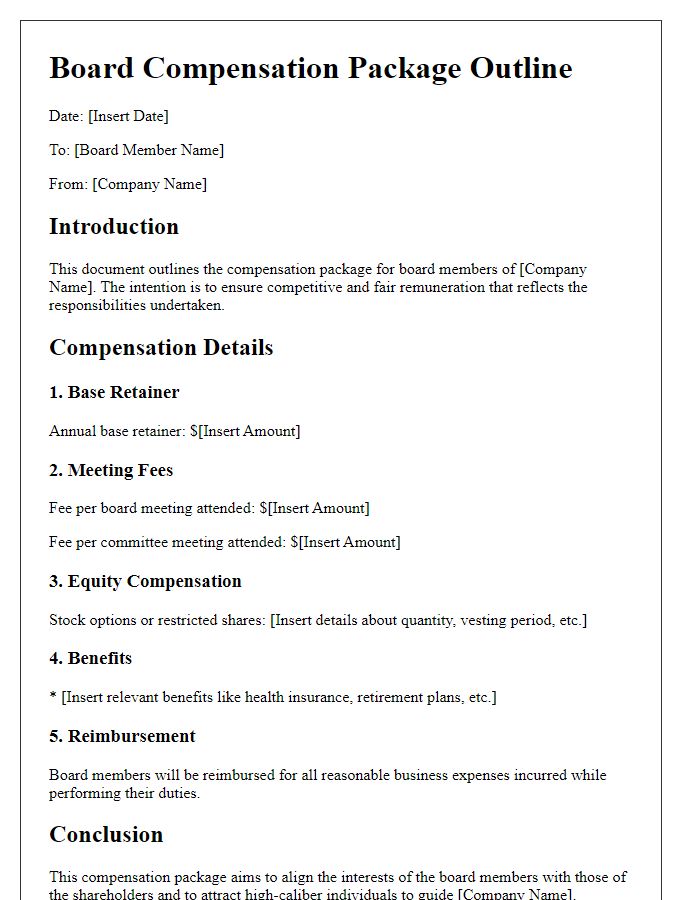

Compensation Package Components

An executive compensation proposal outlines crucial components such as base salary, which represents a fixed remittance of $250,000 annually, along with annual bonuses that can fluctuate based on performance metrics, potentially reaching up to 50% of the base salary. Equity incentives in the form of stock options may also be available, offering executives the opportunity to purchase company shares at a predetermined rate, fostering alignment with shareholder interests. Additionally, long-term incentives could include performance shares that vest over a three-year period if specific company growth targets are met, enhancing commitment. Benefits such as health insurance, retirement contributions up to $15,000, and relocation assistance can further supplement the package. Finally, a structured evaluation process will assess performance annually to ensure competitive positioning within the industry.

Market Analysis and Benchmarking

An effective executive compensation proposal requires a comprehensive market analysis and benchmarking approach to assess competitive compensation practices among peer organizations. A detailed examination of salary ranges, bonus structures, and long-term incentive plans across industry counterparts, such as Fortune 500 companies, should be conducted, focusing on median compensation figures within specific sectors like technology or healthcare. In this context, key metrics should include financial performance indicators like revenue, profit margins, and stock performance (reflected in share price movements) to gauge alignment between executive pay and company success. Geographic factors also play a crucial role, as compensation levels often vary significantly across regions, such as the Silicon Valley tech hub versus Midwest manufacturing locales. Additionally, considerations involving the company's market position, strategic goals, and internal equity among the executive team can further inform the proposal, ensuring a transparent and justifiable compensation framework. Such meticulous benchmarking efforts will provide the necessary insights to attract and retain top-tier executive talent in an increasingly competitive landscape.

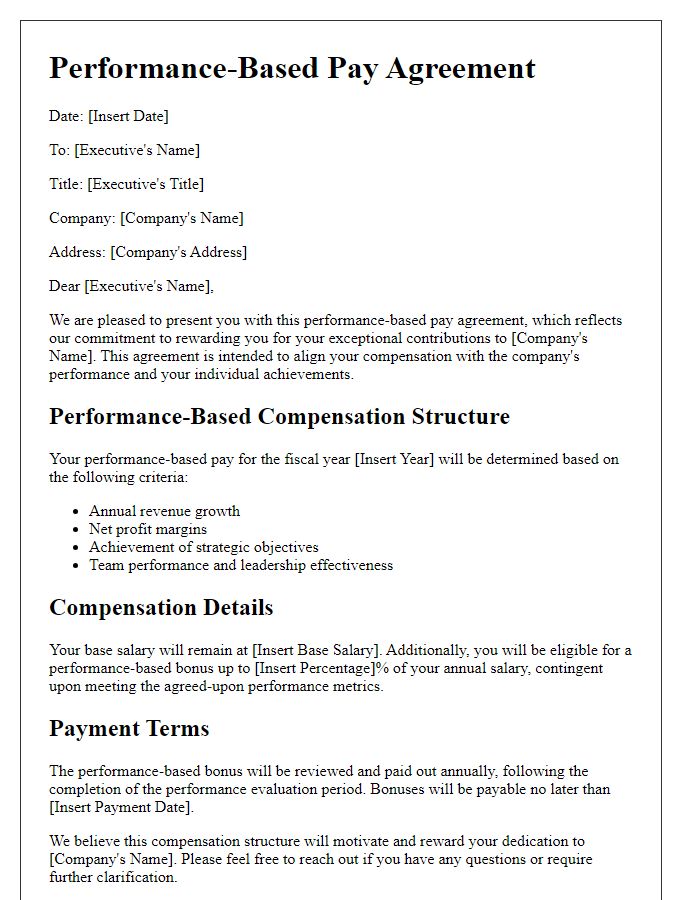

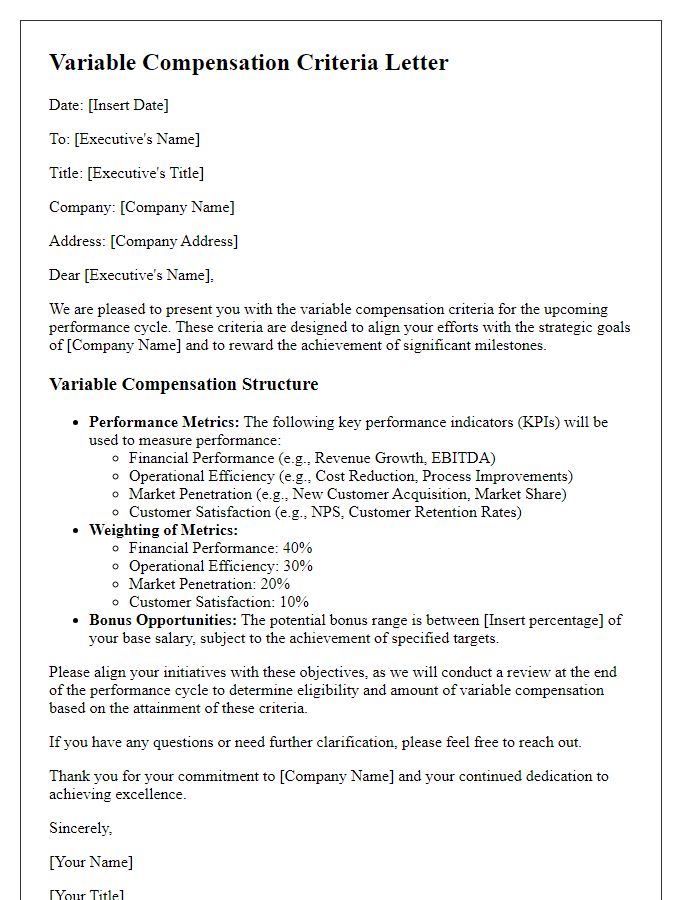

Performance Metrics and Evaluation Criteria

The executive compensation proposal outlines comprehensive performance metrics and evaluation criteria crucial for assessing the achievement of corporate goals. Key performance indicators (KPIs) may include financial metrics such as Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) growth targets of 10% annually, return on equity (ROE) benchmarks surpassing 15%, and revenue increases aligning with market trends. Additionally, non-financial metrics could involve employee engagement scores exceeding 80%, sustainability initiatives aligning with Environmental, Social, and Governance (ESG) standards, and successful implementation of strategic milestones, such as product launches and market expansions. The evaluation will utilize a balanced scorecard approach, facilitating a thorough assessment of both quantitative and qualitative results, ultimately aligning executive incentives with long-term shareholder value and organizational mission.

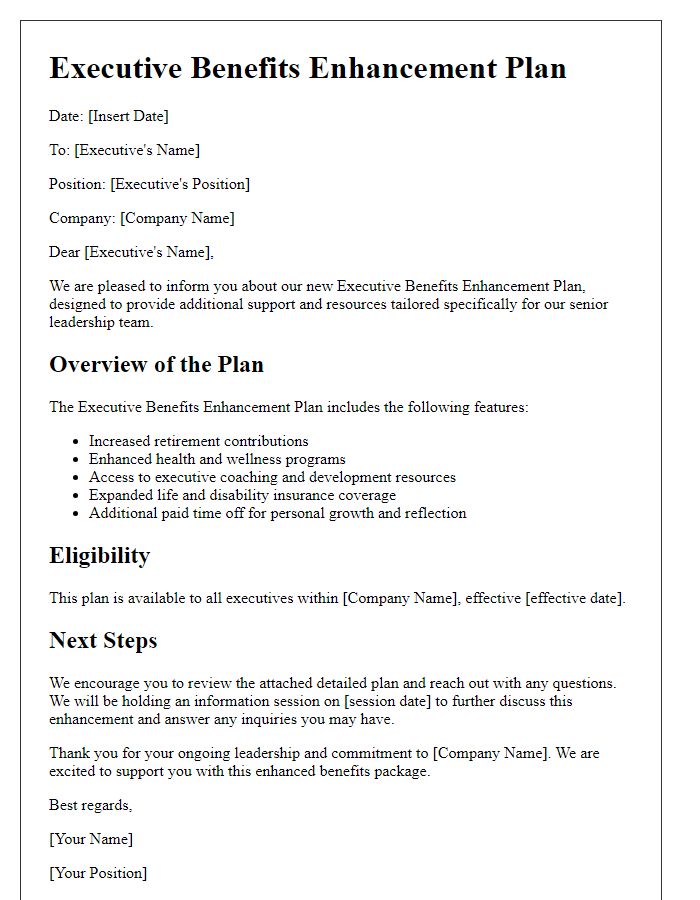

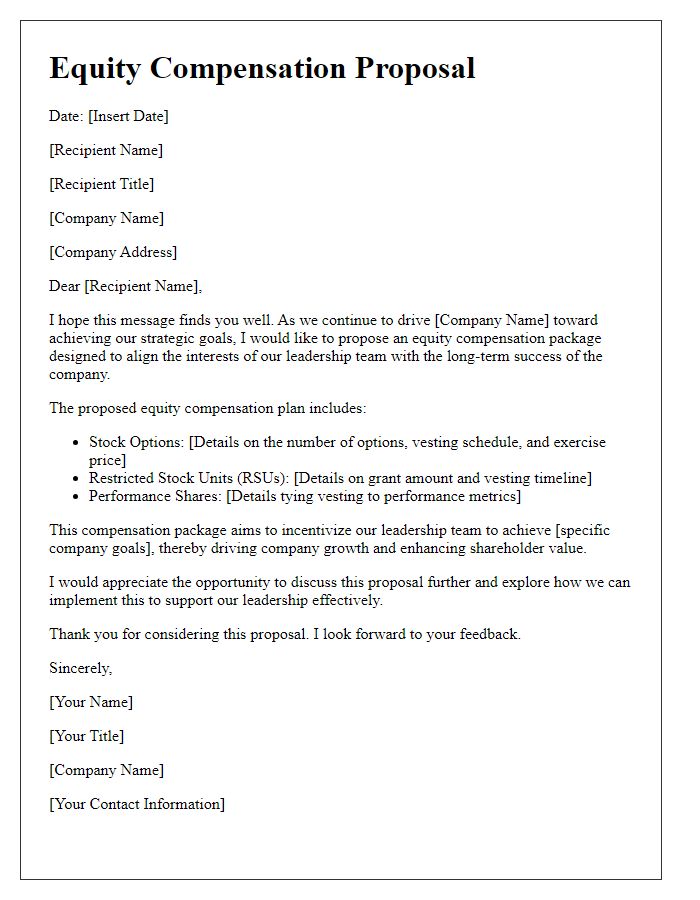

Long-term Incentives and Benefits

Long-term incentive plans comprise essential components of executive compensation packages, aimed at aligning the interests of executives with those of shareholders. These incentives often include stock options, restricted stock units (RSUs), or performance shares linked to specific financial metrics such as Earnings Before Interest and Taxes (EBIT) or Total Shareholder Return (TSR) over periods ranging from three to five years. Significant benefits such as health insurance plans, retirement savings contributions, and additional perks can enhance the overall value of the compensation package. Companies often benchmark these compensation elements against industry leaders, ensuring competitiveness while also addressing retention and motivation. The analysis also includes tax implications for both executives and the organization, emphasizing the need for a balanced approach in structuring long-term incentives.

Comments