Navigating a shareholder dispute can be a daunting task, but it's essential for maintaining the integrity and future of your business. Effective communication is crucial, as it can help clarify misunderstandings and foster a collaborative resolution. Whether you're addressing concerns about decision-making or profit distribution, having a well-structured letter template can streamline the process. Ready to delve deeper into effective strategies for managing shareholder disputes? Let's explore!

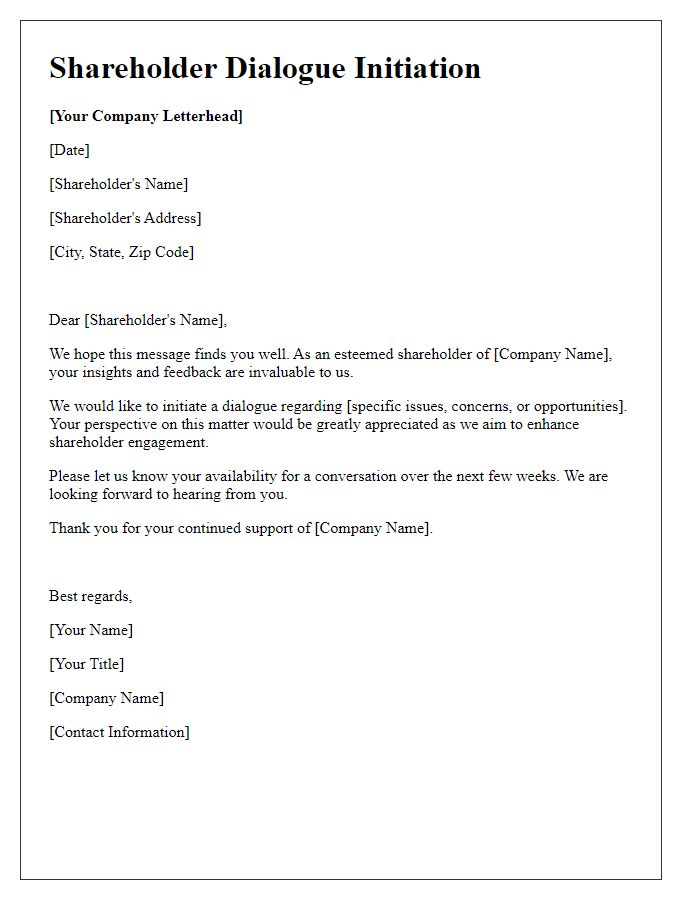

Clear identification of parties involved.

In a shareholder dispute management scenario, clear identification of parties involved is crucial. The primary entities typically include the shareholders, who are individuals or institutional investors owning shares in the company, such as John Smith (50% shareholder) and ABC Capital LLC (30% shareholder). Additional parties may include the company itself, registered as GreenTech Innovations Inc., which operates within the renewable energy sector. Legal representatives for each party, for instance, Jane Doe Esq. representing John Smith and Robert Johnson Esq. for ABC Capital LLC, also play a vital role in the dispute resolution process. Furthermore, the company's board of directors, comprising seven members such as Chairperson Emily Davis and CEO Michael Lee, can influence the dynamics of the dispute through their decision-making authority. Effective identification of these parties facilitates transparent communication and resolution strategies to address the conflict efficiently.

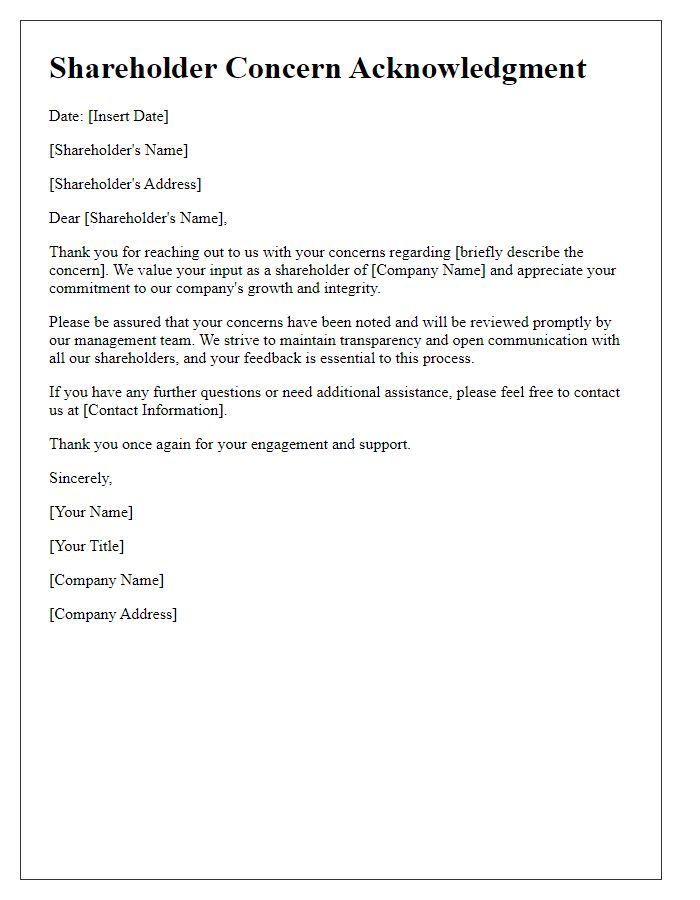

Summary of the dispute issue.

A shareholder dispute in a corporation typically arises from conflicting interests among stakeholders, often over financial decisions, ownership percentages, or management practices. For instance, in a multinational technology firm, shareholders may disagree on a proposed merger worth $500 million, citing concerns over valuation and future market impact. These disputes can escalate, leading to legal actions or boardroom clashes, often detrimental to the company's stability and reputation. Furthermore, elements such as differing visions for growth (short-term profit versus long-term innovation) significantly contribute to tension among shareholders, necessitating efficient management strategies to align interests and restore harmony.

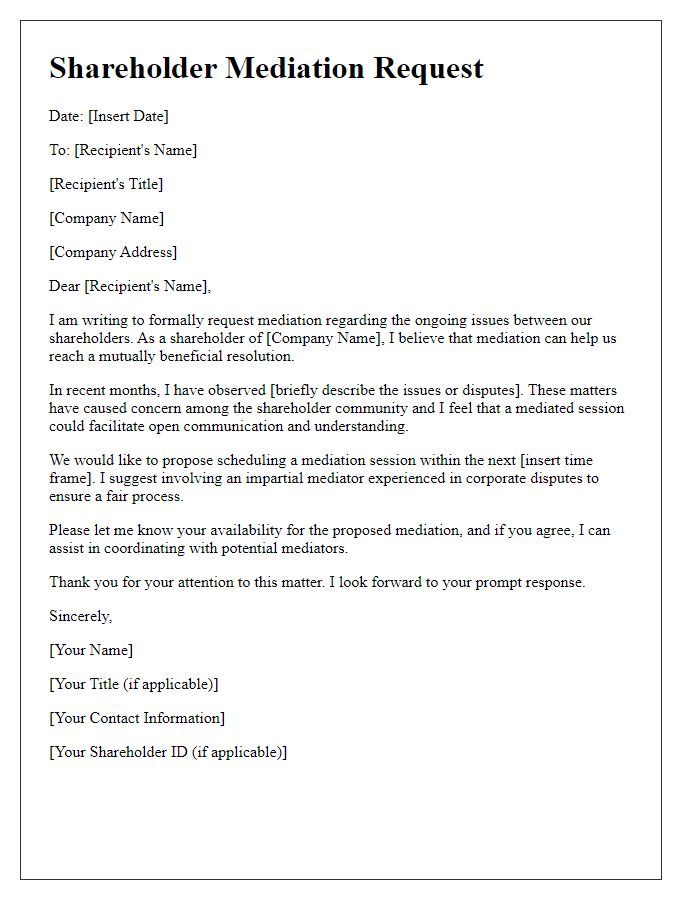

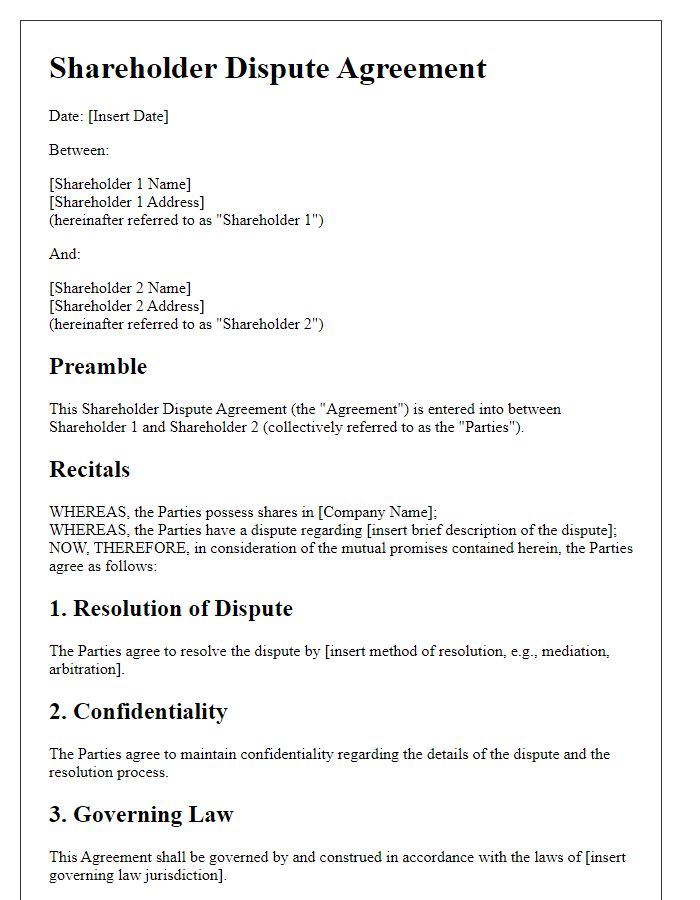

Reference to relevant shareholder agreement clauses.

In shareholder dispute management, referring to the relevant clauses of the shareholder agreement is crucial for resolution. Clauses such as the "Dispute Resolution Clause," typically found in the agreement, outline the mechanisms for addressing conflicts, including mediation or arbitration processes. Specific provisions regarding "Voting Rights" empower shareholders to voice concerns during board meetings, impacting decisions. The "Buy-Sell Agreement" can delineate the terms under which shares may be purchased or sold to resolve disagreements regarding ownership stakes. Additionally, referencing the "Confidentiality Clause" ensures that sensitive information shared during dispute resolution remains protected, fostering a more open dialogue. Engaging legal counsel familiar with corporate law in jurisdictions like Delaware or Texas can enhance the effectiveness of the dispute management process. These frameworks provide a structured approach to addressing shareholder conflicts while adhering to the pre-agreed terms, ultimately aiding in achieving a fair resolution.

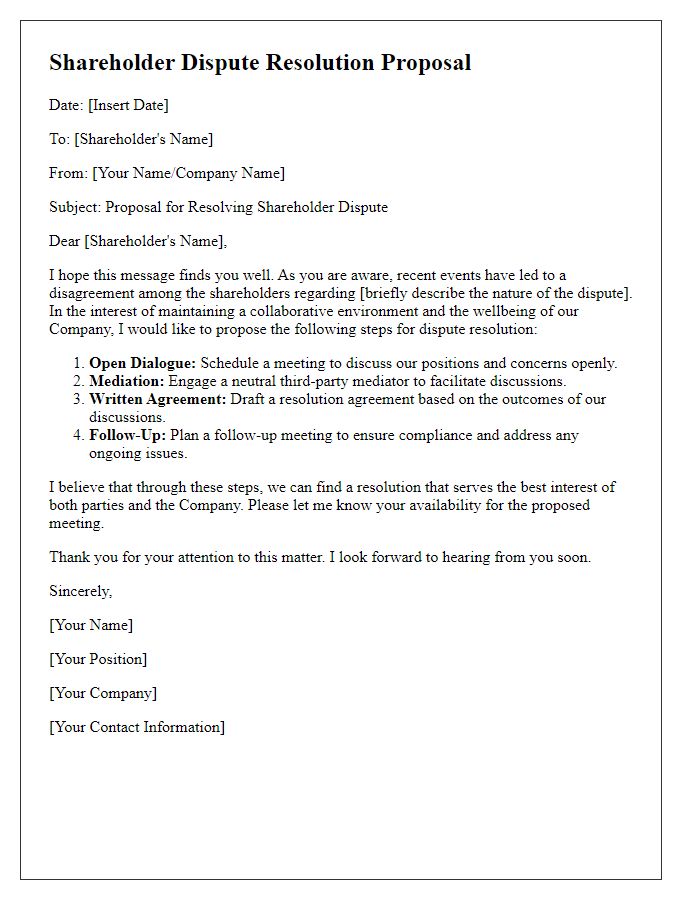

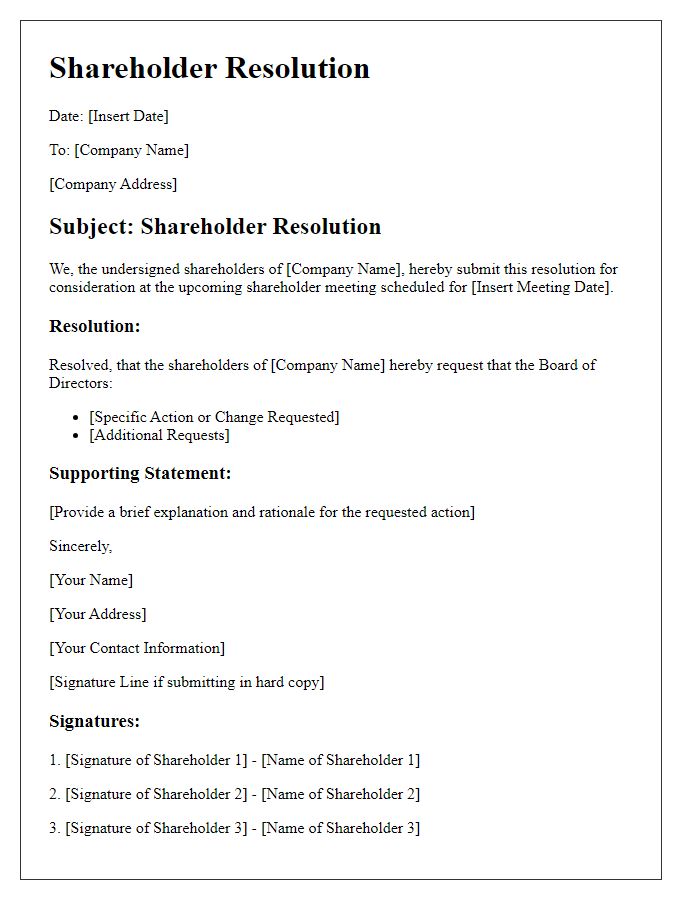

Proposed resolution or next steps.

Proposed resolutions for shareholder disputes often involve thorough mediation processes focused on transparency and communication among the involved parties. One approach includes organizing a scheduled meeting at a neutral location, such as a corporate conference room in downtown New York, to ensure all stakeholders can attend. During this meeting, a certified mediator with extensive experience in corporate governance may facilitate discussions aimed at identifying the core issues causing the dispute, such as disagreements over voting rights or dividend distributions. It is crucial that all parties present their perspectives clearly and collaboratively work towards a consensus. Additionally, drafting a formal agreement detailing the mutually accepted terms can help solidify the resolution, including timelines for implementing suggested changes and stipulations for future communication to prevent similar disputes. Ultimately, the goal is to restore trust and maintain a productive relationship among shareholders while safeguarding the company's long-term interests.

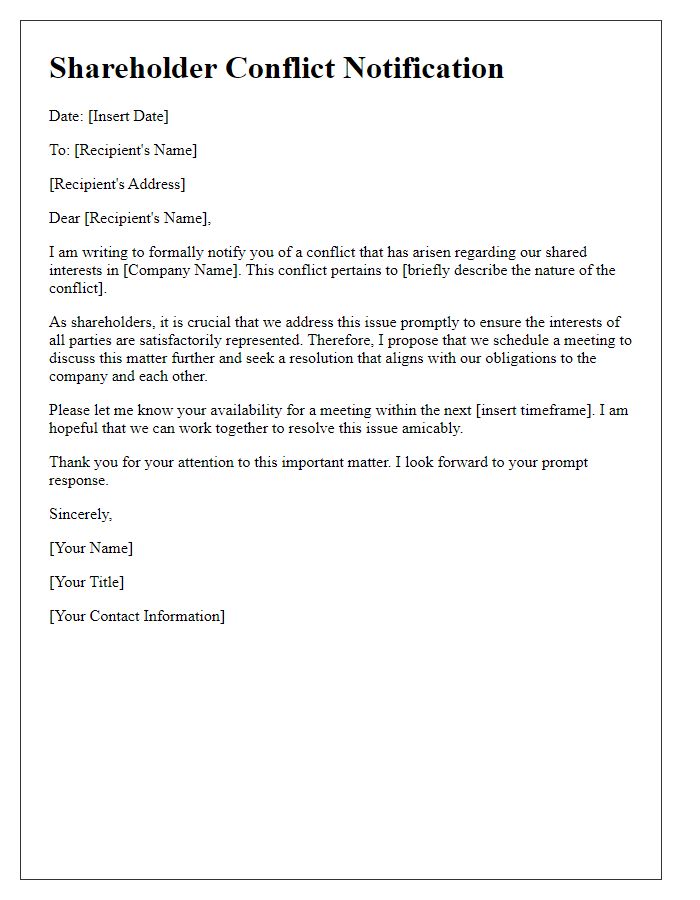

Contact information for further communication.

Shareholder disputes often arise within corporate governance structures, particularly in publicly traded companies. Effective communication mechanisms serve as vital tools for resolution. Contact information should include key representatives, such as the Chief Financial Officer (CFO), who typically oversees financial management, and the Legal Department, which addresses compliance and disputes. Direct phone lines and email addresses for these individuals or departments enhance accessibility. Additionally, providing a dedicated dispute resolution hotline ensures shareholders can voice concerns promptly. Timely response protocols, established within 48 to 72 hours of any inquiry, may significantly improve shareholder relations and trust, fostering a more harmonious corporate environment.

Comments