Are you feeling overwhelmed by the thought of preparing a financial power of attorney? You're not alone; many people find this process daunting, but understanding the essentials can make it much easier. A financial power of attorney is a crucial document that allows you to designate someone to manage your financial affairs in case you're unable to do so. Interested in learning how to navigate the steps to create a solid financial power of attorney? Keep reading for more insights!

Principal and Agent Identification

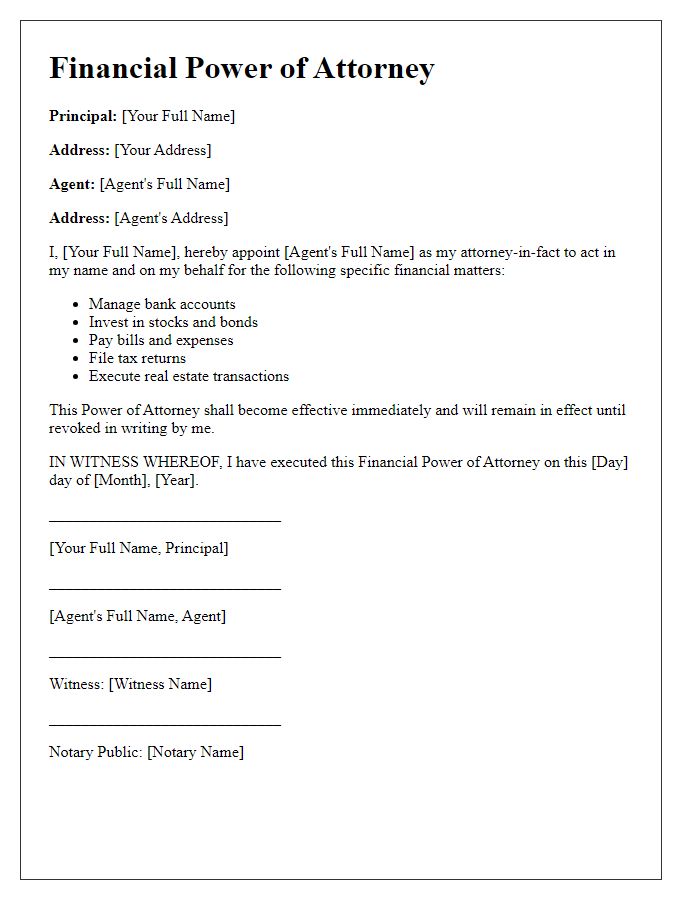

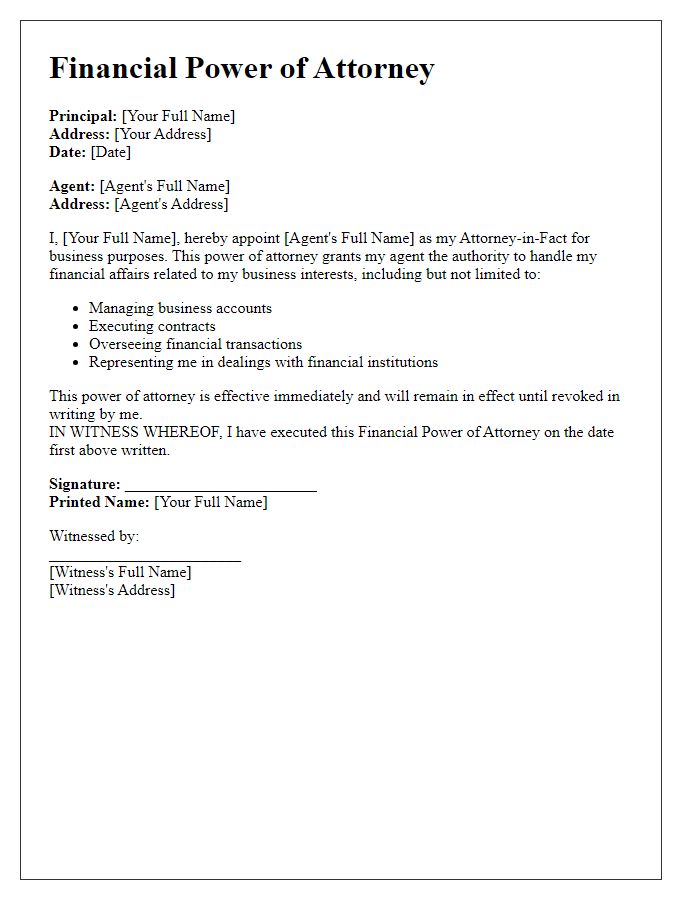

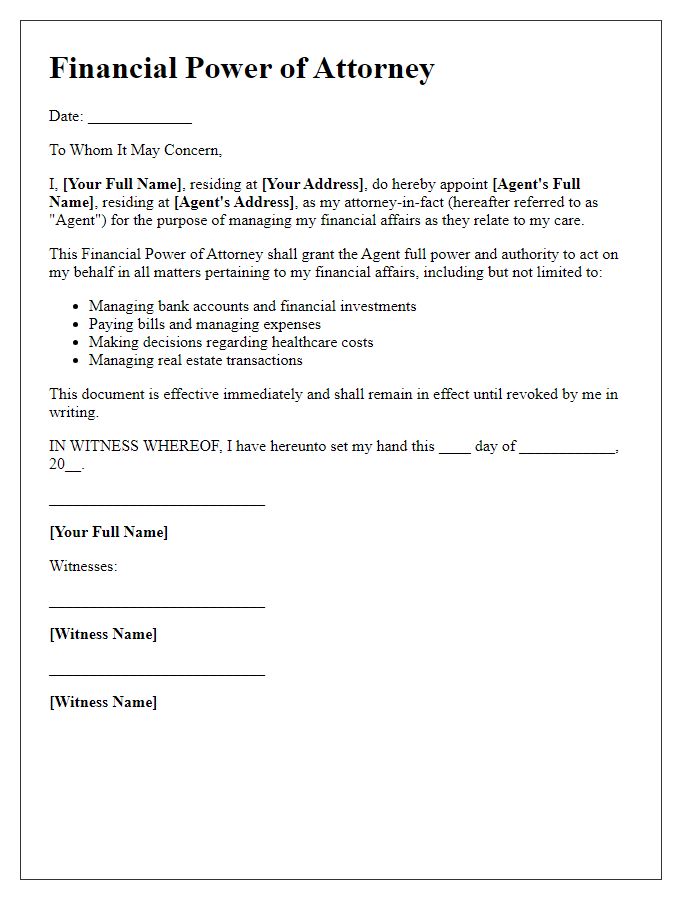

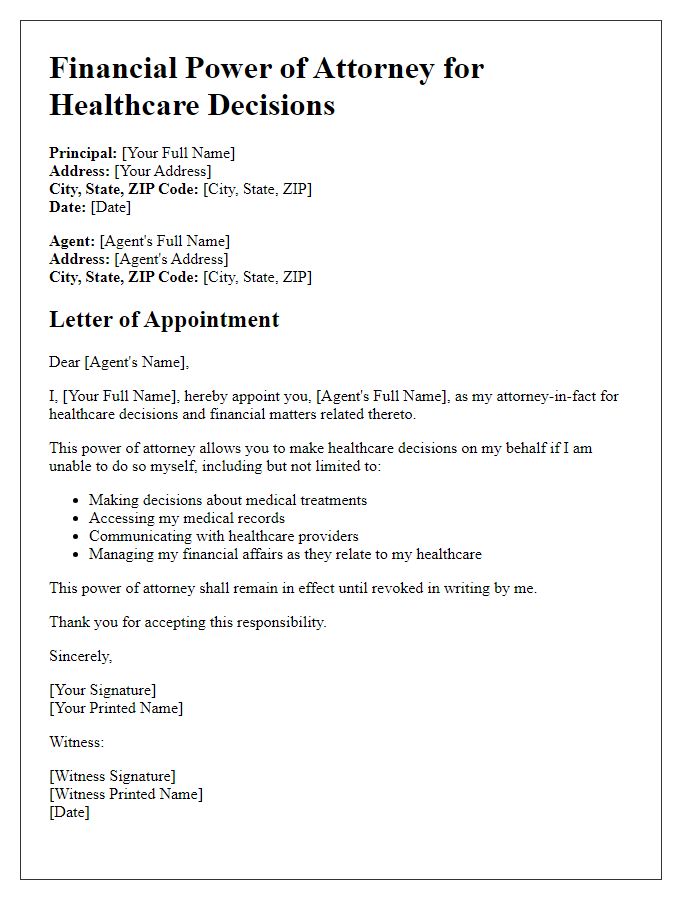

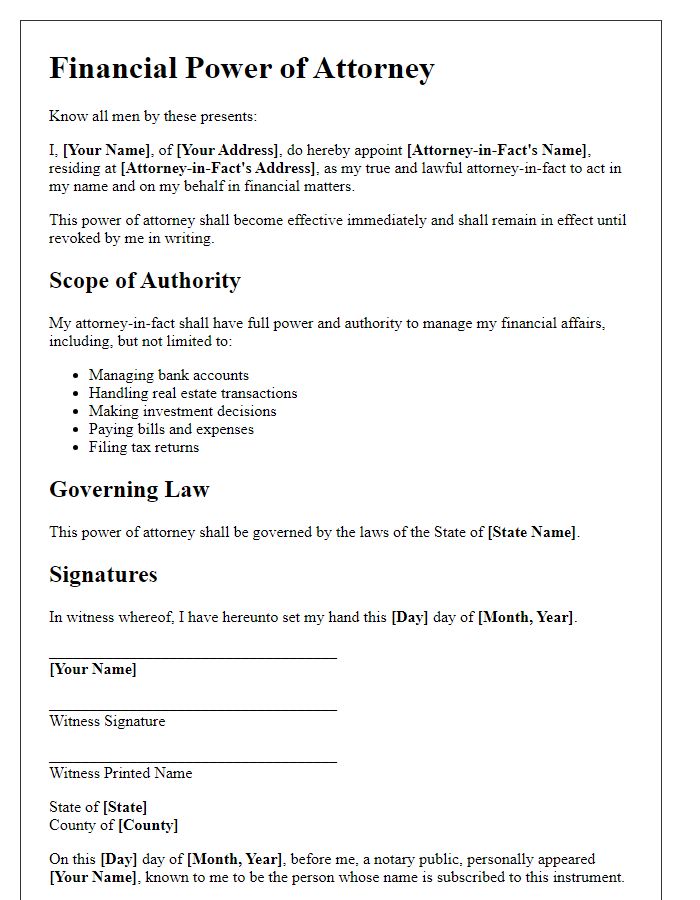

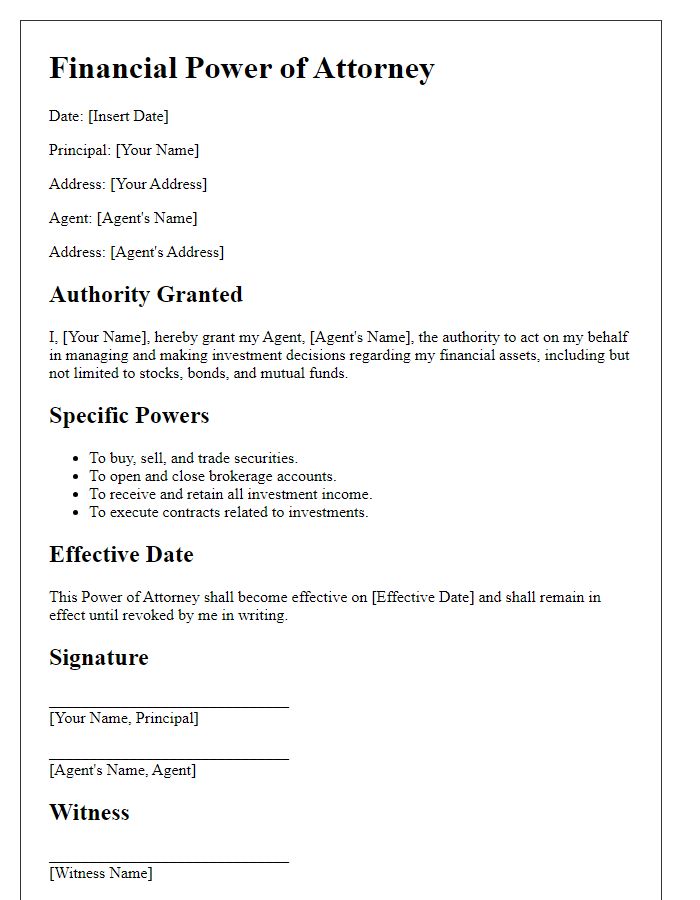

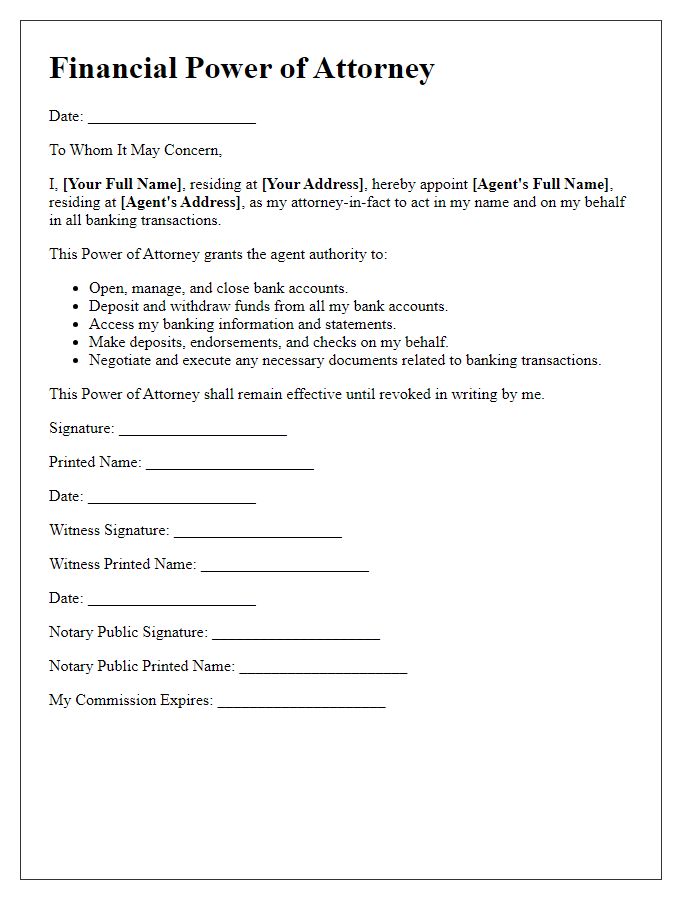

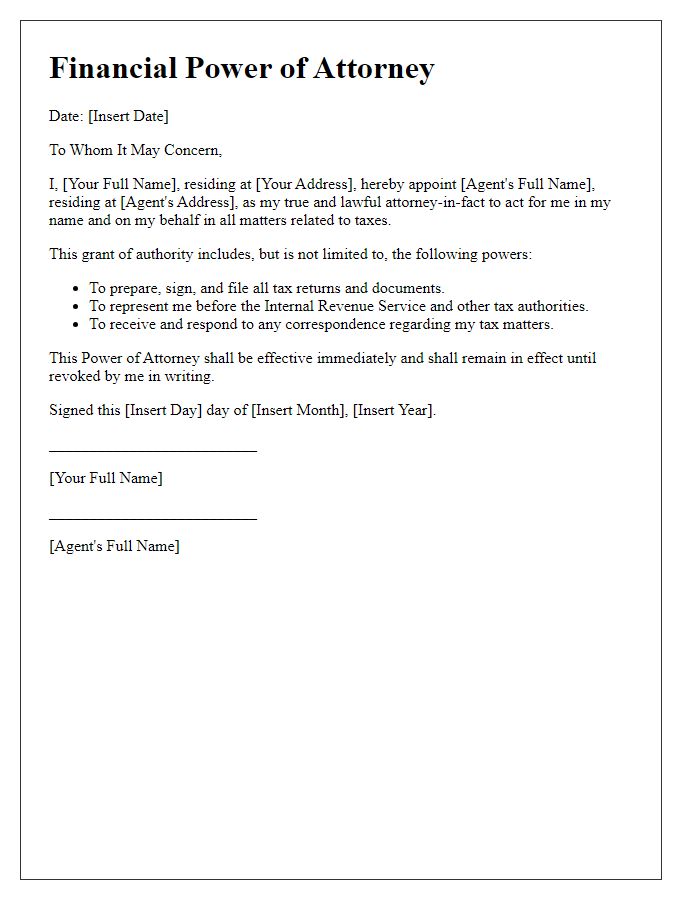

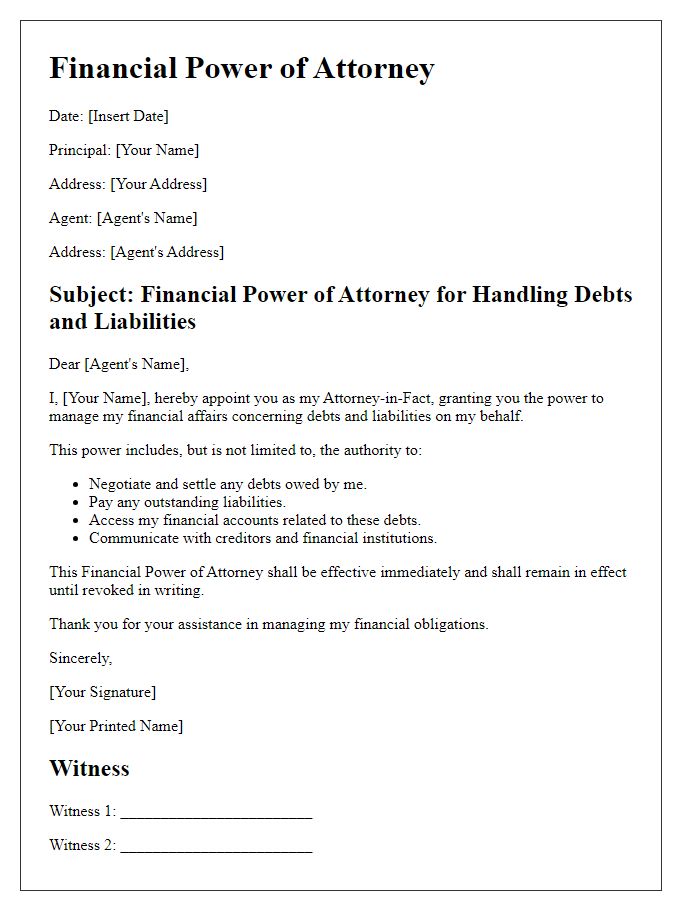

In the financial power of attorney document, principal identification includes the full legal name of the individual granting authority, typically the person managing their assets in situations like incapacity or unavailability. The agent identification specifies the full legal name of the trusted individual, often a family member or close friend, designated to manage financial affairs on behalf of the principal. In a legal context, both parties may also require additional details, such as residential addresses and contact information, ensuring clarity in their roles. Notably, the principal must be of sound mind, legally capable of making decisions at the time of executing the document, while the agent should understand the responsibilities and fiduciary duties associated with managing another's financial interests.

Powers and Authorities Granted

Financial power of attorney documents assign authority over financial matters to an appointed agent, usually outlining specific powers and actions permitted. The scope often includes managing bank accounts, handling real estate transactions, managing investments, and filing tax returns. Certain jurisdictions may require specific language to validate these powers, such as the ability to engage in business transactions, access safe deposit boxes, or make gifts on behalf of the principal. Ensure these documents comply with local laws and regulations, like the Uniform Power of Attorney Act. Legal counsel often recommends notarization for increased validity and protection against fraud.

Duration and Termination Conditions

A financial power of attorney (POA) is an essential legal document that grants an agent the authority to manage financial decisions on behalf of the principal. The POA can have a specified duration, often indicated in months or years, such as a term of five years, or it may be set until a particular event occurs, such as the principal's incapacitation or passing. Termination conditions may include the principal revoking the power in writing, the agent resigning, or the death of the principal, which automatically nullifies the authority. Additionally, a specific clause may outline the conditions under which the POA can be extended or modified, ensuring clarity for both parties involved. It is recommended that regular reviews of the document are conducted to ensure that it aligns with the principal's current financial circumstances and intentions.

Successor Agent Provisions

In financial power of attorney preparations, successor agent provisions outline the designation of alternate agents tasked with managing financial matters in the event the primary agent becomes unable or unwilling to fulfill their duties. Succession is crucial in documents involving significant assets, such as real estate properties, bank accounts, or business interests. These provisions ensure continuity in financial management, particularly in instances of incapacitation, illness, or absence. The successor agent can be named specifically--such as a family member or trusted advisor--and can be granted the same powers and authority as the primary agent. Clear instructions regarding the circumstances under which the successor agent assumes responsibility can help mitigate any potential disputes or confusion.

Legal Compliance and Acknowledgement

A financial power of attorney (POA) document appoints an individual (the agent) to manage financial affairs on behalf of another person (the principal). Proper preparation ensures compliance with legal standards, such as those outlined in the Uniform Power of Attorney Act, which varies by state. Essential elements include the principal's full name, address, and specific powers granted to the agent, such as managing bank accounts, selling property, and filing taxes. The document must be signed by the principal in the presence of a notary public to validate the legitimacy of the agreement. Some jurisdictions also require signatures from witnesses. Acknowledgment of understanding regarding the responsibilities and limitations of the authority granted is crucial to prevent potential misuse. This legal document typically remains in effect until the principal revokes it or passes away, emphasizing the importance of clarity and legal compliance in its formulation.

Letter Template For Financial Power Of Attorney Preparation Samples

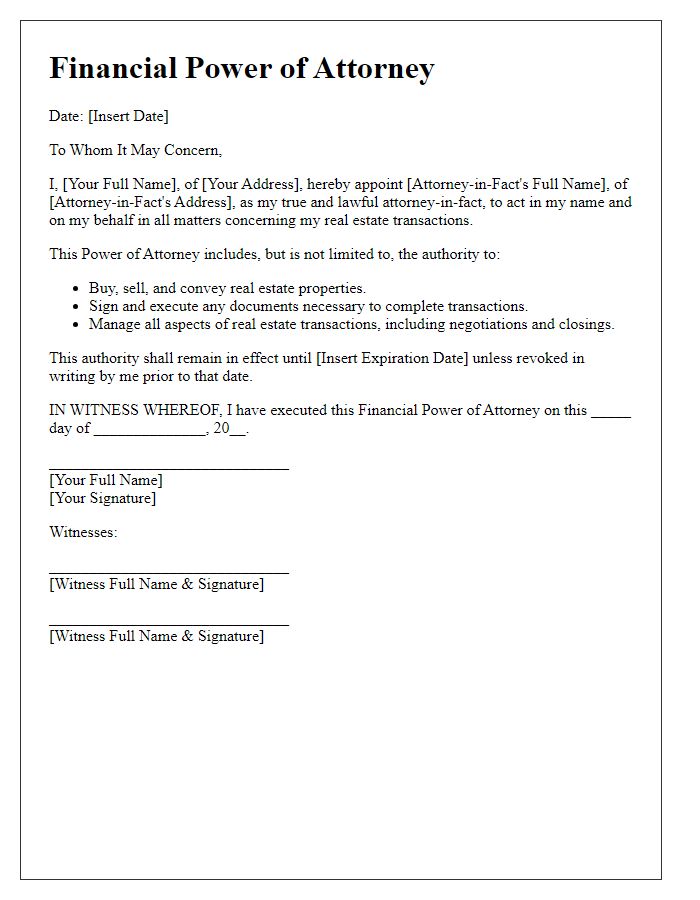

Letter template of financial power of attorney for real estate transactions

Comments