When it comes to corporate mergers, crafting the perfect proposal letter is essential to set the right tone for negotiations. This letter should not only convey the intent of merging but also emphasize the potential benefits for both parties involved. By using clear and accessible language, we can ensure that our message resonates with our counterpart, paving the way for constructive discussions. Ready to dive deeper into the art of writing a compelling merger negotiation proposal? Let's explore further!

Introduction and Executive Summary

A corporate merger negotiation proposal requires a carefully structured introduction and executive summary to convey essential information and set the stage for collaboration. The introduction should outline the motivations behind the merger, emphasizing the market potential and strategic advantages that the union would create. The executive summary must highlight key financial metrics, projected synergies, and the benefits for stakeholders involved, such as increased market share or cost savings. Emphasizing the alignment of corporate cultures and shared vision enhances the attractiveness of the proposal, which is intended to foster a sense of partnership and shared purpose between the organizations.

Strategic Benefits and Synergies

A corporate merger negotiation proposal outlines strategic benefits and synergies between merging companies, such as enhanced market share and operational efficiency. Potential joint ventures can target specific markets, allowing cross-promotion of products and services between brands. Resource allocation can be optimized through consolidated supply chains, reducing costs and improving profitability. Merging technological capabilities may lead to innovative product development and increased competitiveness in an evolving industry landscape. Additionally, leveraging complementary skills and expertise can foster enhanced talent acquisition and retention, benefiting overall organizational growth and resilience.

Proposed Terms and Structure

The proposed terms for the corporate merger between Tech Innovations Inc. and Global Solutions LLC outline a comprehensive structure aimed at maximizing synergies and enhancing market competitiveness. A valuation assessment for Tech Innovations Inc., currently estimated at $500 million, highlights its cutting-edge AI technology and robust customer base. Meanwhile, Global Solutions LLC, valued at $750 million, brings extensive logistics networks and a strong brand presence in North America. The proposed share exchange ratio stands at 1.5:1 in favor of Global Solutions LLC, ensuring equitable distribution of ownership following the merger. The integration strategy will involve combining operational units in key markets such as California and Texas, optimizing resources to eliminate redundancies, and launching joint innovation initiatives by Q3 2024. Key performance indicators will be established to evaluate success post-merger, focusing on revenue growth targets of 15% annually over the next five years. Additional governance structures will include a merged board of directors retaining equal representation from both companies to guide strategic decisions effectively.

Financial Projections and Analysis

A comprehensive financial projection outlines the anticipated revenue, expenses, and growth trajectories for the proposed merger between Corporation A and Corporation B. Revenue forecasts typically include estimated sales growth percentages, market share projections, and analysis of key performance indicators (KPIs) over a 5-year period. Cost synergies from operational efficiencies estimate savings resulting from consolidated resources, such as workforce reductions and shared services, contributing to a streamlined financial structure. Additionally, sensitivity analysis examines various economic scenarios, including best-case, worst-case, and expected outcomes, to gauge the impact of market volatility on profitability. Detailed cash flow analysis projects liquidity needs and capital expenditures, ensuring sufficient resources to facilitate the integration of assets across combined entities in locations like New York and San Francisco. Emphasis on return on investment (ROI) metrics quantifies the economic benefits, reinforcing the strategic rationale for the merger, which aims to enhance market competitiveness and shareholder value.

Legal, Regulatory, and Compliance Considerations

Merging corporations must navigate various legal aspects, including state corporate law regulations (varied by jurisdiction) and federal laws regarding antitrust issues (such as the Sherman Act and Clayton Act in the United States). Comprehensive due diligence processes should address compliance with industry regulations specific to sectors like finance or healthcare. Regulatory bodies such as the Securities and Exchange Commission (SEC) may require disclosures regarding the merger's impact on shareholders and market competition. Compliance with employment laws, such as the Worker Adjustment and Retraining Notification (WARN) Act, becomes crucial when considering layoffs during consolidation. Securing necessary approvals through public filings and legal consultations ensures smooth integration and mitigates risks associated with non-compliance, safeguarding the merger's long-term success.

Letter Template For Corporate Merger Negotiation Proposal Samples

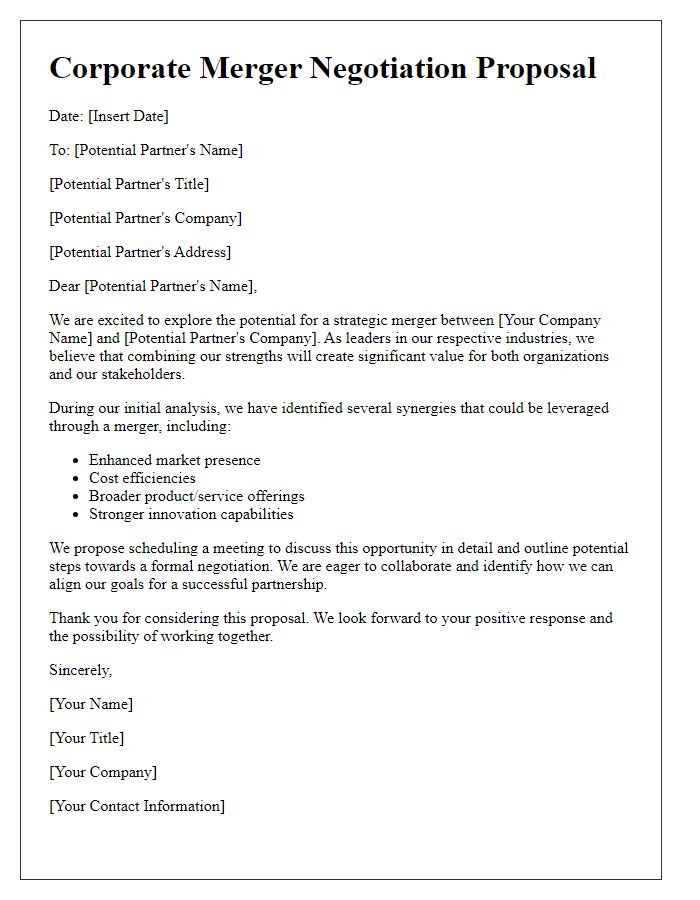

Letter template of corporate merger negotiation proposal for potential partners.

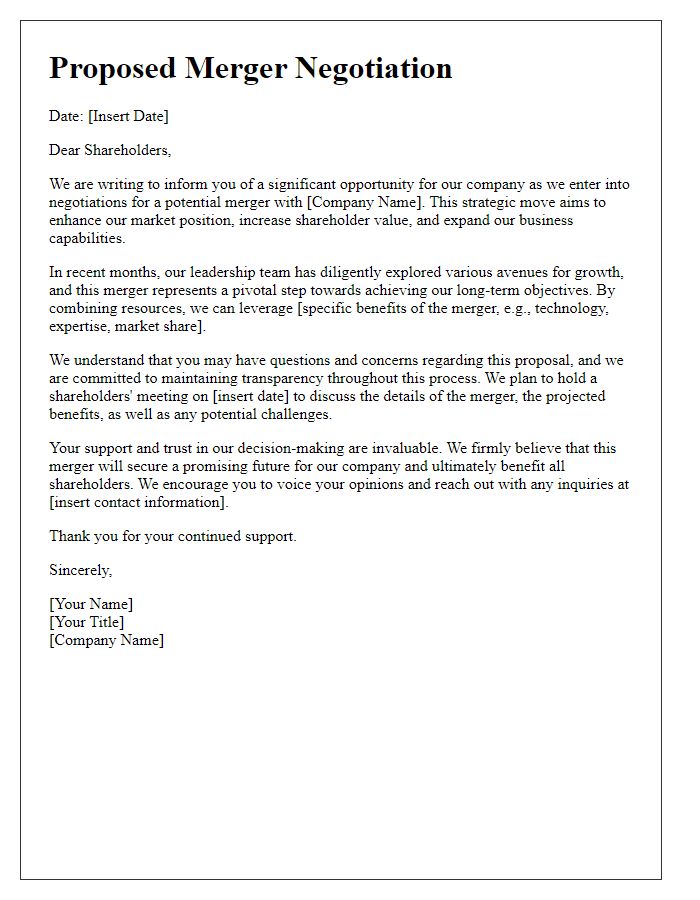

Letter template of corporate merger negotiation proposal addressing shareholders.

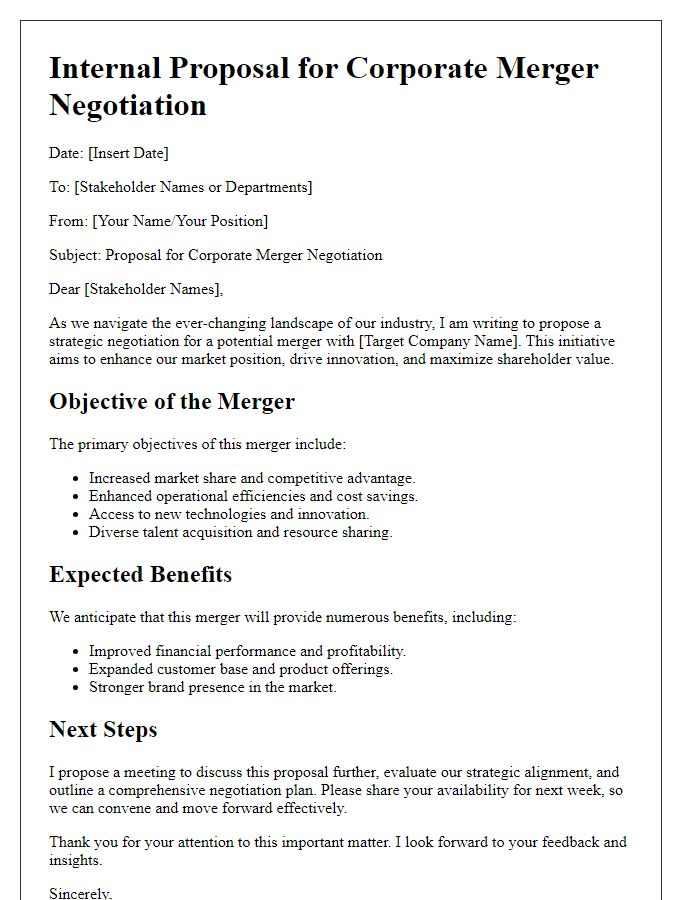

Letter template of corporate merger negotiation proposal to internal stakeholders.

Letter template of corporate merger negotiation proposal highlighting synergies.

Letter template of corporate merger negotiation proposal for legal counsel review.

Letter template of corporate merger negotiation proposal focused on financial benefits.

Letter template of corporate merger negotiation proposal to discuss integration plans.

Letter template of corporate merger negotiation proposal with timeline and milestones.

Letter template of corporate merger negotiation proposal emphasizing risk management.

Comments