Are you navigating the intricate world of financial instrument settlements? Whether you're dealing with equities, derivatives, or fixed-income securities, having a solid letter template can streamline your communication and ensure clarity in your transactions. In this article, we'll explore essential components to include in your financial instrument settlement letters, so you can convey your intentions effectively and professionally. Stay tuned to discover tips and templates that will make your settlement processes smoother and more efficient!

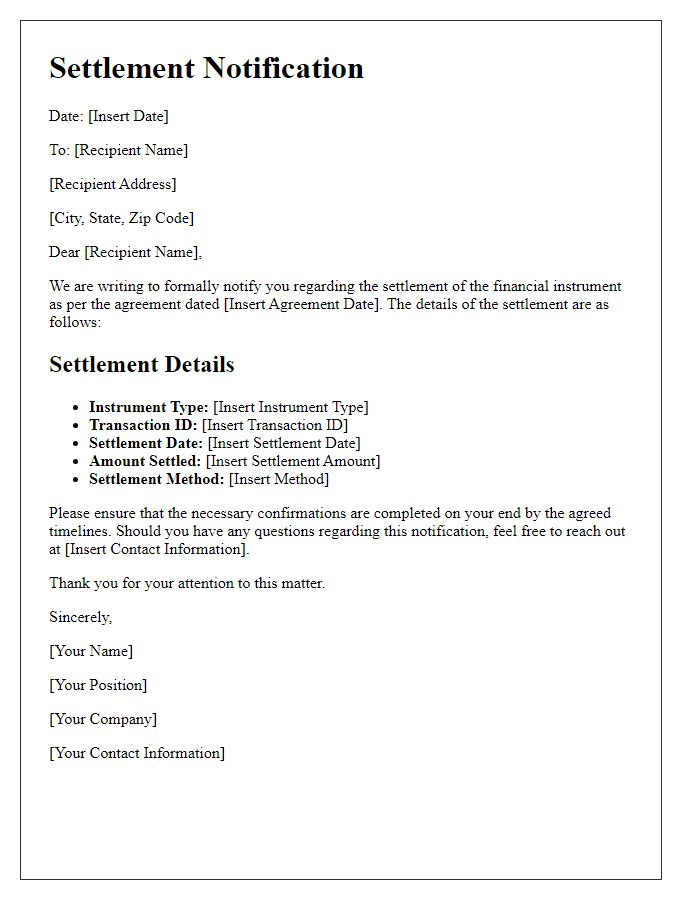

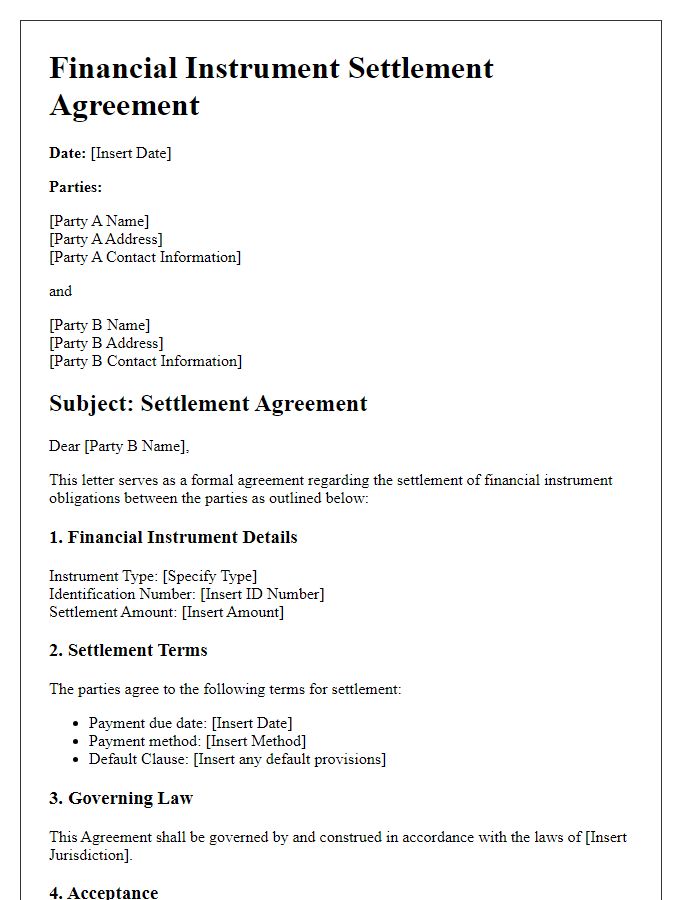

Clear Identification of Parties

In financial instrument settlements, clear identification of parties is crucial. Each entity, such as John Doe Investments, registered at 123 Financial Lane, Capital City, must be distinctly recognized alongside their counterpart, Jane Smith Holdings, located at 456 Market Avenue, Financial District. The registration numbers for these investment firms, along with their respective tax identification numbers (TIN), enhance clarity and ensure compliance with regulations. Additionally, specifying the roles of each party in the transaction, whether buyer, seller, or intermediary, streamlines the settlement process and mitigates potential disputes. Accurate identification promotes transparency within transactions involving various financial instruments, including stocks, bonds, or derivatives, adhering to industry standards set forth by bodies like the Financial Industry Regulatory Authority (FINRA).

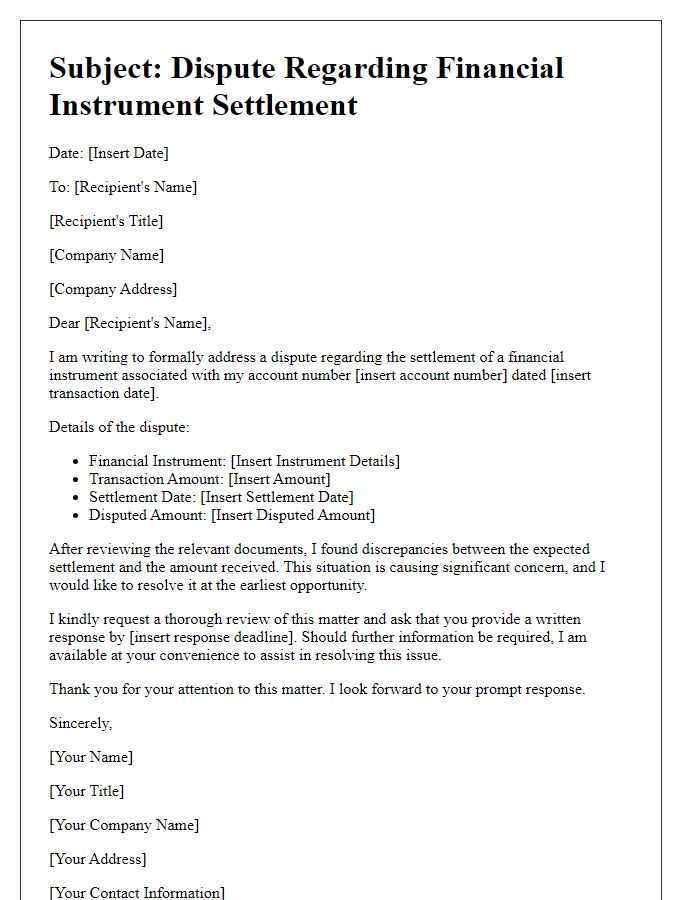

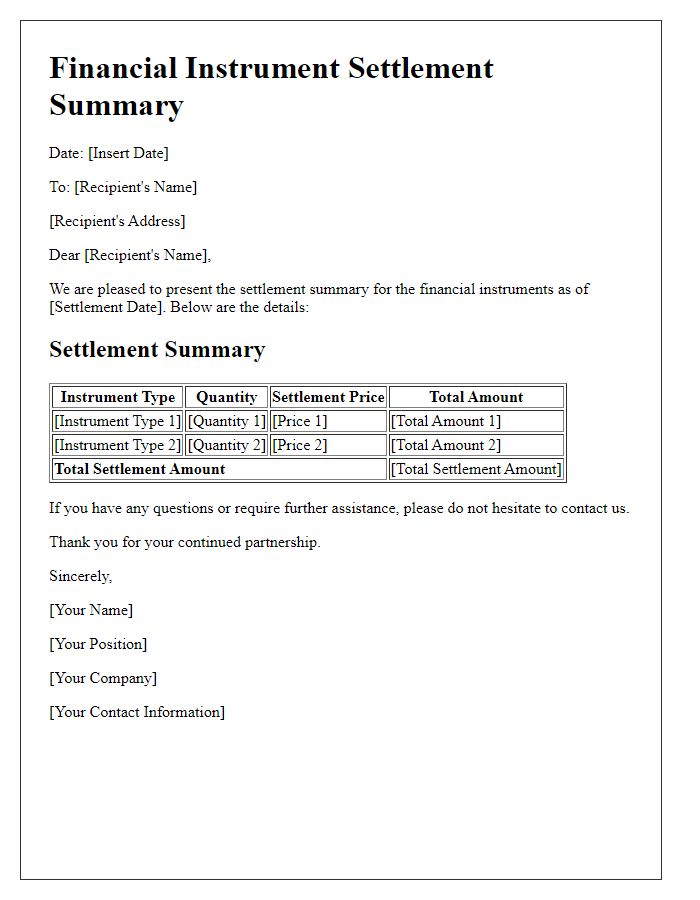

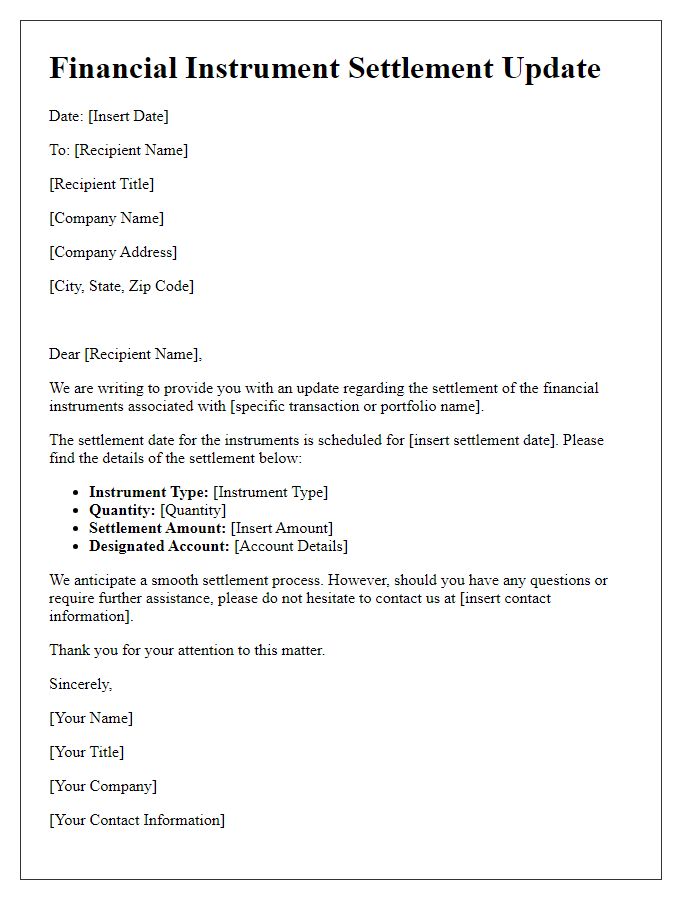

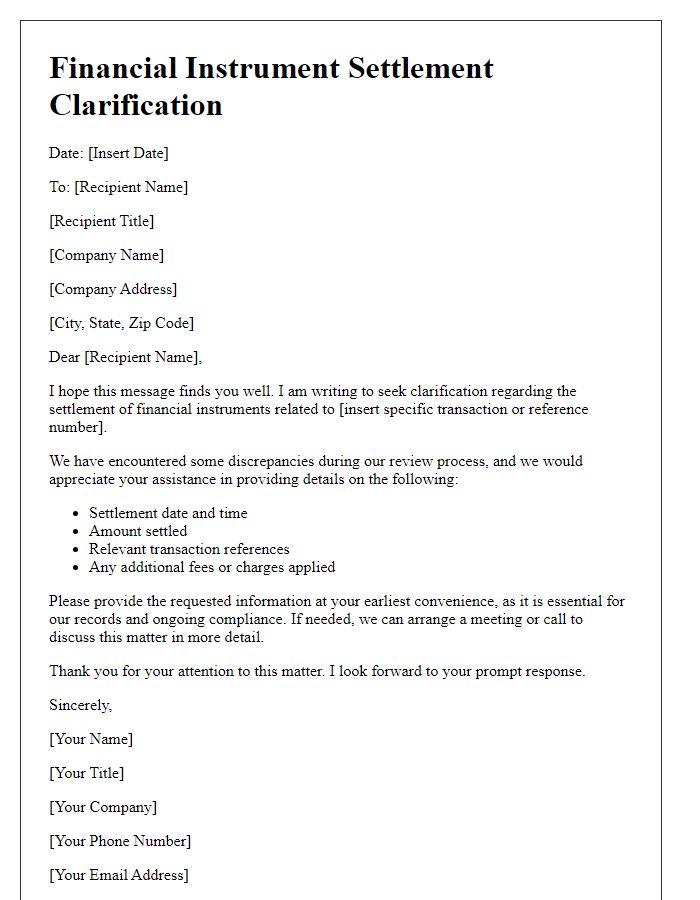

Detailed Transaction Information

In the realm of financial instruments, detailed transaction information plays a crucial role in ensuring smooth settlements. For example, when settling a foreign exchange transaction (FX), key elements include the trade date (often marked as T+2 for two days after the trade date), the notional amount (which represents the sum involved in the trade), and the currency pairs (like USD/EUR or GBP/JPY). Each transaction must also include the settlement date, where funds are transferred between parties, and the clearinghouse involved, such as the Depository Trust & Clearing Corporation (DTCC) in the United States. Furthermore, reference identifiers, such as the International Securities Identification Number (ISIN), help uniquely identify the financial instruments being settled. Accurate documentation of these details ensures compliance with regulations, enhances transparency, and mitigates risks in the financial industry.

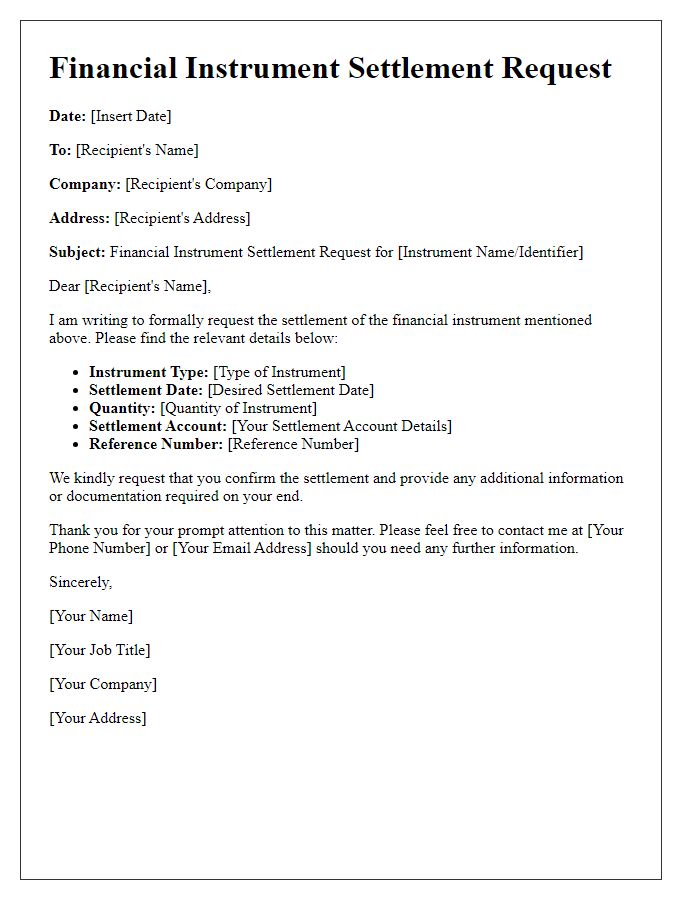

Settlement Instructions

Settlement instructions for financial instruments, including equities, bonds, or derivatives, are crucial for ensuring smooth transactions. These instructions detail the necessary steps for transferring ownership and funds between parties involved in a trade, facilitated through clearing houses or custodians. Key elements include account numbers, trade dates, settlement dates, and specific instructions on delivery versus payment (DVP), ensuring that securities are exchanged simultaneously with the corresponding cash flow. Accuracy in these instructions minimizes the risk of errors, delays, or financial penalties, which can occur due to discrepancies. In 2022, the global securities settlement market reached an estimated $4 trillion daily in transaction volumes, highlighting the importance of efficient settlement processes.

Compliance and Regulatory Adherence

Settlement of financial instruments involves strict compliance and regulatory adherence to ensure legality and transparency within financial markets. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, set forth guidelines that govern transactions. Financial institutions must comply with known standards, including the Dodd-Frank Act, which mandates comprehensive reporting of derivatives transactions to improve accountability. Additionally, adherence to the Anti-Money Laundering (AML) regulations is vital during settlement processes to prevent illicit financial activities. Timely settlement periods, typically within three business days (T+3), enhance market efficiency, while electronic systems like the Central Securities Depository (CSD) facilitate seamless transaction execution. Furthermore, post-trade risk management strategies are implemented to mitigate potential financial exposure and ensure compliance with relevant legal frameworks.

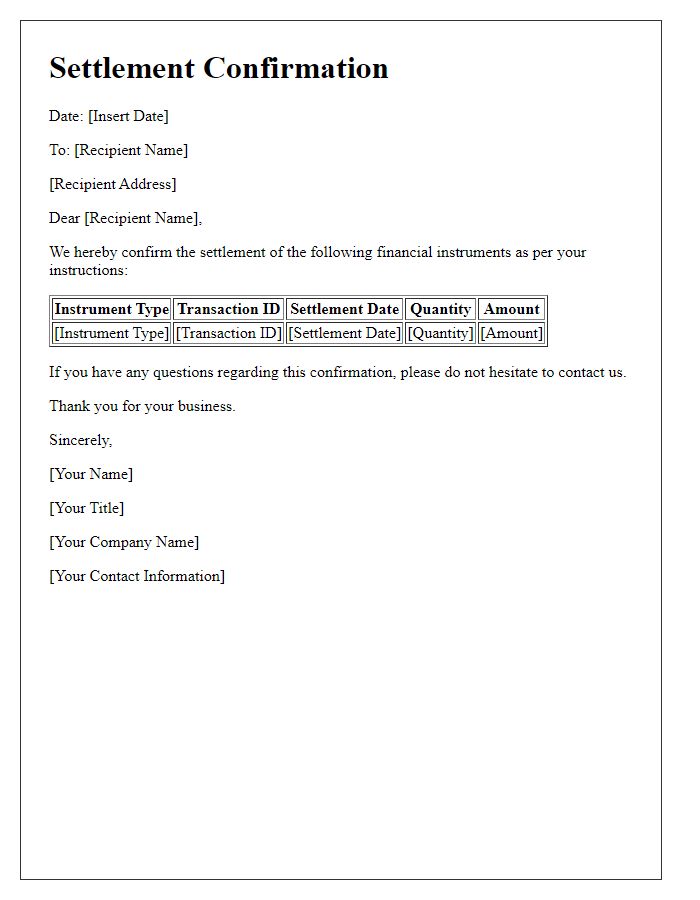

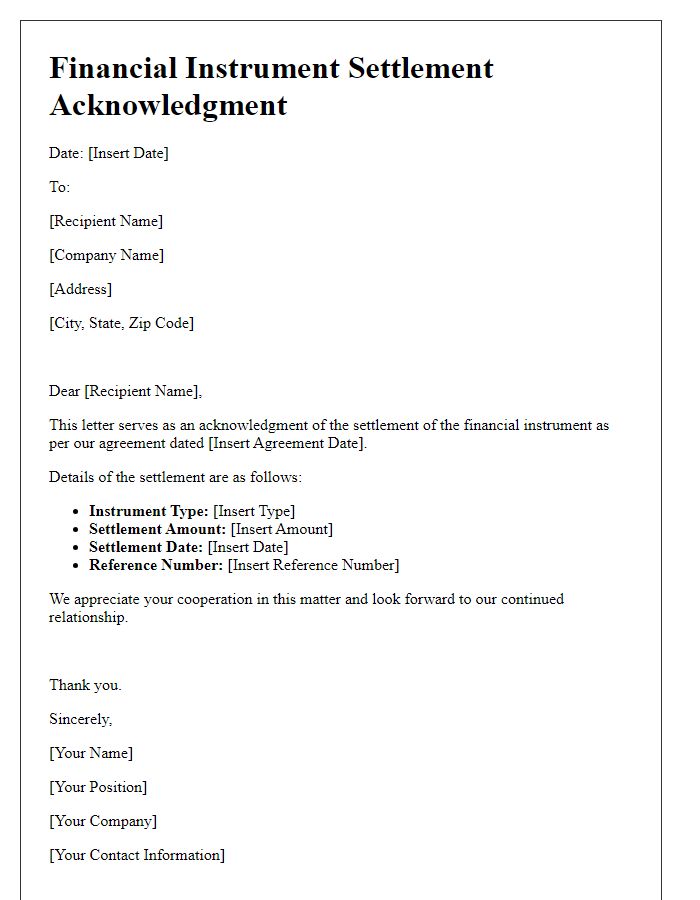

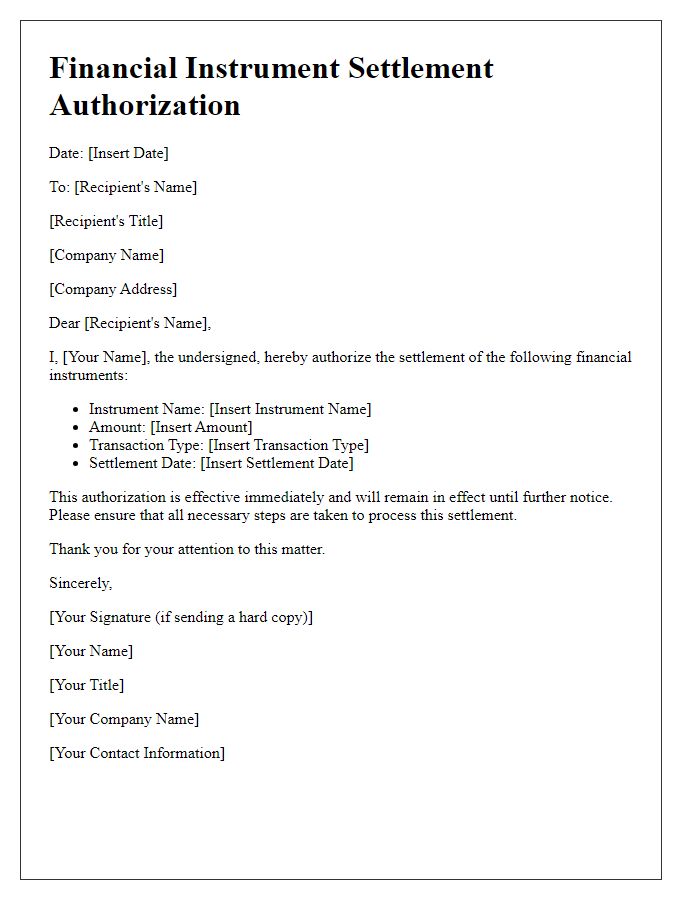

Date and Authorized Signatures

The financial settlement process involves specific dates such as the transaction date, settlement date, and any other relevant timeline indicators. These dates, crucial for logistics, can impact cash flows and accounting records significantly. Authorized signatures from designated officials, often requiring verification processes, ensure the legitimacy of the financial transactions. Each signature typically represents an individual's acknowledgment and approval of the financial instrument transfer, such as stocks or bonds, fostering accountability within institutions or organizations involved. Proper documentation of these elements is essential for regulatory compliance and audit trails in financial operations.

Comments