In today's fast-paced digital world, incorporating electronic signatures into your communication can streamline processes and enhance efficiency. Whether you're finalizing contracts or sending important documents, using an e-signature eliminates the hassle of printing, signing, and scanning. Plus, it adds an extra layer of convenience by allowing you to sign from anywhere at any time. Curious about the best practices and templates for leveraging electronic signatures? Read on to discover how you can simplify your signing process!

Consent and Authorization Clause

Electronic signatures, defined as digital representations of individuals' consent or approval, must be accompanied by explicit consent and authorization to ensure legal validity. In various contexts, including electronic contracts and online agreements, users must clearly understand the implications of granting consent for electronic signature utilization. This process typically involves outlining key aspects, such as the identification of parties, the specific documents being signed, and the circumstances under which consent is provided. Furthermore, stakeholders should be informed about data privacy measures in compliance with regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act), emphasizing the secure handling of personal information during the signature process. Ensuring clarity in consent and authorization facilitates trust and protects all parties involved in electronic transactions, enhancing the overall integrity of digital agreements.

Identity Verification Details

Utilizing electronic signatures for identity verification provides a secure and efficient method of confirming individual identities in various transactions. Digital signatures, particularly those based on Public Key Infrastructure (PKI), utilize cryptographic algorithms to ensure authenticity and integrity of electronic documents. For instance, according to regulations stipulated by the Electronic Signatures in Global and National Commerce Act (ESIGN), signatures created with verified identity documents allow businesses to streamline processes while ensuring compliance. The use of two-factor authentication (2FA) further enhances security by requiring additional verification methods, such as a one-time passcode sent to a mobile device. Various industries, including finance and healthcare, increasingly adopt electronic signatures due to their speed and efficiency, significantly reducing paperwork and improving customer experience.

Technology and Security Measures

The implementation of electronic signatures, such as those facilitated by Public Key Infrastructure (PKI) systems, has transformed document authentication within various sectors including finance and legal. These signatures utilize asymmetric cryptography, ensuring that each signature is linked to a unique digital certificate, which is issued by a trusted Certificate Authority (CA). Security measures, such as two-factor authentication and encryption protocols like AES-256, are critical in safeguarding the integrity of the signing process. In applications like DocuSign and Adobe Sign, the use of secure servers located in compliance with regulations, such as GDPR and HIPAA, ensures that sensitive information remains protected throughout the signature lifecycle. Additionally, digital footprints provide an audit trail that enhances transparency and traceability of signed documents.

Revocation and Modification Terms

The utilization of electronic signatures in business transactions involves specific revocation and modification terms that ensure both security and compliance. When an electronic signature, such as a digitally created signature used in documents signed via Adobe Sign, is utilized, parties must be informed about the ability to revoke consent at any time under the Uniform Electronic Transactions Act (UETA) guidelines. This revocation may require a formal notice submitted electronically via email or a designated online portal within a specified timeframe, usually 30 days. Modifications to the terms of electronic signature usage, specifically in cases of software change, must be documented transparently, allowing all signatories to acknowledge updates regarding privacy policies or data protection measures in accordance with the General Data Protection Regulation (GDPR) standards. Companies must ensure that all parties retain access to a clear record of signed agreements and associated modifications, stored securely in an encrypted digital format to prevent unauthorized alterations, which and protects the legal validity of such electronic transactions.

Legal Compliance and Jurisdiction Information

Electronic signature utilization assures legal compliance across various jurisdictions, including the United States under the Electronic Signatures in Global and National Commerce Act (ESIGN) of 2000, and the Uniform Electronic Transactions Act (UETA). These statutes ensure that electronic signatures hold the same legal weight as traditional handwritten signatures, facilitating remote transactions in business settings. Key jurisdictional considerations include state-specific laws, such as California's Civil Code Section 1633, which explicitly recognizes electronic contracts and signatures. Adequate measures for authentication, such as two-factor authentication protocols, reinforce the integrity of signed documents, guaranteeing that signatories are verified and reducing the risk of fraud. In international contexts, regulations like the European eIDAS framework establish standards for electronic identification and trust services, ensuring cross-border recognition of electronic signatures in member countries.

Letter Template For Electronic Signature Utilization Samples

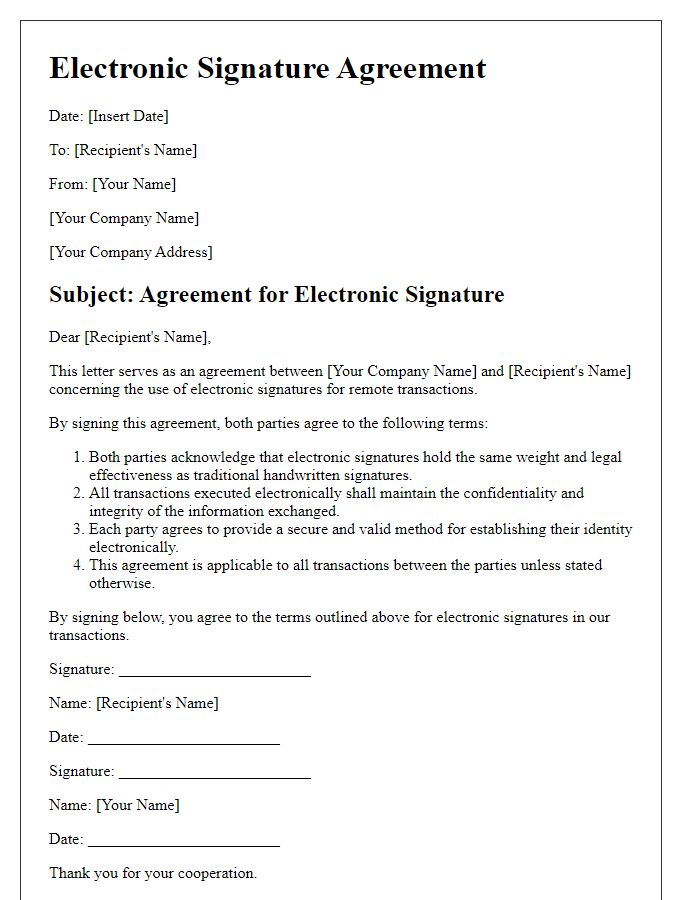

Letter template of electronic signature agreement for remote transactions

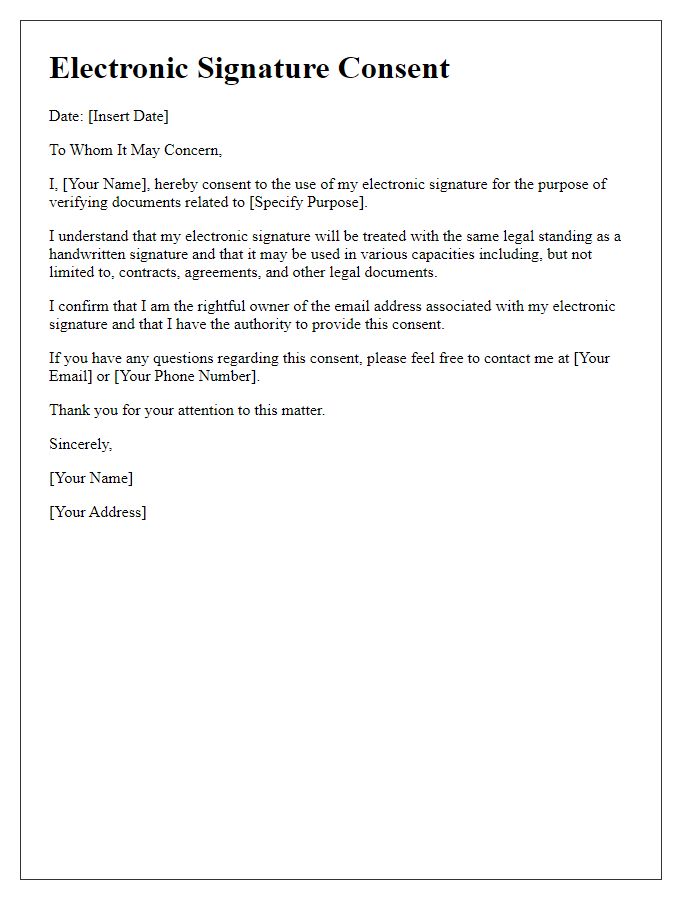

Letter template of electronic signature consent for document verification

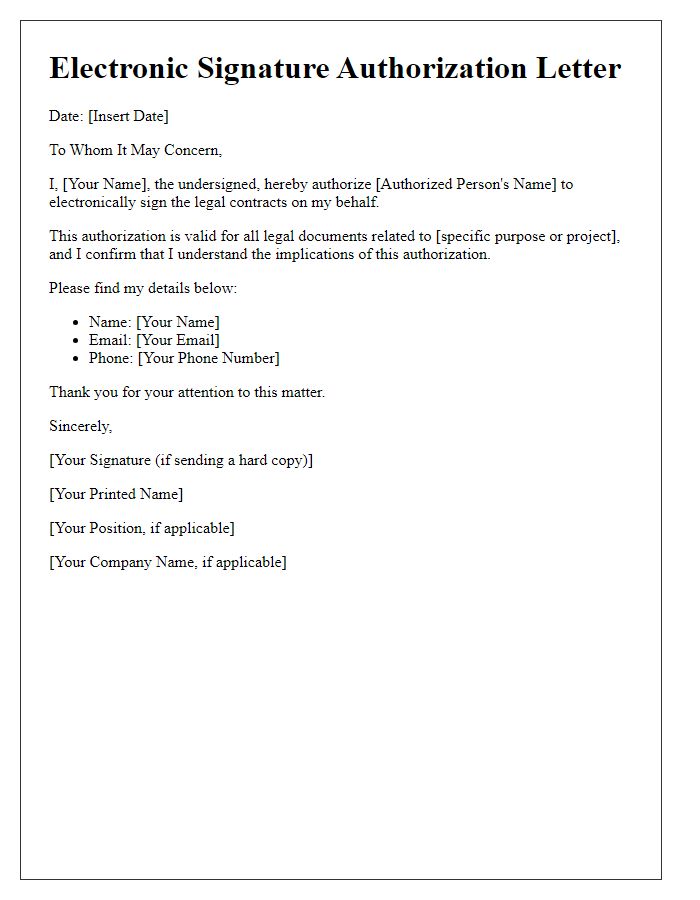

Letter template of electronic signature authorization for legal contracts

Letter template of electronic signature policy for internal communications

Letter template of electronic signature confirmation for service agreements

Letter template of electronic signature guidelines for team collaboration

Letter template of electronic signature acceptance for employment documents

Letter template of electronic signature notification for financial agreements

Comments