Hey there! If you've recently become a victim of identity theft, you may find yourself feeling overwhelmed and unsure of the next steps. One crucial action is drafting an identity theft affidavit, which can help you report the crime and protect your finances. In this article, we'll walk you through a simple letter template that outlines what to include for clarity and efficacy. So, let's dive in and empower you to take back control of your identity!

Personal Identification Information

Identity theft can lead to severe financial repercussions and emotional distress for victims. Personal identification information, including Social Security numbers (nine-digit numerical identifier), driver's license numbers (state-issued identification for legal driving), and bank account numbers (strings of digits linked to financial institutions), can be exploited. Unauthorized use of this information can result in fraudulent activities such as opening credit accounts, making purchases, or committing crimes. Victims often must file affidavits to formally report identity theft, providing detailed documentation of their personal information and the circumstances surrounding the theft. This process frequently involves contacting credit bureaus, such as Equifax, Experian, or TransUnion, and placing fraud alerts or credit freezes on their files. Seeking help from legal entities or identity theft protection services is essential in addressing and mitigating the consequences of identity theft.

Description of the Identity Theft Incident

Identity theft incidents can significantly disrupt lives and financial stability, resulting in unauthorized access to personal information. Such incidents often occur when sensitive data, like Social Security numbers or credit card details, is obtained without consent, typically through methods like phishing scams or data breaches involving large companies. For example, the 2017 Equifax breach exposed the personal information of approximately 147 million people, allowing identity thieves to open new credit accounts or commit fraudulent activities. Victims may notice suspicious transactions on bank statements, unfamiliar accounts being opened in their names, or their credit score significantly dropping due to unpaid debts accrued by identity fraud. Reporting these incidents promptly to financial institutions, credit bureaus, and law enforcement is crucial in mitigating damages and beginning the restoration process.

Statement of Unauthorized Use

Identity theft can result in significant financial loss and emotional distress for victims. According to the Federal Trade Commission (FTC), over 1.4 million identity theft complaints were filed in 2020 alone, highlighting the prevalence of this crime. To combat this issue, individuals often need to complete an identity theft affidavit, a legal document that serves as a formal statement of unauthorized use, detailing the circumstances under which personal information was misappropriated. This affidavit typically includes specific details, such as the victim's name, address, and Social Security number, as well as a description of the fraudulent transactions that occurred, which could involve unauthorized credit card charges or loans taken out in the victim's name. Furthermore, the affidavit may need to be submitted to financial institutions, law enforcement, and credit reporting agencies, helping the victim reclaim their identity and mitigate financial damage.

Declaration of Truth and Accuracy

Identity theft can lead to significant personal and financial distress. The declaration serves as a formal statement that the person filing it has provided truthful information about the fraudulent activity. Key fraud-related events, such as unauthorized credit card transactions or the opening of accounts in the victim's name, must be detailed. Essential details include accurate timelines, names of banks or creditors involved, and specific amounts lost or misused. This declaration, often required for legal processes, helps law enforcement and financial institutions investigate the crime effectively. The process typically involves compiling documentation, including police reports and affected account statements, to substantiate claims, ensuring the victim's identity restoration efforts are robust.

Contact Information and Signature

Identity theft affidavits typically require specific contact information and a signature to verify the identity of the individual reporting the theft. Names of the affected individuals, such as the victim and identity thief, must be clearly defined. The victim's address, phone number, and email address facilitate communication with law enforcement and financial institutions. Date of the incident and signatures add authenticity to the document, making it legally actionable. Moreover, additional documentation may be requested, including police reports or account statements, to support claims of fraudulent activities. Accurate and comprehensive information is crucial in addressing the serious consequences of identity theft.

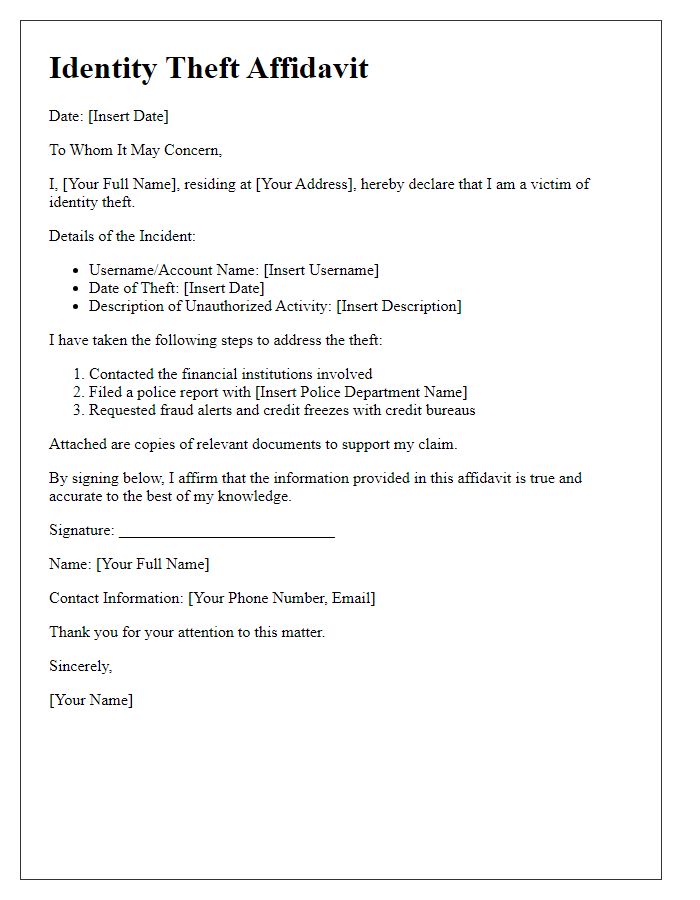

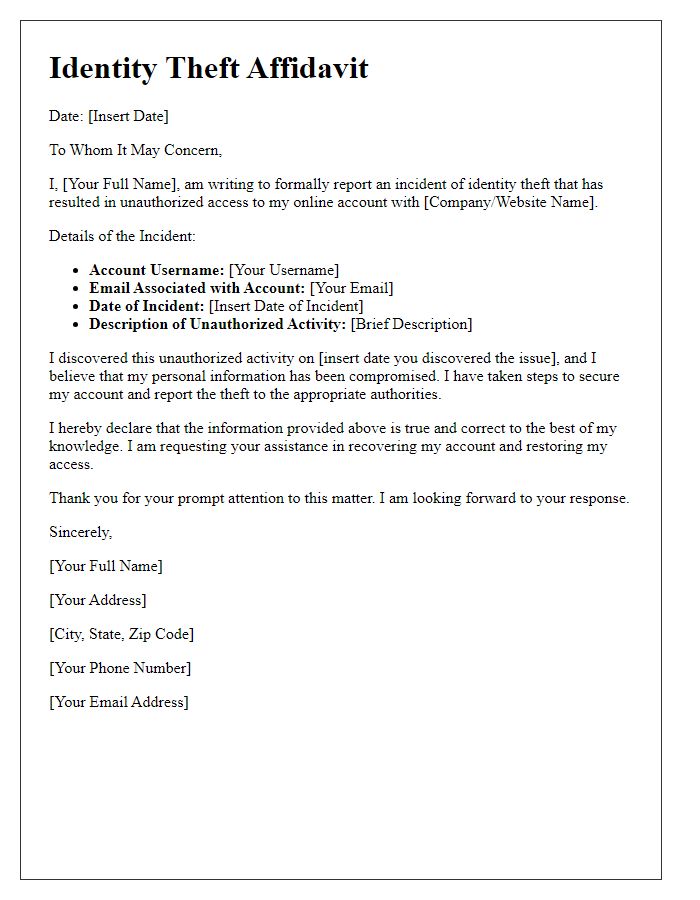

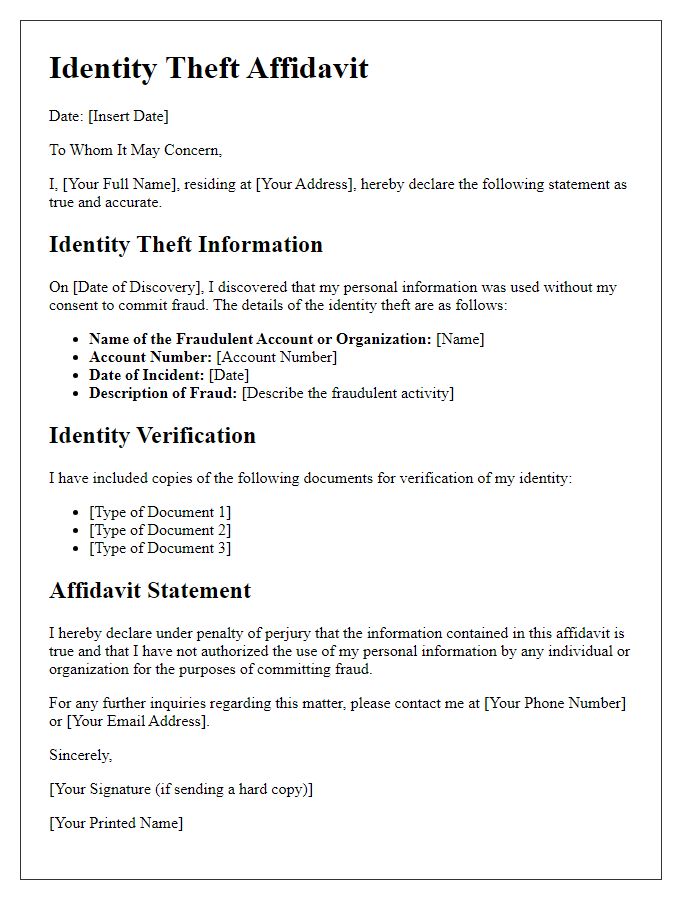

Letter Template For Identity Theft Affidavit Samples

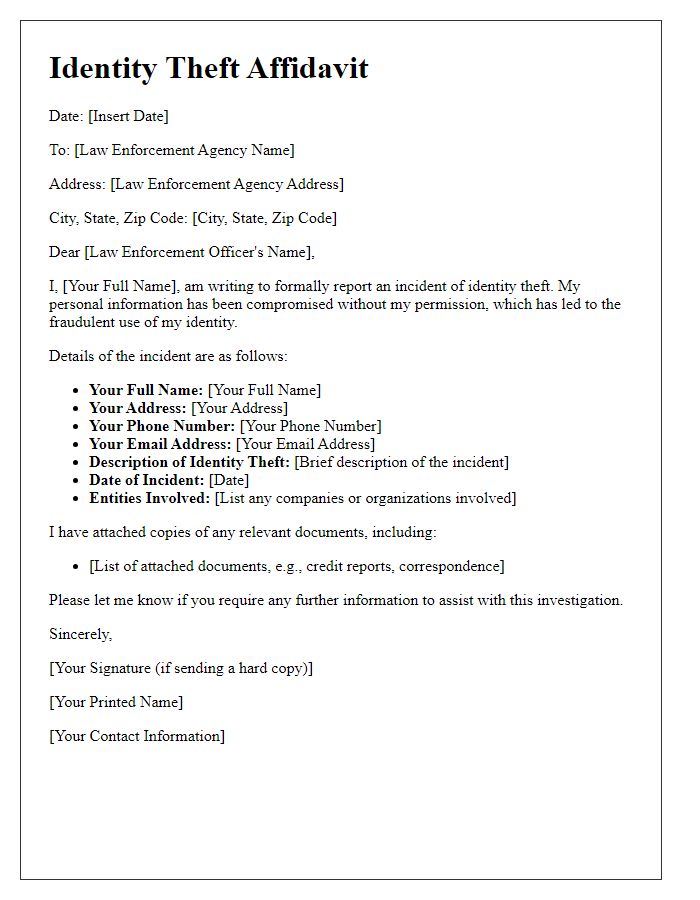

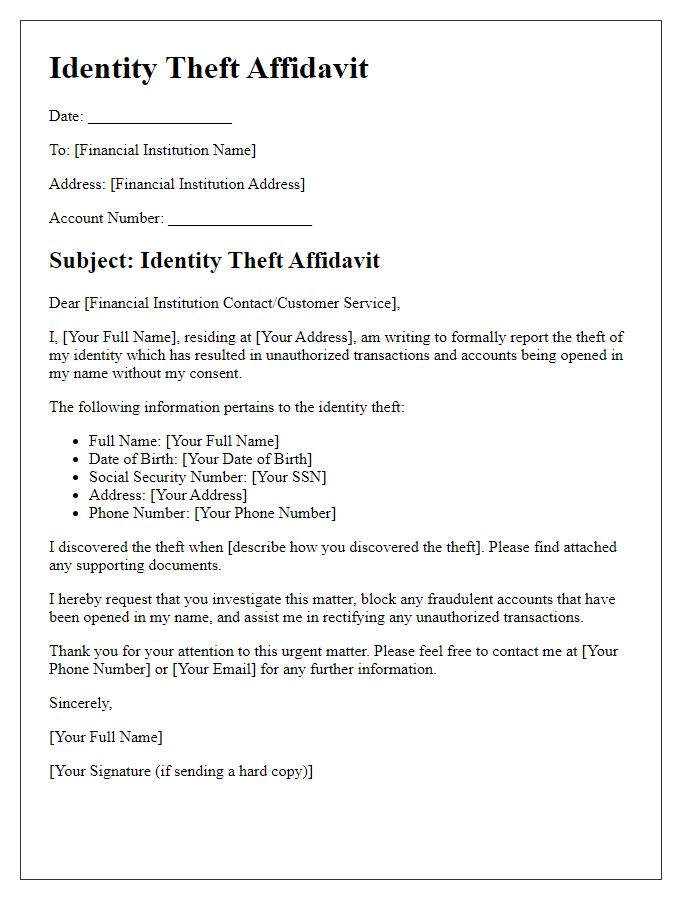

Letter template of identity theft affidavit for reporting to law enforcement

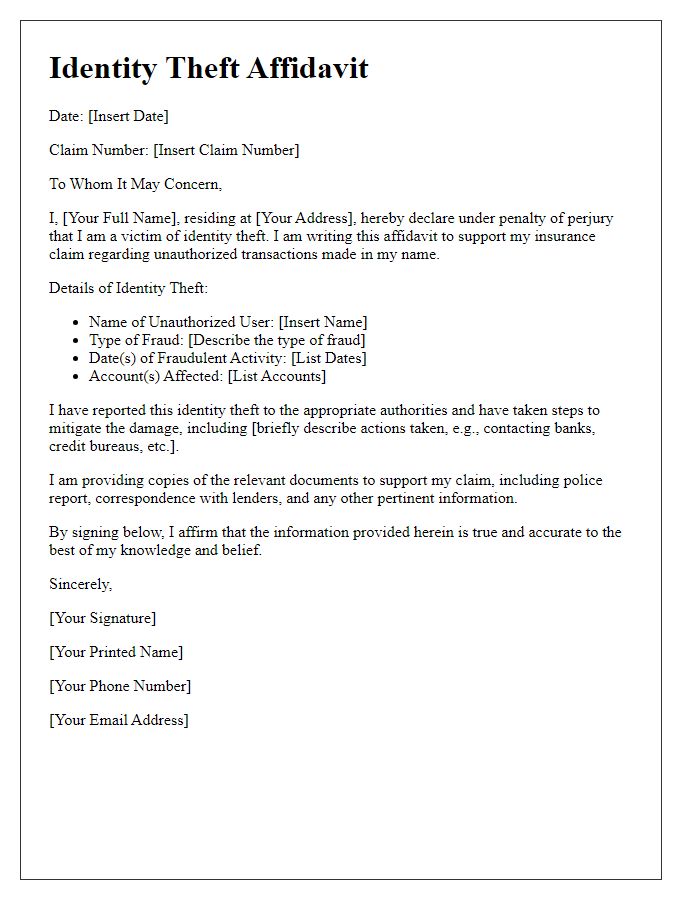

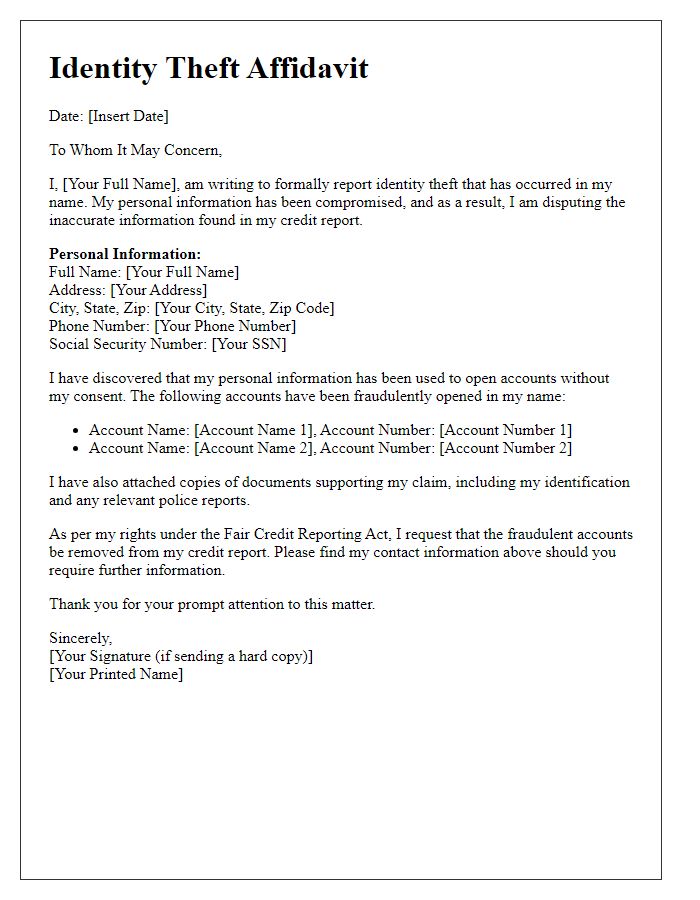

Letter template of identity theft affidavit for insurance claim purposes

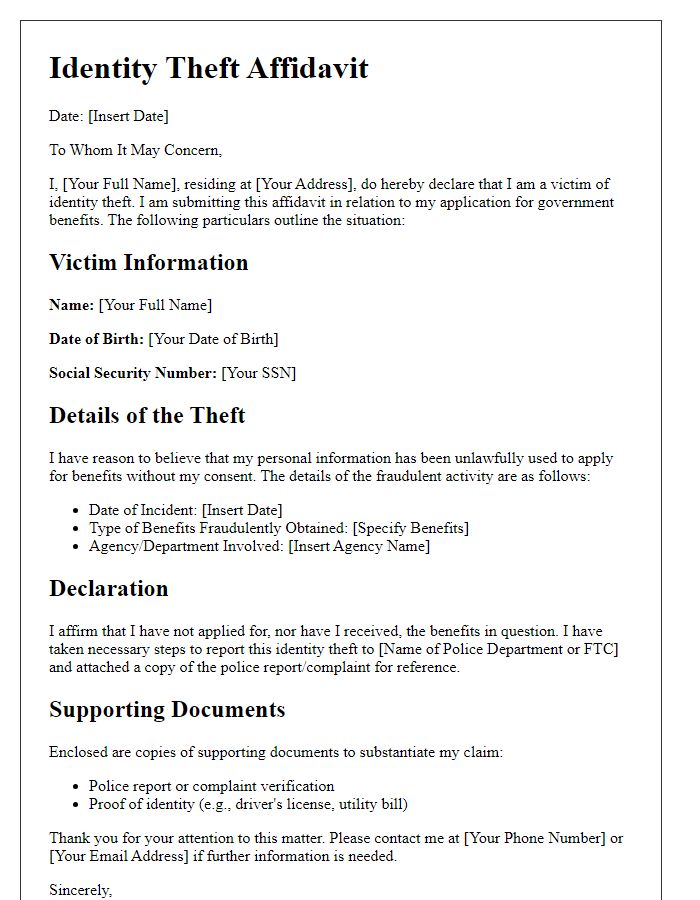

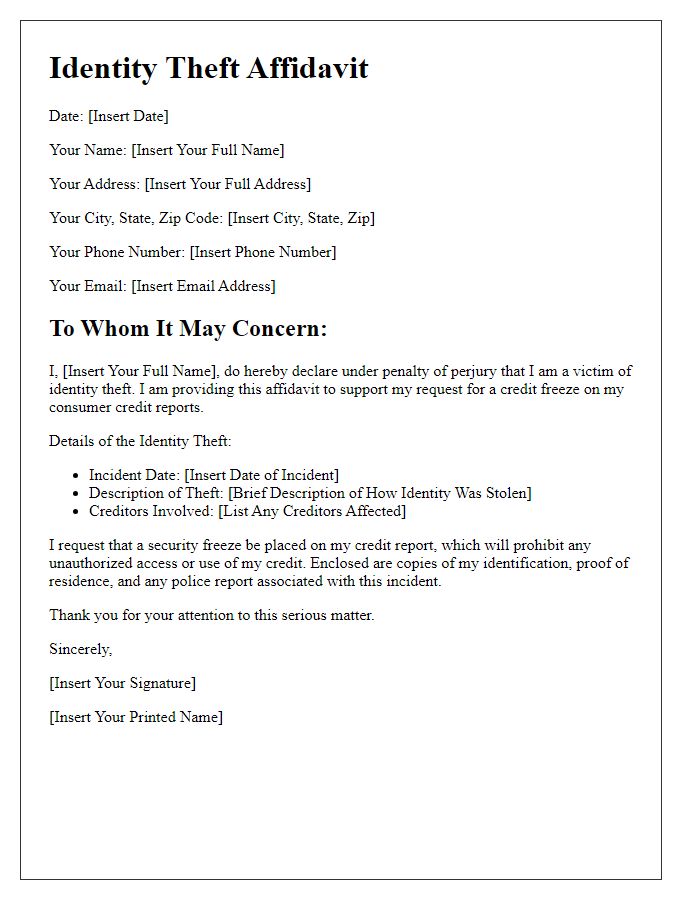

Letter template of identity theft affidavit for government benefits applications

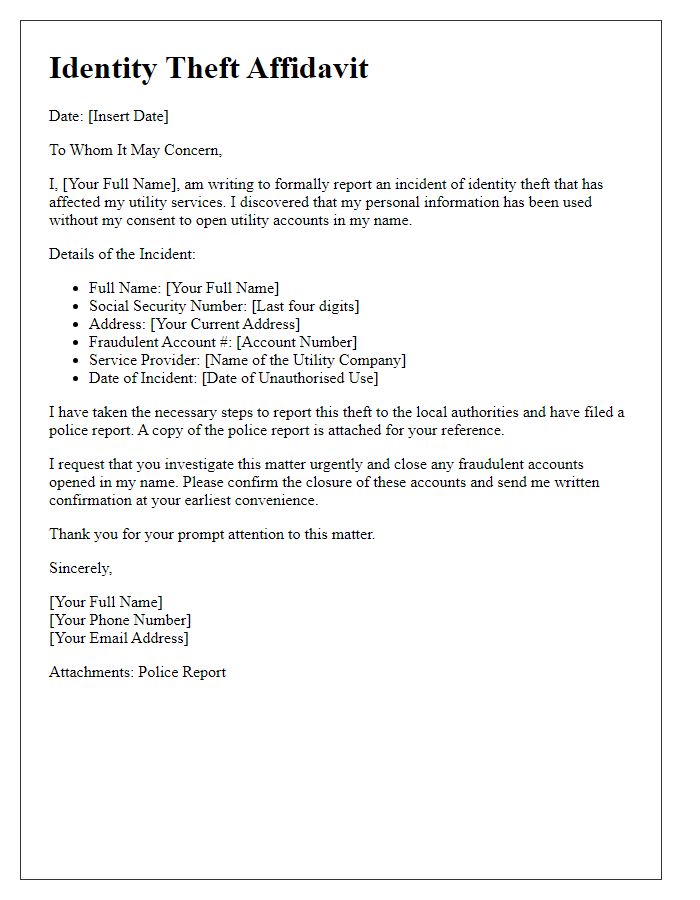

Letter template of identity theft affidavit for utility service providers

Comments