Navigating the complexities of tax disputes can be overwhelming, but effective communication is key to resolving these issues. Whether you're facing an audit or a disagreement over your tax filing, having a well-crafted letter template can help streamline the process and convey your concerns clearly. This article will guide you through essential components to include in your tax dispute resolution letters, ensuring you present your case effectively. So, let's dive in and explore how to tackle your tax disputes with confidence!

Clarity and precision in language

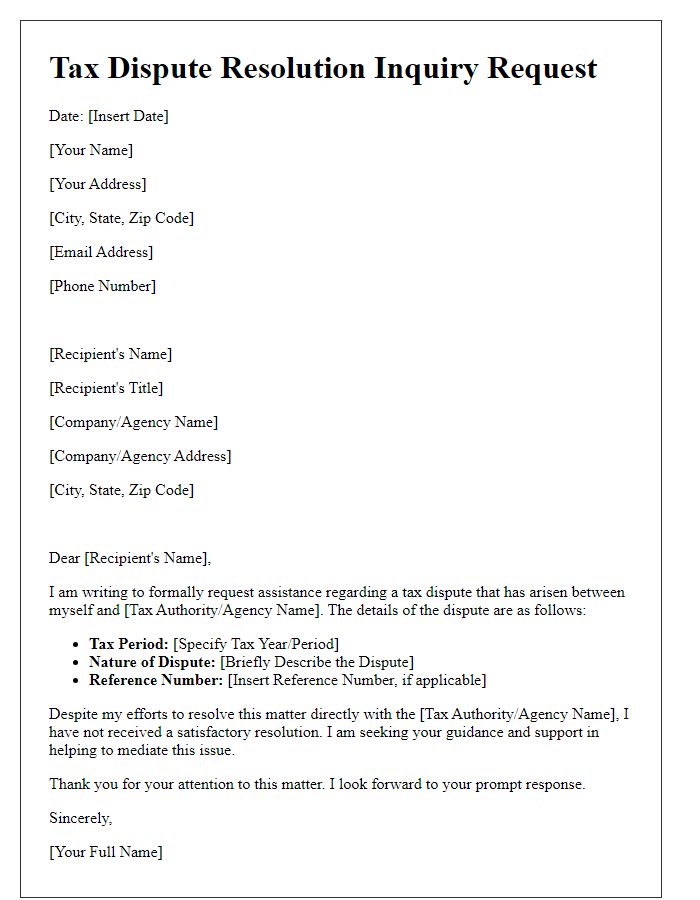

Clear and precise communication in tax dispute resolution is vital for effectively addressing issues with tax authorities, such as the Internal Revenue Service (IRS) in the United States. Taxpayers should detail the specific tax years involved, referencing relevant sections of tax codes, such as Internal Revenue Code (IRC) Section 6201, which pertains to assessment of tax liabilities. This communication should clearly state the nature of the dispute, whether it involves discrepancies in income reporting, potential deductions, or penalties assessed. Supporting documentation, such as W-2 forms, 1099s, or accounting statements, should be organized and referenced appropriately. Additionally, taxpayers may include a timeline of events, outlining critical dates such as notices received, deadlines for appeals, and any previous correspondence with the tax authority. Utilizing a formal tone and maintaining meticulous attention to detail enhances the effectiveness of the resolution process, fostering clarity and reducing potential misunderstandings.

Legal and tax references

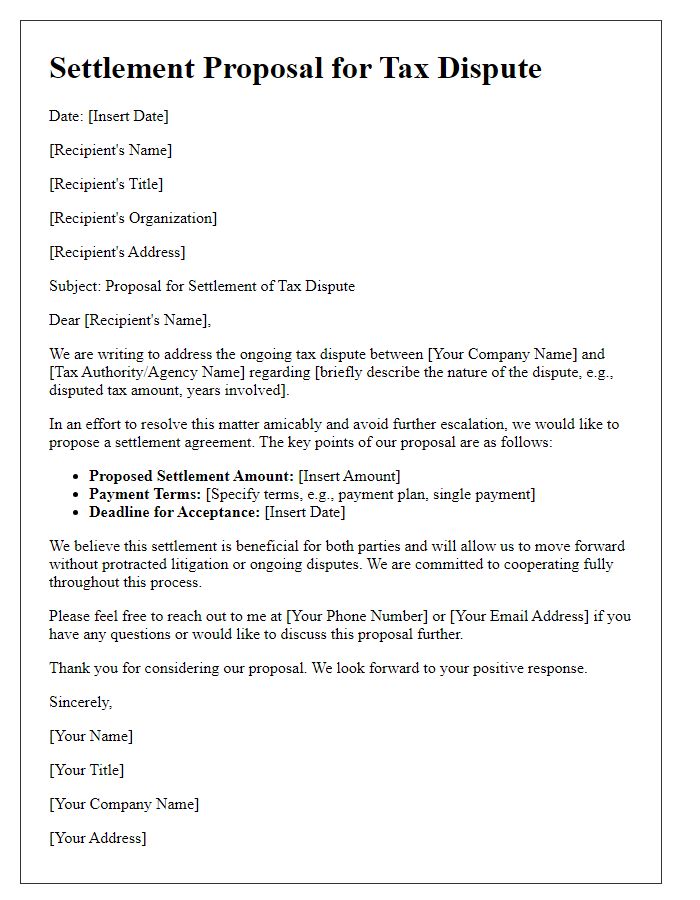

Addressing tax disputes requires a careful examination of legal frameworks and tax regulations. The Internal Revenue Code (IRC) in the United States serves as the foundational document, detailing various tax obligations and rights, such as Section 6110 concerning the release of certain tax information. Taxpayers can engage the Tax Court, a specialized court focusing on tax disputes, to seek resolution on issues like deficiency notices or penalties. Key dates, such as the 90-day period following a notice of deficiency, are crucial for timely responses. Various state revenue codes may also apply, highlighting the importance of understanding both federal and state jurisdictions. Additionally, resources like the IRS Appeals process provide an alternative pathway for resolving disputes without litigation, emphasizing mediation over adversarial tactics. Always consider the statute of limitations, typically three years for income tax assessments, to ensure compliance and prepare for potential audits.

Conciseness and relevance

Tax disputes often arise from discrepancies in reported income, deductions, and credits between taxpayers and the Internal Revenue Service (IRS). Effective communication in resolving these disputes is essential for clarity, ensuring all parties understand the facts. Key elements include concise summaries of the dispute, relevant tax codes (such as Internal Revenue Code Section 162 regarding business deductions), and supporting documentation (such as W-2 forms or 1099 statements). The communication should address specific issues like audit findings or notices from the IRS, detailing any discrepancies in amounts and the taxpayer's position. Clear deadlines for responses and requests for any additional documentation should be outlined to facilitate prompt resolution.

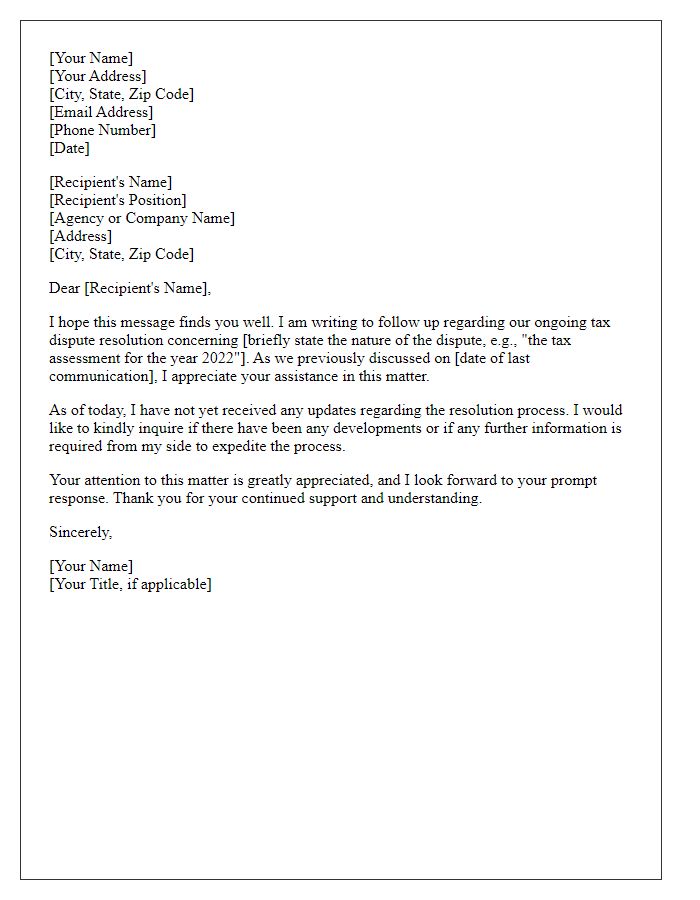

Respectful tone and professionalism

Navigating tax dispute resolutions can involve various complexities, including audits by the Internal Revenue Service (IRS) or other tax authorities, tax assessments disputations, and appeal processes. Clear documentation is essential, comprising tax return forms, correspondence regarding the dispute, and evidence supporting the position being taken. Taxpayers must maintain a respectful tone while communicating with tax officials, emphasizing professionalism in letters to ensure that their disputes receive fair consideration. It's crucial to reference relevant tax codes, deadlines, and any previous communications to substantiate claims. Maintaining organized records during this resolution process can significantly impact outcomes and help achieve satisfactory results.

Structured format and organization

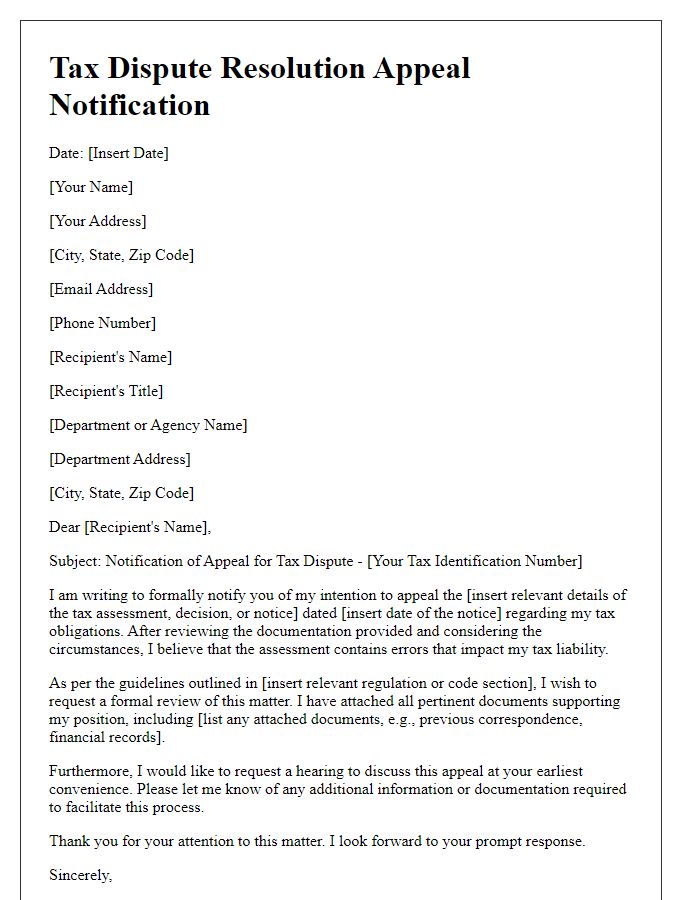

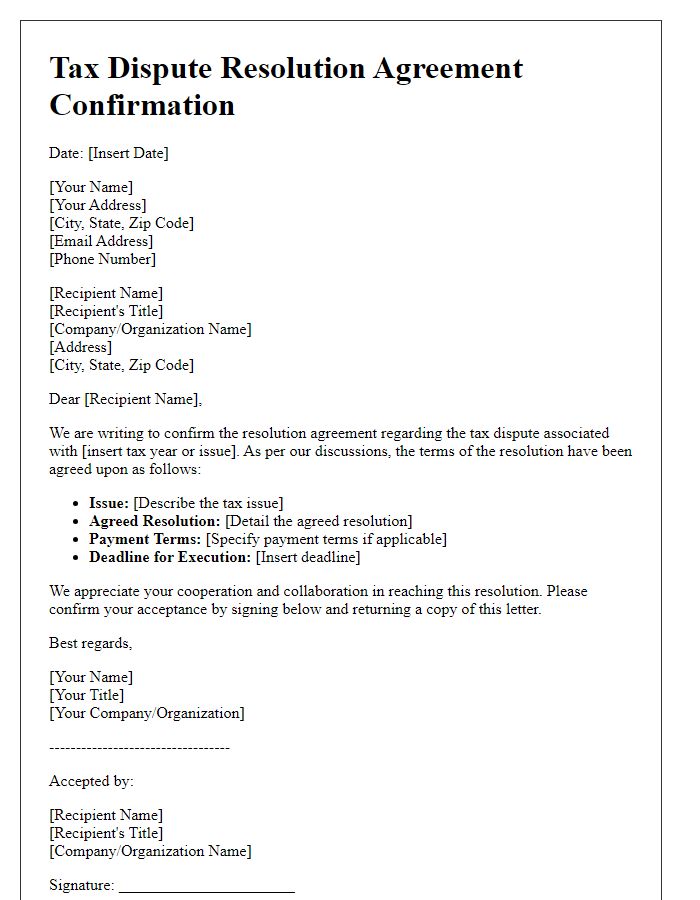

A structured format for tax dispute resolution communications involves clear headings, concise language, and a systematic approach to the details of the dispute. Begin with a formal header, including the name of the tax authority or agency, relevant case number, and date. Follow this with a subject line indicating the nature of the dispute, such as "Request for Tax Dispute Resolution." Next, introduce the parties involved, particularly the taxpayer's name and tax identification number for reference. Present a summary of the dispute, detailing the specific tax issues, such as underpayment, penalties, or miscalculations. Include factual evidence supporting the taxpayer's position, along with relevant laws or regulations. Organize the communication into distinct sections for clarity: Introduction, Background, Argument, and Conclusion. Finally, provide contact information for follow-up, ensuring to include the taxpayer's representative, if applicable.

Comments