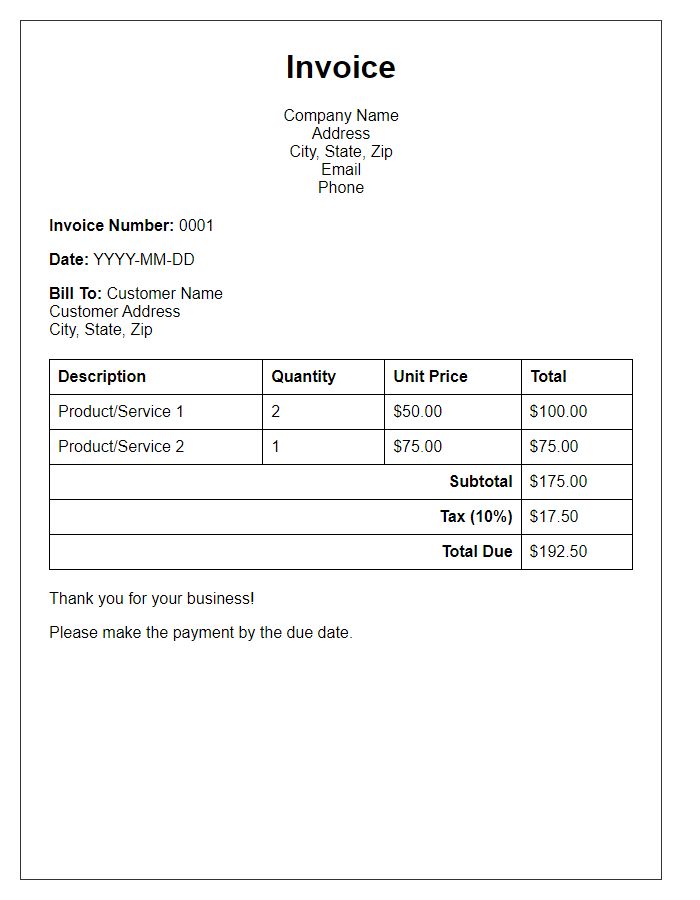

Are you tired of sifting through an endless array of invoice formats that just don't fit your needs? Finding the right template can not only save you time but also streamline your billing process, making it easier for both you and your clients. In this article, we'll explore various invoice format preferences, highlighting what features to look for based on your business type and clientele. So, grab a cup of coffee and dive in to discover the perfect invoice template for your needs!

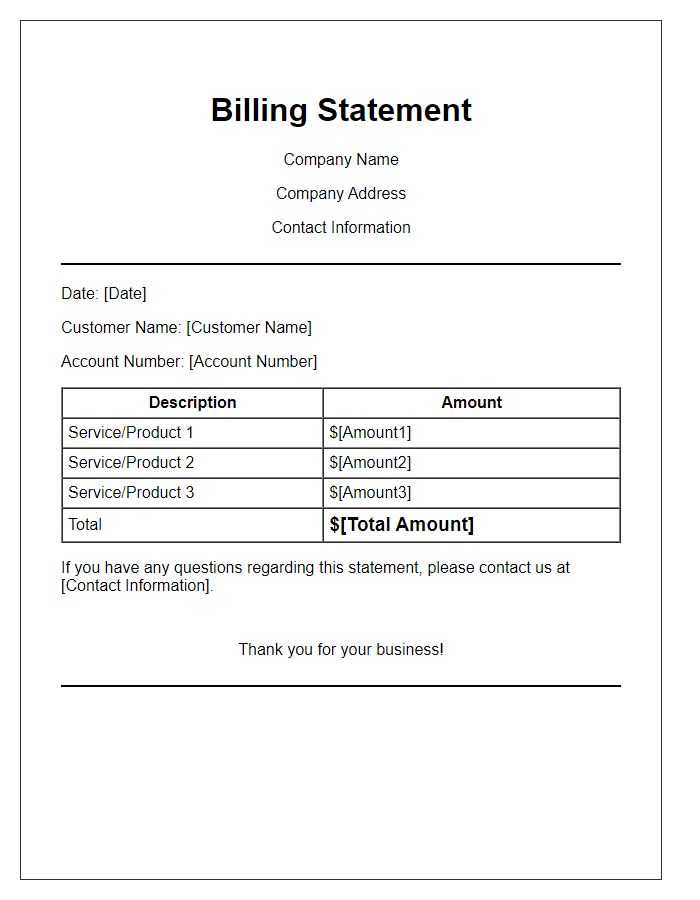

Client and Company Information

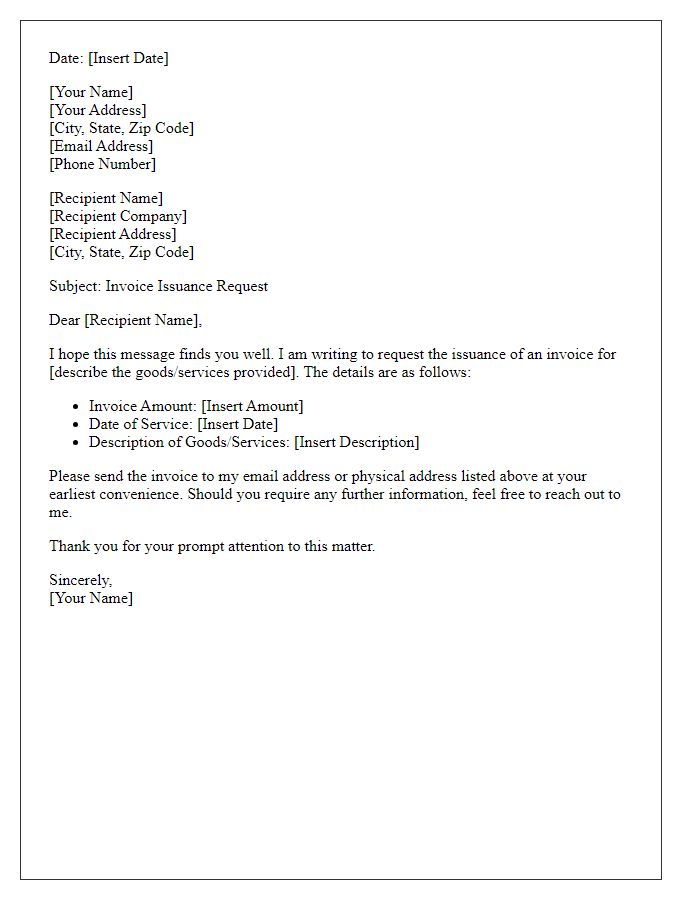

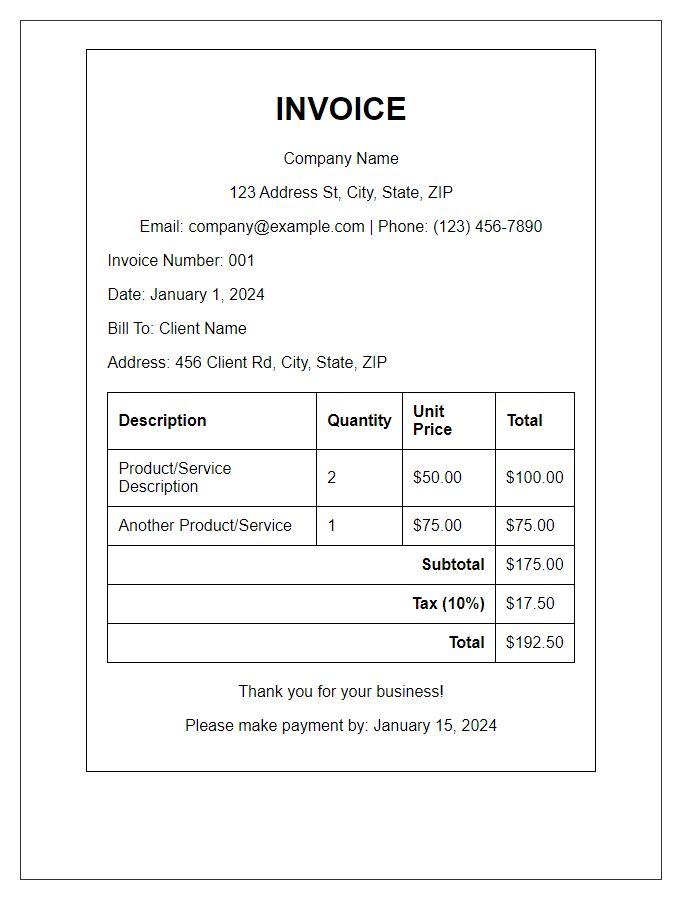

Invoices serve as crucial documents in business transactions, providing necessary details such as client and company information. Client information, including the name (John Doe Enterprises), address (123 Main Street, Springfield), contact number (555-123-4567), and email (john.doe@example.com), is essential for communication and record-keeping. Company information must also include the business name (XYZ Solutions), registered address (456 Elm Avenue, Springfield), phone number (555-987-6543), and tax identification number (TIN: 12-3456789). Accurate representation of this data ensures clarity in financial exchanges, enabling efficient processing and reducing errors. Proper formatting not only enhances professionalism but also reinforces trust between parties involved.

Invoice Number and Date

Invoices serve as essential documents for tracking financial transactions between businesses and clients. An invoice number acts as a unique identifier, typically formatted as a sequential integer, enabling easy reference and organization. The date on the invoice, reflecting when the transaction occurred, holds significance for accounting records and payment deadlines. Proper structure enhances the professional appearance of the invoice, ensuring clarity and compliance with tax regulations. Key details, such as the business name, client information, itemized services or products, and total amount due, contribute to comprehensive documentation and facilitate efficient payment processes.

Detailed Item Description and Pricing

An invoice is a crucial document for transactions, clearly outlining the products or services provided, their individual costs, and the total amount due. Including a detailed item description enhances transparency, allowing clients to understand what they are being charged for. For example, an invoice for graphic design services could list items like "Logo Design - Customizable vector file, 3 initial concepts, 2 revisions," priced at $300, and "Business Card Design - Front and back design, print-ready file," at $150. The inclusion of precise quantities, unit prices, and subtotals enables clients to verify the charges easily, ensuring a smooth payment process. Furthermore, specifying payment terms and due dates is essential, fostering clarity and professionalism in all business transactions.

Payment Terms and Conditions

Payment terms and conditions outline the agreement between businesses and clients regarding the financial obligations for services or products rendered. Standard terms often include payment due dates, typically 30 days from the invoice date, along with acceptable payment methods such as bank transfer, credit card, or PayPal. Additionally, details about late payment fees, often ranging from 1-2% of the total amount per month overdue, should be clearly specified. Clients may also be informed about potential discounts for early payments, usually 2-5% if settled within 10 days. Clear communication of these terms, including the invoice number reference or purchase order (PO) number, ensures that both parties understand their responsibilities and improves the likelihood of timely payment.

Contact Information for Queries

Invoices serve as essential documents for financial transactions and typically include crucial details that facilitate easy communication. A well-structured invoice displays contact information prominently, usually at the top or bottom of the page. This section features the name of the issuing entity, such as a business or freelancer, followed by their address, including street, city, state, and zip code. Additionally, this area should list contact numbers, including a primary phone number and optional fax number for document transmission. Email addresses are vital and should specify a professional domain, ensuring clients can quickly reach out for queries regarding payment, detailing services rendered on the invoice. Including alternative contact methods, like social media handles or a dedicated support link, enhances accessibility. A clear, organized contact section reduces misunderstandings and fosters efficient communication.

Comments