Hey there! As we wrap up the month, we wanted to give you a friendly heads-up about an upcoming invoice you'll be receiving soon. It's always good to stay in the loop, and we believe in keeping our communication clear and hassle-free. So, grab a cozy seat and read more about what to expect in the invoice details!

Subject Line Optimization

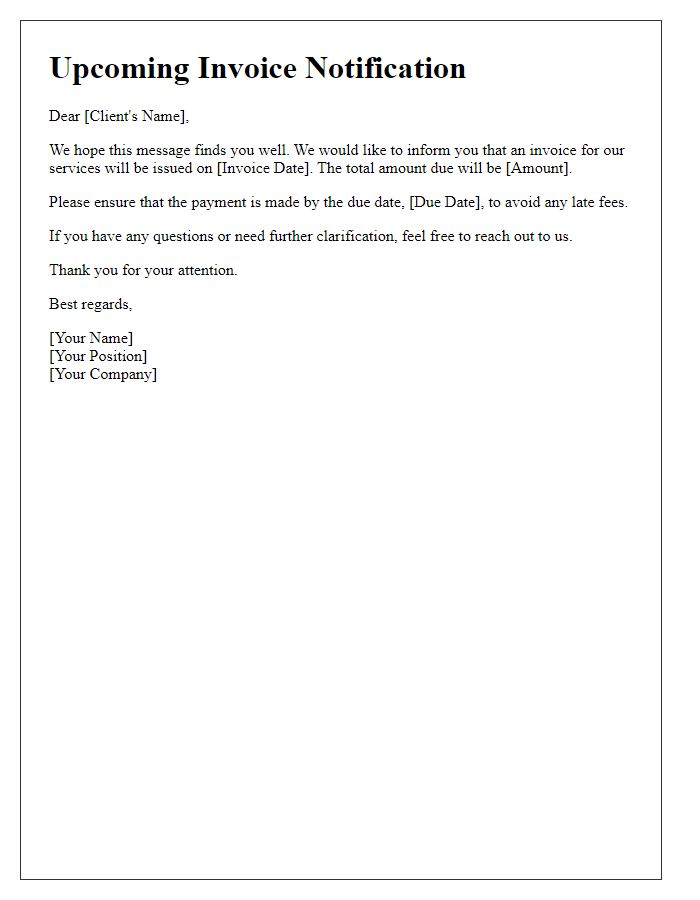

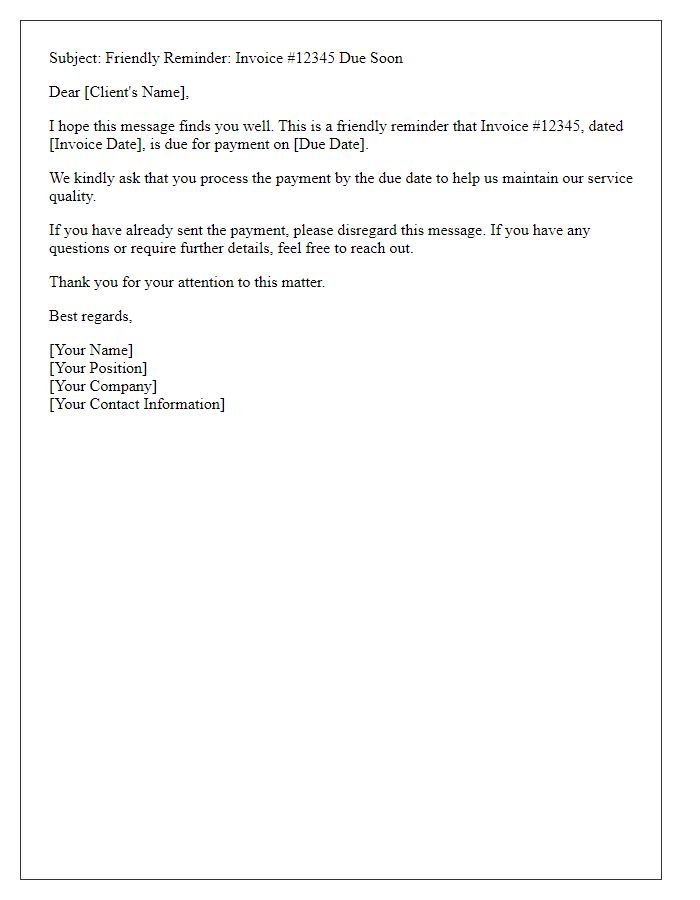

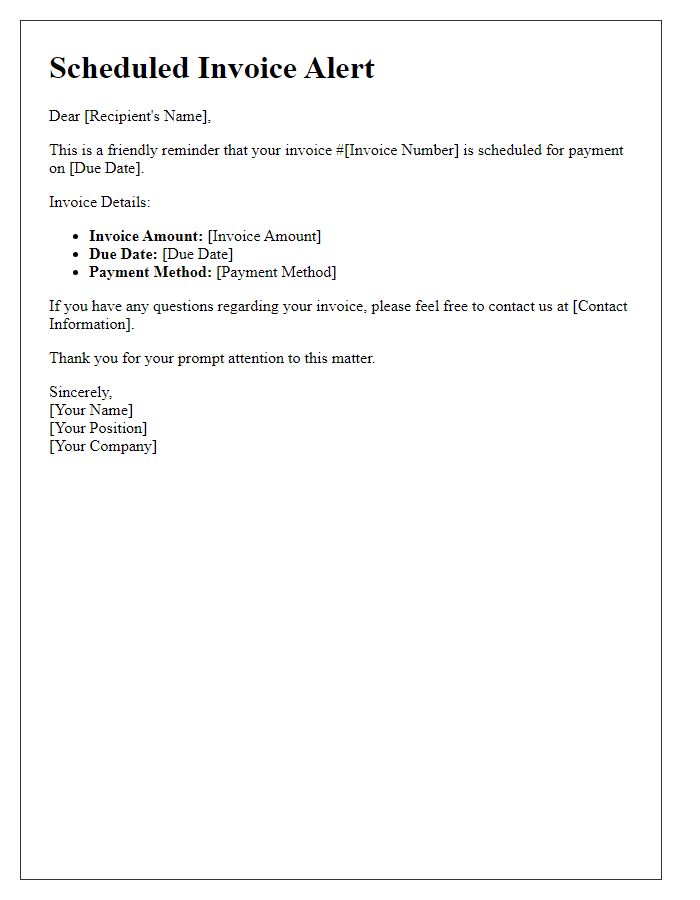

Upcoming invoice alerts serve as critical reminders for businesses to manage cash flow effectively. Monthly billing cycles, often aligned with budget planning, can prompt timely payments from clients. Notable invoice figures may include invoice numbers (for tracking purposes), totals (which can impact financial reporting), and due dates (critical for maintaining healthy financial practices). Specific industries, like subscription services or freelance work, frequently benefit from automated alerts, ensuring clients remain informed about their financial commitments. Utilizing concise subject lines, such as "Upcoming Invoice Reminder - Action Required," can enhance open rates and ensure immediate attention from recipients.

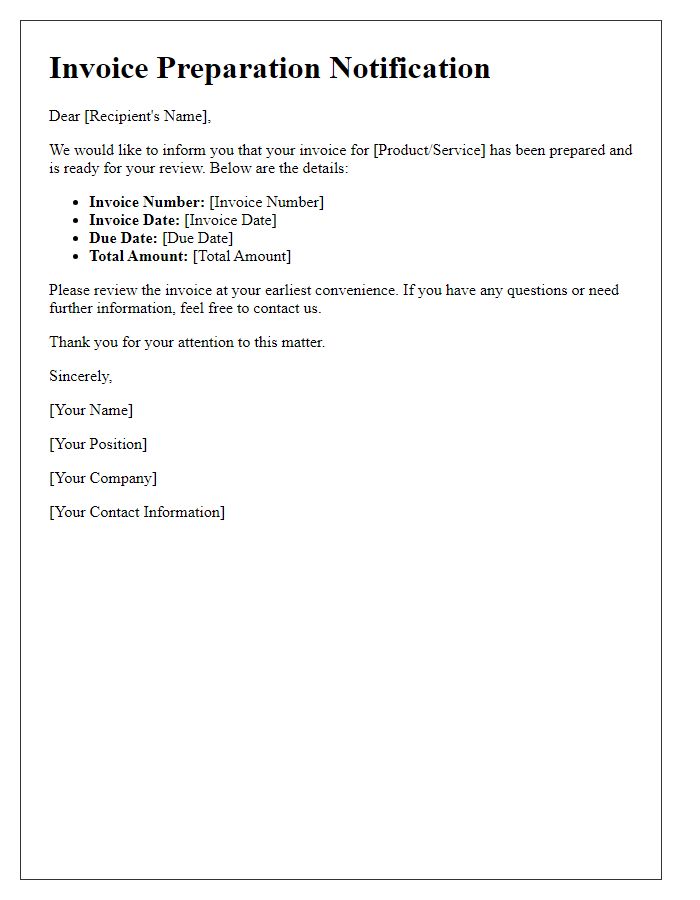

Personalization Elements

Upcoming invoices can significantly impact personal budgeting strategies, particularly for freelancers and small business owners. Notification systems can enhance awareness regarding due dates of invoices, such as monthly service charges or project-based fees. Personalization elements include specific client names (e.g., John Doe), tailored payment amounts (e.g., $500), and detailed descriptions of services rendered (e.g., website development for XYZ Corp). Effective alerts can utilize preferred communication methods, like email or text messages, ensuring timely reminders before payment deadlines. Additionally, establishing recurring payment options can streamline cash flow management and reduce the likelihood of late fees, fostering positive client relationships while enhancing financial stability.

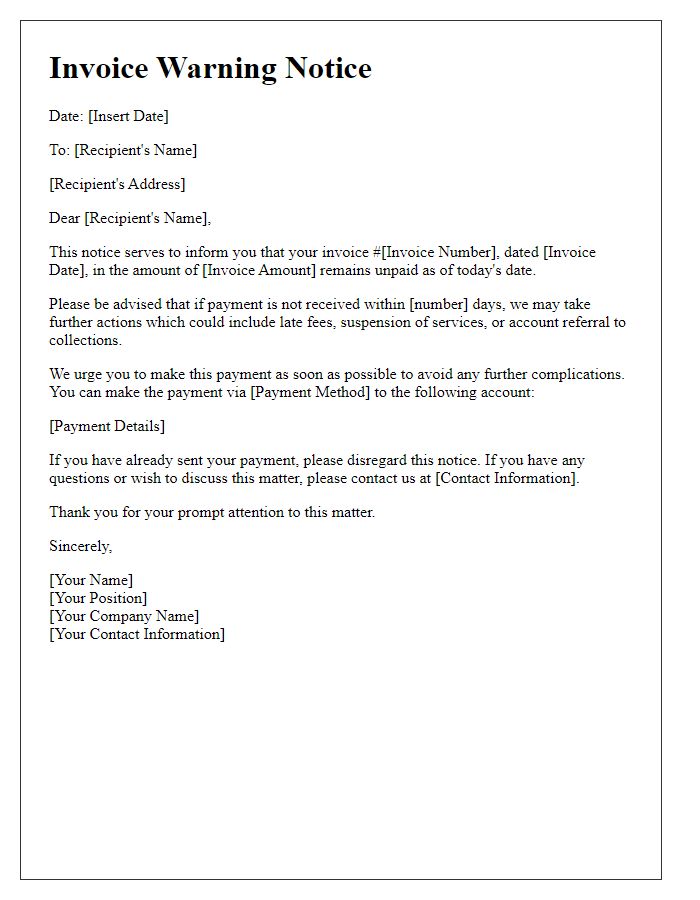

Clarity of Invoice Details

Upcoming invoices prominently feature clarity in details critical for effective financial management. Each invoice contains essential components, including invoice number, due date (typically 30 days from issuance), and itemized charges. Service descriptions, such as consulting hours logged or products delivered (including quantities and unit prices), ensure transparency. Payment terms, often net 30 or net 15, clarify expectations for timely payments. Additionally, clear total amounts and any applicable taxes, like sales tax percentages (often 5-10%), help prevent disputes. Contact information for customer service, including phone number and email address, must be accurate for any inquiries regarding the invoice content.

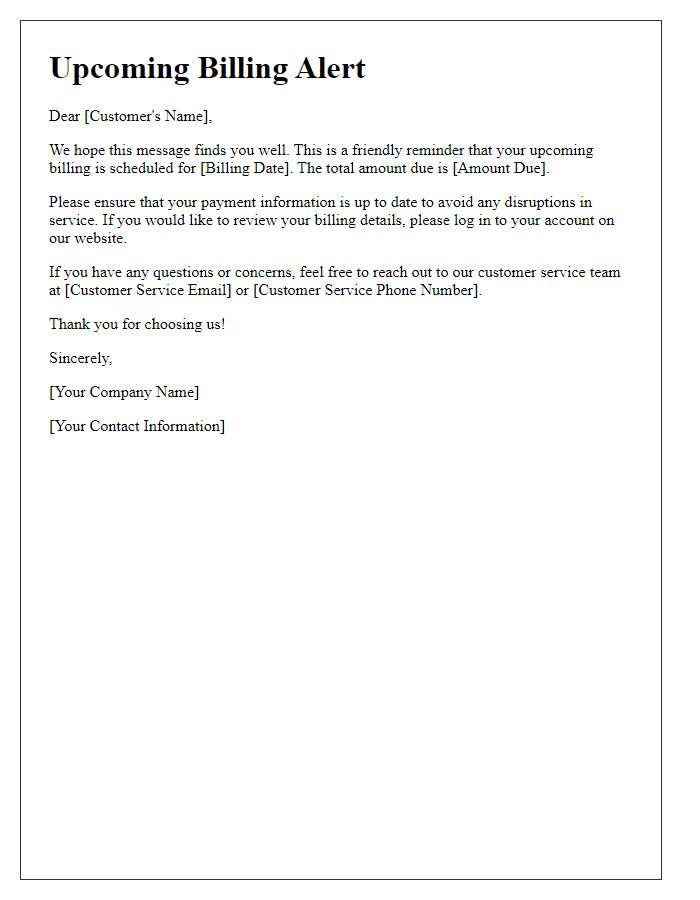

Call to Action

Upcoming invoices will be issued shortly for services rendered during the previous month. Timely payments are crucial for maintaining uninterrupted access to accounts, particularly on platforms such as Salesforce or QuickBooks. Clients are encouraged to review their accounts regularly to ensure all details remain accurate. Payment deadlines typically fall on the 15th of each month, making advance preparation essential to avoid late fees. Support contacts are available for any inquiries related to payment methods or account details, ensuring smooth transactions and continued service.

Contact Information

Upcoming invoices can significantly impact cash flow management for businesses. Timely communication regarding these invoices is essential for financial planning and budgeting. For instance, businesses can send alerts that highlight key details such as due dates, the total amount owed, and any applicable late fees. Companies operating in sectors like construction or freelance services often rely on software tools like QuickBooks or FreshBooks to facilitate invoice management. Ensuring that contact information remains up-to-date, including email addresses and phone numbers, allows smooth correspondence between the service provider and the client, fostering positive business relationships.

Comments