Have you ever found yourself juggling multiple invoices only to realize that a duplicate has slipped through the cracks? It can be a hassle, but don't worry! In this article, we'll guide you through crafting the perfect letter to request the cancellation of a duplicate invoice, ensuring you maintain your professional relationships. So, let's dive in and make the process a breezeâread on to discover our effective template!

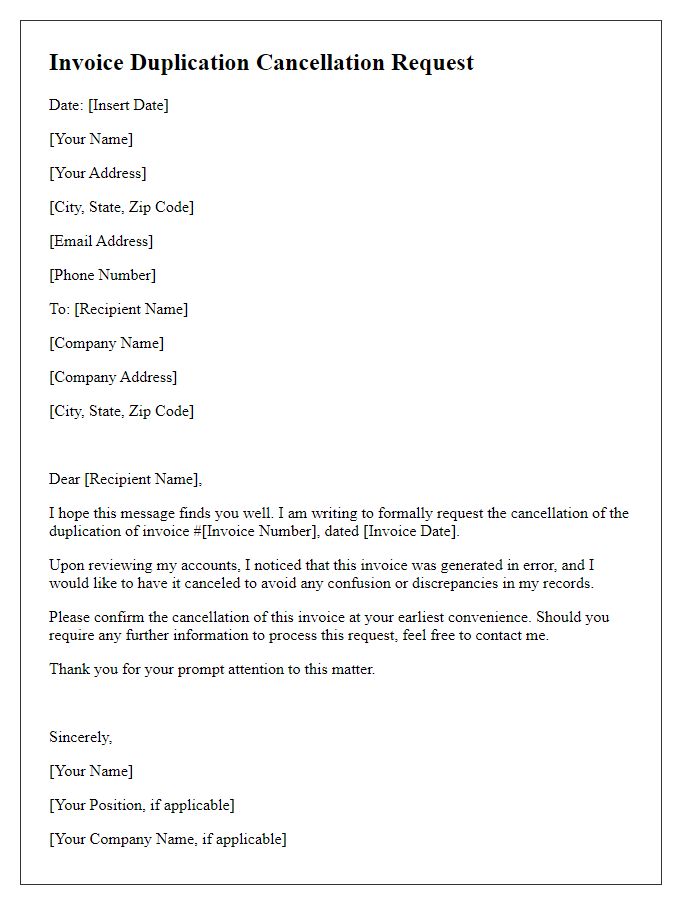

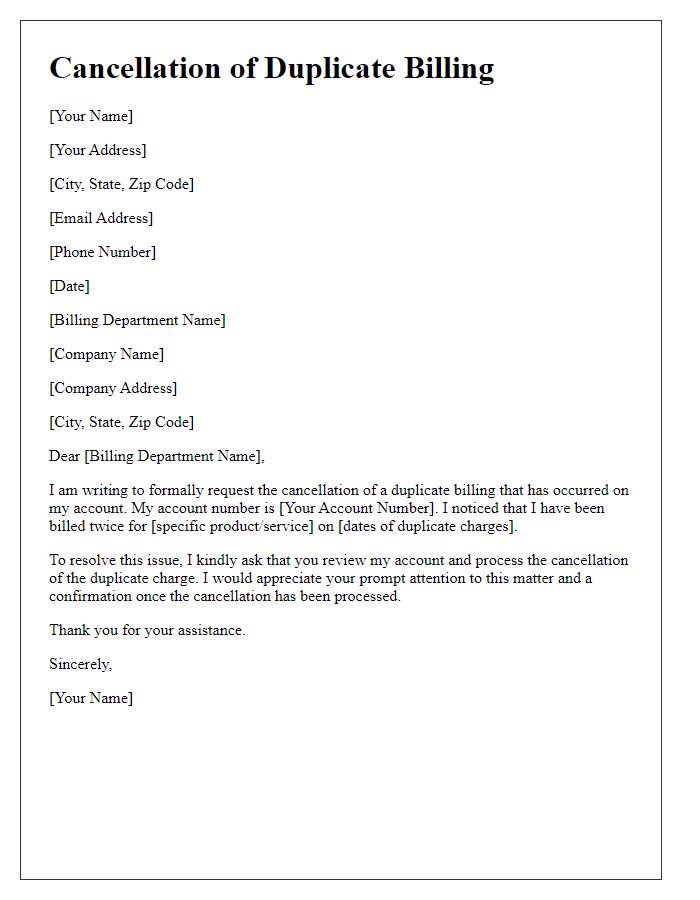

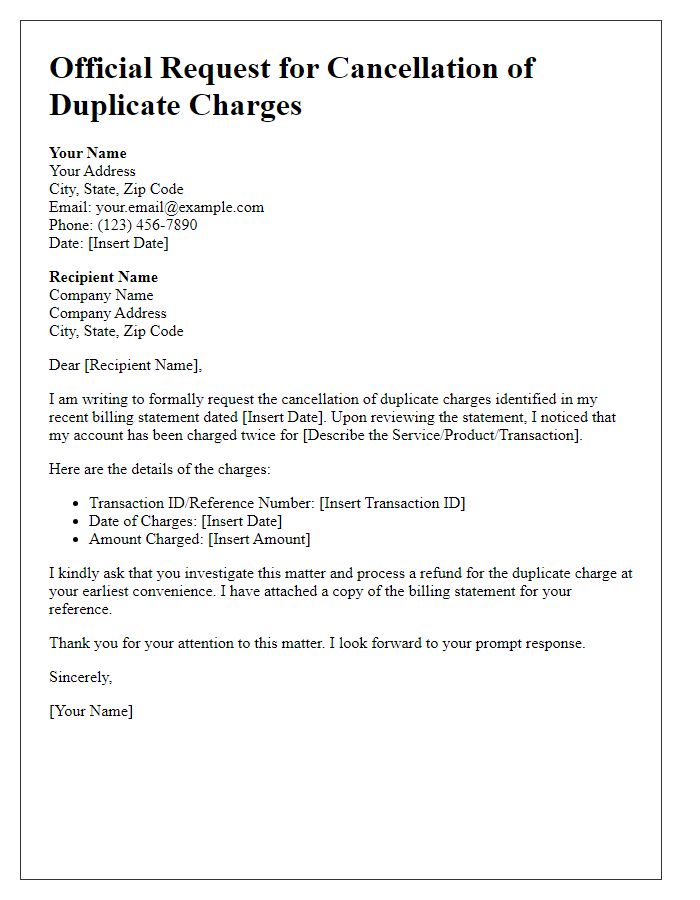

Business Information and Contact Details

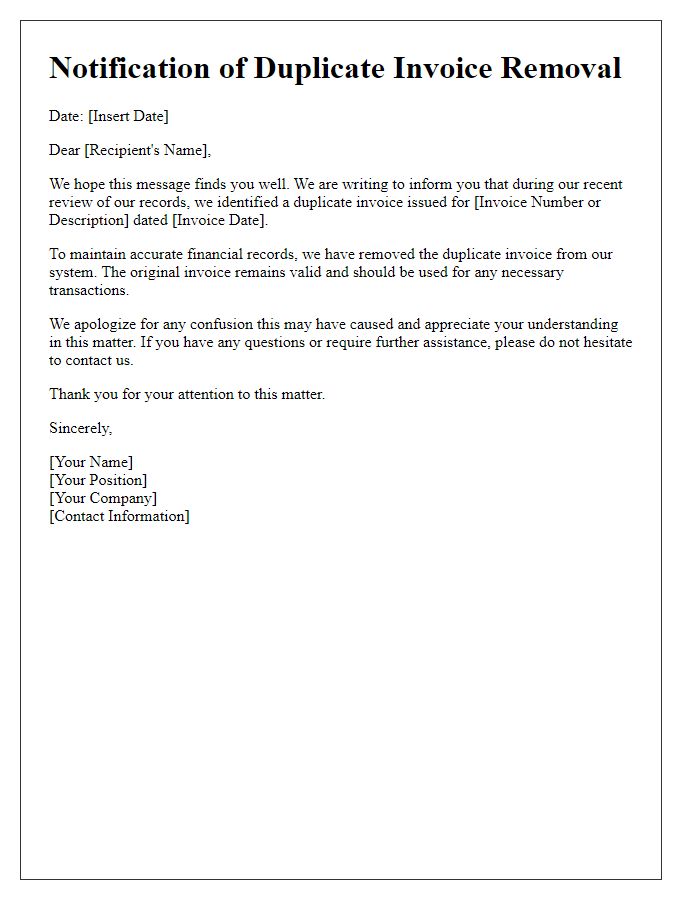

Duplicate invoice cancellation is essential for maintaining accurate financial records. Accurate invoices, with unique identifiers such as invoice numbers (e.g., INV-12345), facilitate effective accounting practices and customer relations. Complexity arises when multiple invoices issued for the same transaction, causing confusion. A well-structured cancellation process should include detailed information including cancellation date, reason for cancellation, and reference to the original invoice. Clear communication with clients is critical, often requiring contact through professional email or phone, emphasizing transparency in billing processes. Efficient cancellation helps prevent discrepancies, ensuring that businesses operate smoothly and providing clients with trustworthy service.

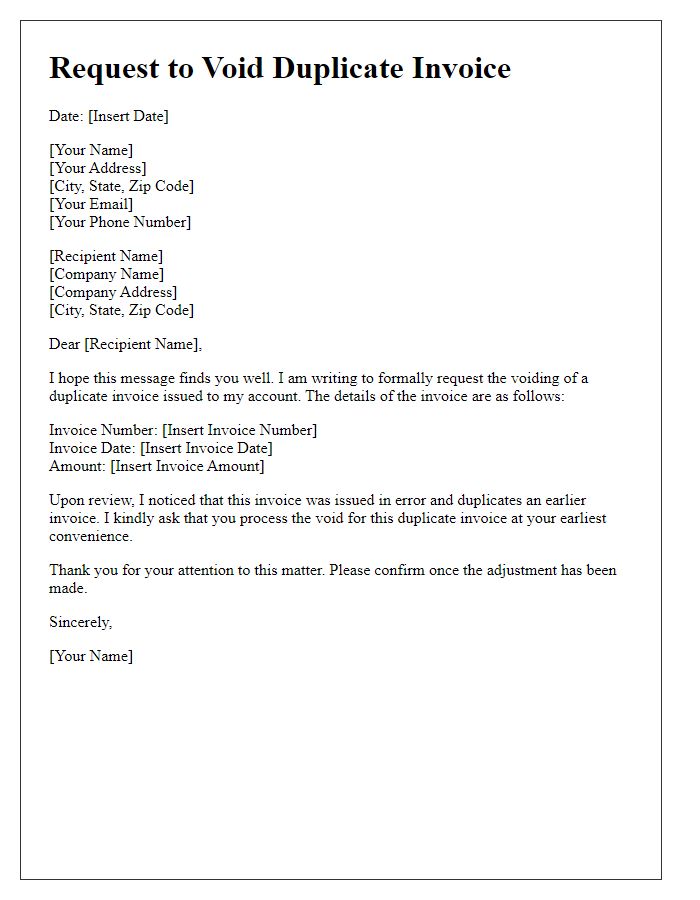

Invoice Details and Reference Number

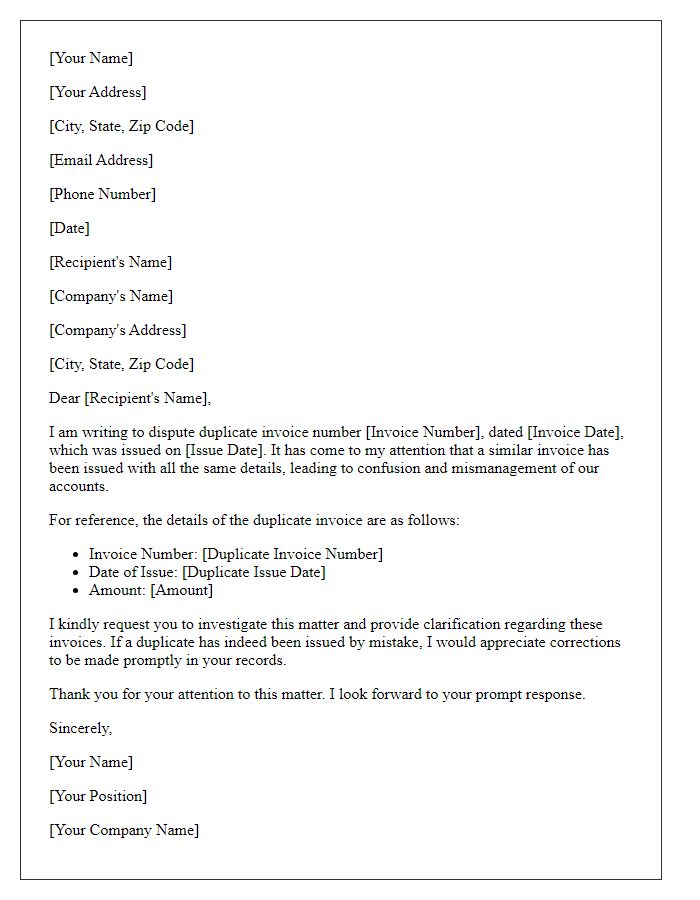

A duplicate invoice cancellation is an essential administrative task that ensures accurate financial records. The invoice details typically include specific identifiers such as the Invoice Number, often formatted as a six-digit code (e.g., INV-123456), and the Invoice Date, which indicates when the original document was issued. The Reference Number, a critical element for tracking and referencing, usually follows a specific pattern that combines letters and numbers for unique identification, ensuring clarity in communication. Businesses often issue duplicate invoices inadvertently due to administrative errors or software glitches, necessitating prompt cancellation to avoid confusion and duplicate payment. Maintaining clear documentation of these cancellations is essential for financial audits and reconciliation processes.

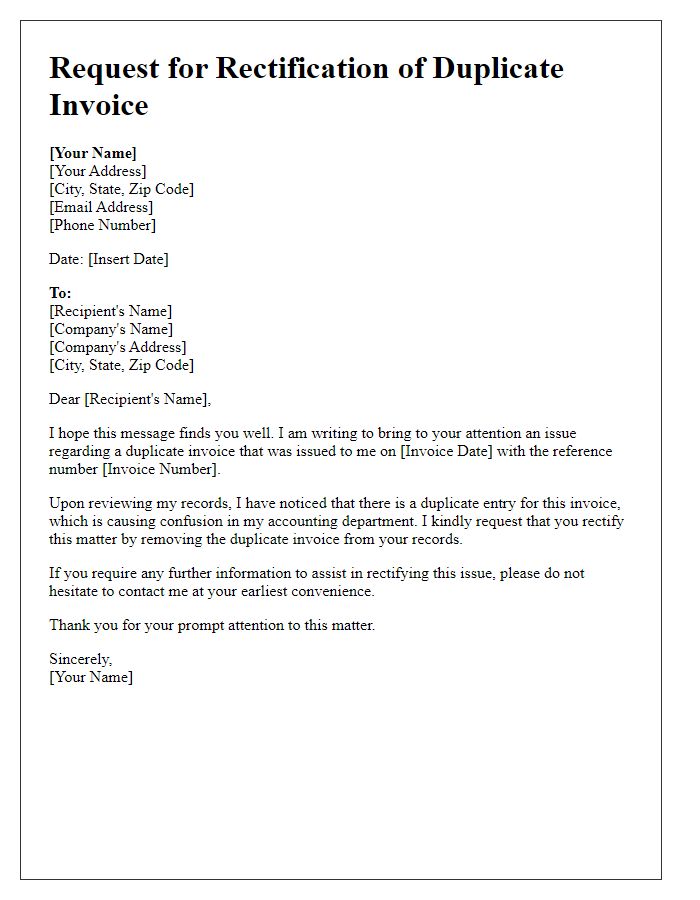

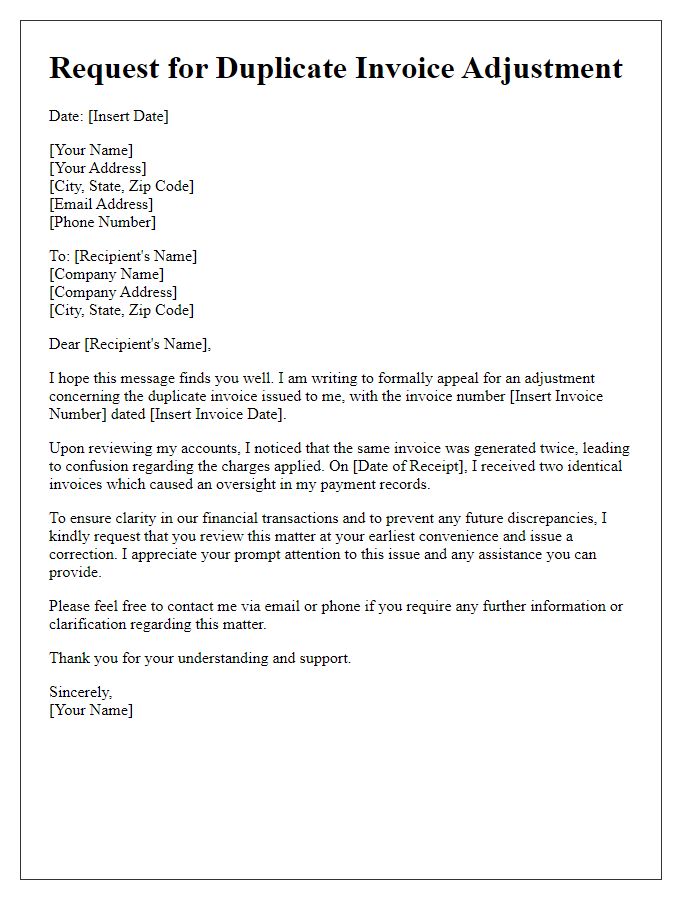

Reason for Cancellation Request

Duplicate invoices can lead to confusion in accounting records and payment processing. An example might include an invoice mistakenly generated for the same service on September 15, 2023, for a project in New York City. This cancellation request seeks to clarify the situation and eliminate redundancy in financial documentation. Proper handling of this request ensures accurate bookkeeping and maintains the integrity of transaction records within the accounts payable department. A confirmation of the cancellation is necessary to prevent future discrepancies in payment tracking.

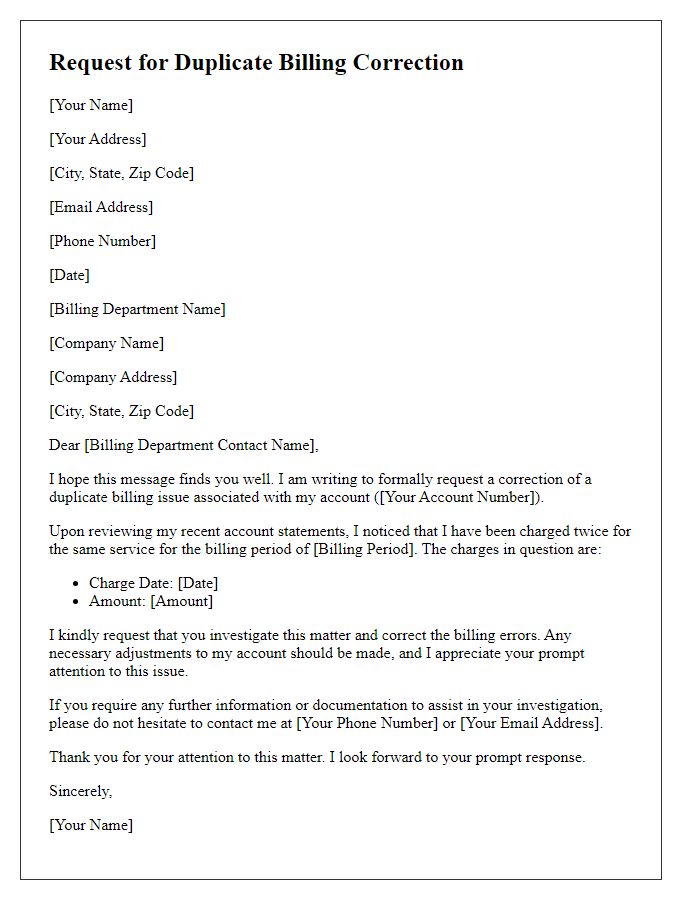

Request for Confirmation of Cancellation

In the financial processes of businesses, duplicate invoices can lead to significant confusion and discrepancies in accounting records. A request for confirmation of cancellation should include essential details such as invoice number, date of issuance (for example, June 15, 2023), and the total amount involved ($1,250). Clear identification of the original invoice (e.g., Invoice #12345) along with the duplicate (e.g., Invoice #12346) is critical for ensuring proper documentation. Additionally, referencing company information, like the vendor's name (ABC Supplies) and address (123 Market Street, Cityville), provides clarity. The request may also invoke company policies regarding invoice management or specific accounting regulations (GAAP) that govern such processes. Prompt confirmation of the cancellation (preferably within 48 hours) will facilitate smoother financial operations and ensure accurate record-keeping.

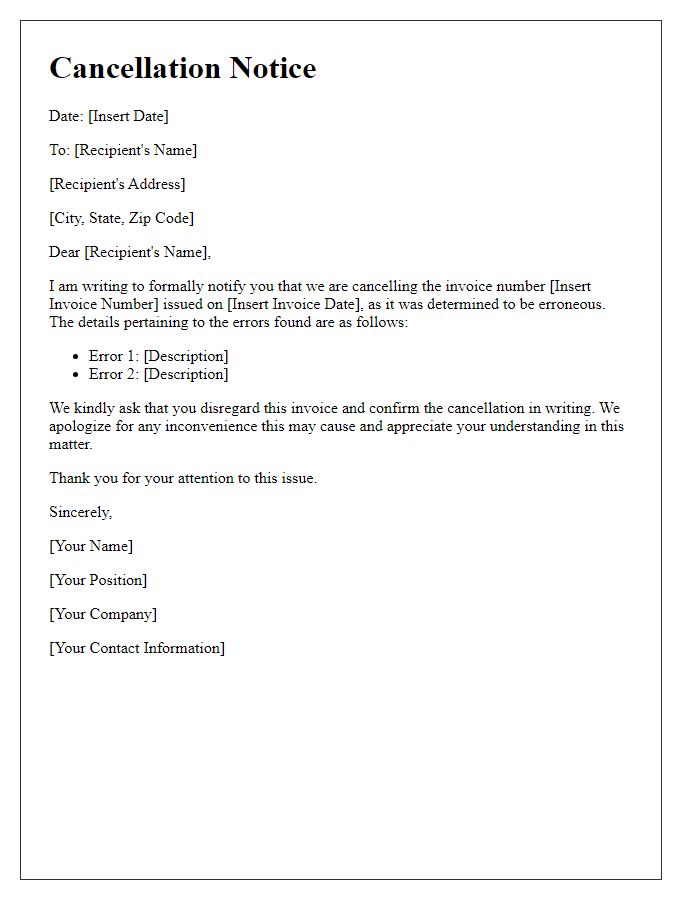

Professional Tone and Closing

A duplicate invoice cancellation can help maintain clear financial records and ensure accurate accounting. Companies often issue corrections on invoices to prevent confusion, enhancing transparency in business transactions. Cancellation notices should include key details such as the original invoice number, date of issuance, and reason for cancellation. Clear communication of this process is crucial in financial management, particularly in maintaining relationships with clients and suppliers. Companies must follow up with an updated invoice, ensuring accurate accounting on both ends. Timely handling of such cancellations, ideally within a week of discovery, can mitigate potential disputes and reinforce professional standards.

Comments