Are you looking to streamline your invoicing process? Setting up a future invoice schedule can save you time and minimize stress, ensuring that payments are received promptly and efficiently. Imagine a world where you can focus on your core business while your invoices take care of themselves! If you're curious about how to implement this game-changing strategy, read on to discover our comprehensive guide.

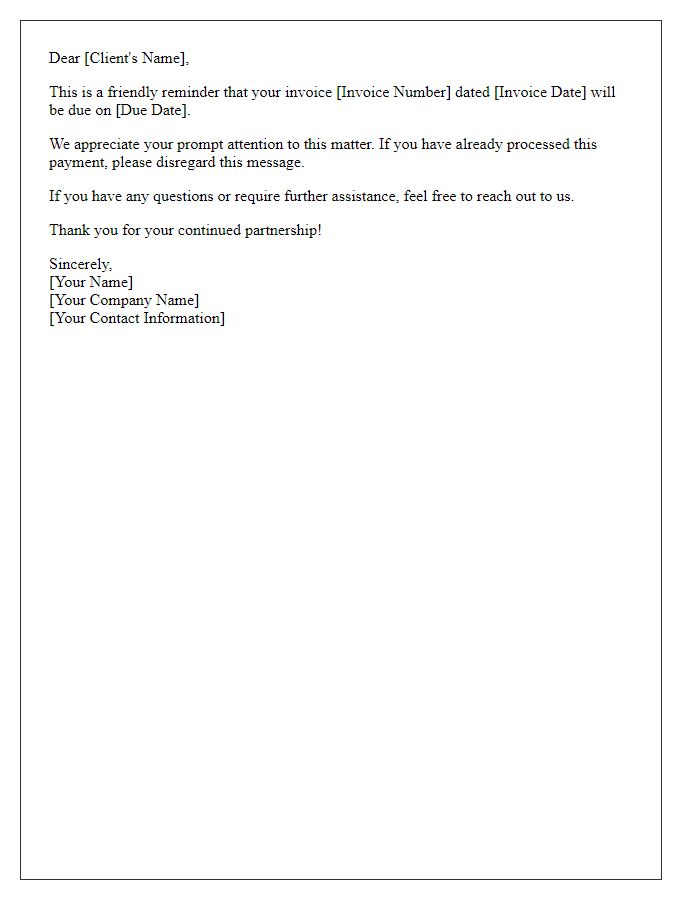

Clear subject line

Future invoice scheduling enhances financial management clarity. Automated systems can notify clients about upcoming payments, providing essential details such as due dates, amounts (e.g., monthly subscriptions of $150), and services rendered (e.g., software maintenance). Specific reminders increase transparency in transactions, allowing businesses to maintain healthy cash flow, especially for recurring payments like utilities. Furthermore, precise scheduling reduces the risk of late fees, improving vendor relationships. Invoices can be sent via email platforms (e.g., QuickBooks or FreshBooks) or printed on company letterhead for physical delivery, ensuring consistent communication.

Recipient's name and contact information

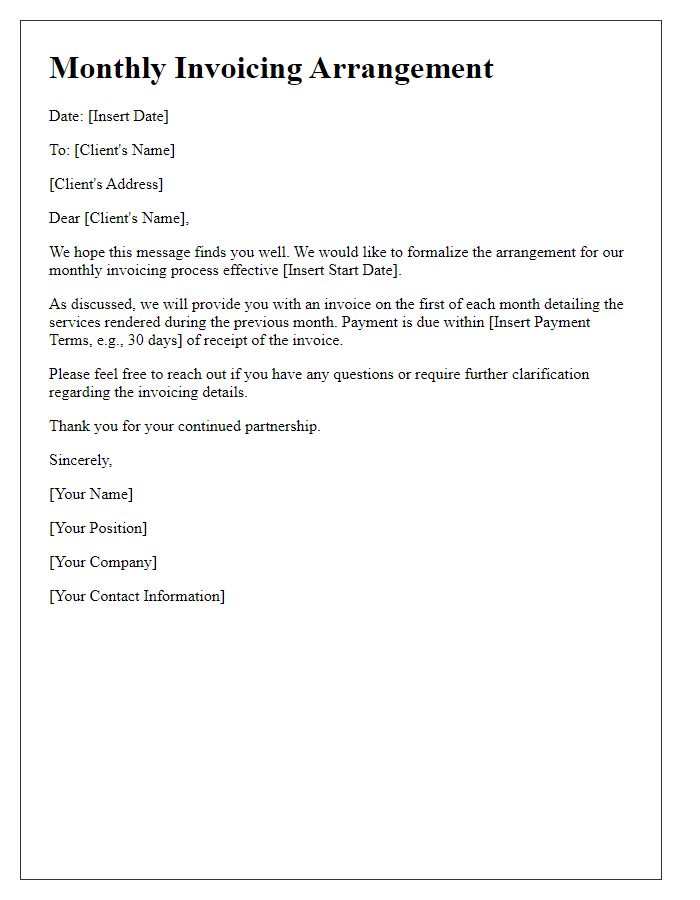

The invoice scheduling process is critical for maintaining seamless financial transactions between businesses or service providers and clients. Contact information, including the recipient's name, company affiliation, physical address, phone number, and email address, plays a vital role in ensuring accurate communication. Properly formatted invoices facilitate timely payments and strengthen professional relationships. Setting reminders for future invoices can help manage due dates efficiently, enabling both parties to keep track of financial obligations. Using invoicing software can also streamline this process by automating scheduling, improving accuracy, and providing notifications as due dates approach, thereby enhancing overall financial management.

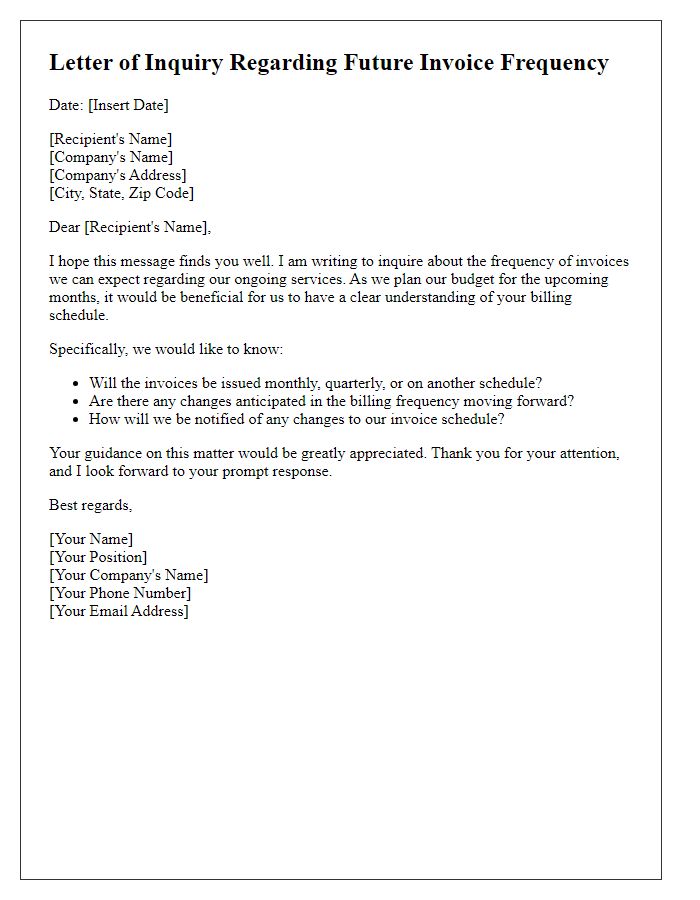

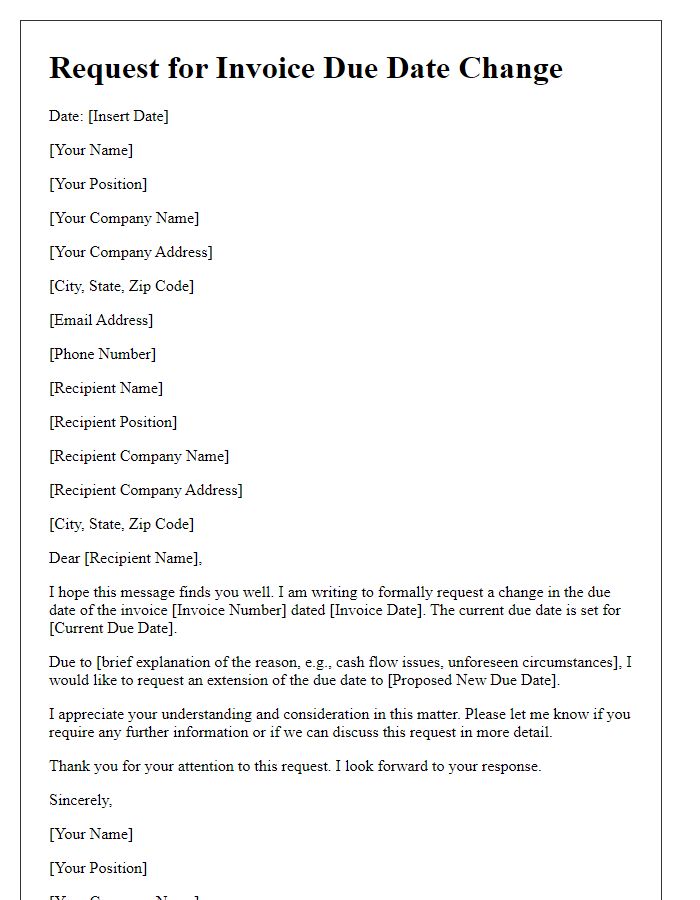

Invoice details (amount, date, and description)

Future invoices may require precise details for smooth processing. Invoice dates should include specific time frames, such as the first day of each month or quarterly deadlines. The invoice amount must reflect accurate calculations based on services rendered, including any applicable taxes or discounts. A clear description should detail each service provided or product sold, incorporating identifiable features like model numbers, quantities, and unit prices for clarity. Ensuring these key details enhances communication and facilitates timely payments from clients, thereby maintaining strong business relationships.

Payment terms and deadlines

Future invoice scheduling requires clarity on payment terms and deadlines to ensure timely transactions. Standard practices include a 30-day payment period from the invoice date, commonly referred to as Net 30. Late payment penalties may apply, often set at a percentage, such as 1.5% monthly. Specific deadlines, including the last day for financial remittance, should be prominently indicated on invoices. Clear communication regarding acceptable payment methods, like bank transfers or online payment platforms, enhances efficiency. Establishing a systematic reminder schedule, such as 7 days before and on the due date, improves cash flow management for both parties.

Contact information for queries

Accurate contact information for queries regarding future invoice scheduling is essential for seamless communication. Primary contacts should include the finance department, reachable at phone number 555-123-4567, or via email at billing@example.com. For urgent inquiries, a secondary contact is advisable, such as the accounts manager, who can be contacted at 555-987-6543. Additionally, providing a dedicated support email address, such as support@example.com, facilitates quick responses to billing-related questions. Establishing these contact points ensures clarity in the invoicing process, minimizing potential misunderstandings and improving overall transaction efficiency.

Comments