Are you looking to streamline your invoice payment process? Updating your payment terms can enhance clarity and foster better relationships with clients, making it easier for them to understand expectations. In this article, we'll explore effective strategies for communicating these changes while maintaining a professional tone. So, let's dive in and discover how to make your invoice payment terms update smooth and straightforward!

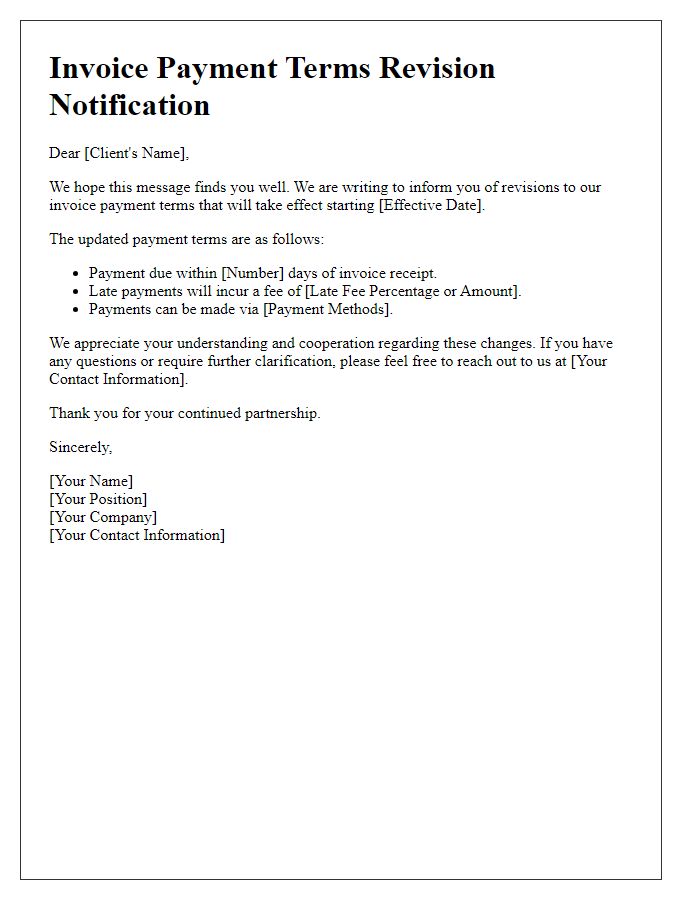

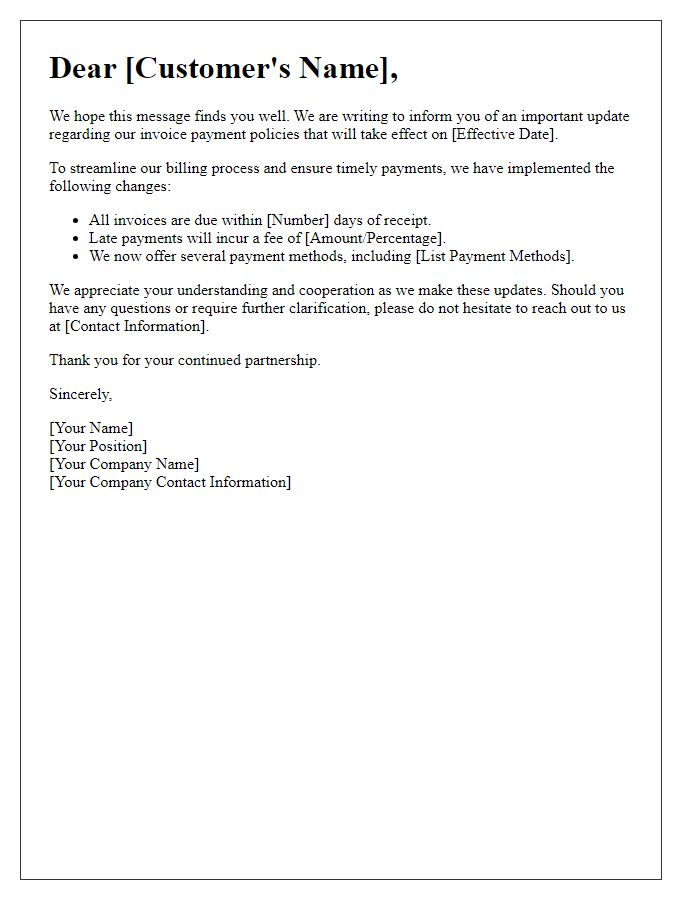

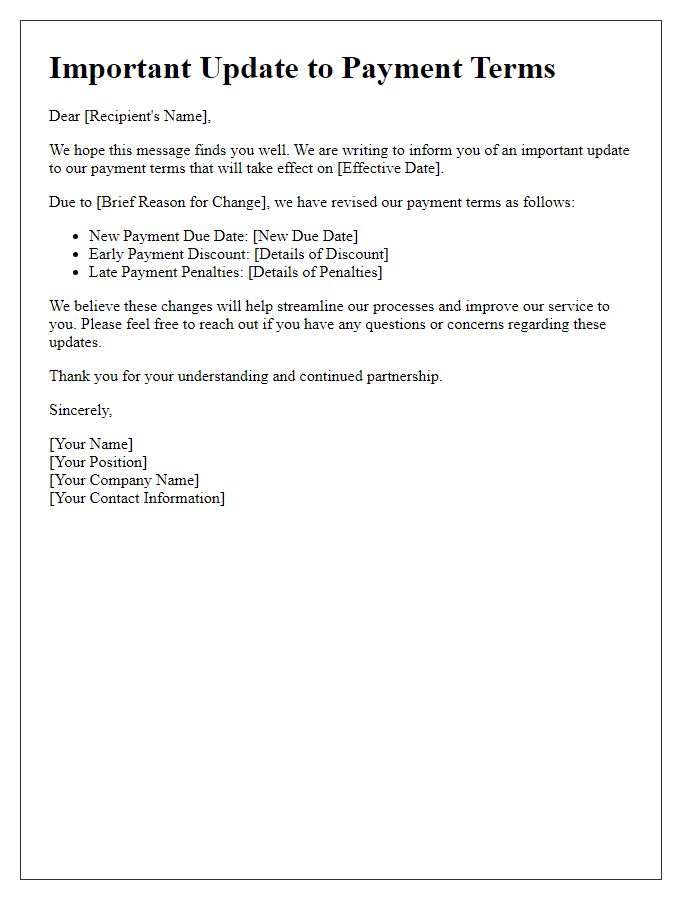

Clarity and simplicity of language

Clear communication regarding invoice payment terms is crucial for maintaining positive business relationships. Updated terms should explicitly state the payment deadline, such as "net 30 days," emphasizing the importance of timely payments. Include any penalties for late payments, such as a 2% fee for each month overdue. Define accepted payment methods, including bank transfers, credit cards, or checks, and provide necessary details like bank account information or invoicing software used. Furthermore, a friendly reminder about early payment discounts can encourage promptness. Ensure that these terms are easily accessible, preferably highlighted at the top of the invoice for immediate visibility.

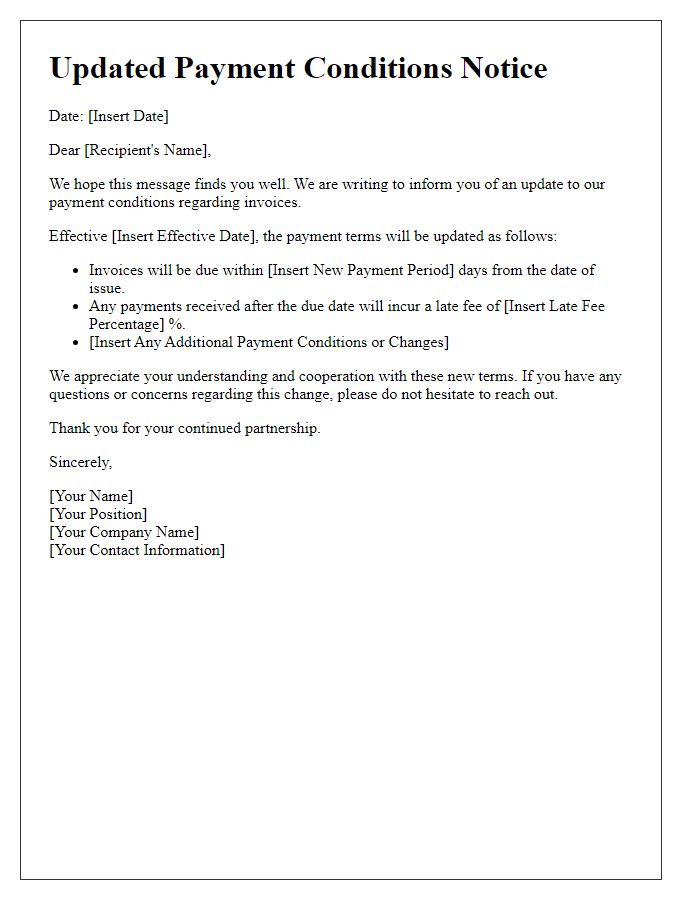

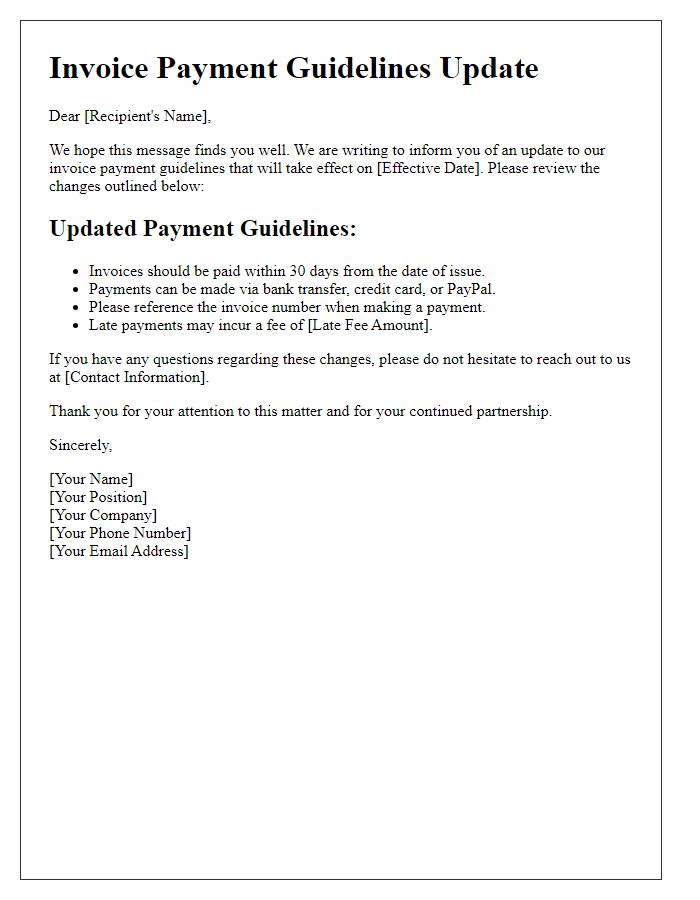

Legal and regulatory compliance

Updating invoice payment terms is essential for maintaining legal and regulatory compliance within financial transactions. Clear specifications regarding due dates, interest rates, and penalties for late payments are critical components, often dictated by regulations such as the Fair Debt Collection Practices Act or the Uniform Commercial Code. Payment terms should be clearly outlined, typically including standard net 30 or net 60 days, catering to varying business practices in industries such as retail or construction. Additionally, transparent communication regarding any changes, including methods of payment accepted--such as credit cards or electronic funds transfers--ensures adherence to compliance standards while promoting financial integrity. Regular audits of invoice processes, according to local laws, help in identifying potential discrepancies and maintaining accurate records for taxation purposes.

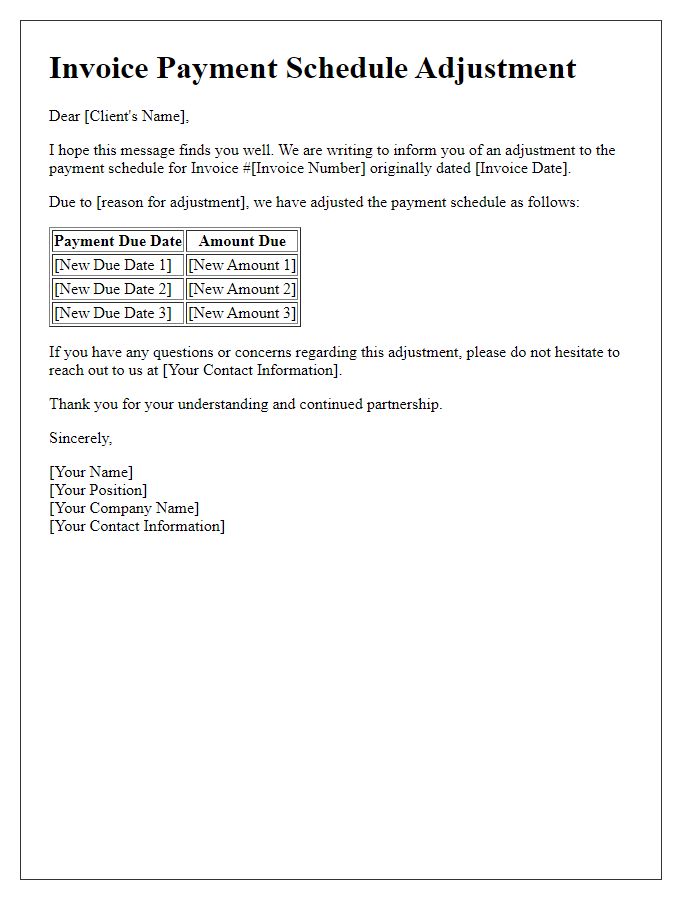

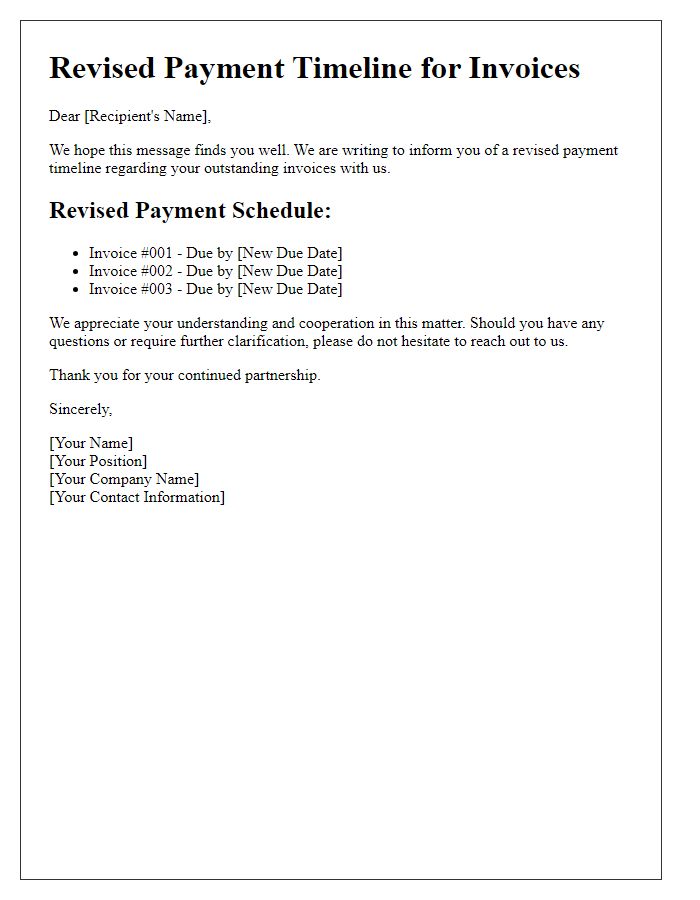

Consistency with current company policy

Updates to invoice payment terms reflect consistency with current company policy, ensuring clarity for clients and maintaining financial integrity. Standardized terms might include a net 30 days payment schedule, where clients are expected to remit payment for services rendered within thirty days of invoice issuance. Discounts for early payments, such as a 2% discount for payments made within ten days, can encourage timely transactions. Specific details about accepted payment methods, including electronic transfers, credit cards, or checks, reinforce professionalism. Clear communication of late fees for overdue balances, typically around 1.5% per month, preserves cash flow and mitigates risks associated with delayed payments. Regular updates to payment guidelines align organizational practices and enhance client relationships through transparency.

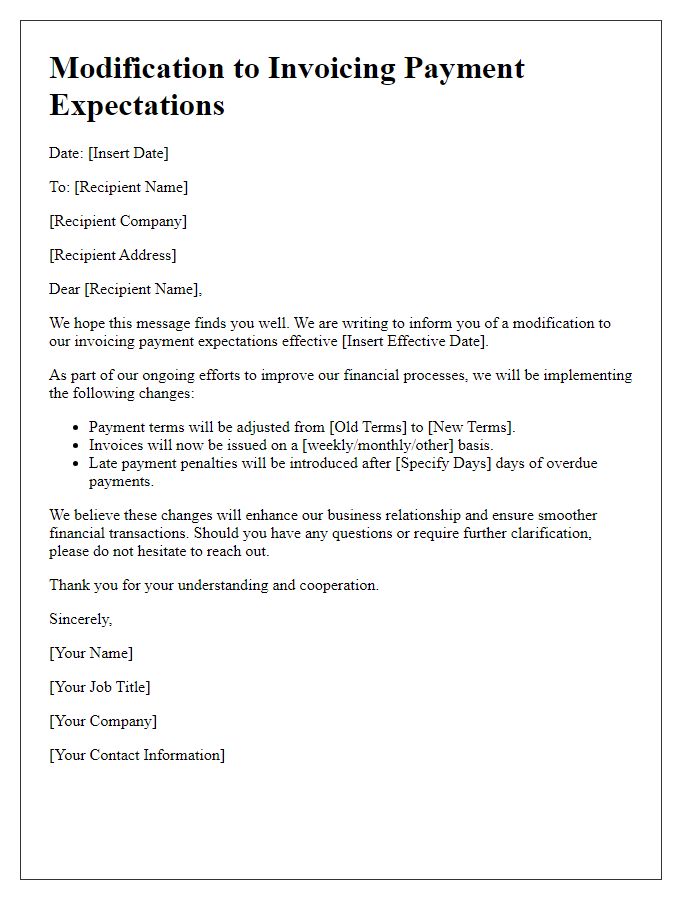

Professional tone and format

Invoice payment terms serve as crucial guidelines for financial transactions within businesses. Payment terms specify the period in which payment is expected from clients after receiving an invoice, often ranging from net 30 to net 60 days. Clear communication about changes in these terms can significantly affect cash flow management, ensuring timely payments that support operational efficiency. Additionally, mentioning late fees or interest rates for overdue payments can incentivize prompt compliance. Maintaining professionalism in the communication about these updates is essential to foster ongoing client relationships while ensuring that expectations are set effectively.

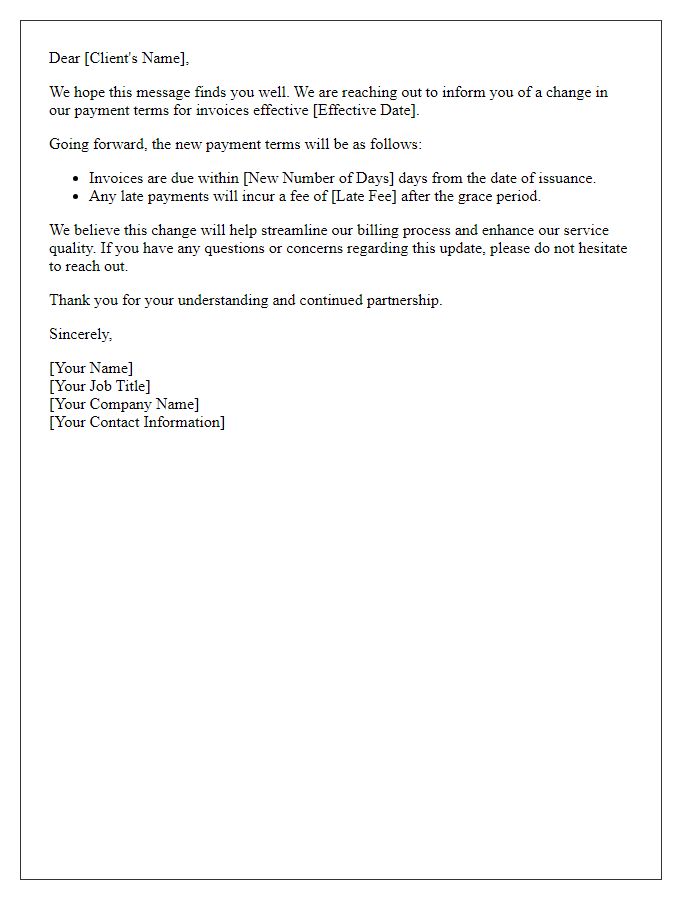

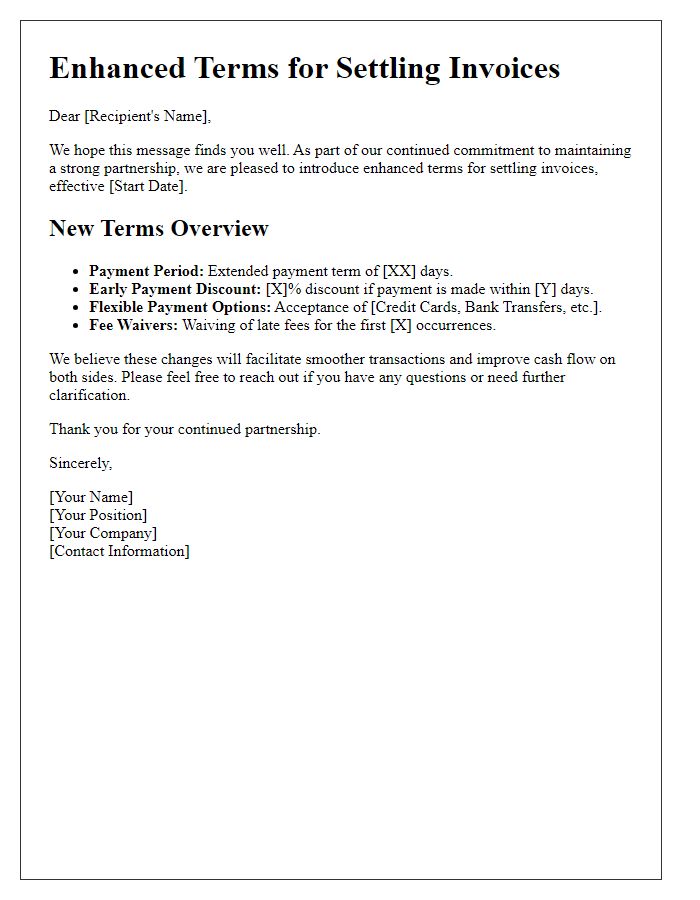

Flexibility and negotiation terms

Flexibility in invoice payment terms can enhance business relationships while ensuring timely cash flow. Payment terms, such as Net 30 or Net 45, provide customers with a specific timeframe to settle invoices, while early payment discounts (e.g., 2% discount for payment within 10 days) can encourage prompt payments. Negotiation options, such as installment plans or extended payment schedules, cater to clients facing financial constraints, making it easier for them to manage expenses. Offering online payment options through platforms like PayPal or Stripe can streamline the payment process, reducing delays caused by traditional methods. Regular communication with clients regarding their financial situations and preferences allows for tailored solutions, fostering trust and collaboration.

Comments