Mistakes can happen to anyone, and that includes the occasional mix-up with invoice numbers. If you've found yourself in a situation where you need to request a correction on an invoice number, don't worry; navigating this process is simpler than you think. A well-crafted letter can not only address the issue directly but can also foster good communication with your client or provider. So, let's dive into how to create an effective template that ensures your request is clear and courteousâkeep reading to learn more!

Invoice number details

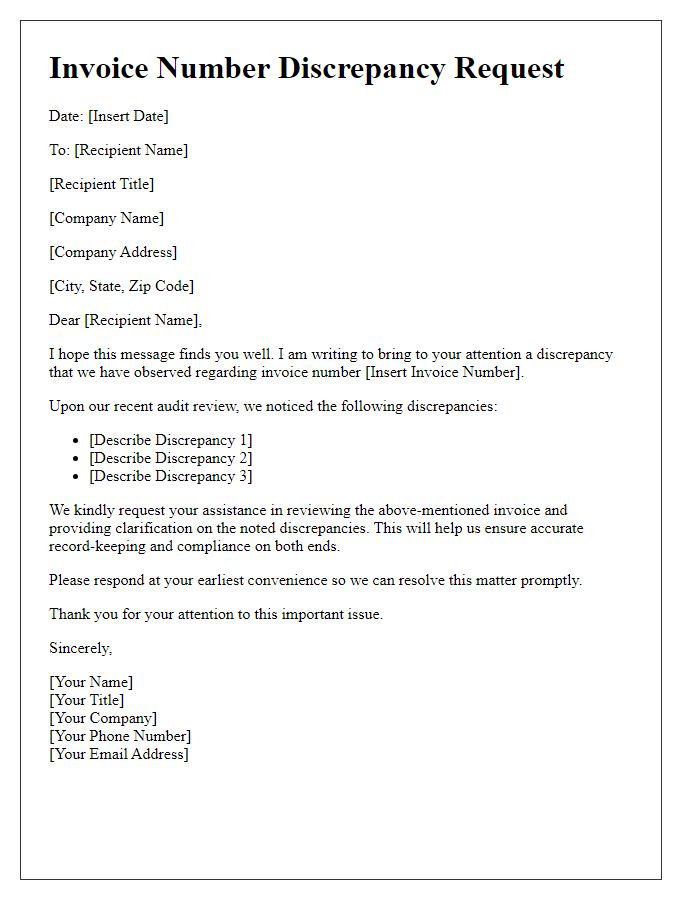

Invoice number discrepancies can lead to confusion in accounting records. An incorrect invoice number, like 12345 instead of the intended 54321, can affect payment processing and affect financial statements in business operations. Accurate invoice numbers are essential for tracking transactions and maintaining organized records for tax purposes. Businesses utilize centralized accounting software, such as QuickBooks or FreshBooks, to manage these identifiers for clearer financial reporting. Ensuring that every invoice reflects the correct number is crucial for maintaining professional relationships with clients and supporting audit trails during financial reviews.

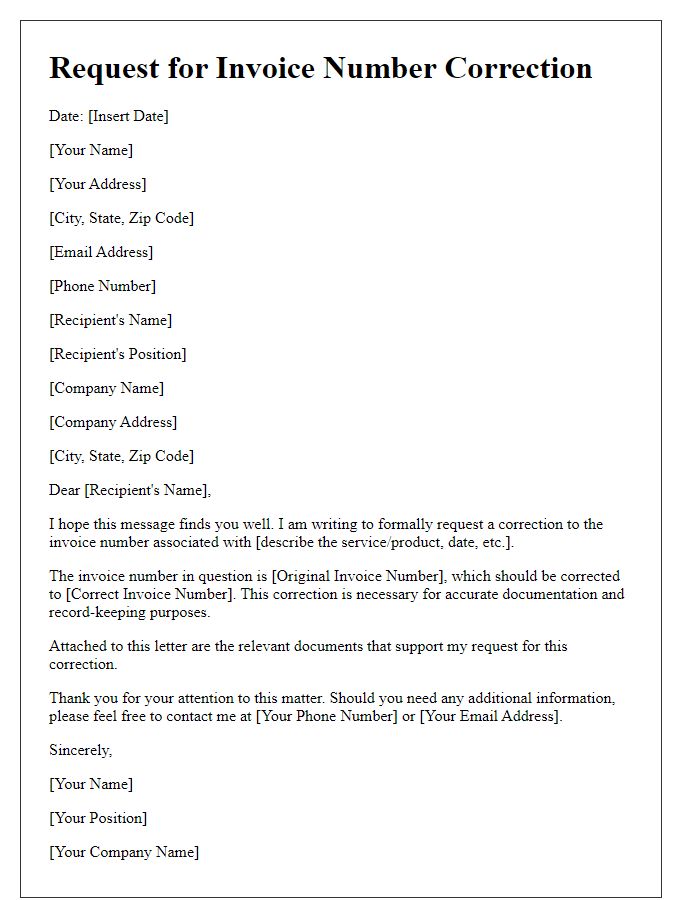

Corrected invoice number information

Inaccurate invoice numbers can lead to significant discrepancies in financial records for businesses. An invoice number serves as a unique identifier for transactions, facilitating tracking and ensuring accurate accounting practices. Businesses often rely on systems like QuickBooks or SAP to manage invoicing, where incorrect numbers can generate confusion or delays. Correcting an invoice number is essential to maintain clear financial audits, tax reporting, and compliance with regulations, especially during events like annual audits or tax season. This ensures that both companies and clients have accurate documentation, fostering better communication and trust.

Reason for correction request

A simple request for correcting an invoice number may stem from discrepancies in billing records or mistaken entries. For example, an invoice issued for service rendered on March 15, 2023, incorrectly lists the invoice number as 1256 instead of the accurate number 1265. This discrepancy not only creates confusion among accounting departments but can also lead to complications during audits or financial reconciliations. Ensuring accuracy in invoice numbers is critical for both tracking payments effectively and maintaining a transparent financial relationship.

Contact information for clarification

Invoice number discrepancies can lead to confusion in financial records, requiring immediate attention. Clients often need to provide their contact information, such as telephone numbers and email addresses, to facilitate prompt clarification with the billing department. An incorrect invoice number, particularly in large transactions (e.g., exceeding $5,000), can cause significant delays in payment processing and account reconciliation. This process emphasizes the importance of accuracy in invoice details, ensuring that both parties maintain clear communication throughout the resolution of discrepancies. Addressing these issues quickly can enhance the overall efficiency of financial operations in a business environment.

Requested action or resolution deadline

An invoice number correction is essential for maintaining accurate financial records, particularly when dealing with tax compliance for businesses. An incorrect invoice number can lead to issues during audits and financial reconciliations, specifically impacting accounts payable and receivable processes. Prompt action for correction is crucial, typically within a 7-day period, to avoid delays in payment processing. Providing detailed information regarding the incorrect invoice, including the date issued and the correct invoice number, ensures clarity in communication with the accounting department, streamlining the resolution process.

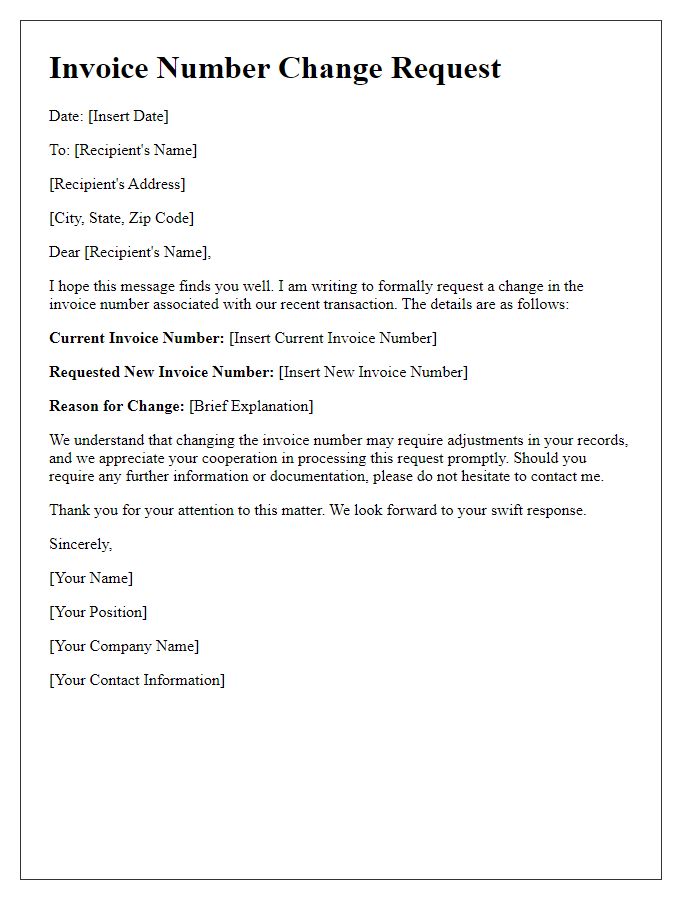

Letter Template For Invoice Number Correction Request Samples

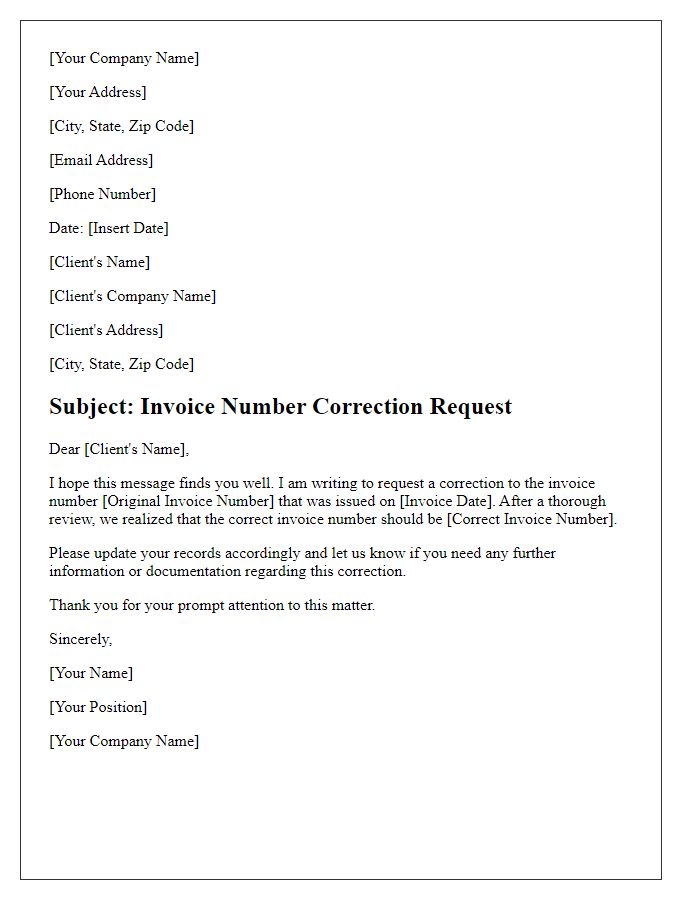

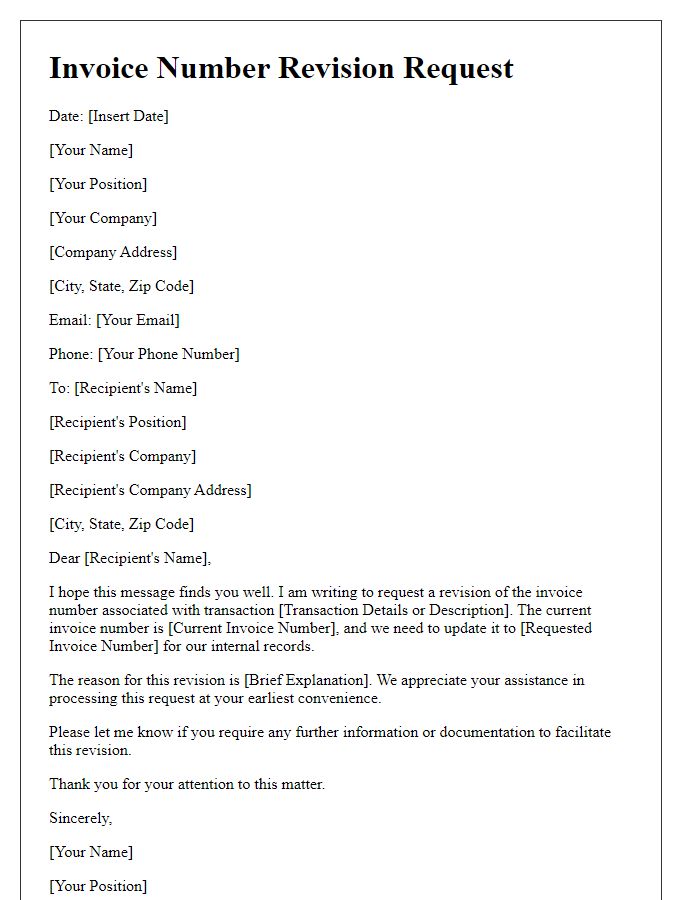

Letter template of Invoice Number Correction Request for Client Communication

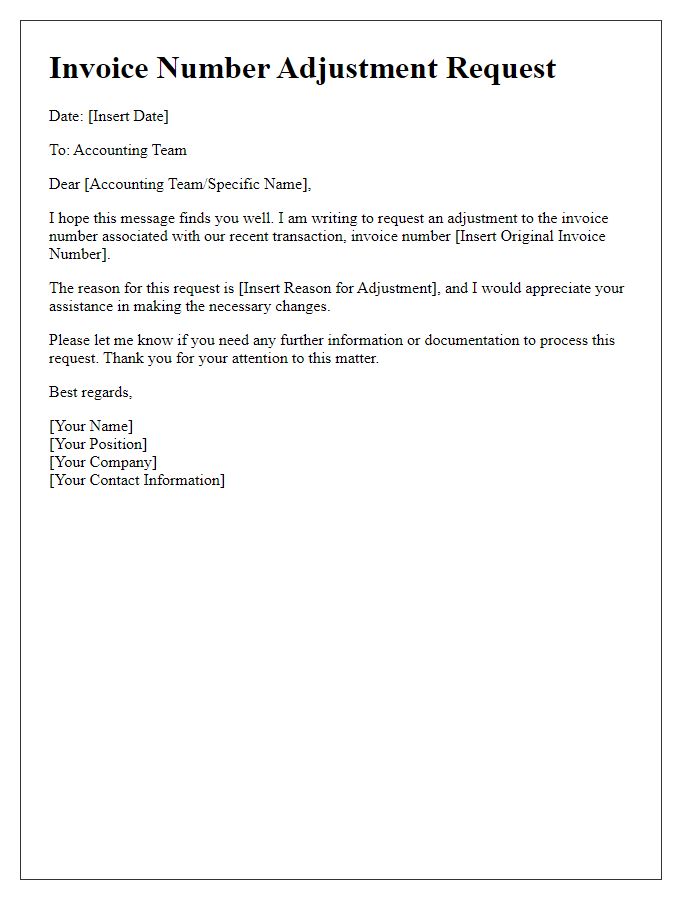

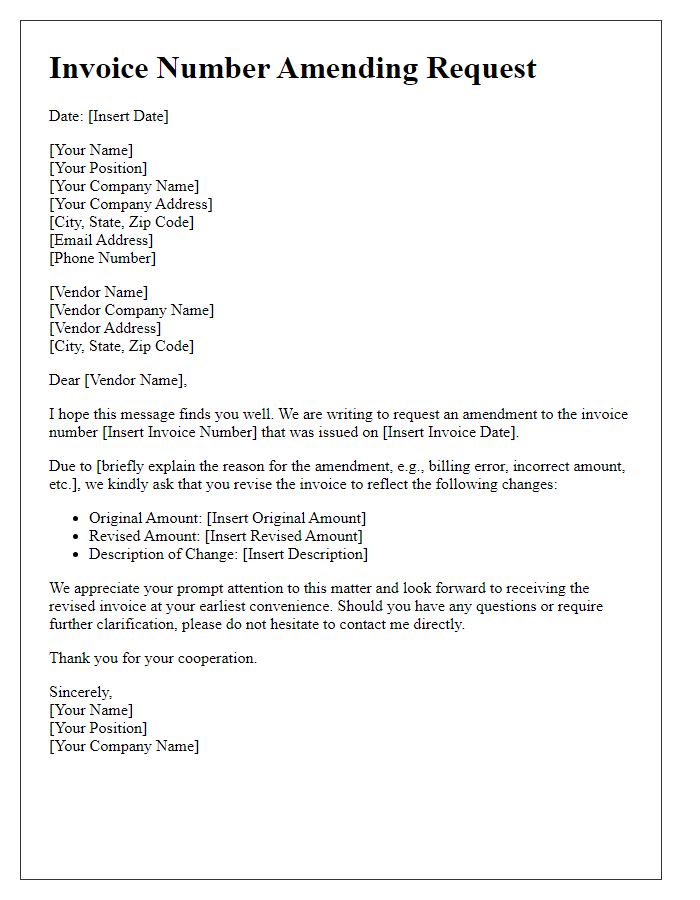

Letter template of Invoice Number Adjustment Request for Accounting Team

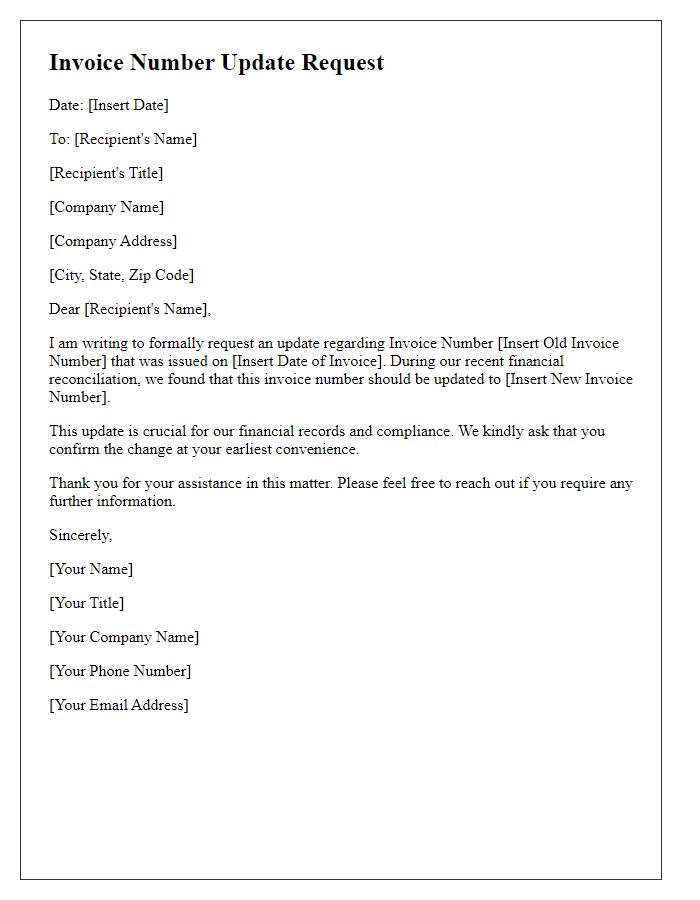

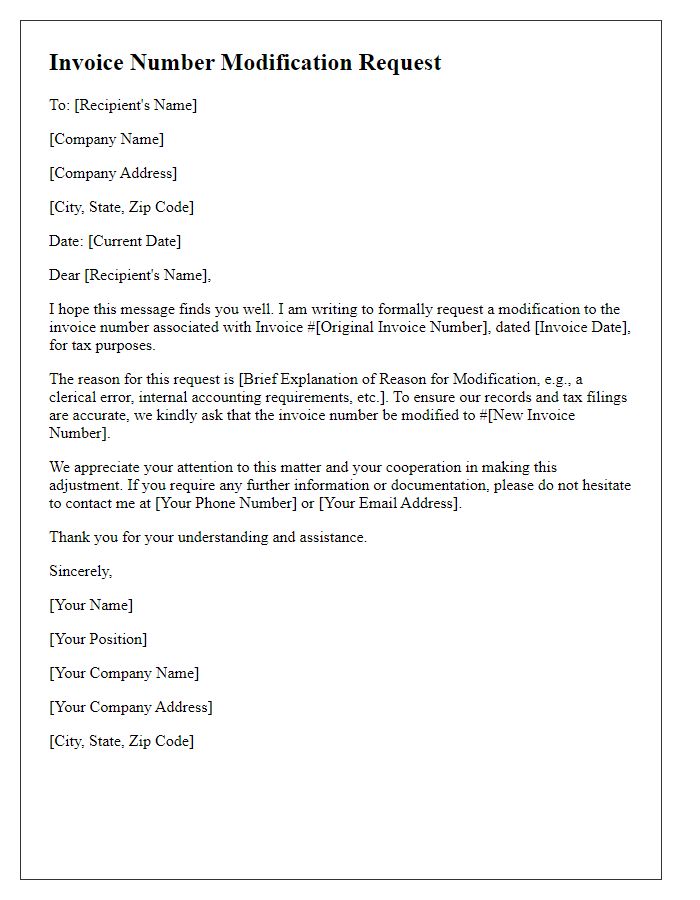

Letter template of Invoice Number Update Request for Financial Reconciliation

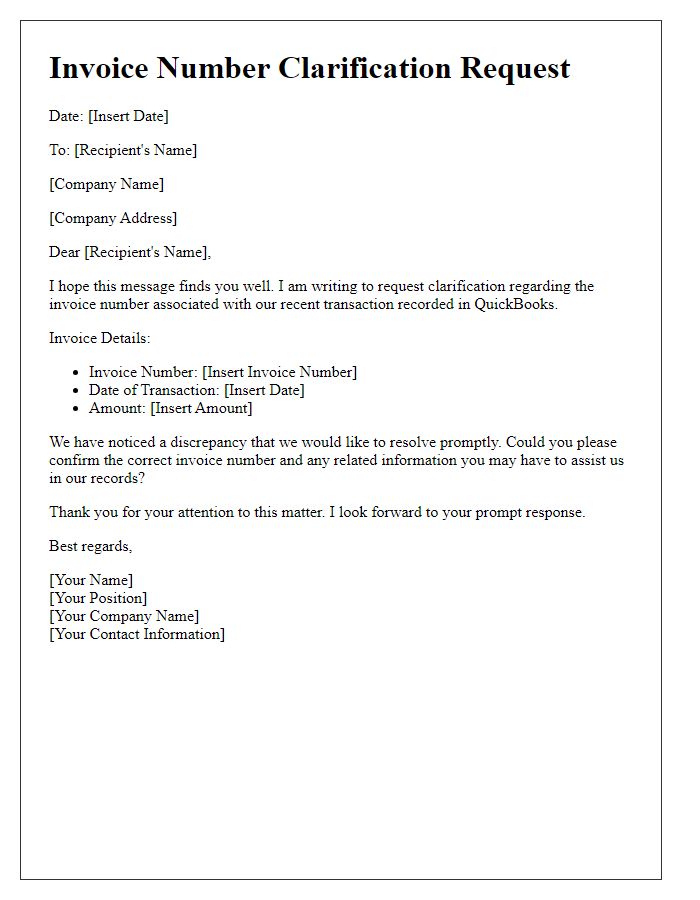

Letter template of Invoice Number Clarification Request for Quickbooks Integration

Comments