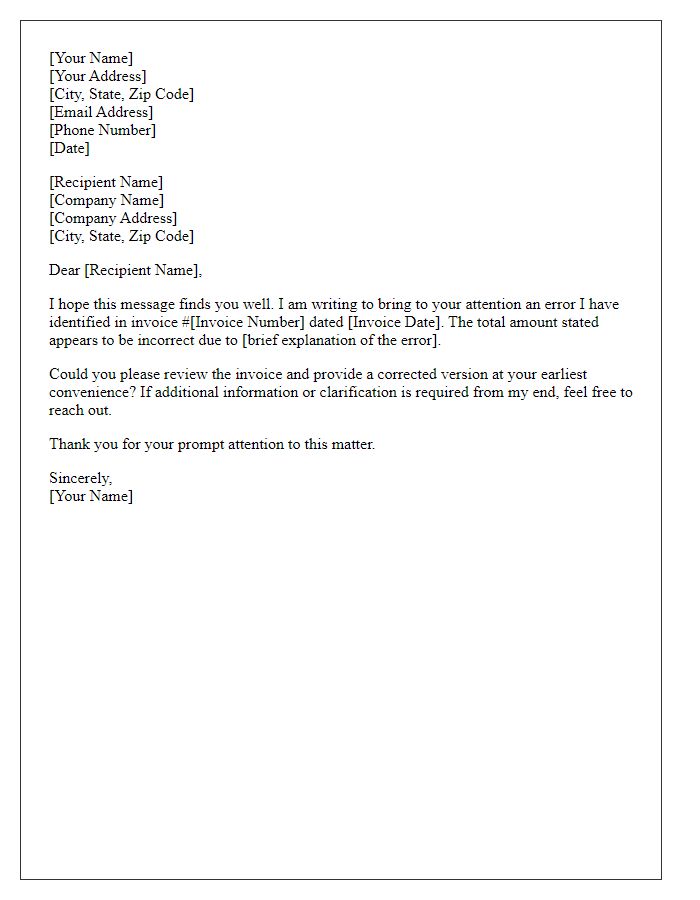

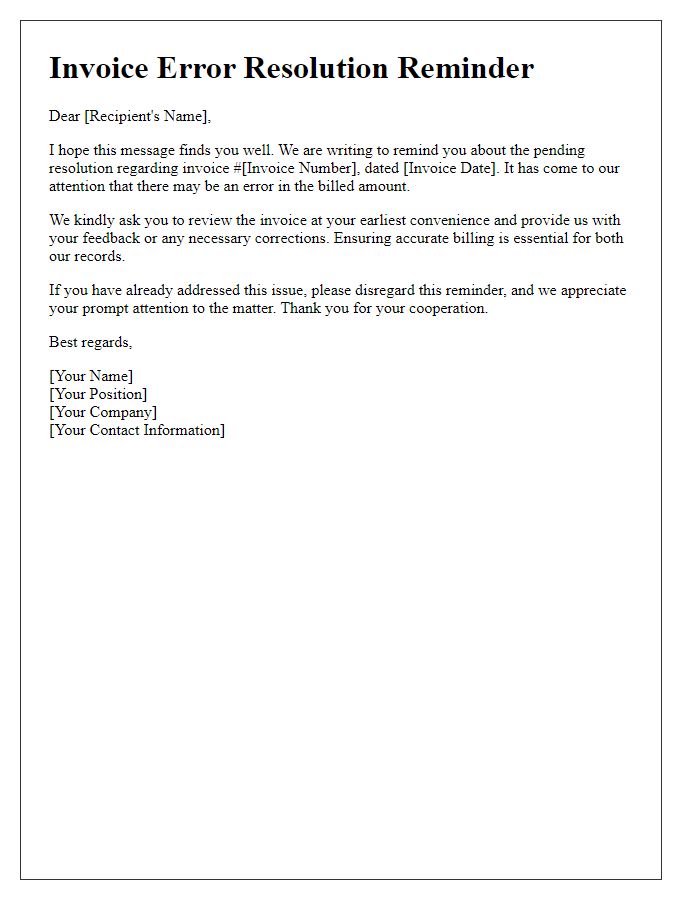

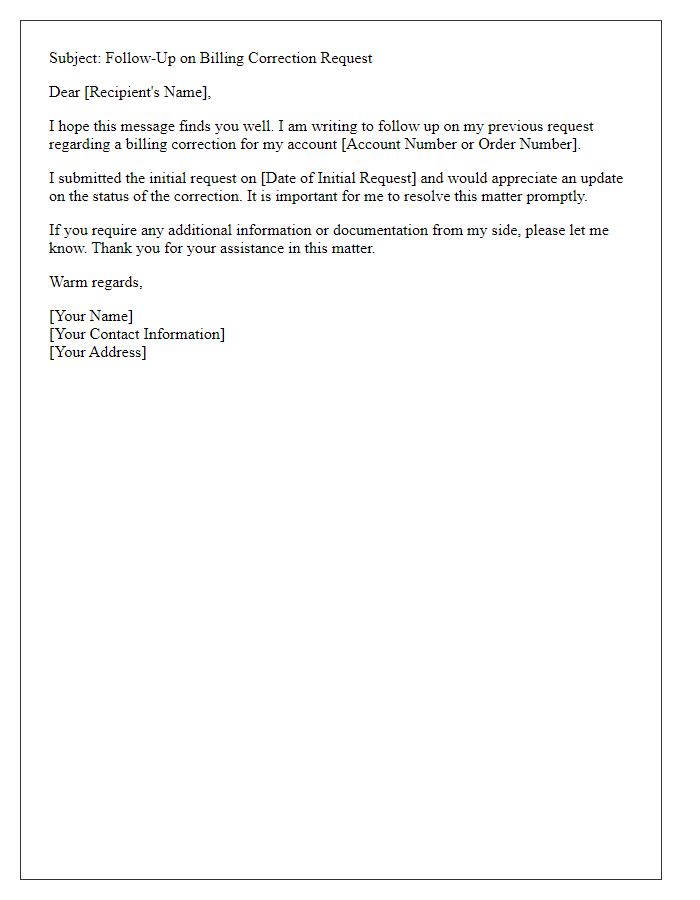

Sometimes, navigating the world of invoices can feel like a maze, especially when errors occur. If you've ever found yourself in a situation where you need to follow up on a mistake in an invoice, you're not alone. It can be a bit stressful, but knowing how to communicate effectively can make all the difference. Stick around for practical tips on how to craft the perfect letter for invoice error correction!

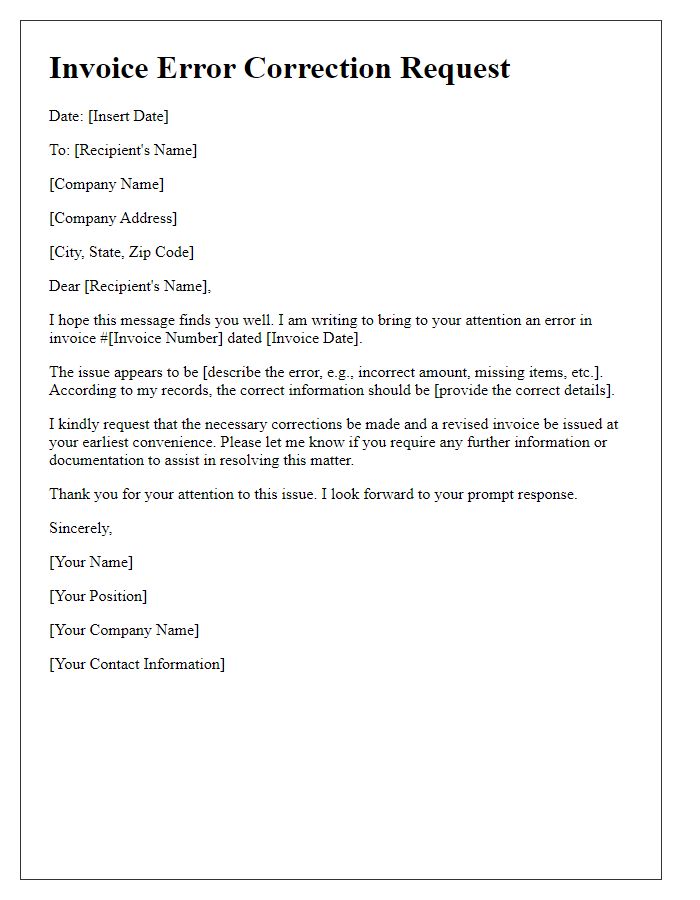

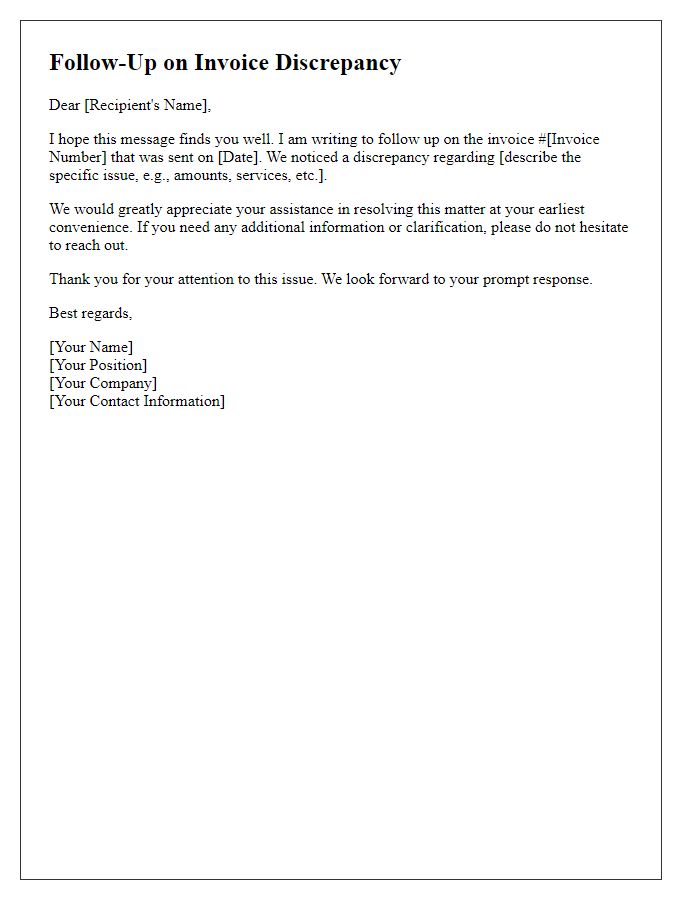

Subject Line Precision

Subject Line Precision is crucial when addressing invoice error corrections in business communications. A well-crafted subject line, such as "Invoice Correction Request for Invoice #12345," clearly identifies the document in question. This specificity aids in efficient tracking and prioritization of the issue within the company's accounting systems. Including the invoice number serves as a key reference point for both the sender and recipient, minimizing confusion. A concise subject line also enhances clarity, ensuring that the request reaches the appropriate personnel promptly, facilitating swift resolution of discrepancies and maintaining accurate financial records.

Clear Reference Details

An invoice error correction follow-up can involve various entities like payment dates, amounts, and transaction references. In the context of accounting processes, discrepancies may arise in invoices associated with specific transactions (e.g., invoice number 12345 for services rendered on July 15, 2023). Details such as the corrected total amount (for example, $1,250 instead of $1,500) need clarification. Reference to the original agreement (contract signed on June 1, 2023) may also be necessary. Clear communication (preferably via email) ensures efficient resolution of discrepancies, aiding in maintaining timely payments and accurate financial records. Addressing errors promptly minimizes potential hindrances to cash flow, crucial for operational continuity.

Error Description

Invoice discrepancies can lead to significant confusion in business transactions, necessitating a systematic approach to resolve them. For instance, a common error might involve incorrect billing amounts, where totals calculated from individual line items do not align with the final amount due. In some cases, the error could stem from miscommunication about the terms of service provided, as detailed in contracts signed by both parties at the beginning of a project. Contacting the finance department of the respective company is crucial, ideally referencing invoice numbers issued on specific dates, to ensure accurate tracking of the original submission. Clear documentation of the error, such as additional charges incorrectly applied in the case of unexpected expenses, is essential for effective follow-up. Stipulating a resolution timeframe ensures that both parties remain aligned on expectations moving forward.

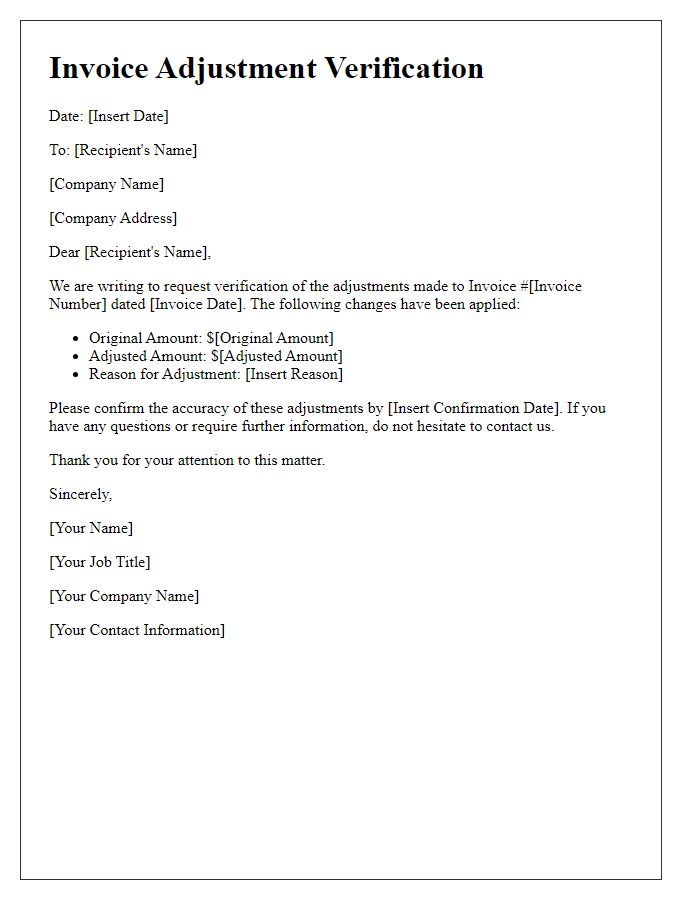

Corrected Information

An invoice error correction follow-up is essential for maintaining accurate financial records. In business transactions, incorrect information can lead to complications such as delayed payments or discrepancies in accounting. Corrected information might include revised invoice numbers, accurate billing addresses, or updated item descriptions, which are crucial for clarity. For instance, if an invoice issued on September 15, 2023, contains a miscalculation in the total amount due of $1,250 instead of the correct amount of $1,500, it's vital to communicate this correction promptly. This ensures that both parties have an accurate understanding of the financial obligations. Proper documentation and timely follow-ups can enhance transparency and foster trust between businesses.

Contact Information

Inaccurate billing statements can lead to discrepancies in financial records, affecting both individuals and businesses. Ensuring accurate contact information is crucial for resolving invoice errors efficiently. For instance, the company name, invoice number, billing address, and email can directly impact communication regarding the correction. Errors in these details can delay processing times, create confusion, and potentially result in late fees or service interruptions for clients relying on timely billing. Accurate information facilitates smoother transactions and maintains trust in business relationships. Additionally, verifying contact methods, such as phone numbers or alternative email addresses, can enhance response times and ensure that all parties remain informed throughout the correction process.

Comments