Welcome to our guide on crafting the perfect invoice settlement confirmation letter! Whether you're a business owner looking to maintain strong relationships with your clients or an accounts professional aiming to uphold organizational efficiency, it's crucial to confirm when invoices are settled. A well-structured letter not only communicates professionalism but also fosters trust and clarity in financial transactions. Ready to learn how to create an effective confirmation letter? Let's dive in!

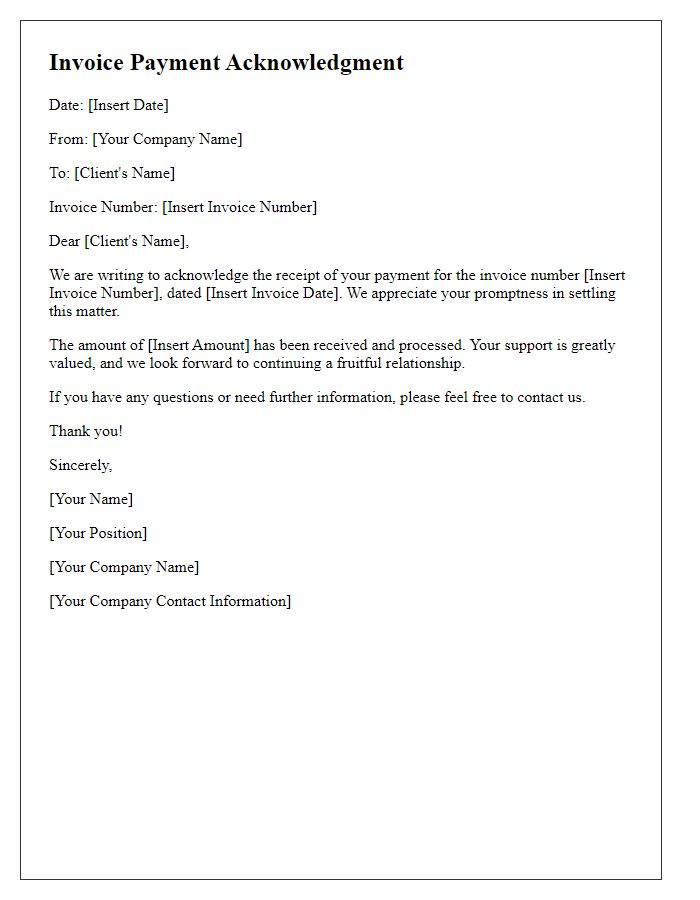

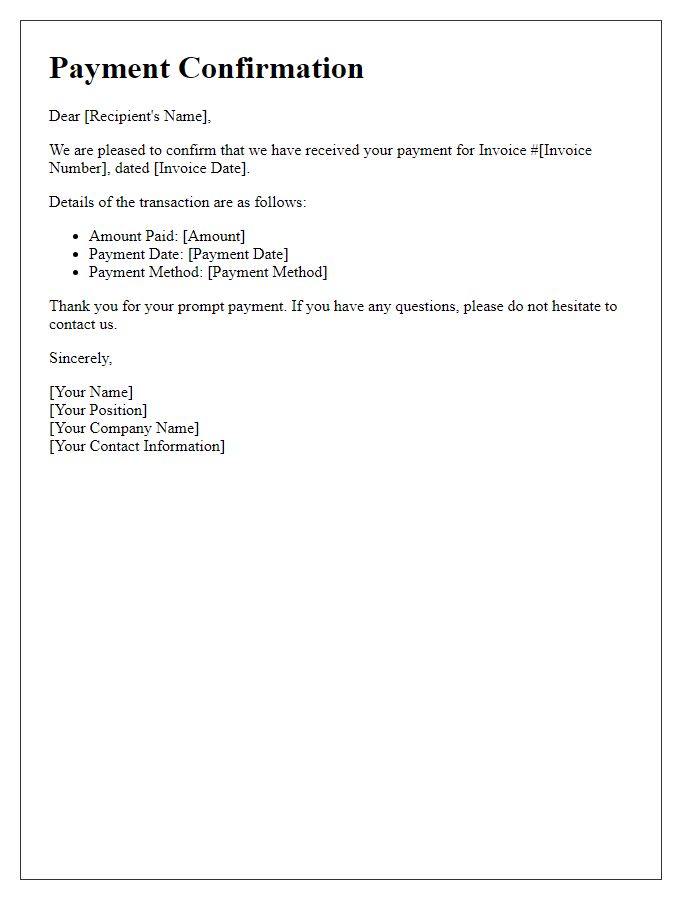

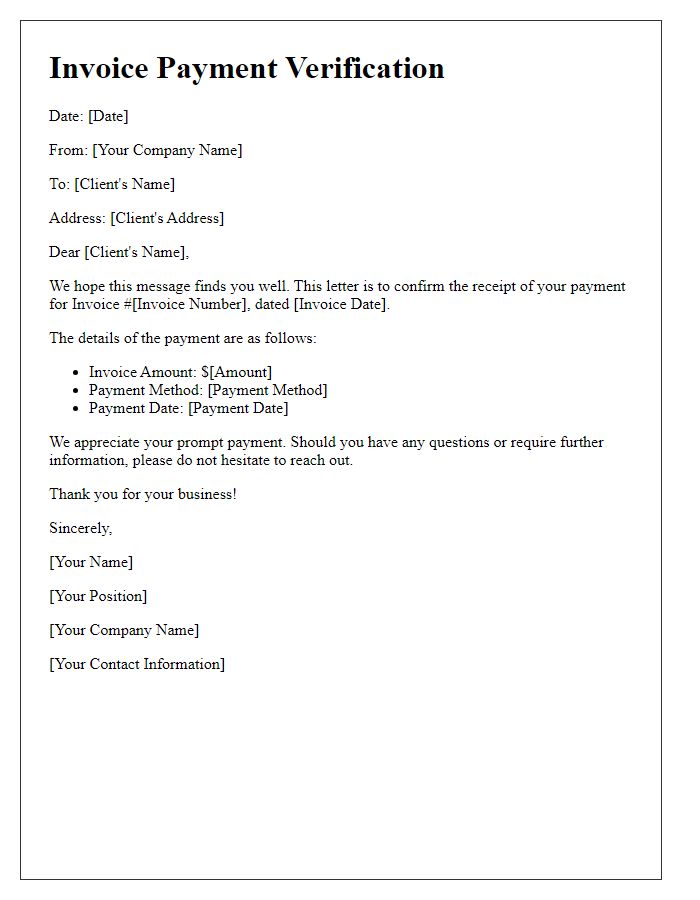

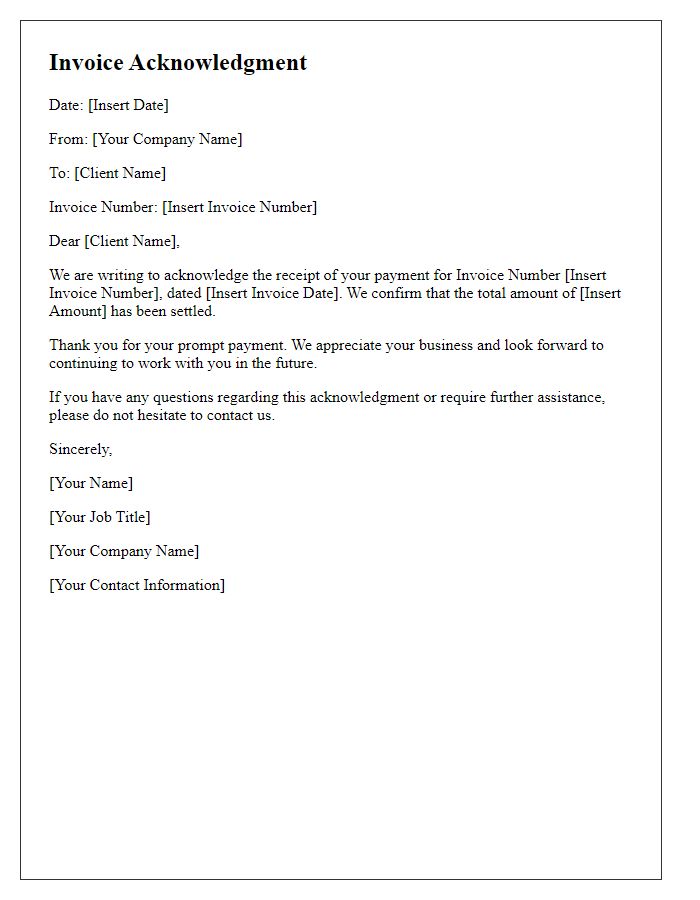

Sender and receiver's contact information

A detailed invoice settlement confirmation includes sender's name, address (typically a business location), phone number, and email. Receiver's contact information should also be included, featuring their name, business address, phone number, and email address. The invoice number should be specified, along with the date of payment, payment method (such as bank transfer or check), and amount settled. Additionally, reference any related purchase order or contract numbers for clarity. Ensure to include a summary of items or services rendered alongside any applicable tax breakdown to provide a comprehensive record of the transaction.

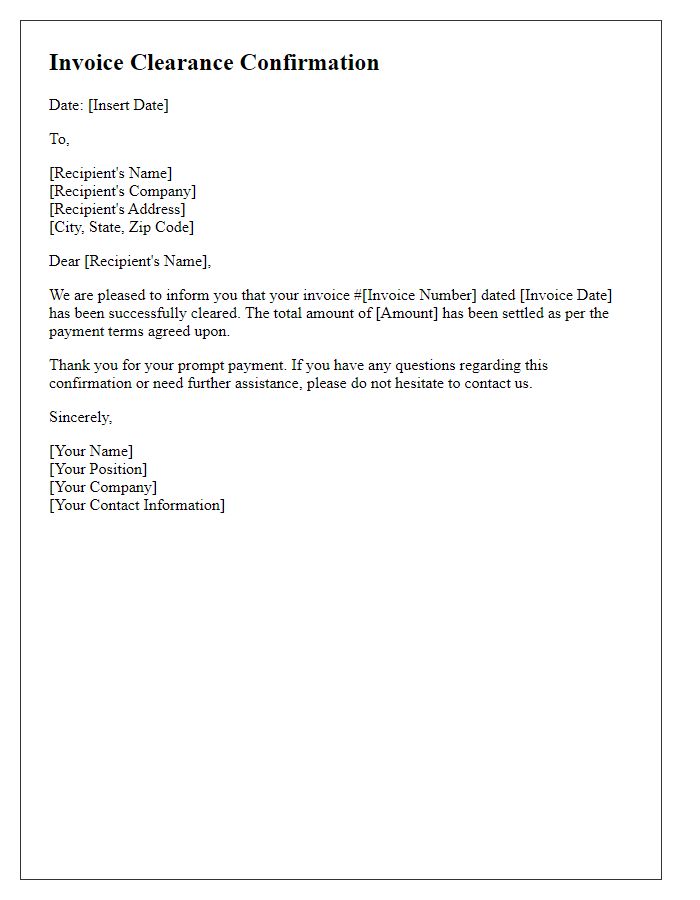

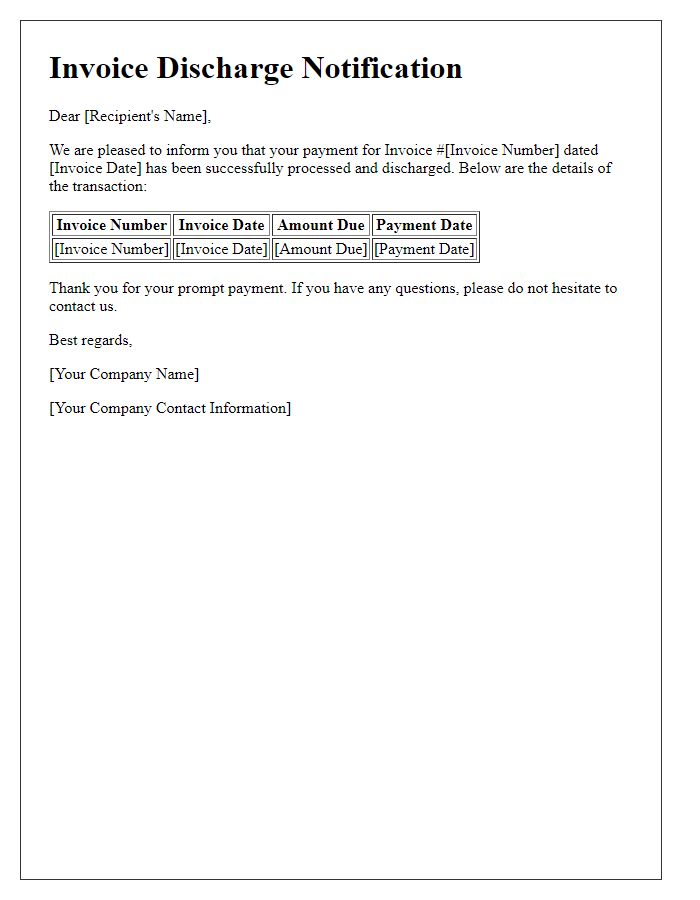

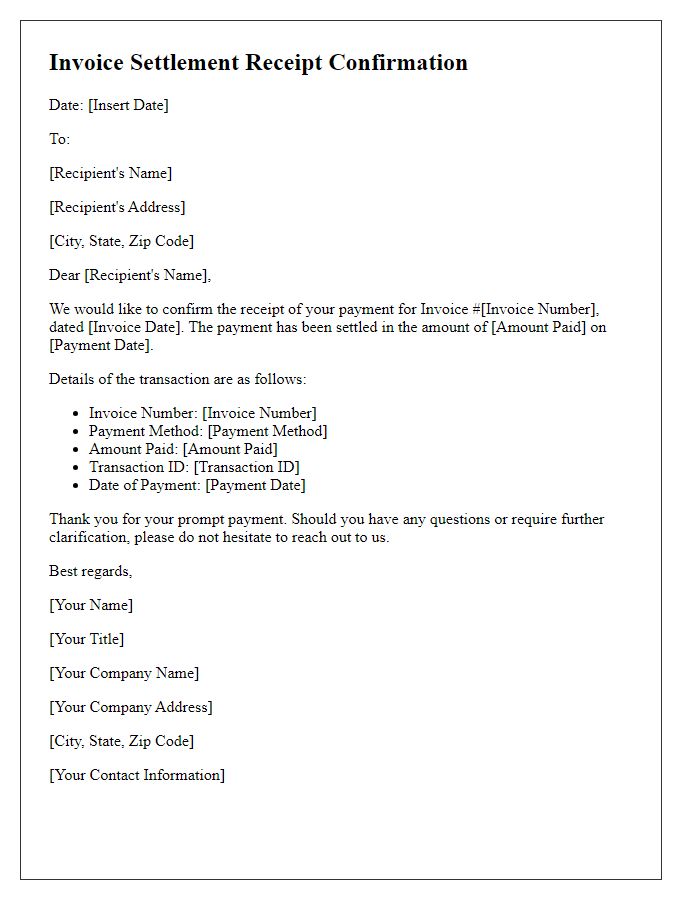

Invoice number and date of issue

Invoice settlement confirmation ensures clarity in financial transactions, particularly for businesses. Invoice number (a unique identifier assigned to each invoice document for tracking) and date of issue (the specific day when the invoice is generated, usually reflecting the sale date) are critical components in this process. Successful confirmation validates payment receipt for services rendered or products delivered, maintaining robust financial records for both vendors and clients. Proper documentation (such as copies of receipts or payment confirmations) supports accountability, leading to improved cash flow management in fiscal operations.

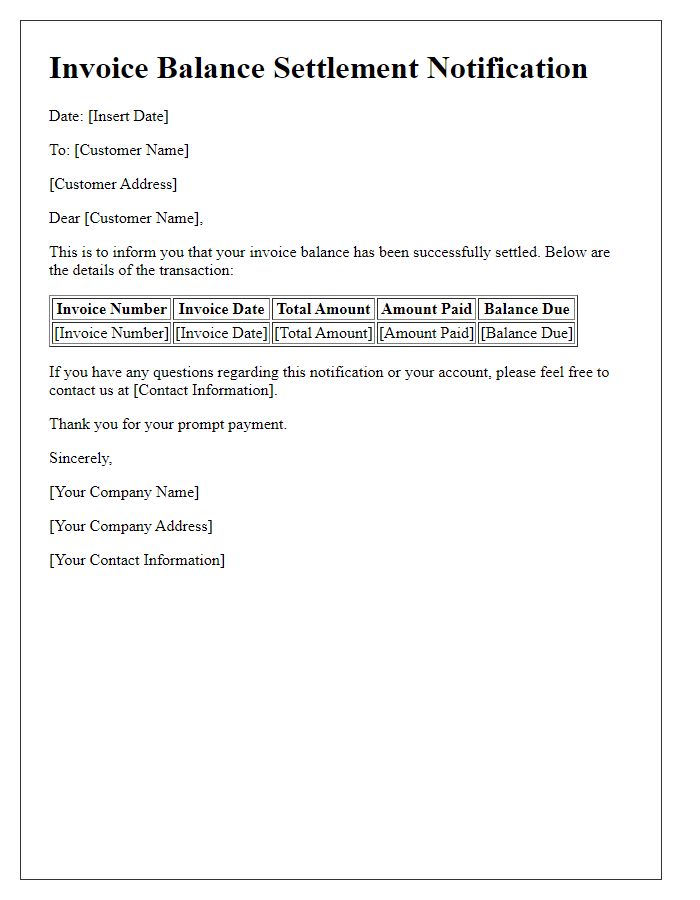

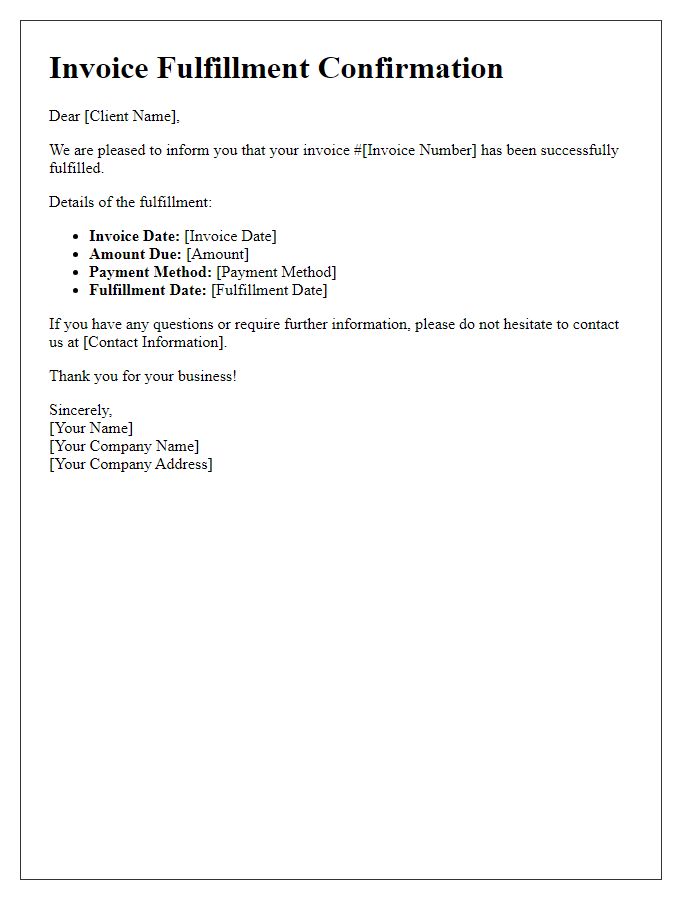

Details of settled amount and payment method

Invoice settlement confirmations provide important details regarding the completion of payment transactions for goods or services rendered. Confirmation documents typically include clear information such as settled amounts, which may vary based on agreed terms, adjustments, or discounts. Common payment methods include credit cards, bank transfers, or alternative payment platforms like PayPal. Details like transaction IDs, the date of payment, and corresponding invoice numbers enhance the record-keeping process for both parties involved in the transaction. Accurate documentation decreases confusion in financial records and aids in resolving any future disputes that might arise concerning the settled account. For businesses, maintaining organized confirmation records supports efficient accounting practices and ensures cash flow management.

Acknowledgment of receipt and confirmation statement

Acknowledgment of receipt of invoice payment confirms the transaction's successful completion for services provided or goods delivered. This confirmation statement may include critical information such as the invoice number (e.g., INV-1001), payment amount (e.g., $1,500), payment method (e.g., bank transfer or check), and payment date (e.g., October 12, 2023). Essential details, such as the client's name (e.g., ABC Corp), contact information, and any relevant purchase order numbers, should also be referenced. The confirmation serves as a record for both parties, ensuring transparency and accountability in financial dealings, particularly for future audits or reconciliation processes.

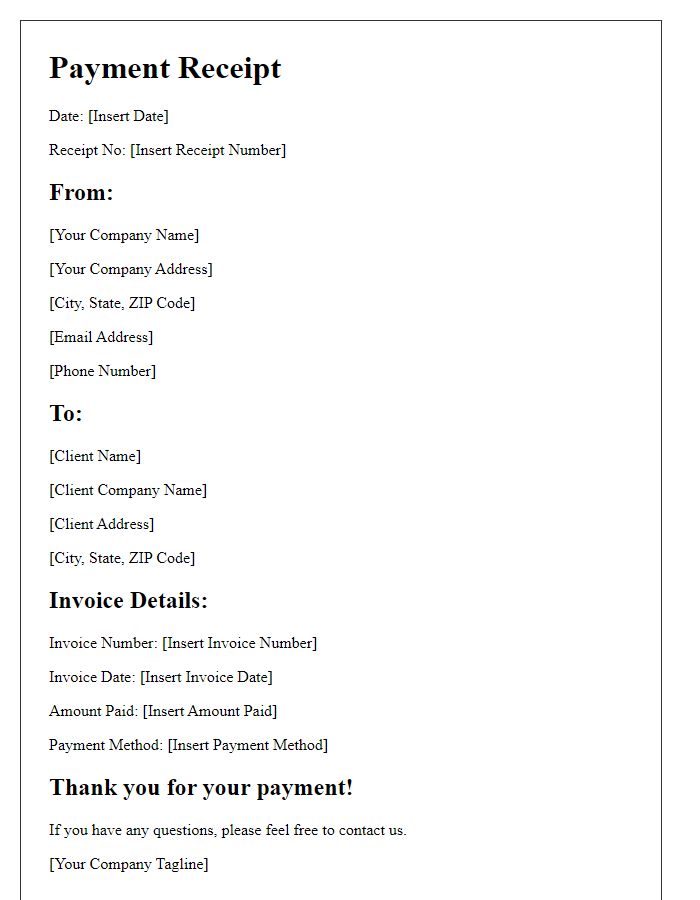

Any further obligations or next steps

Invoice settlement confirmation establishes clarity regarding payment status for both parties. Upon receipt of the payment for Invoice #12345 dated March 1, 2023, issued by Acme Corp, it is important to acknowledge the fulfillment of financial obligations. The total amount of $1,200 was settled on March 15, 2023, through a bank transfer to the account specified in the invoice. Next steps may include providing a receipt or confirmation of payment, discussing any potential future invoices or projects (scheduled for April 2023), or establishing a timeline for follow-up communications regarding ongoing services or products. This ensures both parties remain informed and aligned on future expectations.

Comments