Are you looking to make your invoicing process smoother and more beneficial for both you and your clients? Introducing early payment invoice discounts can encourage timely payments while strengthening your business relationships. In this article, we'll explore the advantages of offering discounts for prompt payment and provide you with a handy template you can easily customize. Join us as we delve into this topic and discover how to enhance your invoicing strategy!

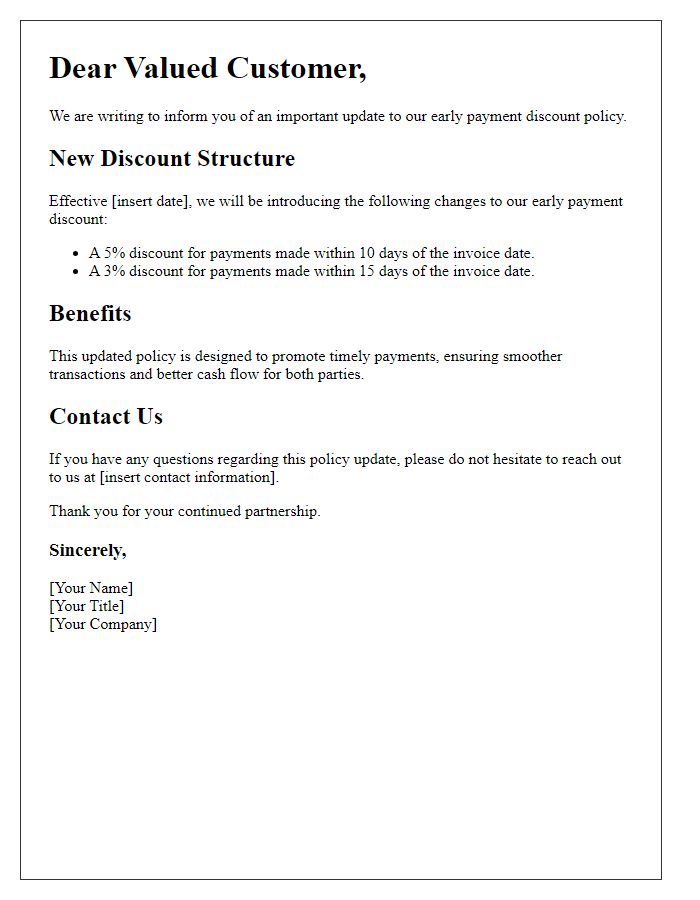

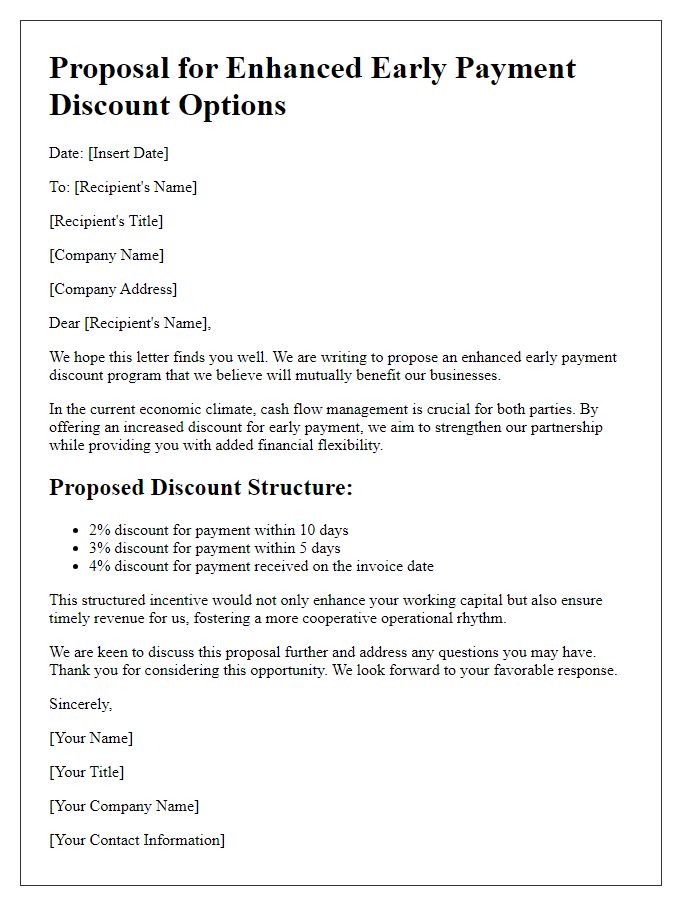

Clear Discount Terms

Early payment invoice discounts can offer valuable incentives for prompt financial transactions. Typically, businesses might implement a discount of 2% to 5% for payments received within 10 to 30 days from the invoice date. This strategy, frequently utilized by companies like Microsoft or Amazon, encourages timely cash flow. Clear terms should specify eligible invoices and discount periods to prevent confusion. For instance, an invoice dated April 1, with a 2% discount applicable if paid by April 10, must clearly indicate the required payment methods and any potential penalties for late payments. Understanding these terms enhances financial planning for both buyers and sellers, promoting healthier business relationships.

Specific Payment Deadline

Early payment discounts can incentivize quick settlement of invoices. Offering a discount, typically ranging from 1% to 5%, for payments received before the specified deadline promotes timely cash flow. For example, an invoice of $1,000 with a 2% discount available for payment within 10 days encourages clients to settle promptly, fostering goodwill and stronger financial management. Implementing clear terms, such as a specific due date (e.g., November 30, 2023) highlighted on the invoice, can ensure clients are aware of both the discount mechanics and the importance of meeting the deadline. Companies often use these strategies to enhance customer relationships and maintain steady cash flow without incurring additional debt.

Invoice Details

Invoices issued for early payment discounts often include specific details to emphasize the financial benefit. An invoice reflecting a total amount due of $1,200 may offer a 5% discount for payments received within 10 days. Payment instructions are vital, specifying bank transfer details or credit card options. Clear identification of the invoice number enhances tracking, while the issue date, for instance, July 1, 2023, is crucial for clarity. Additionally, including terms and conditions related to the discount can prevent misunderstandings, reinforcing professional integrity. A thank you note for timely payments can foster positive client relationships, ensuring future cooperation.

Contact Information

Early payment discounts can incentivize clients to settle invoices ahead of schedule, benefiting cash flow for businesses. For example, a 2% discount on an invoice amounting to $1,000 can encourage quick payment, resulting in a total of $980 due. Important contact information includes the business name (like ABC Corp), address (123 Business Rd, Cityville), phone number (555-123-4567), and email (info@abccorp.com). Clear communication of payment terms stating how early payments impact discount eligibility enhances transparency and encourages compliance, ultimately strengthening client relationships and financial stability.

Polite Tone

Prompt payment of invoices can significantly enhance cash flow for businesses. Offering early payment discounts, typically 2% to 5%, incentivizes clients to settle invoices faster, improving liquidity. This strategy often applies to invoices due within 30 days, encouraging quicker transactions. The discount can positively impact customer satisfaction, fostering stronger relationships and repeat business. Proper communication about the early payment terms, timeline, and discount details in invoices ensures clarity and maintains professionalism in business operations. Effective management of accounts receivable becomes crucial for overall financial health.

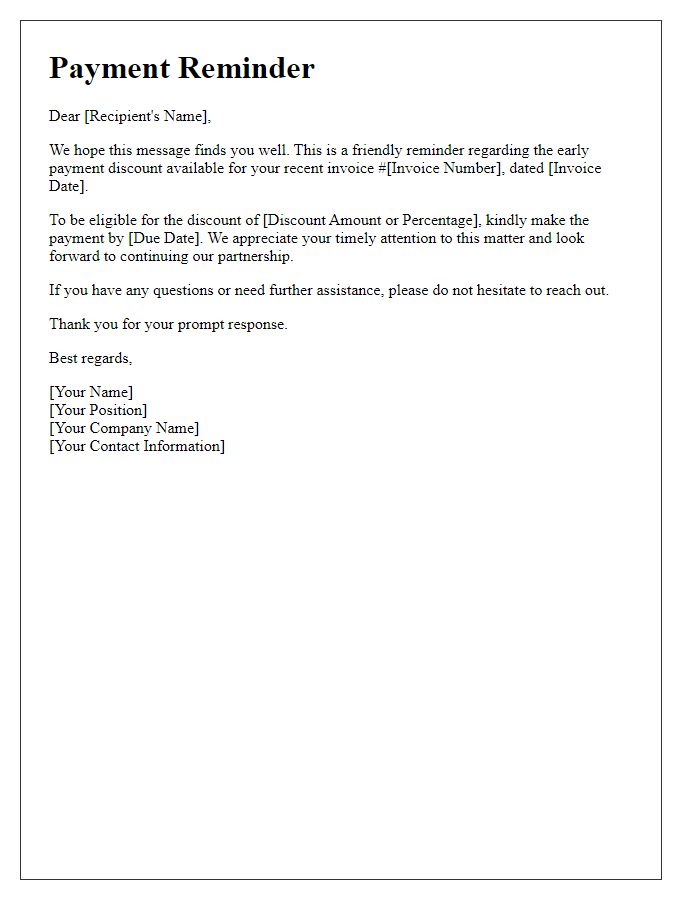

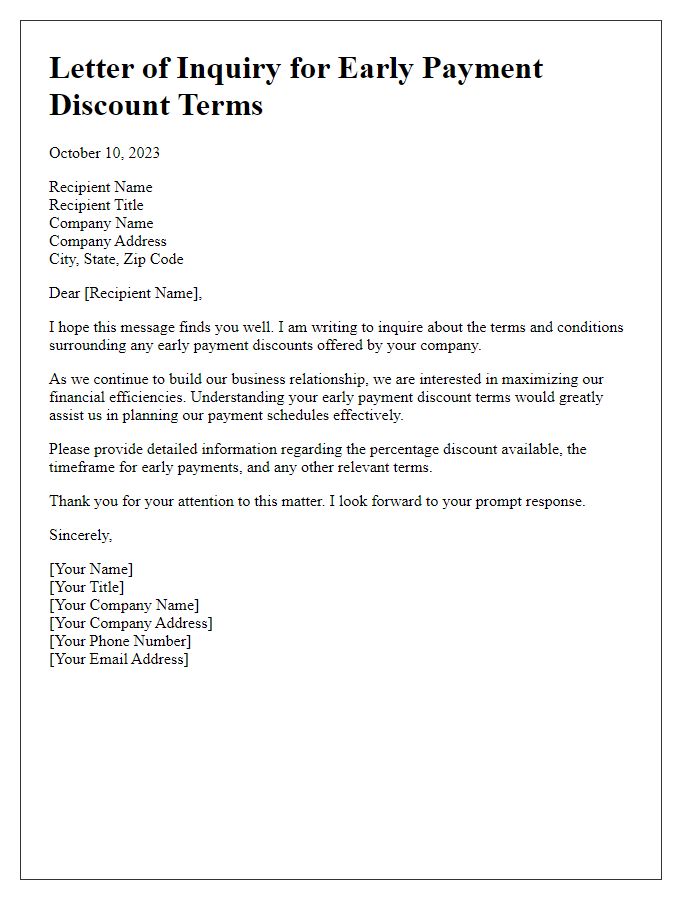

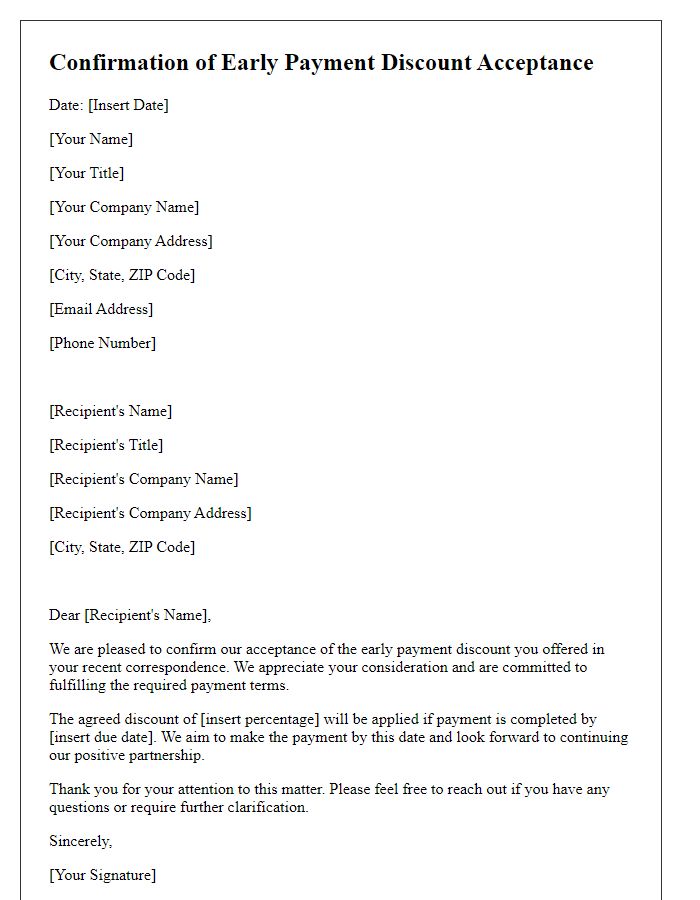

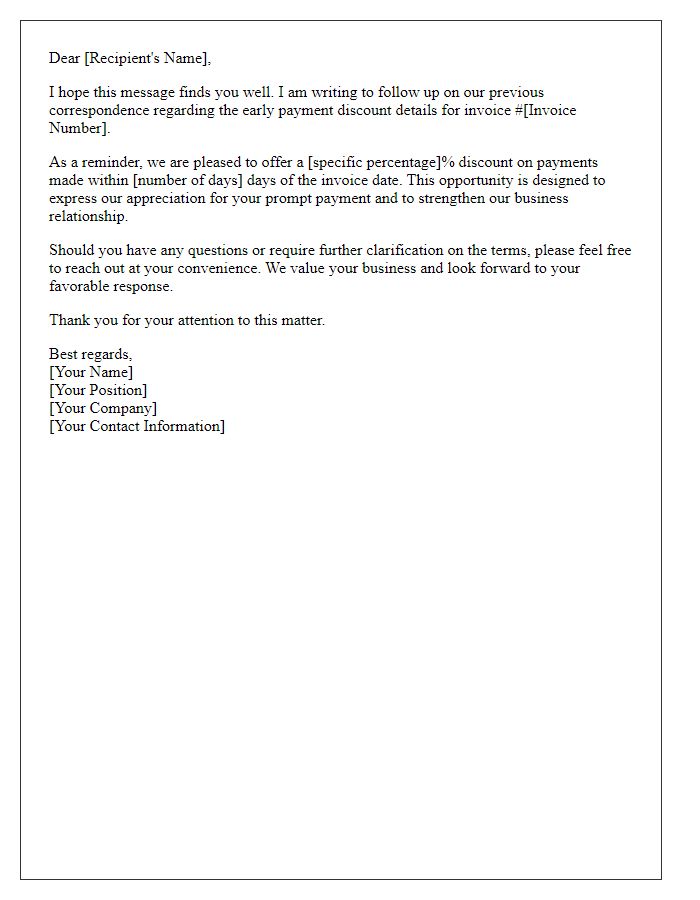

Letter Template For Early Payment Invoice Discount Samples

Letter template of appreciation for taking advantage of early payment discount

Letter template of invitation to discuss early payment discount arrangements

Comments