Hey there! If you're looking to streamline your billing process, a quarterly invoicing cycle could be the perfect solution. Not only does it simplify tracking payments, but it also helps you maintain consistent cash flow throughout the year. In this article, we'll discuss how to implement this system smoothly and the benefits it can bring to your business. So stick around to discover the best practices for setting up your quarterly invoicing!

Subject Line Clarity

Subject lines are critical for effective communication, especially in quarterly invoicing cycles. They need to convey essential information at a glance. For example, "Quarterly Invoice Request Q1 2024" indicates the specific time frame (Q1 2024) and the purpose (invoice request). Another effective subject line could be "Request for Quarterly Invoice - Due Date: April 15, 2024," which highlights the urgency of the request with a specific due date, ensuring prompt attention. Alternatively, "Quarterly Billing Update: Services Rendered for January-March 2024" provides context about the billing period and reinforces clarity regarding the services involved, facilitating better tracking and management of financial tasks.

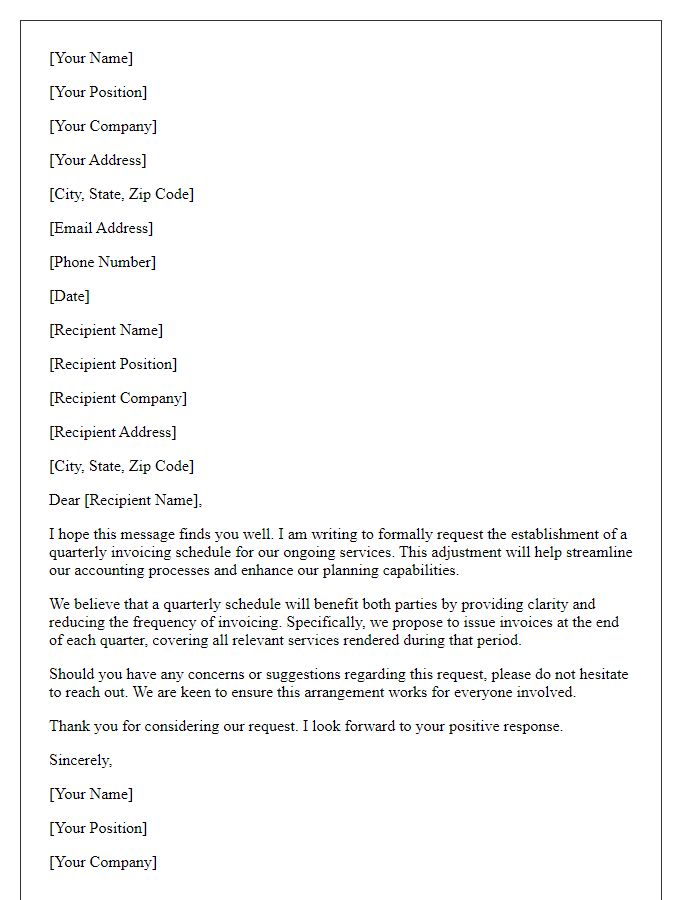

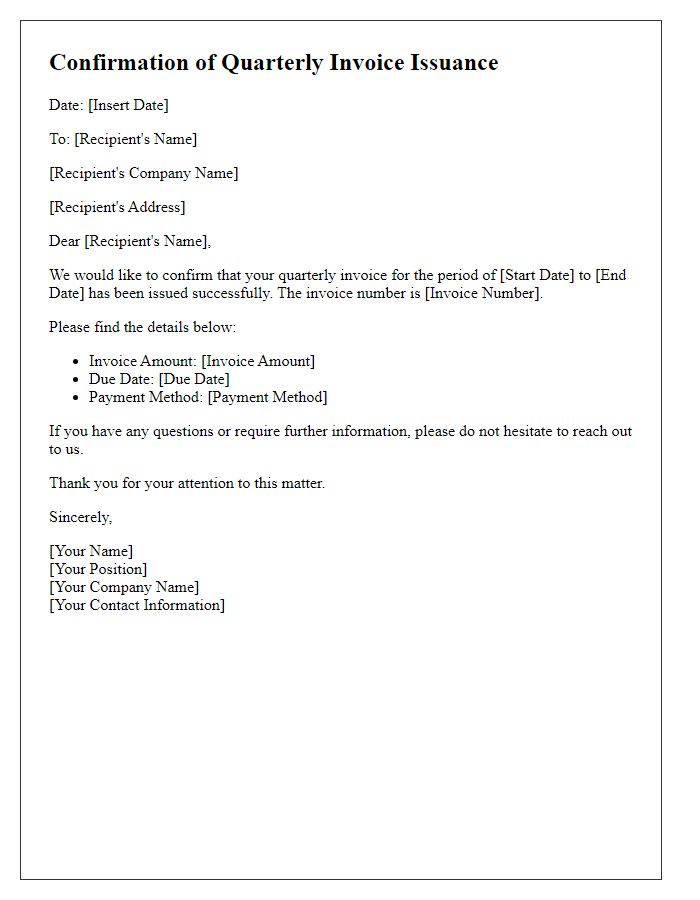

Recipient's Proper Address

To streamline the quarterly invoicing cycle, it is essential to gather accurate recipient addresses. Each address should include detailed components such as the recipient's name, street address (number and street name), city, state (or province), and postal code (ZIP code). This level of detail ensures successful delivery of invoices and reduces discrepancies. For example, an address formatted as "John Doe, 1234 Elm Street, Springfield, IL, 62701" minimizes confusion and aligns with standard addressing protocols. Ensuring clarity and precision in addressing can enhance the efficiency of financial transactions and maintain professional relationships.

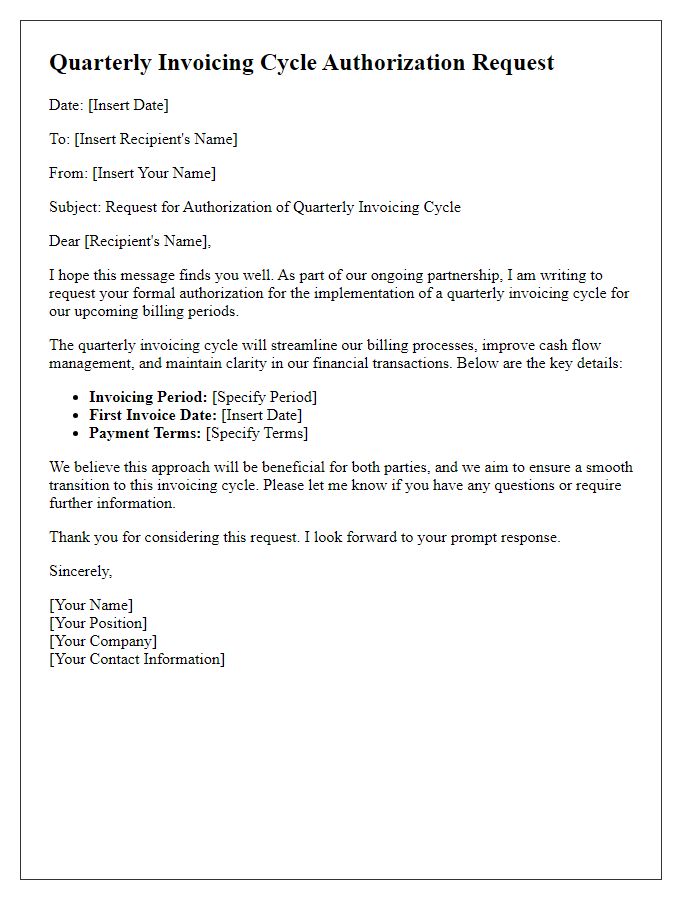

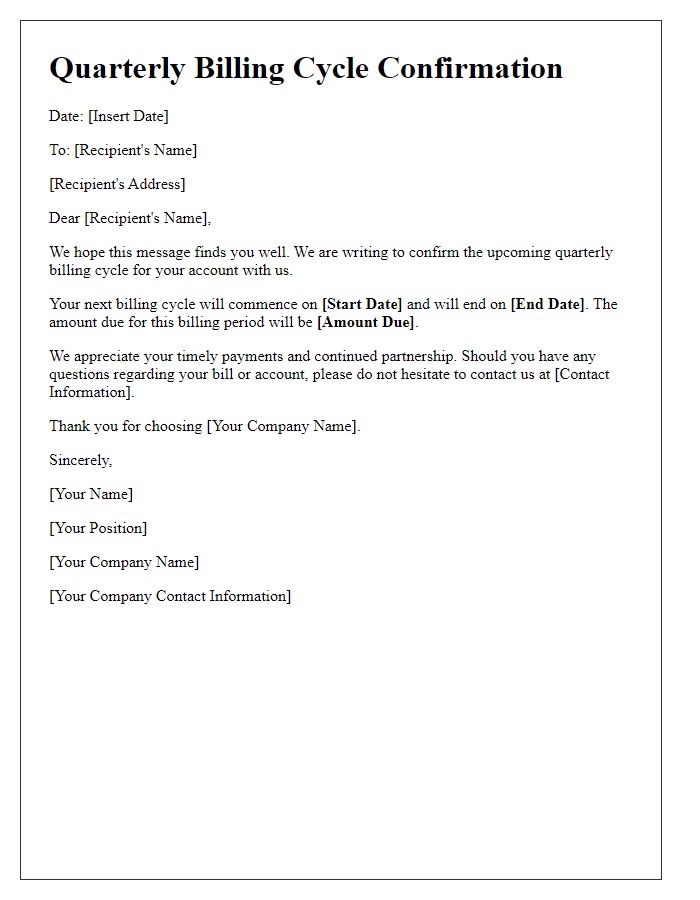

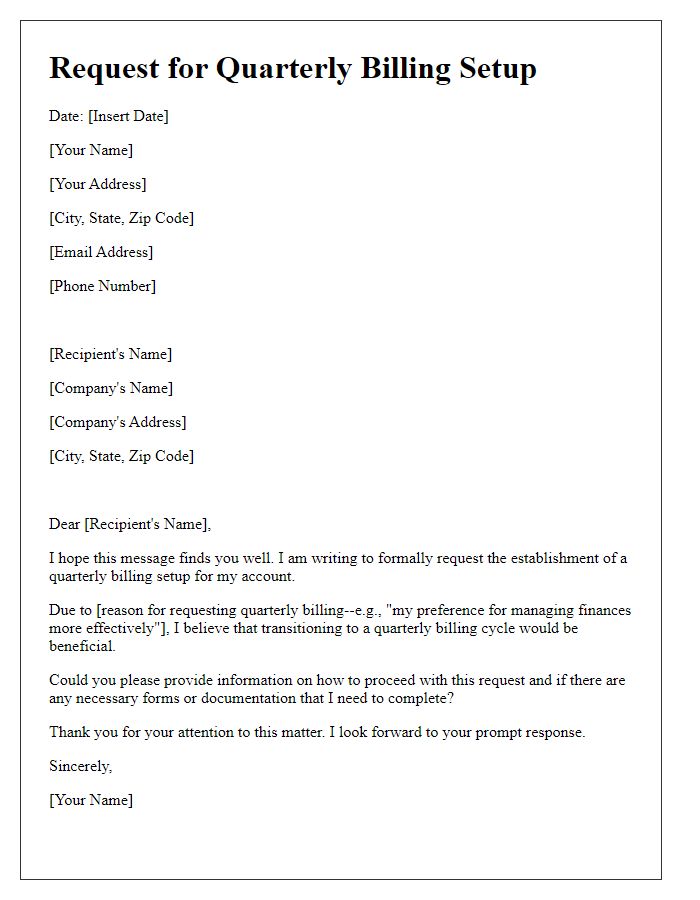

Purpose Statement

Quarterly invoicing accurately reflects financial activities over designated three-month periods, facilitating effective budgeting and cash flow management for businesses. This structured method of billing helps in tracking expenses (like operational costs or project expenses) and revenue streams, essential for fiscal analysis. Implementing quarterly invoicing allows for timely adjustments to financial strategies, improving overall operational efficiency. Businesses typically adopt this cycle aligned with fiscal calendars (like January to March or April to June) to ensure compliance with accounting standards and optimize tax reporting.

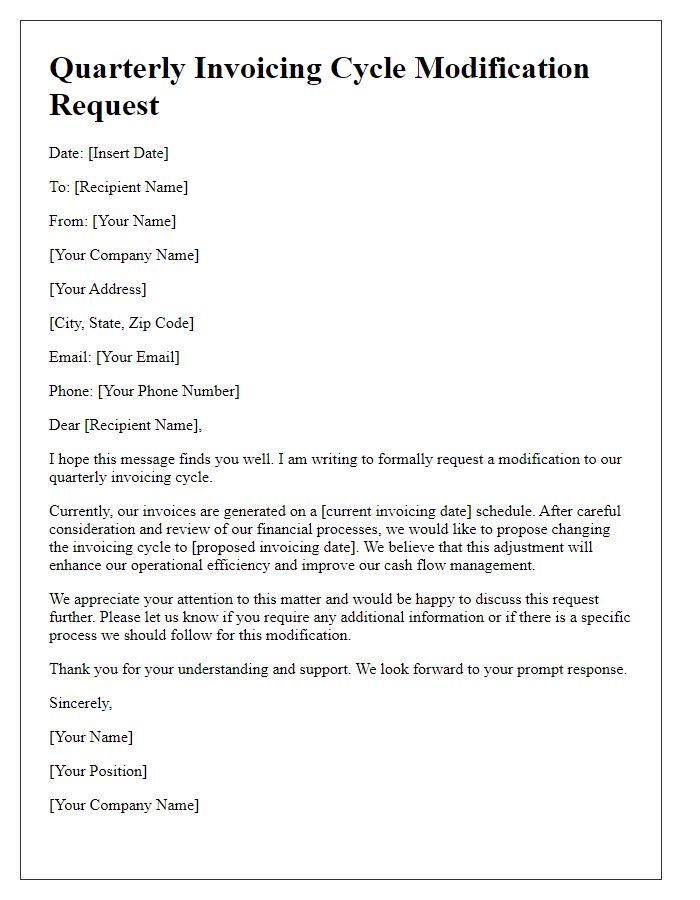

Service Period Specification

Quarterly invoicing cycles facilitate predictable cash flow for businesses, especially in service-based industries, such as consulting or maintenance. Typically, a service period is defined as three months, aligning with common fiscal quarters: January to March, April to June, July to September, and October to December. Clear specification of service deliverables within each period ensures accountability. For example, a digital marketing firm may designate monthly reporting, strategy sessions, and campaign management during each quarter. Accurate invoicing aligned with the service period not only enhances transparency for clients but also streamlines financial operations for the service provider, promoting better client relationships and financial stability.

Personalized Closing

Specialized quarterly invoicing cycles can streamline financial processes, enhancing cash flow management for businesses. Implementing a personalized closing approach allows clients to receive tailored invoices that reflect specific needs and preferences, such as itemized billing for services rendered. Customization may include setting due dates aligned with client payroll schedules and including detailed descriptions of provided services or products. Utilizing software like QuickBooks or FreshBooks can facilitate the generation of these personalized invoices, ensuring accuracy and professionalism. Regular communication throughout the invoicing cycle fosters positive relationships and encourages timely payments, ultimately supporting overall business efficiency and profitability.

Comments