Are you looking to streamline your accounting process and keep track of your financial records more effectively? Requesting your invoice history might seem daunting, but it's actually quite simple and can save you a lot of time. In this article, we'll guide you through crafting the perfect letter to request your invoice history, ensuring you cover all necessary details. So, let's dive in and simplify your invoicing woesâread on to learn more!

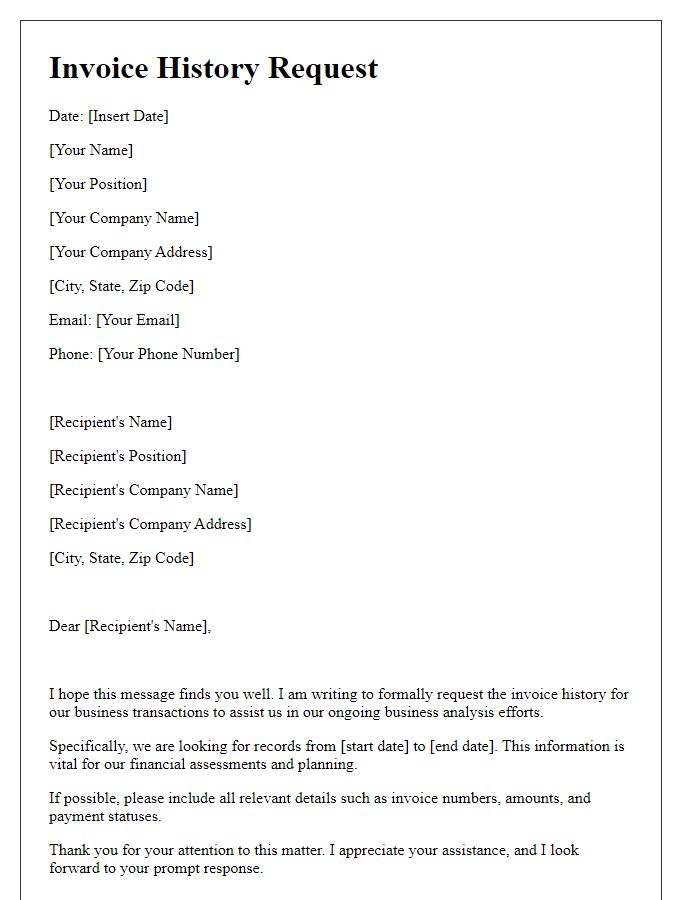

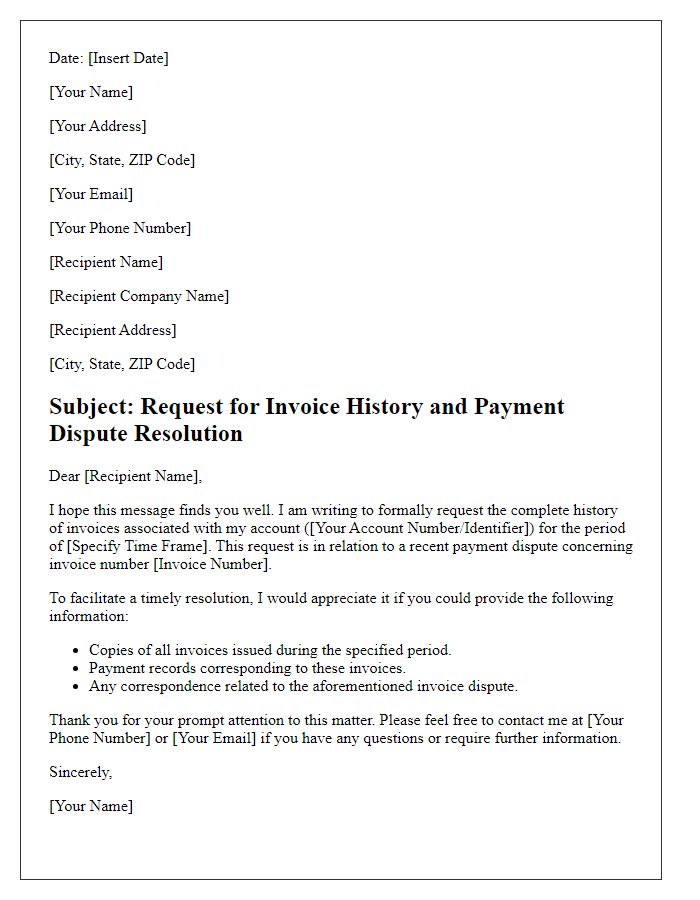

Sender's Contact Information

Requesting invoice history is essential for accurate financial management. Businesses often need comprehensive records of transactions to ensure proper accounting and tax compliance. Including detailed sender's contact information, such as full name, email address, and phone number, allows easy communication and swift resolution of any discrepancies. Specific invoice numbers or time frames (e.g., Q1 2023) can be mentioned, enhancing clarity and expediting the retrieval process. Clear identification of the recipient organization's name fosters a professional approach, ensuring the request is directed to the right department, such as accounts receivable, for efficient processing.

Recipient's Contact Information

Recipient's contact information is crucial for ensuring effective communication regarding the invoice history request. Accurate details include full name, company name, job title, phone number, and email address. A clear address should also be maintained, reflecting street, city, state, and zip code, to facilitate any necessary postal correspondences. Failing to provide precise contact information may lead to delays in processing requests or miscommunication, impacting financial records review. Keeping this information updated ensures smooth transitions for financial inquiries or disputes that might arise concerning billing.

Purpose and Request Statement

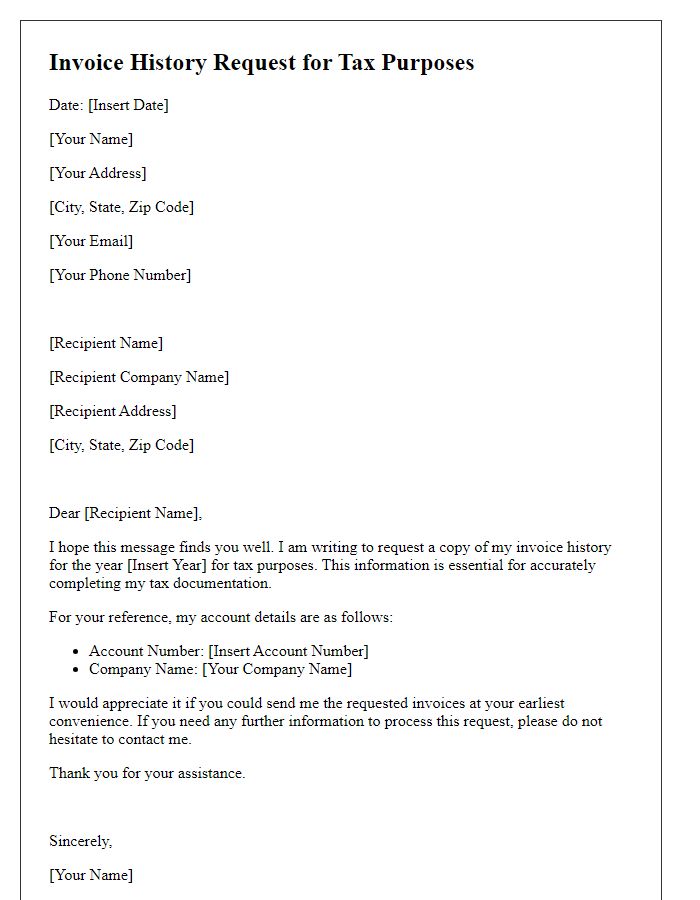

A request for invoice history is essential for businesses and individuals needing to keep accurate financial records, typically for accounting or tax purposes. Accurate invoice history records, including date ranges, invoice numbers, and amounts owed, are crucial for assessing financial health over specific periods. Clients may request this information from companies or service providers to verify payments, track expenditures, or reconcile accounts. Benefiting from detailed statements can prevent potential discrepancies and ensure both parties maintain transparent financial relationships.

Specific Invoice Details Requested

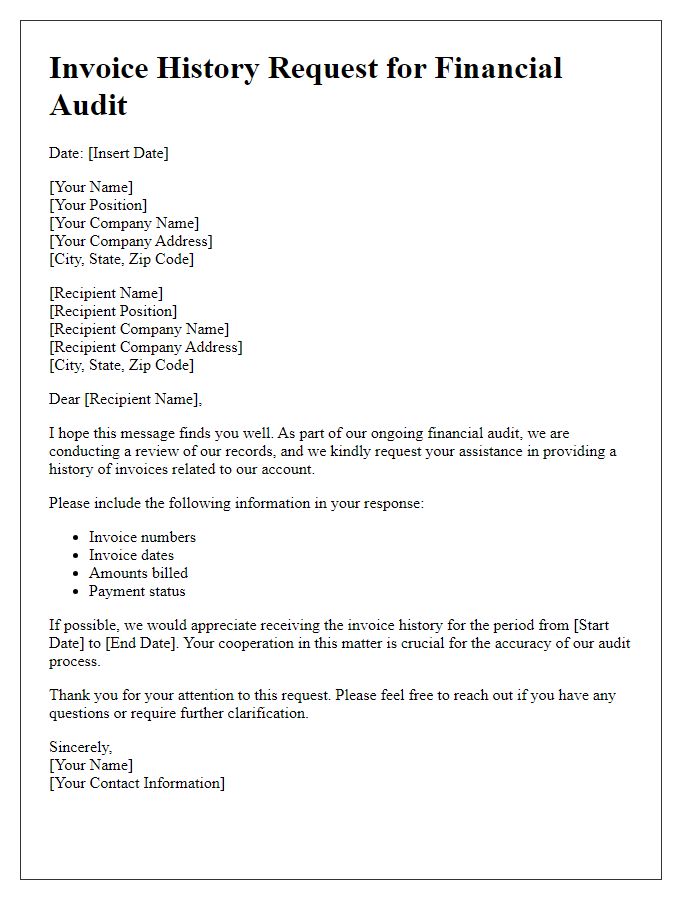

In a request for invoice history, clarity and accuracy are crucial for effective communication. Specific details, such as invoice numbers (usually a unique identification sequence), dates of transactions (timestamps that indicate when the services or goods were rendered), and the amount charged (total monetary value specified in the invoice), are essential for precise referencing. Customers often seek information to resolve discrepancies, align accounting records, or for tax purposes. Providing context such as the issuing company name and service descriptions can also enhance understanding. An efficient response to such inquiries reinforces customer relations and streamlines business operations.

Closing and Contact Information

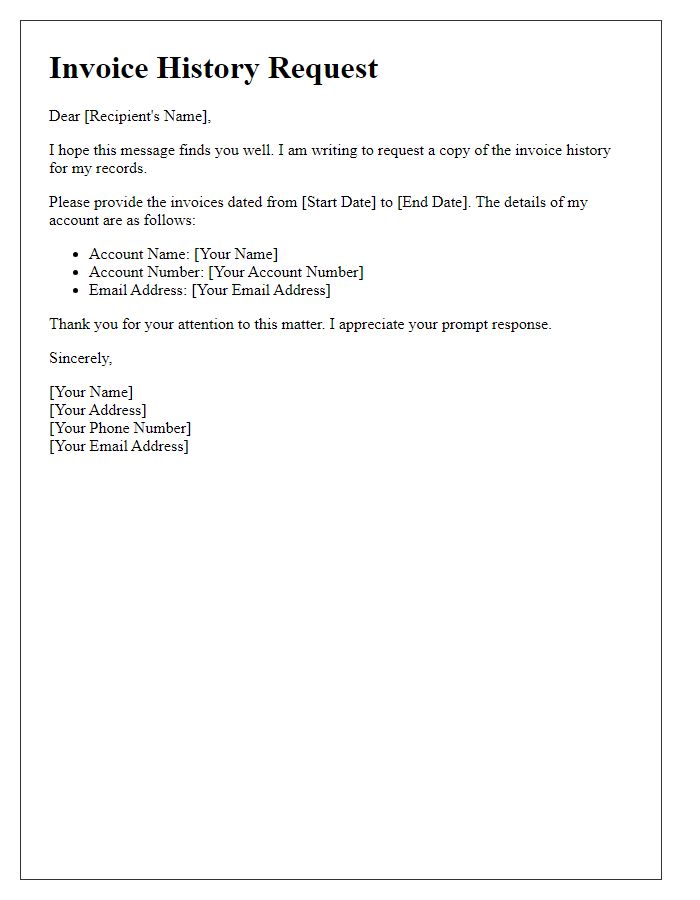

A comprehensive invoice history request involves various elements such as client identification, request details, and contact information. Invoices serve as essential documentation for transactions, outlining items, quantities, prices, and payment terms. These records ensure transparency and financial tracking for businesses, especially in sectors like accounting, legal services, and e-commerce. Contact information must include not only the sender's and recipient's names but also addresses and phone numbers to facilitate follow-up communication. A well-structured request typically references specific invoice numbers, dates, and amounts, enabling the recipient to process the inquiry efficiently. Proper closing statements reinforce professionalism, ensuring the communication appears courteous and respectful.

Letter Template For Invoice History Request Samples

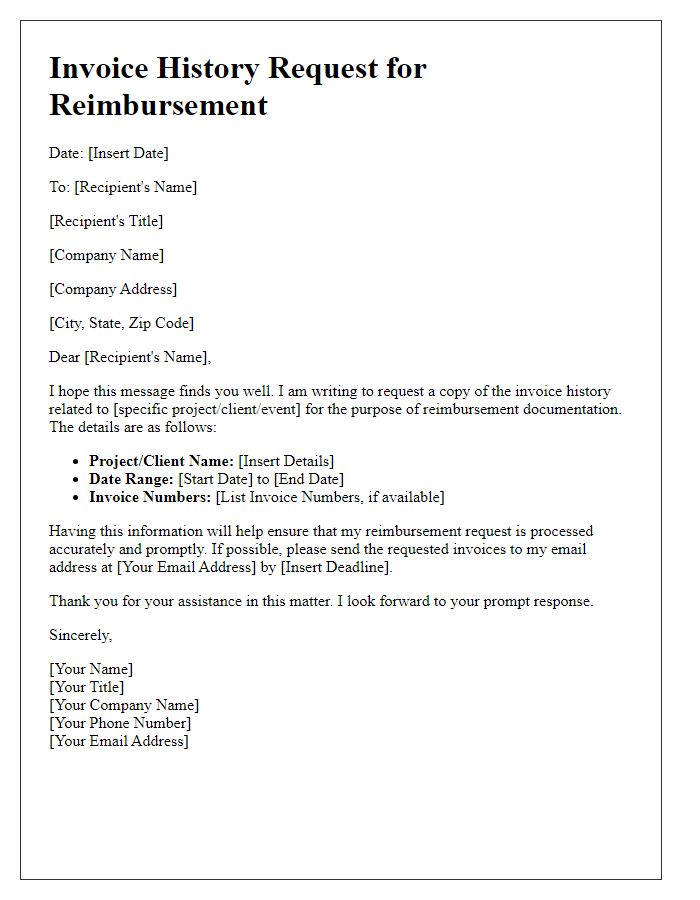

Letter template of invoice history request for reimbursement documentation.

Comments