We all know that life can get a bit hectic, and sometimes bills slip through the cracks. If you've found yourself in a situation where a late fee has unexpectedly popped up, you're not aloneâthis happens to the best of us. Fortunately, many companies have options in place for waiving those pesky charges, especially when it's your first time or there were extenuating circumstances. Curious about how to request a late fee waiver effectively? Read on to discover tips and templates that can help you craft the perfect letter!

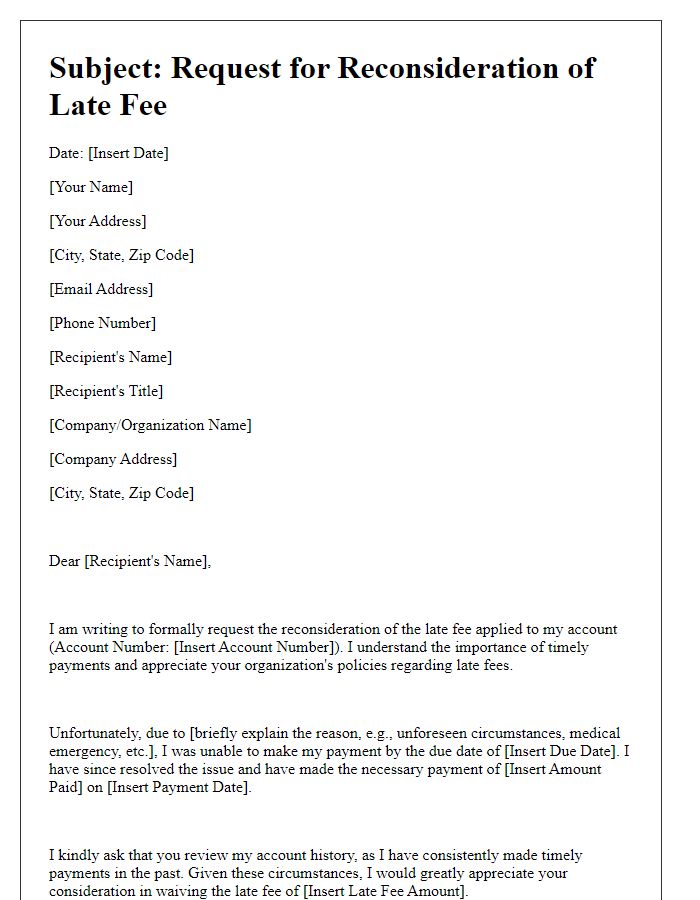

Customer Information and Account Details

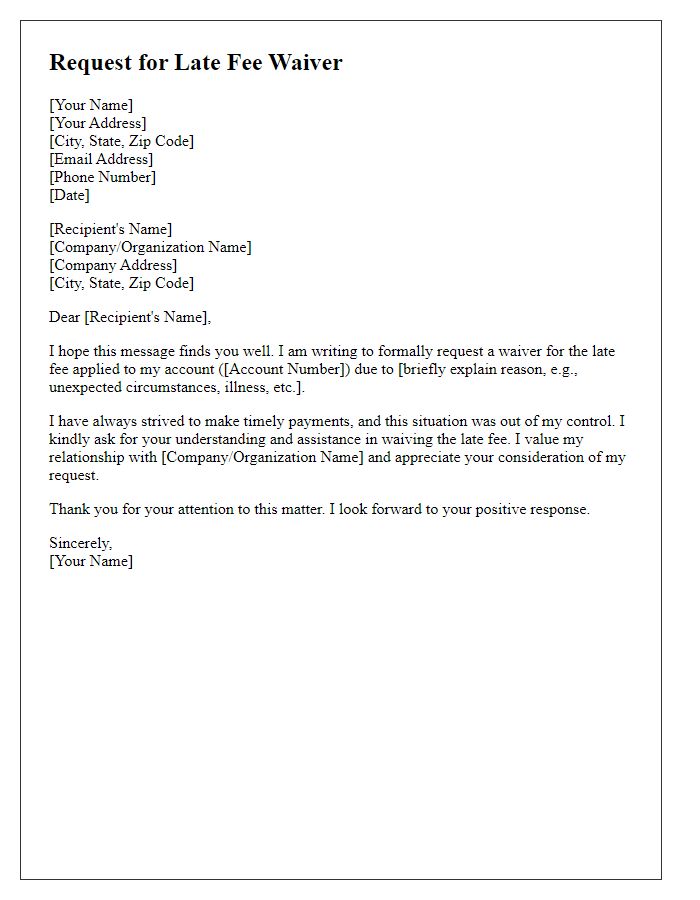

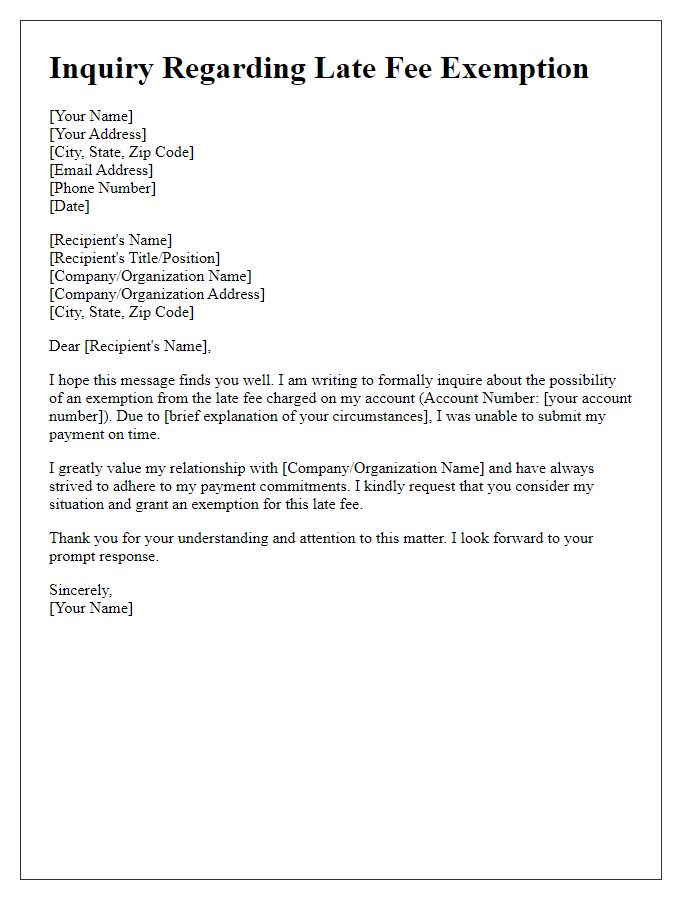

Customer information plays a crucial role in managing billing queries and payment histories. For instance, an account holder's name, such as John Smith, along with unique identifiers like account number 123456789, can streamline communications. Contact details, including the email address johnsmith@email.com and phone number (555) 123-4567, ensure timely responses. Addressing the customer's residential location, like 456 Elm Street, Springfield, enhances personalized service. Invoice details, such as Invoice Number INV-2023-001 and Amount Due $150, determine the context for late fees. Understanding these specific data points aids efficient processing of waiver requests and fosters a positive customer relationship.

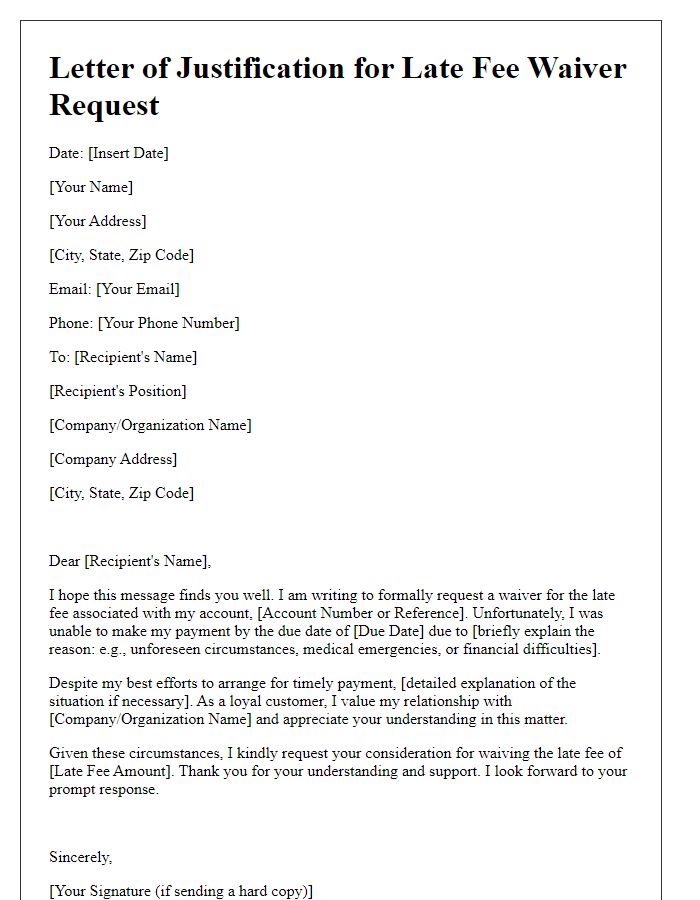

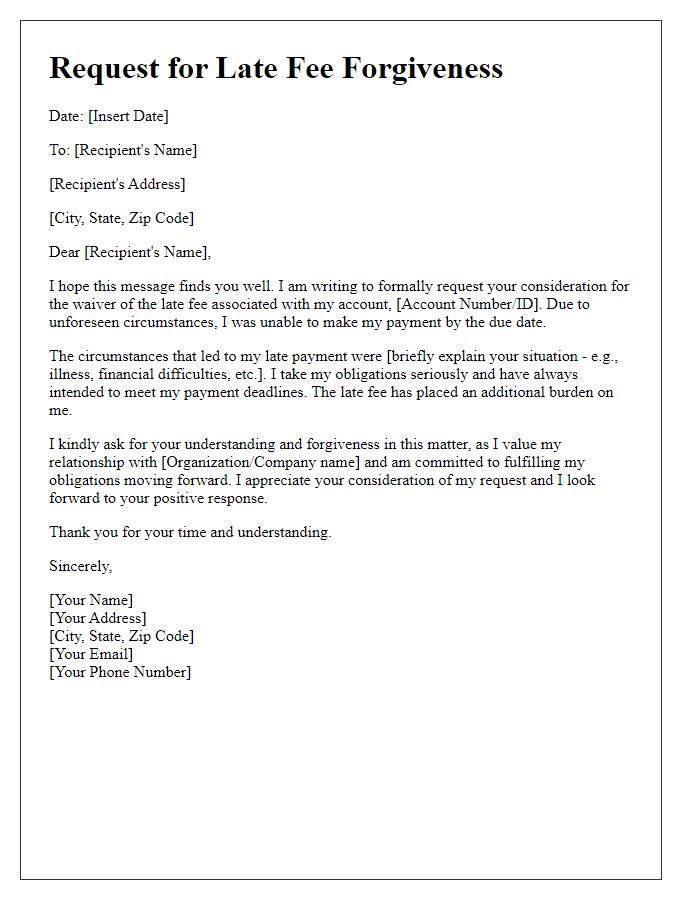

Explanation for Late Payment

Late payment can often occur due to unforeseen circumstances, like unexpected medical expenses or job loss, impacting financial stability. In such situations, individuals may receive a late fee on invoices dated September 15, 2023, for services rendered by local utility companies. Clients should communicate these challenges respectfully, providing details about the circumstances affecting timely payments. Documentation, such as hospital bills or termination letters, may support the request for a waiver. Organizations often consider individual cases, especially when the client has a long history of on-time payments. Showing genuine intent to resolve the outstanding balance while requesting understanding can lead to a positive response regarding fee waivers.

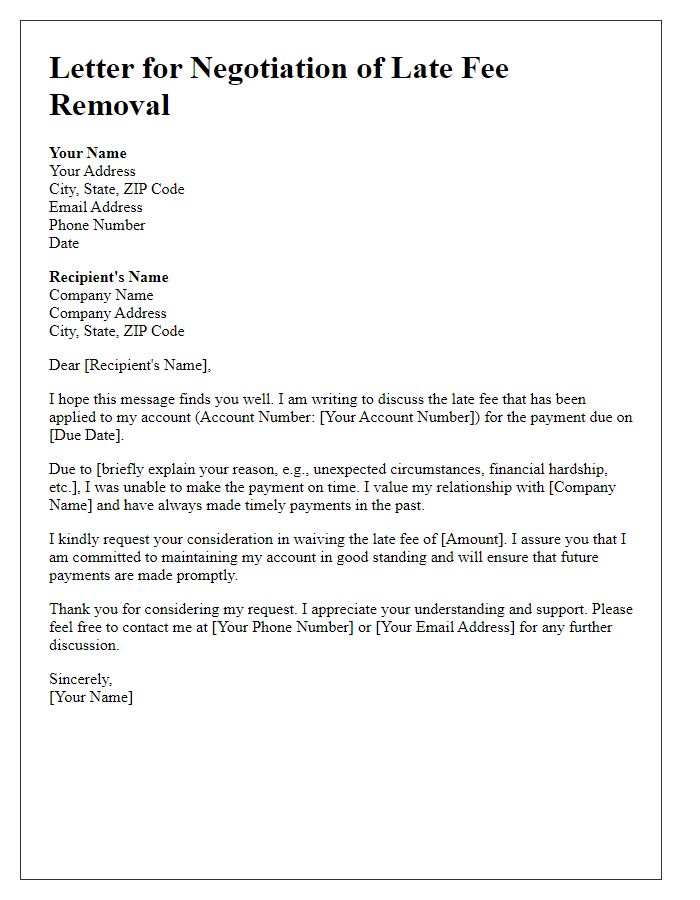

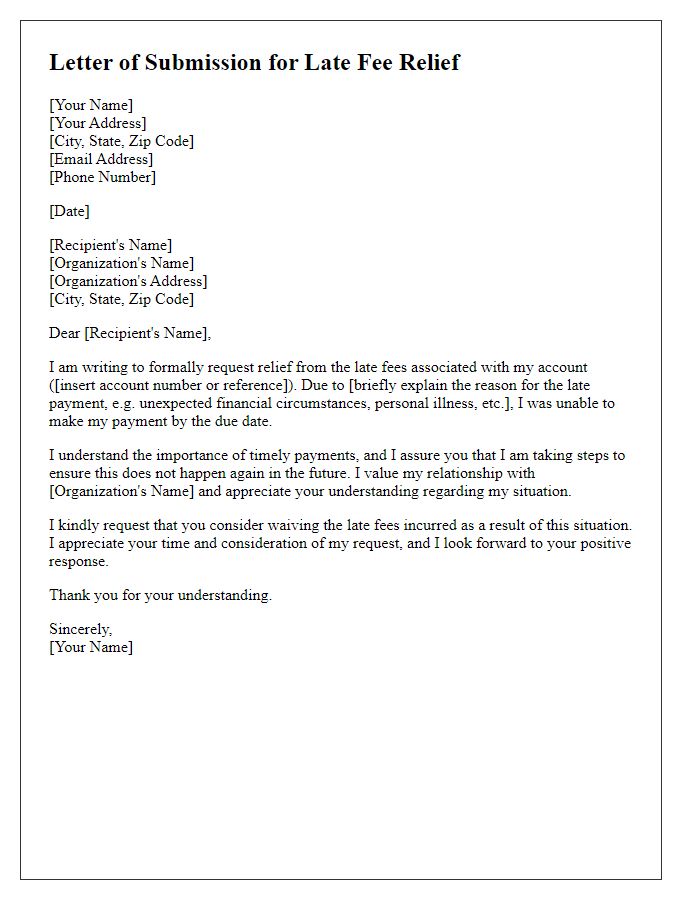

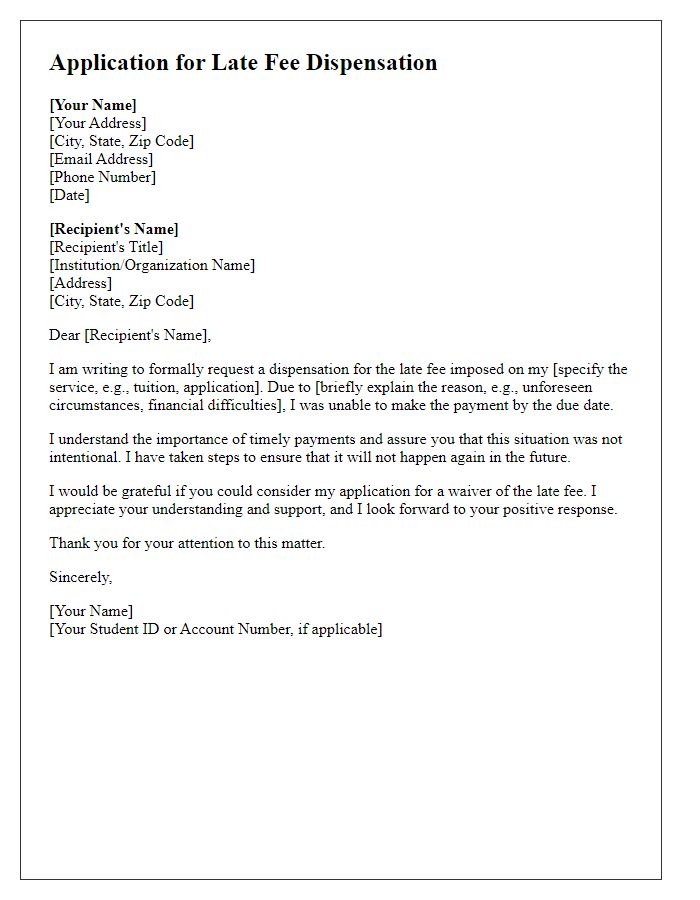

Request for Waiver of Late Fee

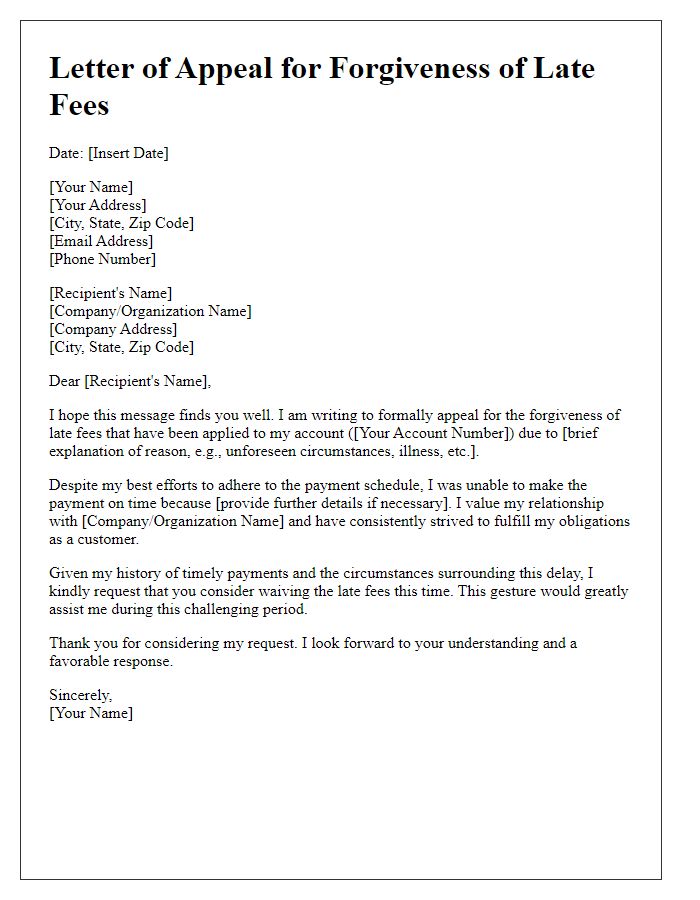

A late fee waiver request aims to alleviate financial burdens due to unexpected circumstances. Individuals often submit such requests to service providers including utility companies, landlords, or educational institutions. Reasons for the late payment can include job loss, medical emergencies, or unexpected expenses. In crafting a request, it is important to detail the circumstances leading to the delay, emphasizing honesty and financial hardship. Additionally, providing a timeline outlining previous on-time payments may bolster the request. Personal touches, such as expressing appreciation for the past service received, can lend a sincere tone to the message.

Expression of Customer Loyalty and Continuity

A late fee waiver can promote customer loyalty and encourage continuity in business relationships. Many customers, especially long-term clients, may appreciate consideration in specific situations where late payments occur due to unforeseen circumstances, such as medical emergencies or job losses. Establishing a history of loyalty can also strengthen the relationship between the business and customer, potentially leading to increased referrals and positive word-of-mouth marketing. Adopting a policy that allows for a one-time late fee waiver enhances goodwill, demonstrating commitment to customer service while maintaining long-term engagement. Tracking instances of customer history and overall satisfaction can further inform these decisions, ensuring a balanced approach between maintaining profitability and fostering loyal client relationships.

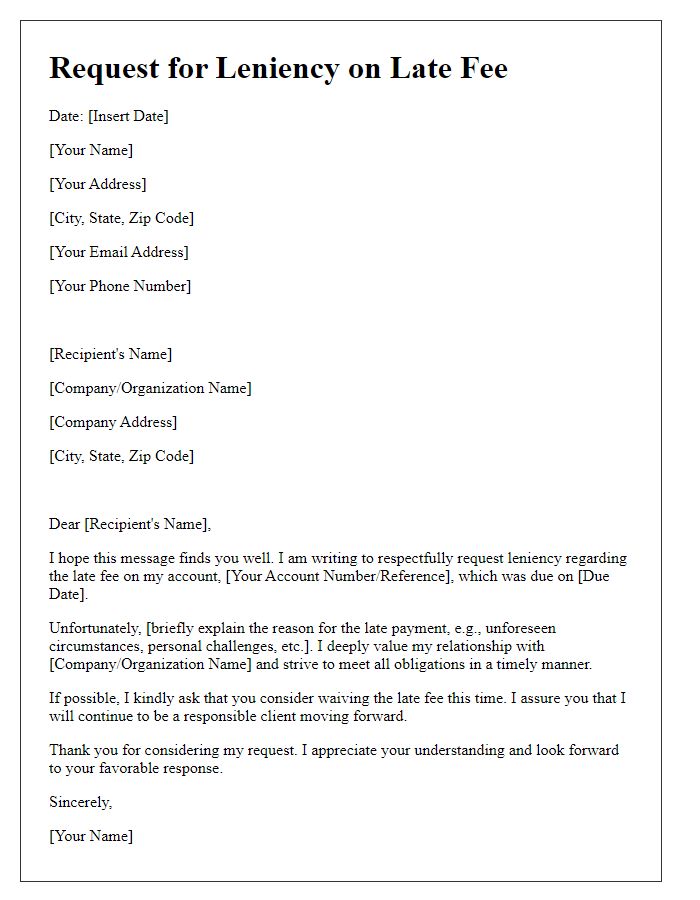

Courtesy and Professional Tone

A late fee waiver can significantly ease financial pressure on clients, especially during challenging situations. Organizations can apply for a waiver due to unforeseen circumstances such as pandemic-related hardships, emergencies, or honest billing mistakes. Clear communication regarding the request enhances the chances of approval; therefore, providing detailed context is essential. For example, specifying the exact late fee amount, original invoice number, and the date it was due shows transparency. Including any prior payment history can strengthen the case for the waiver, demonstrating a reliable track record despite the unforeseen issues. Prompt submission of the request within the same month of the late fee also aids in timely resolution, promoting goodwill and maintaining professional relationships.

Comments