Are you tired of juggling multiple invoices every month? Consolidated invoicing can simplify your billing process, saving you time and reducing headaches. In this article, we'll explore how a consolidated invoicing plan can streamline your finances and improve your cash flow management. Stick around to discover the key benefits and tips for implementing this effective solution!

Clear and concise subject line

The consolidated invoicing plan offers a streamlined approach for managing multiple billing statements, enhancing efficiency and clarity for businesses. This strategy consolidates various invoices into a single document, simplifying the payment process for clients. The process can encompass several accounts, reducing the administrative burden associated with handling separate invoices. Furthermore, implementing automated systems can ensure timely submissions, improving cash flow management. By adopting this method, organizations can foster better relationships with clients, minimize errors, and ultimately save time and resources on accounts receivable tasks.

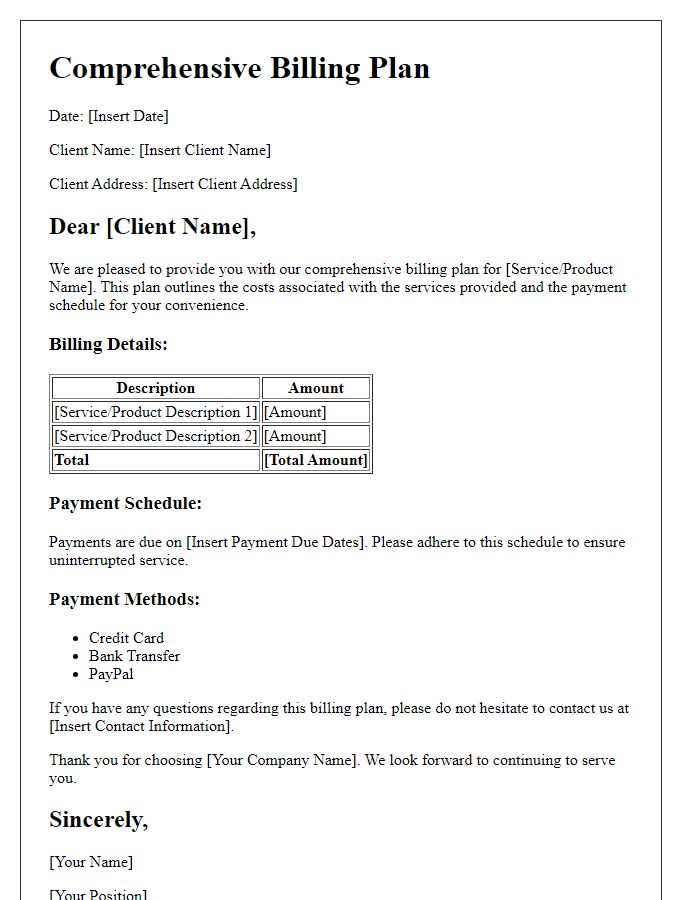

Introductory paragraph explaining the purpose

Consolidated invoicing is a strategic financial management approach aimed at streamlining billing processes for efficient transaction handling and improved cash flow. This plan encompasses the integration of multiple invoices into a single billing statement, thereby simplifying payment processes for clients across various sectors, such as retail or service industries. By consolidating invoices, organizations can enhance clarity, minimize administrative workload, reduce processing costs, and foster stronger customer relationships. Additionally, this method promotes timely payments and accurate financial reporting, ultimately contributing to better operational efficiency and resource management.

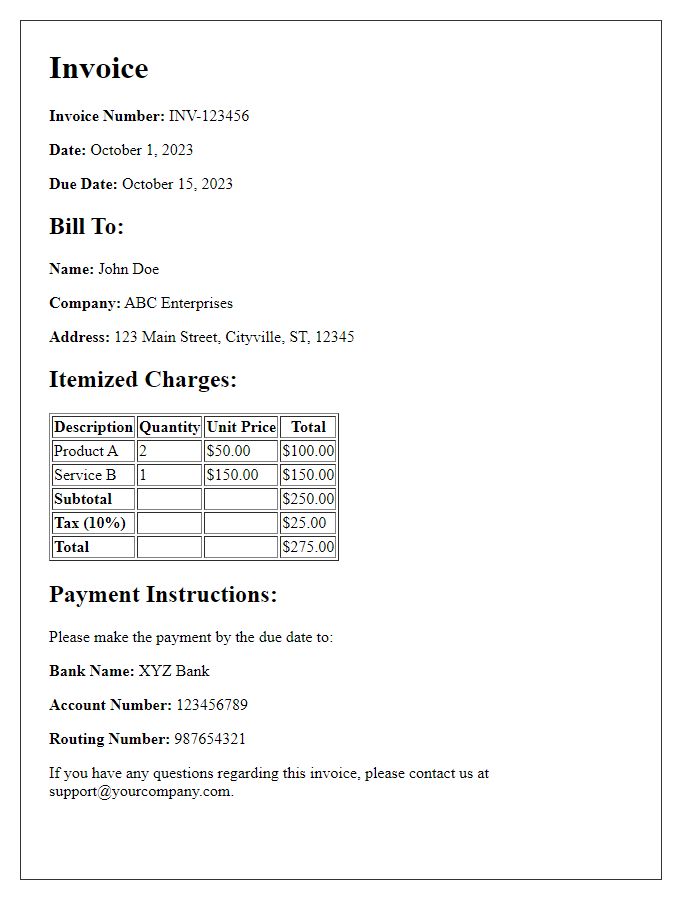

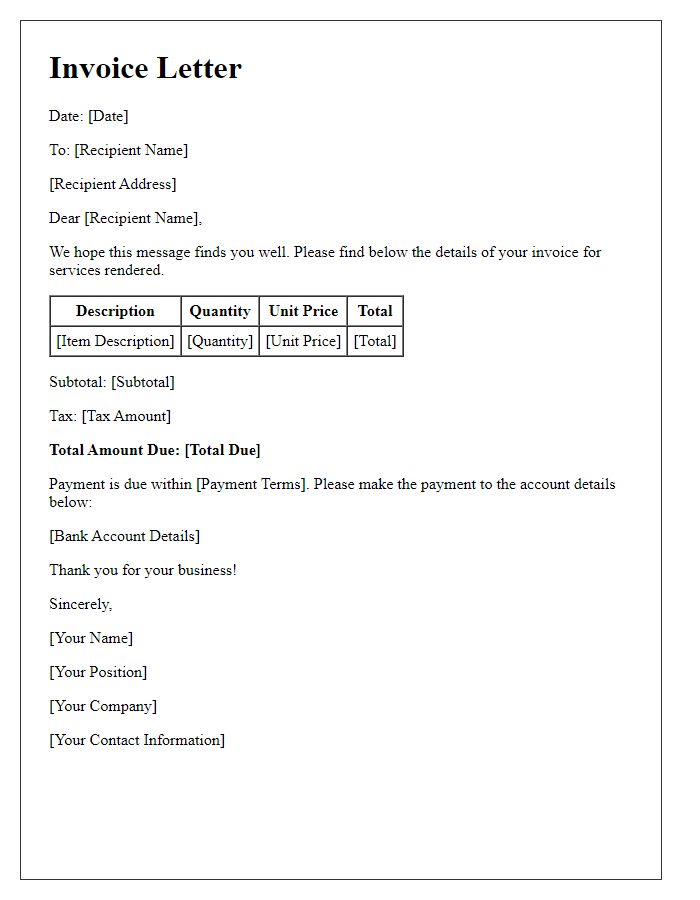

Detailed description of the invoicing plan

The consolidated invoicing plan streamlines the billing process for companies managing multiple accounts or services. This approach consolidates all transactions--such as subscriptions, services rendered, and product purchases--into a single invoice, simplifying financial tracking. Monthly invoicing cycles are typically utilized, with detailed line items outlining each transaction's date, description, and amount. This plan enhances clarity for clients and reduces administrative overhead for businesses. Companies can implement automated systems for accurate calculations and consistent billing dates, allowing for regular cash flow and aiding in easier budget planning. Regular reviews of invoice data can also reveal trends in spending, helping businesses optimize their expenditures. The final invoice can be sent electronically, ensuring timely delivery and facilitating prompt payment processing.

Terms and conditions of payment

Consolidated invoicing plans streamline payment processes, enhancing efficiency for businesses handling multiple transactions. Parties involved must agree on specific payment terms, including due dates, typically net 30 days following the invoice date, to ensure timely settlement. Invoices must detail consolidated charges across all services and products provided, ensuring transparency and clarity in financial obligations. Late payments may incur interest penalties, often set at 1.5% monthly, encouraging prompt payment. Parties must also outline dispute resolution procedures, specifying a timeline, usually 10 business days, for addressing discrepancies before further action. Compliance with these terms is vital for maintaining a productive and professional relationship.

Contact information for follow-up queries

Consolidated invoicing plans streamline the billing process for businesses by merging multiple invoices into a single document. Efficient communication is vital for addressing follow-up queries. Contact information should include essential details such as the name of the billing department, email address (e.g., billing@company.com), and a dedicated phone line (e.g., +1-800-555-0199) for immediate support. Providing operating hours (e.g., Monday to Friday, 9 AM to 5 PM EST) ensures clients know when to reach out. Including a designated contact person, such as Jane Doe, Accounts Manager, can personalize the experience, enhancing customer satisfaction and facilitating quicker resolutions to invoicing issues.

Comments