Are you looking to enhance your cash flow while offering your clients something valuable? Introducing early payment discounts can be a win-win for both you and your customers, encouraging prompt payments while fostering stronger relationships. In this article, we'll explore the benefits of implementing such a strategy and share tips on how to present it effectively. Join us as we delve into the details and help you discover how early payment discounts can boost your business!

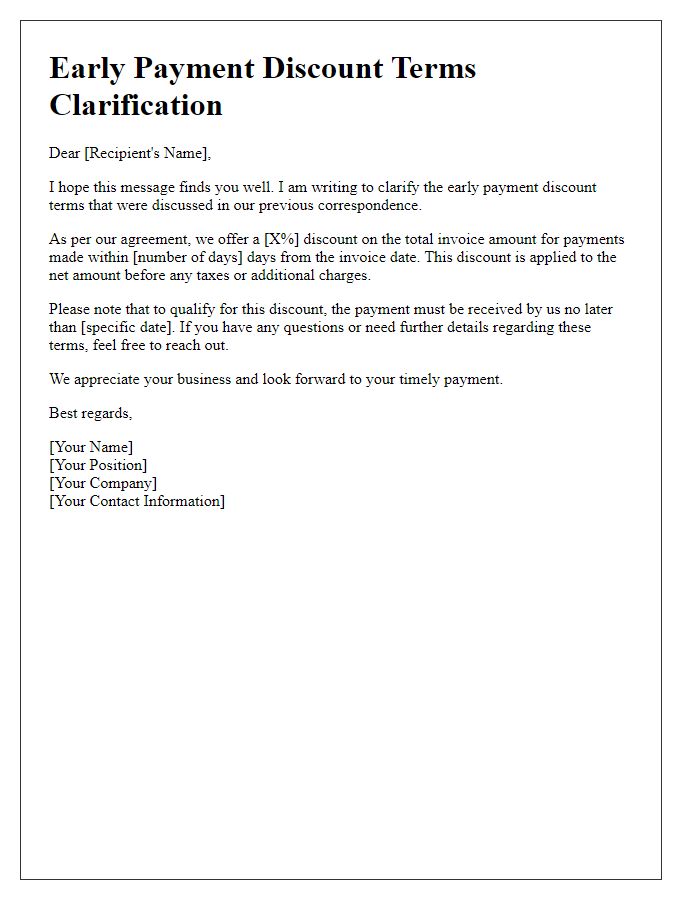

Clear explanation of discount terms.

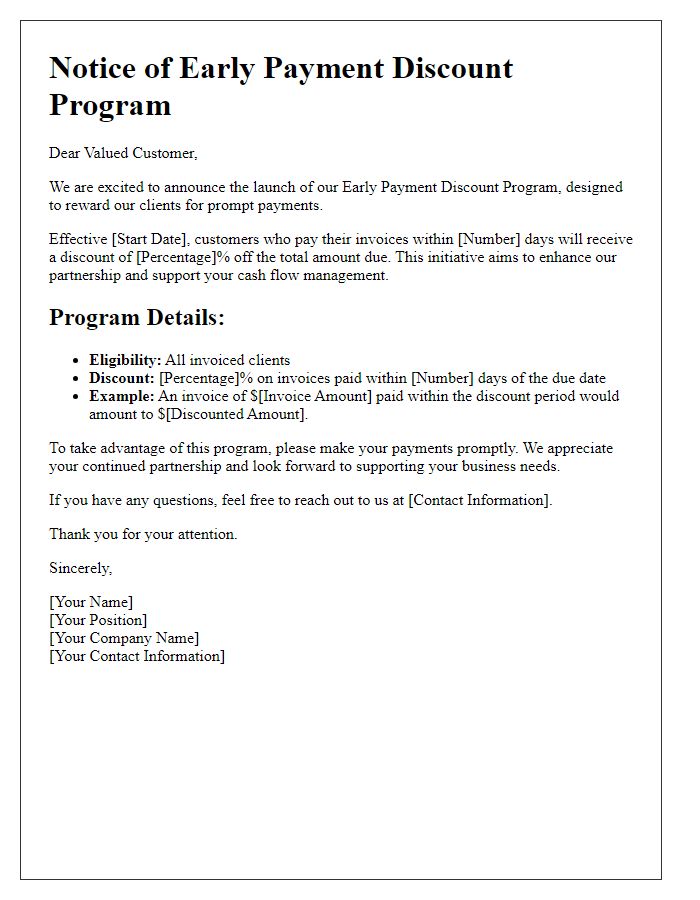

Introducing early payment discounts can significantly encourage prompt payment from customers. Offering a 2% discount on invoices paid within 10 days of issuance provides substantial savings on the total amount due. Invoices typically payable within 30 days present an opportunity for clients to benefit from this incentive. This early settlement strategy not only improves cash flow for businesses but also strengthens customer relationships by rewarding timely payments. Clear communication of these terms in invoices and contracts ensures clients understand the conditions and can take full advantage of the discount.

Specific payment deadline for eligibility.

Introducing an early payment discount can incentivize clients to settle invoices promptly. Clients paying within 10 days of receiving the invoice will be eligible for a 5% discount on the total amount due, effectively rewarding timely financial handling. This initiative aims to improve cash flow and strengthen client relationships by encouraging quicker payments. Clear communication regarding the payment deadline, alongside the potential savings, can enhance participation in this offer. Detailed terms will be outlined in the invoice to avoid confusion, fostering a mutually beneficial agreement.

Contact information for inquiries.

Early payment discounts serve as a financial incentive for clients to settle invoices promptly, typically ranging from 1% to 5% of the total invoice amount. This proactive approach not only enhances cash flow for businesses but also fosters stronger relationships with clients by rewarding timely payments. The discount period often spans from 10 to 30 days following the invoice date, encouraging swift transactions. Businesses can implement this strategy using clear terms on invoices, specifying the discount rate, payment deadline, and the total amount due. Contact information is vital for inquiries related to the discount, ensuring clients can easily reach out for clarification or assistance, thus facilitating smoother communication and reinforcing trust.

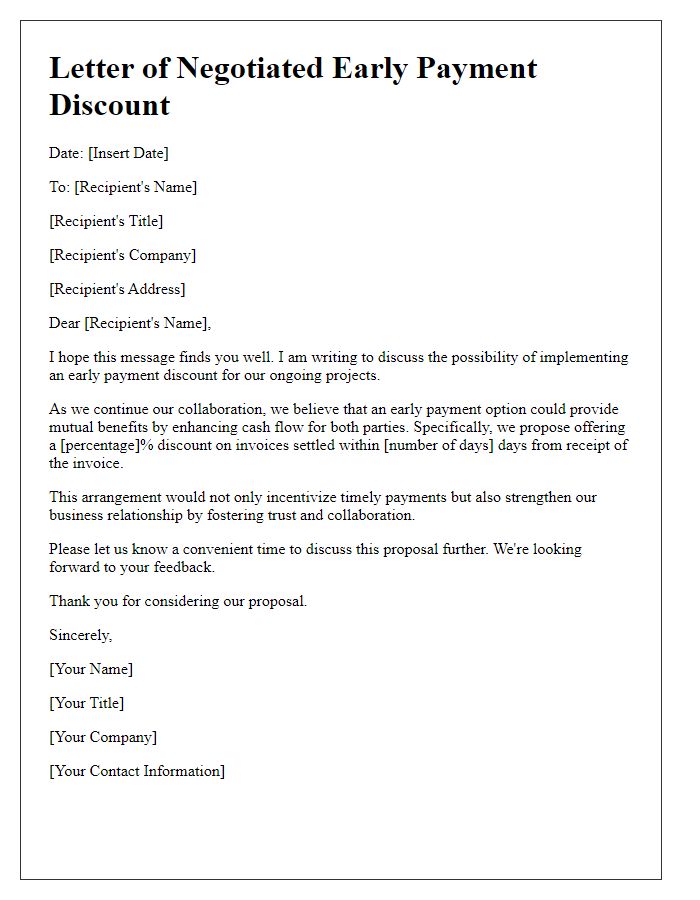

Emphasis on mutual benefits.

Introducing an early payment discount provides a strategic financial advantage for both sellers and buyers in various industries. This initiative encourages timely cash flow while rewarding customers for punctuality. For instance, a 5% discount on invoices settled within ten days not only enhances liquidity for businesses but also strengthens customer relationships. Mutual benefits arise as improved cash flow allows suppliers to reinvest in operations, while customers enjoy savings. Various sectors, including retail and manufacturing, can adapt this model to foster sustainable partnerships and enhance operational efficiency.

Encouragement for prompt response.

Businesses can benefit from early payment discounts, which incentivize clients to settle invoices ahead of time. These discounts typically range from 1% to 3% off the total invoice amount, encouraging quicker cash flow management. For instance, a company like ABC Manufacturing may offer a 2% discount on invoices paid within ten days in order to streamline revenue intake, supporting operational expenses and investment opportunities. This approach enhances client relationships while fostering a culture of financial responsibility. Prompt responses to discount offers can lead to mutually beneficial arrangements, boosting business efficiency and collaboration.

Letter Template For Introducing Early Payment Discount. Samples

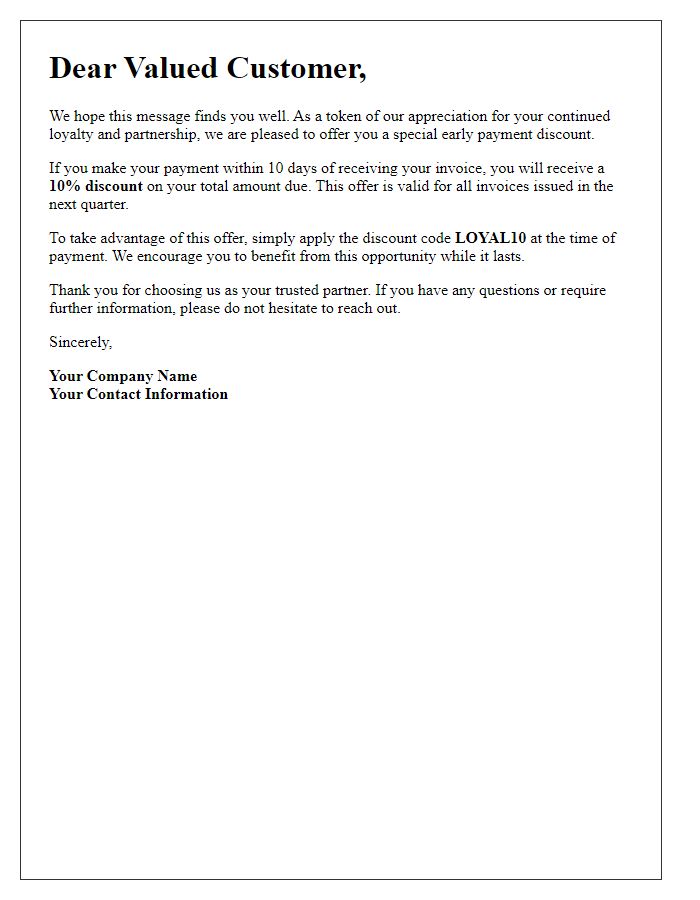

Letter template of special early payment discount proposal for loyal customers.

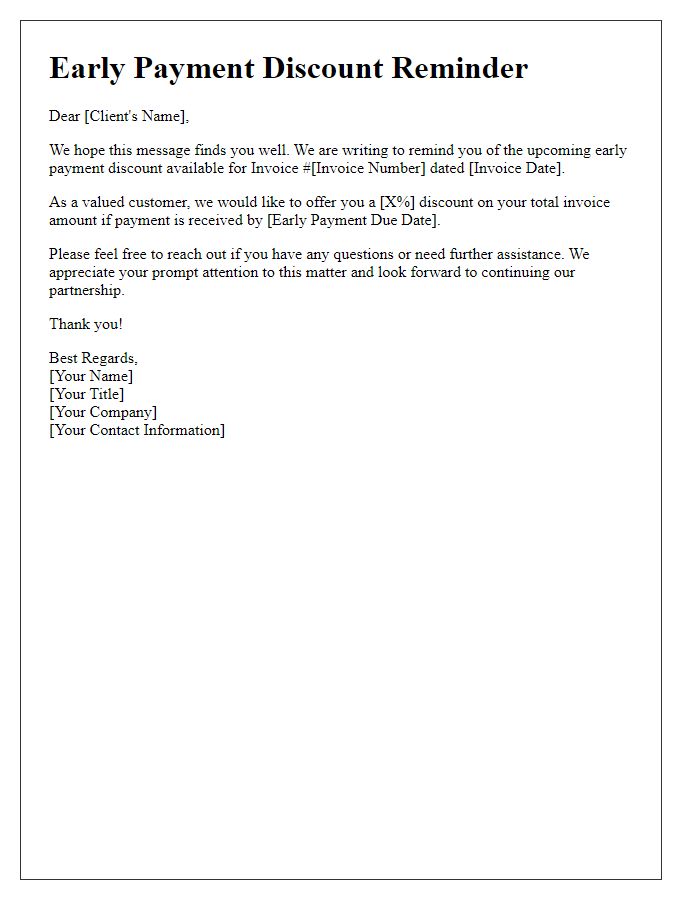

Letter template of early payment discount reminder for invoice settlement.

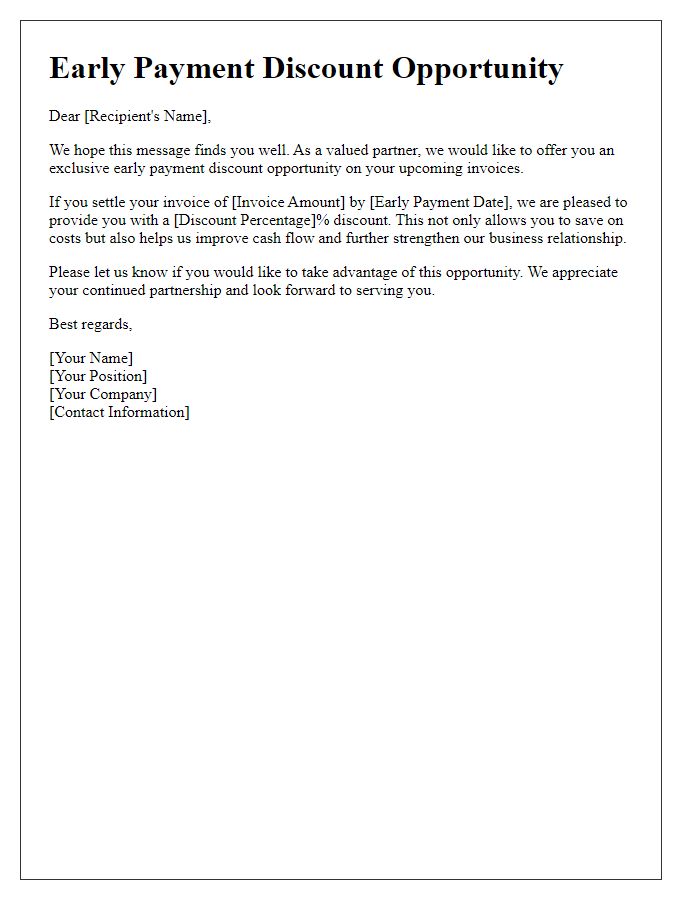

Letter template of tailored early payment discount opportunity for businesses.

Letter template of early payment discount incentive for prompt payments.

Letter template of early payment discount benefits for cash flow improvement.

Comments