Hello there! We all know that keeping track of finances can sometimes slip through the cracks, and that's why we're reaching out to you today regarding an unpaid invoice. We've noticed that the payment for the invoice dated [insert date] hasn't been received yet, and we want to ensure that everything is alright on your end. If you have any questions or need assistance with the payment process, please don't hesitate to reach out, and while you're here, feel free to read more about our services and how we can help you thrive!

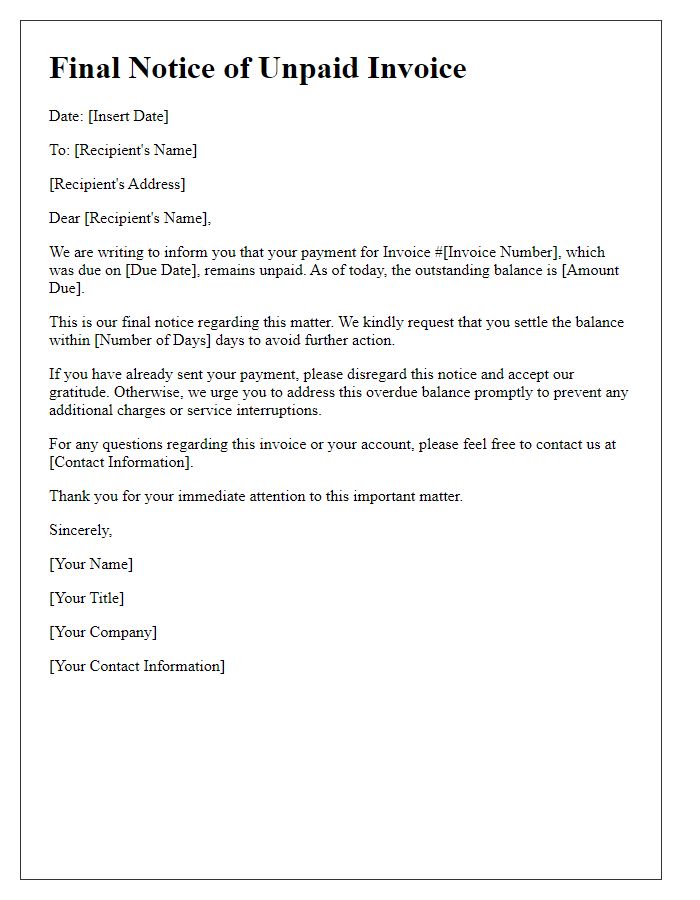

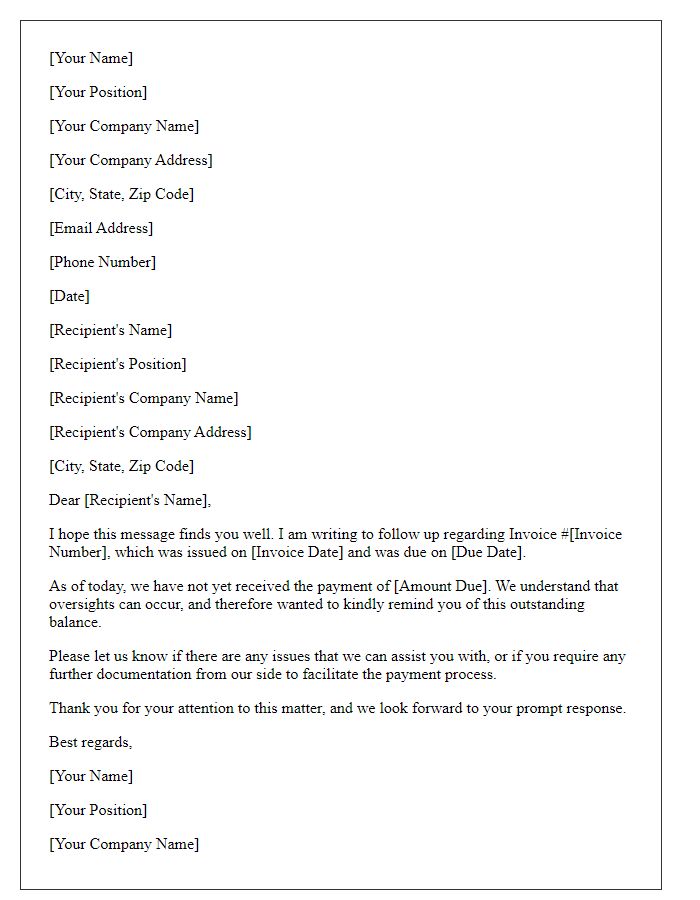

Subject Line

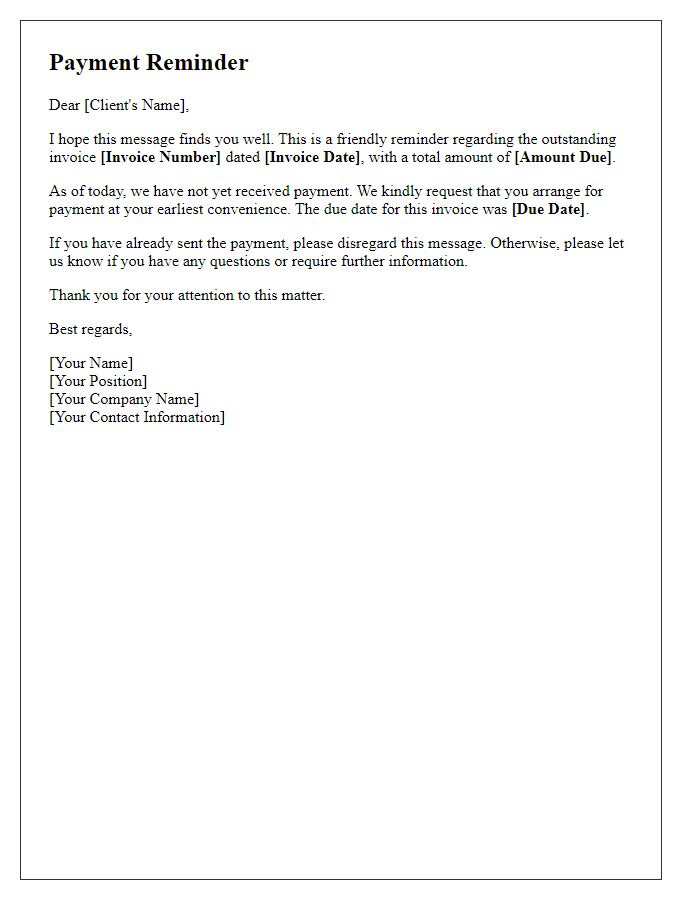

Subject Line: Reminder: Unpaid Invoice for [Invoice Number/Description] Due [Due Date] Note: This subject line includes the invoice number and due date to grab attention and provide clarity, enhancing the urgency of the follow-up.

Invoice Details

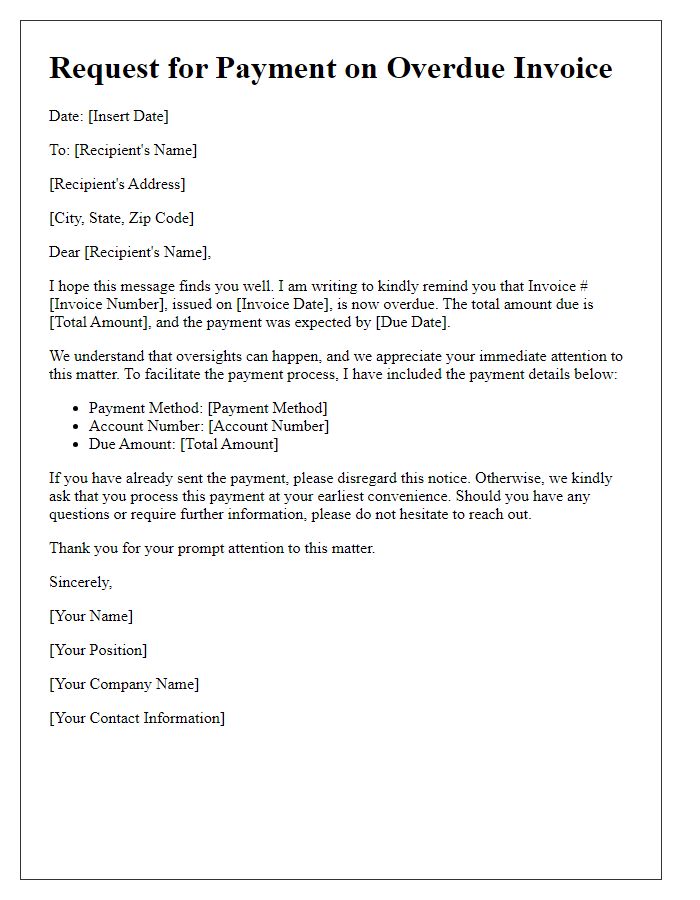

Unpaid invoices can create cash flow issues for businesses, especially for small enterprises relying on timely payments. The invoice typically includes essential information such as an invoice number (for tracking), due date (the deadline for payment, often set at 30 days), total amount due (the sum that needs to be paid), and payment method (credit card, bank transfer, etc.). Companies may use accounting software (like QuickBooks or Xero) to generate and manage invoices, allowing for better organization and easier follow-up. Sending a follow-up communication is crucial, highlighting the importance of resolving outstanding balances to maintain healthy vendor relationships and ensure financial stability.

Reminder Statement

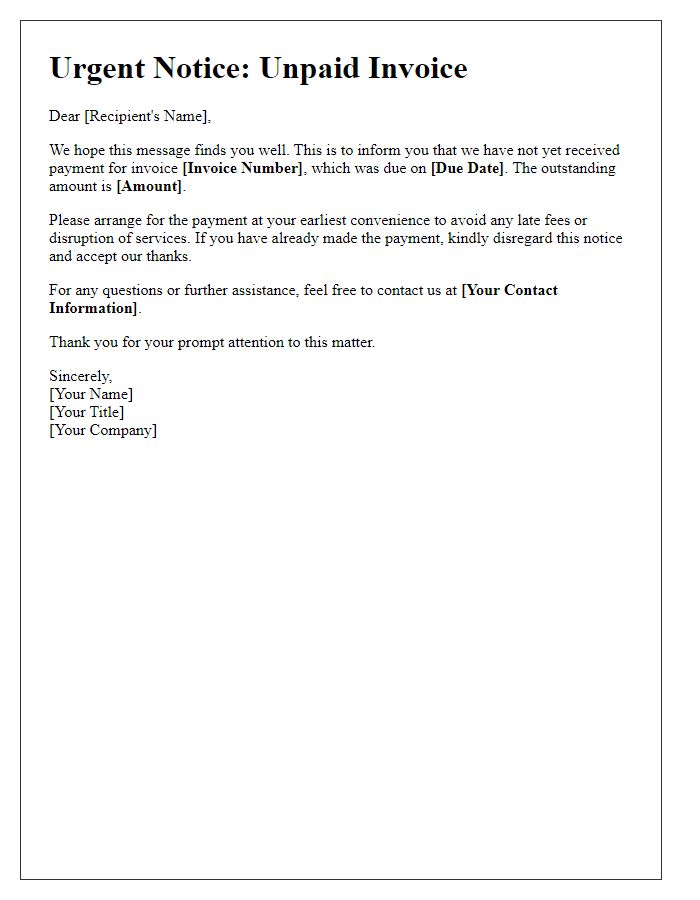

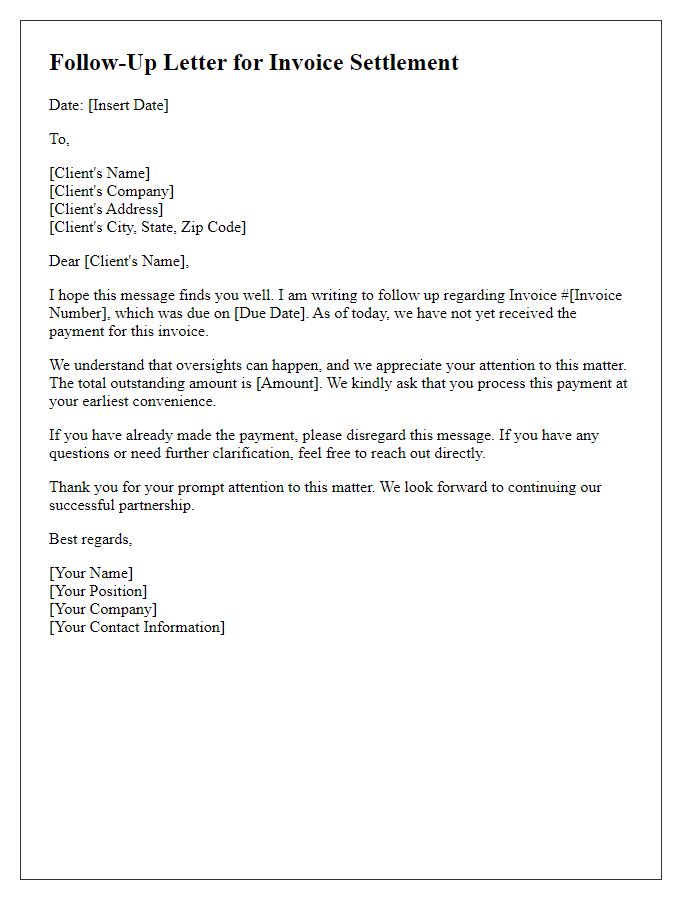

Unpaid invoices can strain business relationships and hinder cash flow. For instance, a company's cash flow may suffer if a $5,000 invoice due on January 15 remains unpaid by February 15. Communication, such as a reminder statement, can help prompt clients to fulfill their financial obligations. Including relevant details, like invoice numbers and due dates, ensures clarity. Effective reminders may lead to quicker resolutions, preserving client relationships while ensuring financial stability for the business. Moreover, maintaining professional tone in follow-up emails encourages prompt payments, reflecting positively on the company's reputation.

Payment Instructions

Late payments can significantly impact small businesses, creating cash flow issues. Payment instructions should clearly outline the necessary steps to settle an unpaid invoice promptly. Including a breakdown of the invoice details, such as the invoice number, original due date, and the total amount owed, can enhance clarity. Providing multiple payment methods, such as bank transfers, credit card options, or online payment platforms like PayPal, allows flexibility for the client. It's essential to create a gentle tone in the follow-up communication to maintain the client relationship while encouraging timely payment. Additionally, offering a direct contact number or email for any questions can facilitate immediate communication regarding payment concerns.

Contact Information

Unpaid invoices can significantly impact cash flow for businesses. When following up on an outstanding invoice, include relevant details such as invoice number, due date (usually 30 days after issuance), and the total outstanding amount (typically ranging from $100 to $10,000 for small to medium transactions). Clearly state the services or products provided, along with the date of delivery to remind clients of the transaction. Incorporating a polite request for payment and offering alternative payment methods (like bank transfer or credit card) can facilitate prompt settlement. Maintaining a professional tone ensures ongoing positive relationships while addressing important financial matters.

Comments