Are you confused about the payment processing times and why they can vary so much? You're not aloneâmany people find this aspect of transactions a bit perplexing. Understanding the nuances behind payment processing can help set your expectations and improve your financial planning. Dive in with us as we unravel the details and clear up any confusion surrounding this essential topic!

Payment Processing Timeline

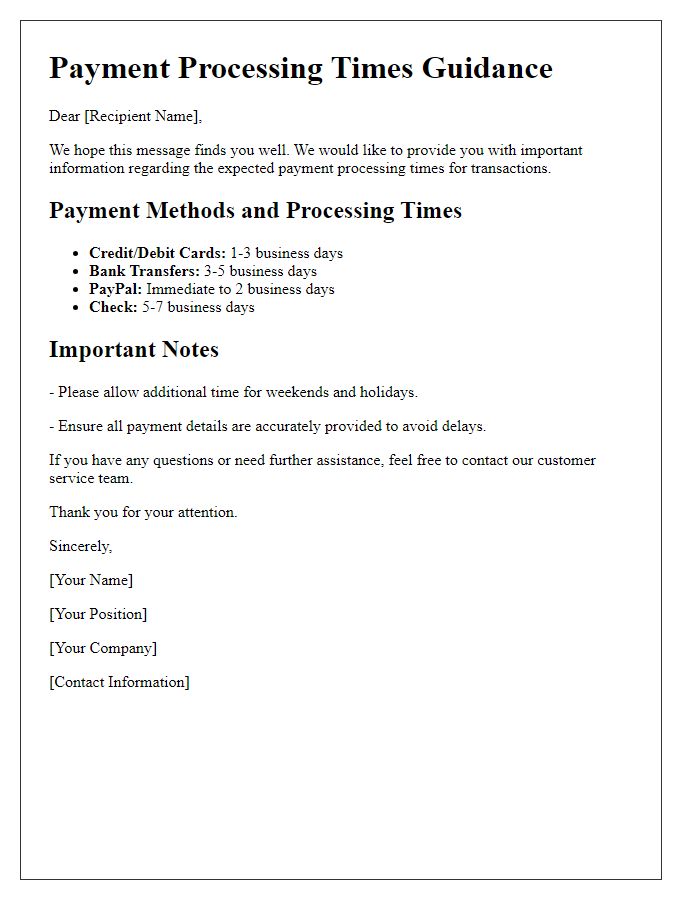

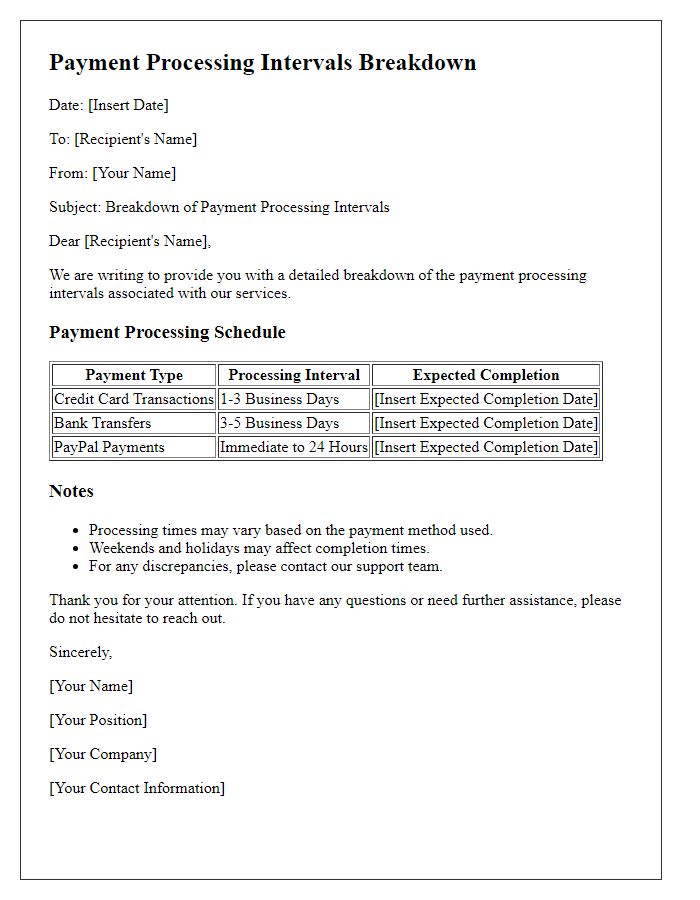

Payment processing timelines can vary significantly depending on the payment method used. Credit card transactions often take between 1 to 3 business days, while bank transfers can extend up to 5 business days, influenced by the financial institutions' policies. Electronic payment systems, like PayPal or Stripe, typically process payments within minutes to hours, although they may take longer during peak times or security checks. Additionally, international payments may incur delays due to currency conversion and cross-border regulations. Understanding these factors can help manage expectations regarding fund availability for both businesses and customers.

Factors Affecting Delay

Payment processing times can vary widely based on several factors, including the chosen transaction method (credit card, ACH transfer), the payment processor's efficiency (such as PayPal, Stripe), and the banks involved (issuer and acquirer). Delays may occur due to authorization issues, where a transaction takes longer to be approved, or compliance checks related to anti-fraud measures. Additionally, weekends and holidays can extend processing times, as many banks do not process transactions on these days. Finally, currency differences and international transactions may contribute to longer delays due to additional layers of processing and conversion.

Steps for Expedite Processing

Expedited payment processing involves several crucial steps that can significantly shorten transaction durations. First, verifying account information accuracy is essential; errors can delay transactions. Next, utilizing express payment methods such as same-day ACH (Automated Clearing House) can ensure faster fund transfers, often within hours instead of days. Implementing priority handling in the processing queue prioritizes urgent transactions, minimizing wait times. Additionally, maintaining clear communication with the receiving financial institution can help facilitate faster approvals. Monitoring for any alerts related to compliance or fraud checks is important, as these can hinder processing if not addressed promptly. Overall, understanding and optimizing these steps can lead to a more efficient payment processing experience.

Contact Information for Inquiries

Payment processing times can vary significantly depending on the method used, such as credit cards, PayPal, or direct bank transfers. Typically, credit card transactions are processed within 2 to 3 business days, while PayPal payments may reflect in the account instantly or within a few hours. Direct bank transfers often take 3 to 5 business days to complete due to the banking protocols involved. Various factors, including weekends, holidays, and the specific banking institutions, can also influence these timelines. For any inquiries regarding payment statuses or processing delays, customers can reach out to the customer service department at [company's contact number] or email at [company's contact email].

Reassurance of Resolution

Payment processing times can significantly impact customer satisfaction, especially for online transactions. Typically, digital payments might take between 1 to 5 business days depending on the payment method, such as credit cards or bank transfers. Delays can occur due to various factors including bank procedures, weekends, or public holidays. For example, a payment initiated on a Friday may not be processed until the following Monday. Additionally, discrepancies in payment details, such as account numbers or billing addresses, can cause further delays. It is crucial for merchants to communicate these timelines clearly to customers, ensuring transparency and managing expectations effectively during the payment experience.

Comments