Are you navigating the world of investment opportunities and need to verify your status as an accredited investor? It's essential to understand the importance of proper documentation and verification in this process, as it opens doors to exclusive investment options. In this article, we'll guide you through the steps and provide you with a handy letter template to make your verification simple and efficient. So, let's dive in and explore how you can streamline your accredited investor verification today!

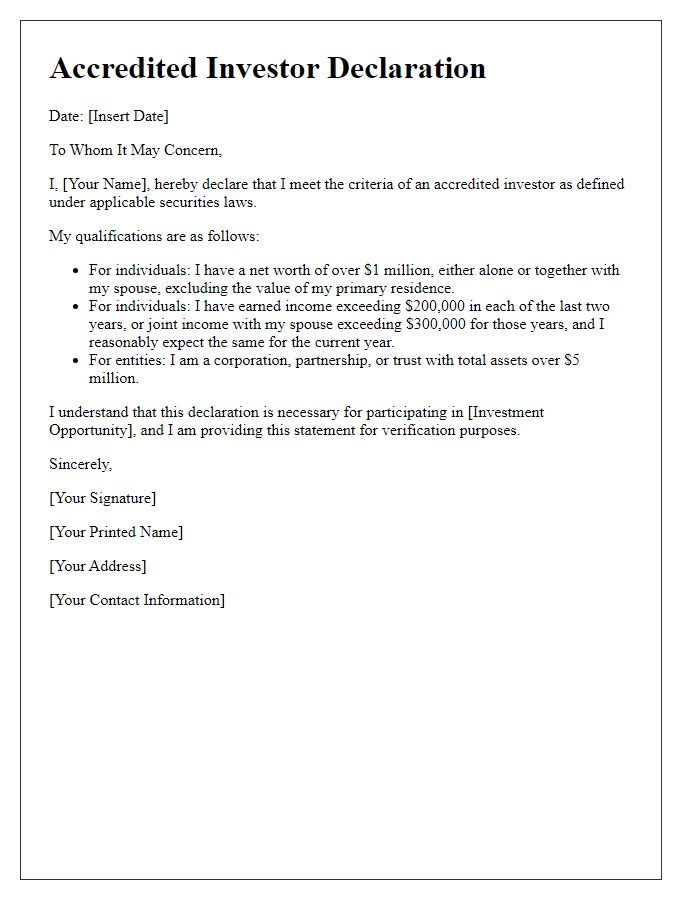

Accredited Investor Definition

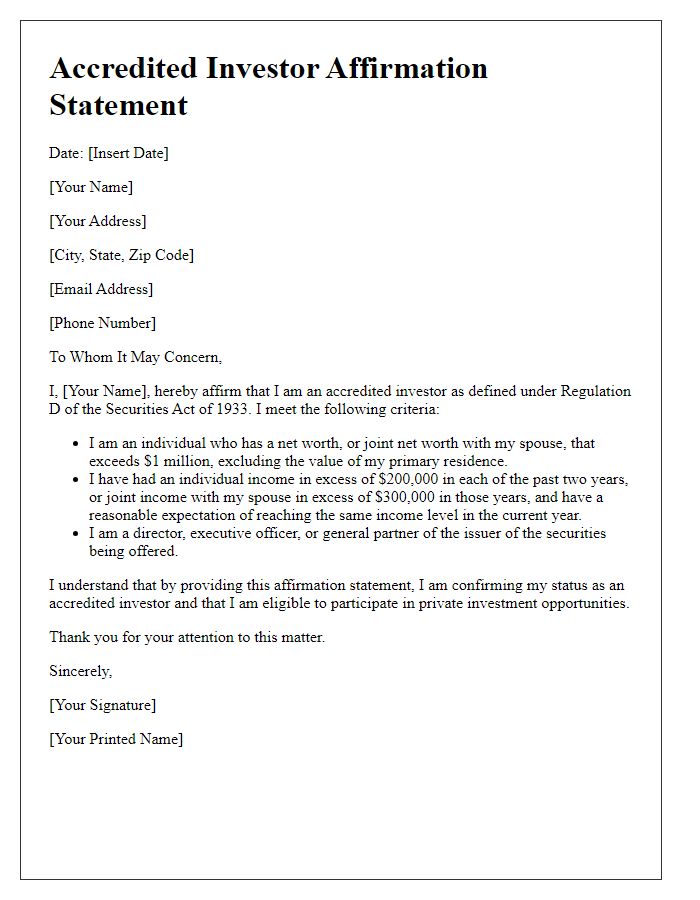

Accredited investors play a crucial role in the investment landscape, defined by the U.S. Securities and Exchange Commission (SEC) under Regulation D. Individuals must meet specific financial criteria, including a net worth exceeding $1 million (excluding primary residence) or an annual income surpassing $200,000 in the last two years (or $300,000 with a spouse). This classification affirms their financial sophistication and ability to bear potential risks of investments in private placements and hedge funds, which typically offer less regulatory protection compared to public offerings. Additionally, entities such as banks, insurance companies, and certain trusts may qualify as accredited investors, provided they maintain a minimum total assets threshold of $5 million. The accreditation process ensures that only qualified individuals and entities engage in higher-risk investment opportunities.

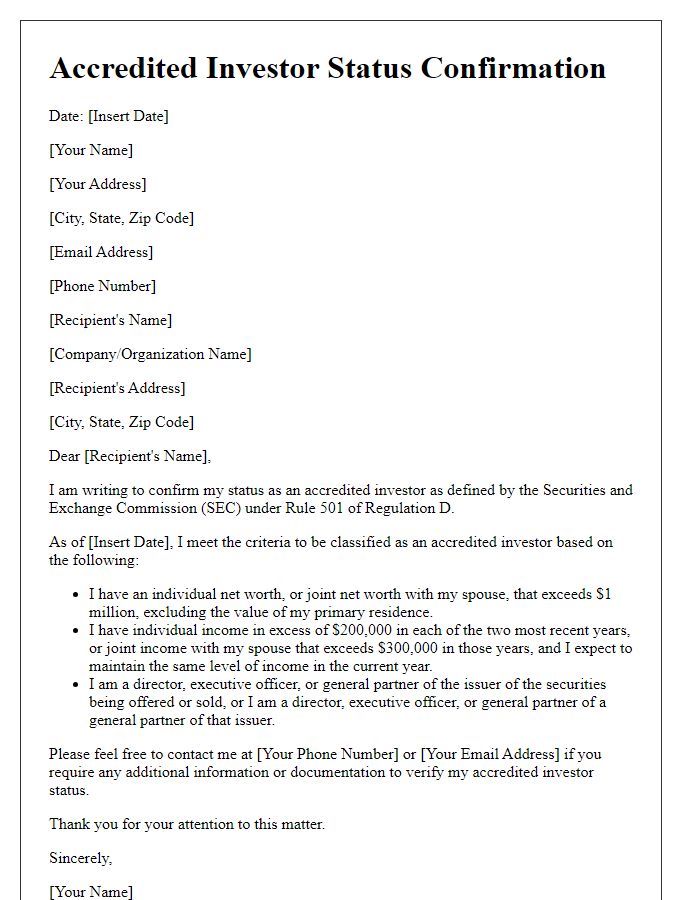

Verification Methods

Accredited investor verification processes often involve a range of methods to substantiate an individual's financial status and affluence. Documentation typically includes tax returns (most recent two years), bank statements reflecting sufficient liquid assets, and investment account statements revealing a net worth exceeding $1 million, excluding primary residences. Verification may also incorporate third-party validation, assessing income requirements (annual income exceeding $200,000 for single filers or $300,000 for joint filers over the previous two years), and legal affirmations from certified professionals, such as CPAs or attorneys. High net-worth individuals in this category enjoy access to exclusive investment opportunities, including private placements and hedge funds, often regulated under SEC Rule 501 of Regulation D.

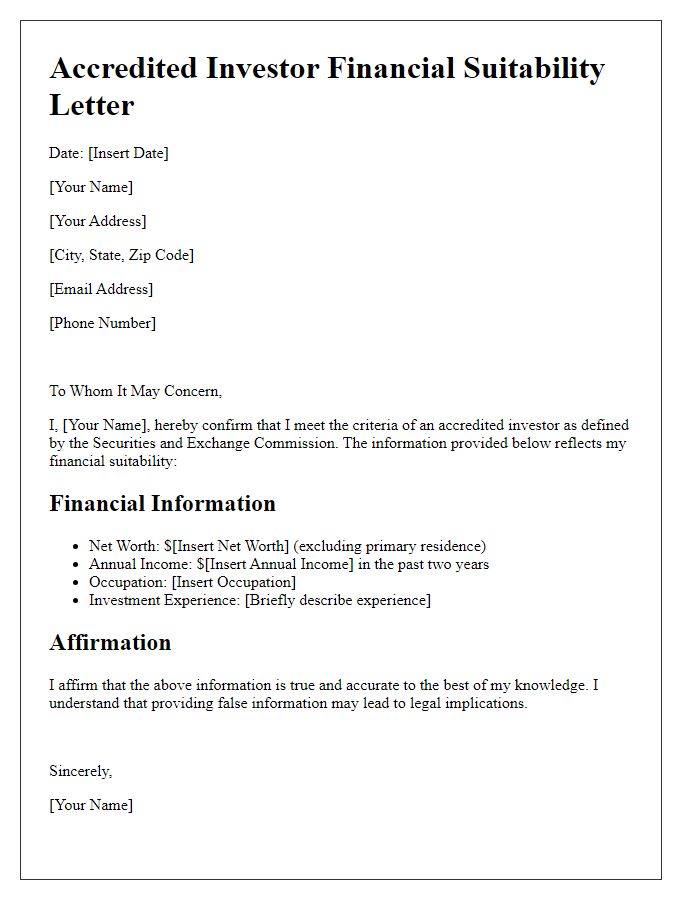

Investor Financial Information

Accredited investors require verification of their financial information to ensure compliance with Securities and Exchange Commission (SEC) regulations. Documents such as recent tax returns, bank statements, and investment account balances are essential to assess net worth, which must exceed $1 million, excluding primary residence. Annual income must also be shown, typically exceeding $200,000 individually or $300,000 jointly with a spouse for the past two years. This verification process often involves third-party companies specializing in investor accreditation, ensuring that the provided financial details meet the necessary legal standards. Verification takes approximately one week, depending on the complexity of the financial situation. Proper documentation and a thorough review help protect all parties involved in investment opportunities.

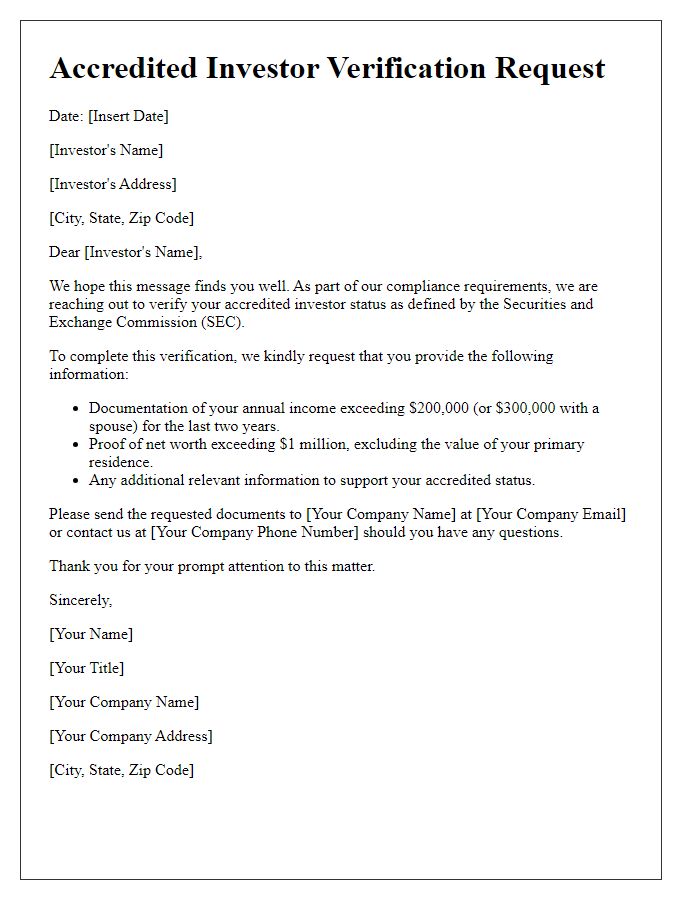

Third-Party Verification

Accredited investor verification plays a crucial role in financial transactions, involving third-party entities that assess the investor's qualifications. This process typically requires documentation such as tax returns, bank statements, or securities licenses to confirm income levels surpassing $200,000 for single filers or $300,000 for joint filers over the last two years. The verification involves firms registered with the Financial Industry Regulatory Authority (FINRA) or certified public accountants (CPAs) who ensure compliance with the Securities and Exchange Commission (SEC) guidelines. Platforms like VerifyInvestor.com or other accredited verification services streamline this process for both investors and issuers, providing a secure and efficient means of validating investor status. These measures protect both parties during investments in private placements or hedge funds.

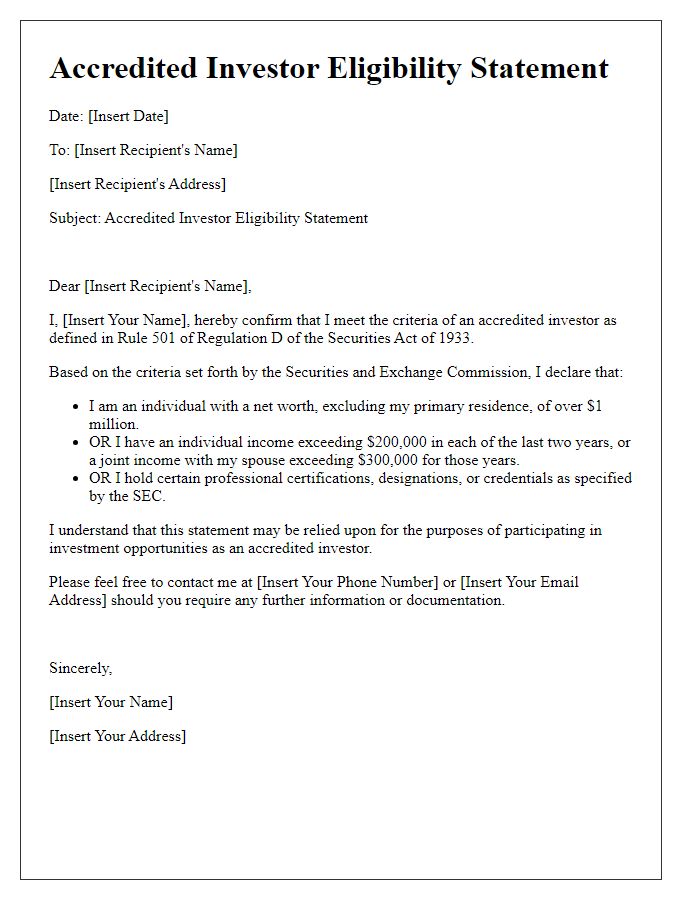

Confidentiality and Compliance

Accredited investor verification ensures adherence to financial regulations, impacting investment opportunities within private placements. This verification process is significant for individuals meeting specific income, net worth criteria, or professional experience under regulations such as Regulation D of the Securities Act. Confidentiality remains paramount throughout the assessment to protect sensitive financial information. Organizations, such as private equity firms and hedge funds, routinely engage third-party services to validate accreditation status without disclosing personal data. Compliance with both federal and state securities laws is essential to avoid legal repercussions and maintain investor trust. Understanding these elements helps investors navigate the complexities of private investment landscapes effectively.

Comments