Are you looking to effectively allocate your investment budget but not sure where to start? Understanding how to prioritize your financial resources can make a significant difference in achieving your long-term goals. In this article, we'll discuss proactive strategies for budget allocation that align with your investment objectives and risk tolerance. So, let's dive in and explore how you can optimize your investment budget for success!

Purpose of Investment

Strategic investment budget allocation is crucial for businesses aiming to expand operations and enhance profitability. A clear purpose of investment can guide these decisions, such as increasing market share within the technology sector or improving infrastructure to support e-commerce initiatives. Financial resources need to be directed towards high-potential areas, including research and development (R&D) for innovative product offerings, digital marketing campaigns targeting millennials, or upgrading supply chain logistics in cities like San Francisco to meet growing consumer demand. Additionally, investing in employee training programs fosters a skilled workforce, ultimately leading to increased productivity and customer satisfaction. Setting measurable goals for these investments ensures accountability and allows performance evaluation, optimizing budget effectiveness.

Investment Goals and Objectives

Investment goals and objectives should be clearly defined to guide budget allocation. Key objectives may include capital growth (increasing the value of investments over time), income generation (receiving regular returns from sources such as dividends or interest), and risk management (minimizing potential financial losses). Specific targets such as achieving a 7% annual return or allocating 20% of the portfolio to environmentally sustainable assets may be established. Understanding the investment horizon, which refers to the time period before the funds are needed, is essential, with typical horizons ranging from short-term (less than three years) to long-term (beyond ten years). Additionally, factors such as current market trends, economic indicators, and individual risk tolerance play crucial roles in shaping the overall investment strategy and guiding budget allocation decisions.

Financial Analysis and Projections

Investment budget allocation involves a detailed financial analysis and accurate projections. A comprehensive assessment can identify viable investment opportunities in various sectors such as technology, healthcare, and real estate, each projected to yield different returns. An example, the global technology market is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2028, reaching approximately 5 trillion USD. Detailed projections, including revenue forecasts, expense estimations, and net profit calculations, will facilitate informed decision-making. Analyzing quantitative data, such as risk assessments, cash flow forecasts, and market trends, is crucial to optimize budget allocation. Additionally, keeping abreast of economic indicators like inflation rates and employment statistics can provide insights into market conditions, ensuring strategic allocation of financial resources.

Allocation Strategy and Rationale

The investment budget allocation strategy focuses on diversifying assets across multiple sectors to optimize returns while mitigating risks. The total budget of $1 million will be divided among equities (50%), fixed income (30%), and alternative investments (20%). Equities will target high-growth markets in technology and healthcare sectors, with expected annual returns of approximately 8% to 10%. Fixed income investments will prioritize government bonds and corporate bond funds, aiming for a steady income stream with a conservative return of around 4% to 6% per annum. Alternative investments, including real estate investment trusts (REITs) and commodities, will be utilized to hedge against inflation and provide additional upside potential, with projected returns ranging from 6% to 8%. This strategic allocation aligns with macroeconomic trends and investor risk appetite, ensuring a balanced approach to achieving financial growth while safeguarding capital.

Risk Assessment and Mitigation

Investment budget allocation requires careful analysis of potential risks associated with financial markets, industry fluctuations, and specific asset performance. Key risk factors include market volatility, which can result in significant fluctuations in asset values, and liquidity risk, affecting the ability to quickly convert assets into cash without loss. Assessing credit risk is crucial when investing in bonds or equities, particularly in companies with unstable financial standings. Mitigation strategies such as diversification across various asset classes and thorough due diligence on investment opportunities can reduce exposure to unexpected financial downturns. Establishing clear thresholds for acceptable losses and maintaining a contingency reserve can further safeguard investments against unforeseen challenges, ensuring long-term financial stability.

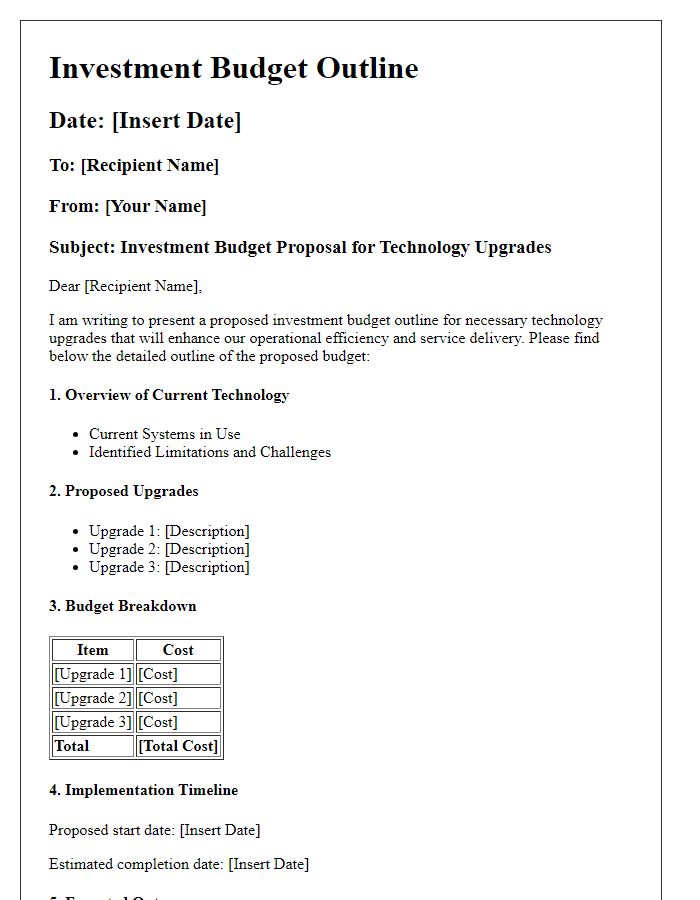

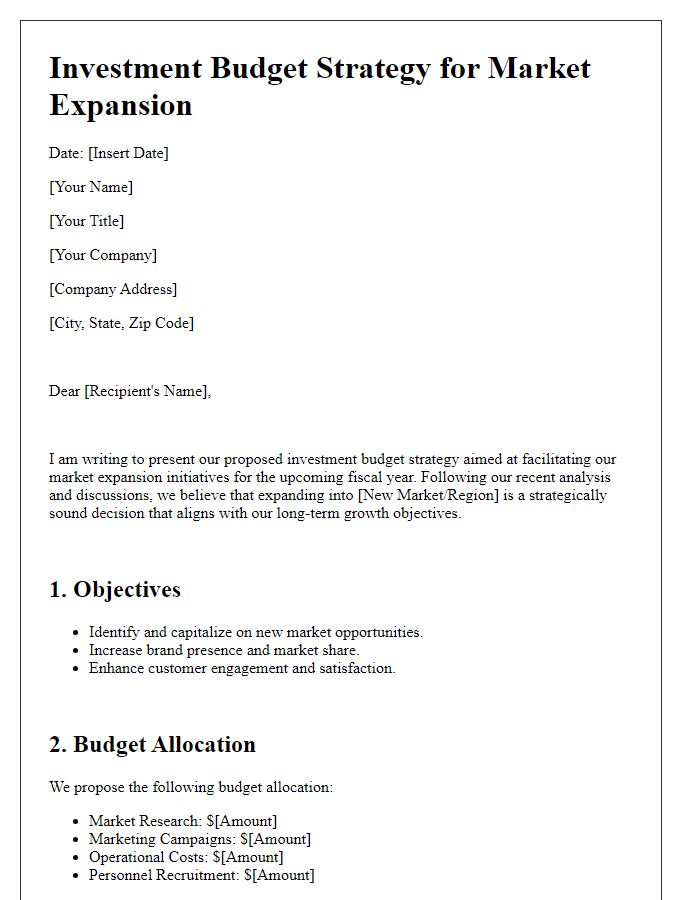

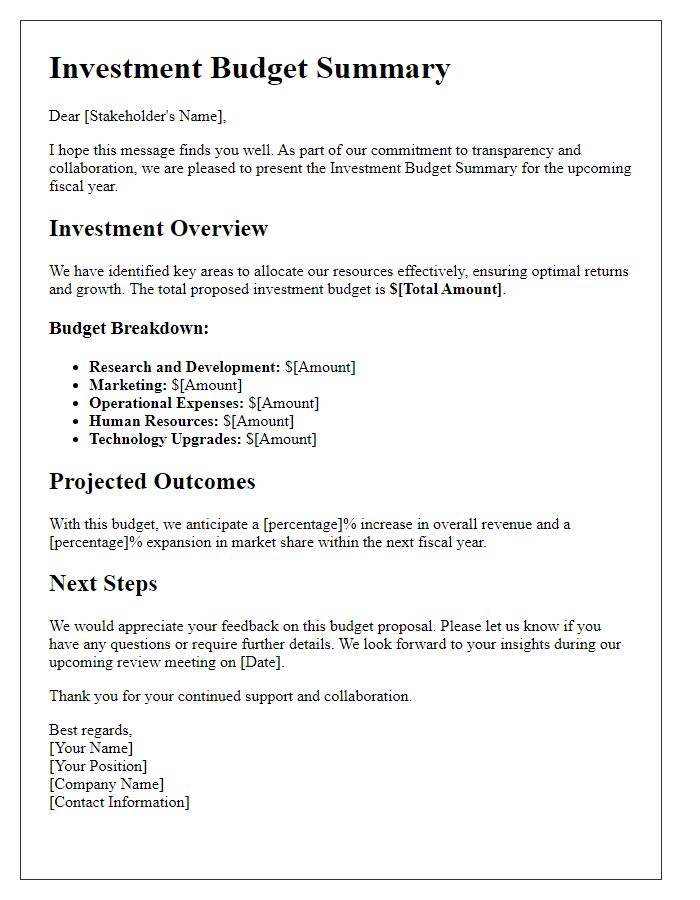

Letter Template For Investment Budget Allocation Samples

Letter template of investment budget allocation for new product development.

Letter template of investment budget distribution for operational efficiency.

Letter template of investment budget justification for talent acquisition.

Letter template of investment budget recommendation for sustainability projects.

Letter template of investment budget plan for risk management initiatives.

Comments