Are you an investor wondering how tax implications could affect your financial decisions? Understanding the nuances of tax liabilities can empower you to make more informed choices and maximize your returns. In this article, we will break down essential tax considerations that every investor should be aware of, from capital gains to deductions. So, let's dive in and uncover the critical information you need to stay ahead in your investment journey!

Investor's personal tax residency status

Understanding an investor's personal tax residency status is crucial for determining tax implications related to investment income. The tax residency status typically relies on criteria such as physical presence (often quantified by the number of days spent in the country, with 183 days being a common threshold) and permanent establishment, which can vary dramatically across jurisdictions. For instance, individuals residing in countries like the United States may be subject to federal taxes on worldwide income, alongside state taxes that can differ by location. Conversely, countries like the United Arab Emirates offer tax-free environments, attracting international investors. Other critical considerations include the types of investment income, such as dividends, interest, and capital gains, each often taxed at varying rates depending on residency status. Awareness of tax treaties between countries can further impact withholding taxes on cross-border investments. These factors combined impact an investor's net return and overall investment strategy.

Type of investment and holding period

Investing in stocks, bonds, or real estate generates potential returns and carries specific tax implications, which vary based on the type of investment and holding period. For instance, short-term capital gains, realized from selling assets held for less than one year, are typically taxed at ordinary income rates, which can range from 10% to 37% depending on total income levels. Conversely, long-term capital gains from assets held for over one year usually benefit from a lower tax rate, generally between 0% to 20%. Real estate investments, particularly when selling properties, may incur additional considerations such as depreciation recapture, taxed at higher ordinary rates. Understanding these nuances is crucial for effective financial planning and maximizing investment returns.

Applicable tax rates and regulations

Investor tax implications can vary significantly based on jurisdiction, investment type, and income levels. In the United States, capital gains tax rates may range from 0% to 20% depending on the taxpayer's income, while qualified dividends are often taxed at a favorable rate of 15% for most taxpayers. Tax regulations like the Tax Cuts and Jobs Act of 2017 introduced changes to personal tax brackets, which can affect the overall tax liability of investors. Additionally, losses such as those from short-term investments can offset gains, reducing taxable income. Various reporting requirements from the Internal Revenue Service (IRS), including Form 1099, track investment earnings accurately, ensuring compliance with laws. Understanding these implications is crucial for effective investment planning and maximizing returns while minimizing unnecessary tax burdens.

Deductions and credits available

Investing in real estate offers various tax deductions and credits, with potential financial benefits for investors in the United States. Mortgage interest payments qualify as a significant deduction, leading to reduced taxable income due to the high-interest rates typical of real estate loans exceeding 3% in many cases. Property taxes, typically ranging from 0.5% to 2.5% of the property's assessed value annually, can also be deducted, providing substantial savings. Depreciation, an annual deduction based on the property's useful life (27.5 years for residential properties), allows investors to offset income, further decreasing taxable income. In addition, investors may qualify for tax credits such as the Low-Income Housing Tax Credit (LIHTC), which incentivizes the development of affordable housing. Capital gains tax exemptions may apply when selling a primary residence, potentially excluding up to $250,000 for individuals and $500,000 for married couples filing jointly. Understanding these financial aspects can enhance overall investment strategy and tax efficiency.

Reporting requirements and deadlines

Investor tax implications encompass various reporting requirements and deadlines that affect financial activities. For instance, the IRS Form 1099, which reports income earned by investors, must be filed by January 31 for most types of income received in the previous calendar year. Additionally, investors must consider estimated tax payments, typically due quarterly on April 15, June 15, September 15, and January 15 of the following year. Capital gains must be reported on Schedule D, alongside the associated returns (Form 1040) by April 15 for individual taxpayers. Furthermore, specific states may impose additional deadlines or forms, such as California's Franchise Tax Board requirements, emphasizing the importance of adhering to local tax laws. Proper record-keeping of transactions, including buy and sell dates, purchase prices, and dividends, is crucial for accurate reporting and minimizing potential penalties.

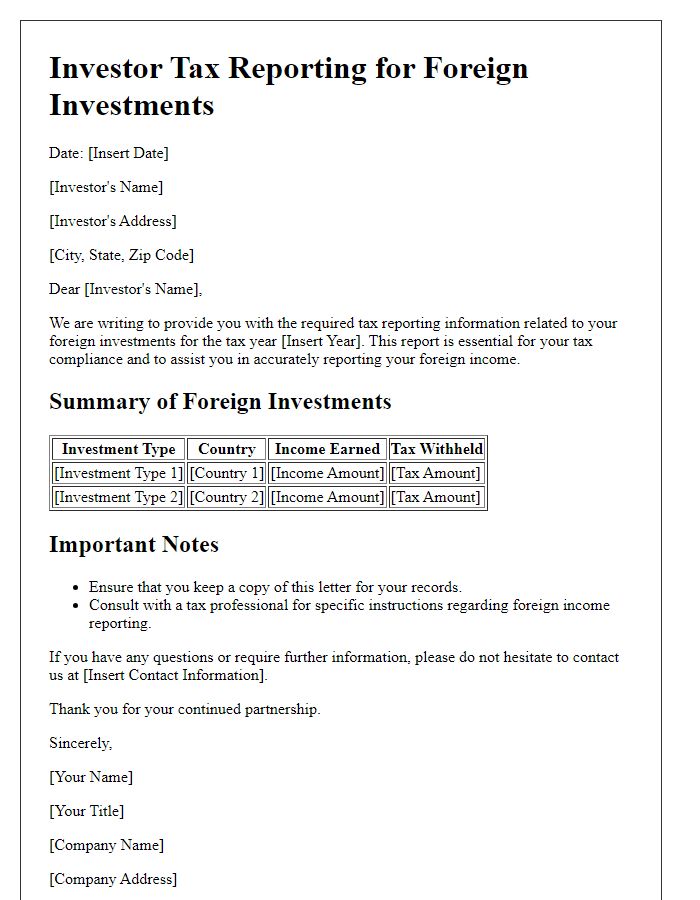

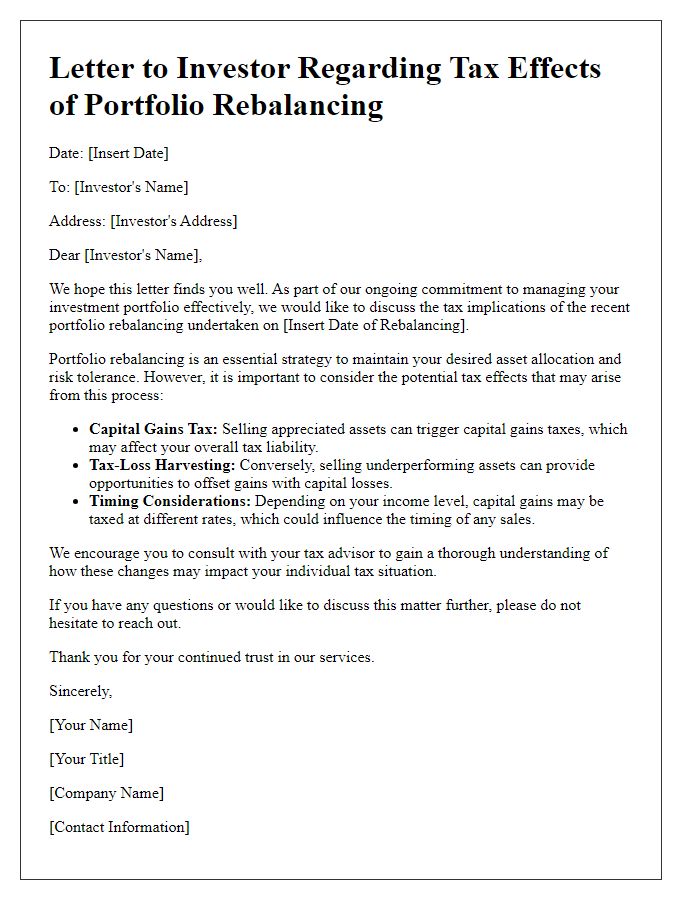

Letter Template For Investor Tax Implication Overview Samples

Letter template of investor tax considerations for real estate investments.

Comments