Welcome to our latest article on fixed income investment portfolio reviews! If you've been navigating the complexities of the bond market, understanding the nuances of your portfolio can feel like an overwhelming task. We're here to break it down for you and provide insights that will help you optimize your investment strategy. So, grab your favorite beverage and join us as we explore key factors to consider for a successful portfolio review!

Portfolio Performance Analysis

The fixed income investment portfolio performance analysis reveals vital insights into asset allocation and yield generation. In the second quarter of 2023, the portfolio achieved an average yield of 4.5%, outperforming the benchmark index, the Bloomberg U.S. Aggregate Bond Index, which yielded 3.8%. The allocation emphasizes U.S. Treasury securities, contributing significantly to overall stability, particularly during market volatility events. Investment in corporate bonds, specifically from the technology sector, generated substantial returns, benefiting from strong earnings reports. Duration management remains crucial, with a current duration of 6.2 years, aligning with interest rate forecasts from the Federal Reserve indicating potential rate hikes within the next year. Credit risk monitoring is essential, with a notable focus on bonds with credit ratings of BBB and above, mitigating default risk while seeking higher income generation.

Interest Rate and Market Conditions

Fixed income investment portfolios, which primarily consist of bonds and other debt securities, are significantly influenced by prevailing interest rates and current market conditions. As of October 2023, the U.S. Federal Reserve maintains a target range for the federal funds rate between 5.25% and 5.50%, aimed at controlling inflation and stabilizing economic growth. Fluctuations in interest rates directly impact bond prices; for instance, a 1% increase in rates typically leads to a decrease in bond values by approximately 7-10%, depending on the bond's duration. Additionally, geopolitical events such as the ongoing conflict in Ukraine and shifts in trade policies can create volatility in the fixed income market, affecting yields and spreads. Recent inflation data shows a year-over-year increase of 3.7%, further complicating the outlook for risk-adjusted returns in fixed income investments. Therefore, continuous monitoring of these critical factors is essential for optimizing performance and achieving investment objectives.

Asset Allocation Review

An asset allocation review of a fixed income investment portfolio is essential for understanding the distribution of investments across various bond categories, such as government bonds, corporate bonds, and municipal bonds. Often focusing on risk levels, this review assesses the percentage allocation, enabling investors to gauge alignment with financial goals. Duration and credit quality are critical factors in evaluating the portfolio's exposure to interest rate fluctuations and default risks, respectively. Performance metrics, such as yield to maturity and current yield, play a vital role in determining the portfolio's overall effectiveness in generating income. Notable events in the fixed income market, such as Federal Reserve interest rate hikes or geopolitical tensions affecting bond yields, are also analyzed to provide clarity on current positioning and future adjustments. Regular reviews ensure that the investment strategy remains responsive to market conditions and investor objectives.

Risks and Credit Ratings Assessment

Fixed income investment portfolios require careful monitoring to assess risks associated with credit ratings of underlying securities. Credit ratings, assigned by agencies such as Moody's, S&P, and Fitch, can fluctuate based on issuer creditworthiness, impacting overall portfolio risk. For example, an upgrade from BB to BBB can enhance investment grade status, reducing default risk. Conversely, a downgrade to B can signal potential financial instability in companies or municipalities. Additionally, economic indicators like interest rate changes or inflation rates (currently at 2.6% in the U.S.) can influence bond yields, affecting total returns. Regular analysis of macroeconomic trends and issuer financial health ensures better risk management and informed decision-making for sustaining portfolio performance.

Future Investment Strategy and Recommendations

Fixed income investment portfolios often require regular reviews to adapt to evolving market conditions and individual financial goals. A thorough analysis includes assessing bond performance metrics, interest rate forecasts, and economic indicators such as inflation and unemployment rates. Portfolio allocations typically focus on government bonds (like US Treasuries), corporate bonds (considering credit ratings), and municipal bonds, aiming for a balance between risk and yield. Future strategies could involve diversifying into emerging market debt or high-yield bonds to enhance returns, especially in a low-interest rate environment. Regularly rebalancing, maintaining liquidity, and monitoring credit risk are crucial for optimizing the portfolio's performance in the current financial landscape.

Letter Template For Fixed Income Investment Portfolio Review Samples

Letter template of Fixed Income Investment Portfolio Performance Analysis

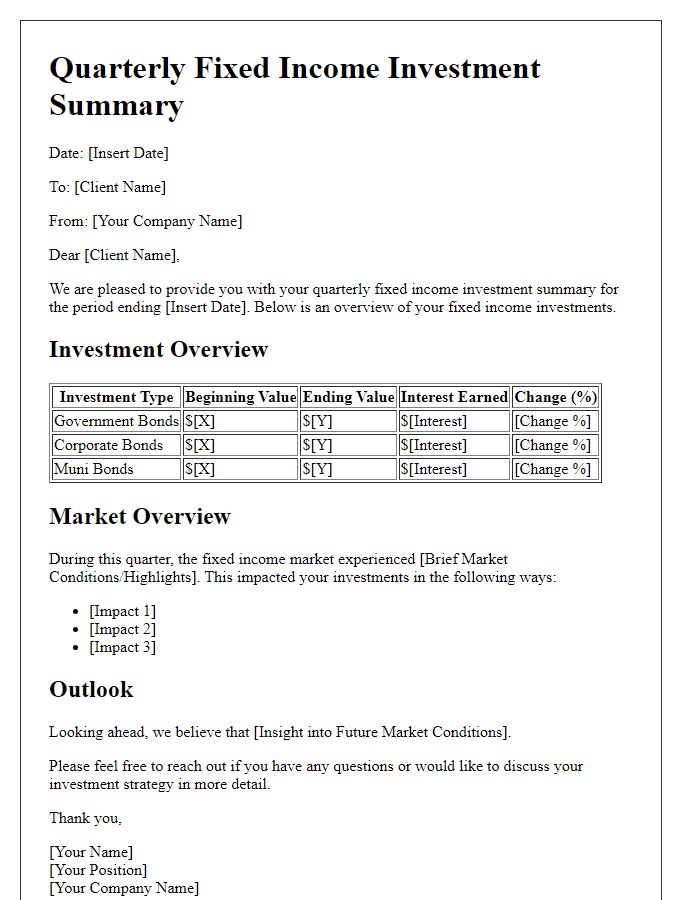

Letter template of Fixed Income Portfolio Evaluation and Recommendations

Letter template of Fixed Income Investment Portfolio Diagnostic Assessment

Letter template of Updated Insights for Fixed Income Investment Portfolio

Comments