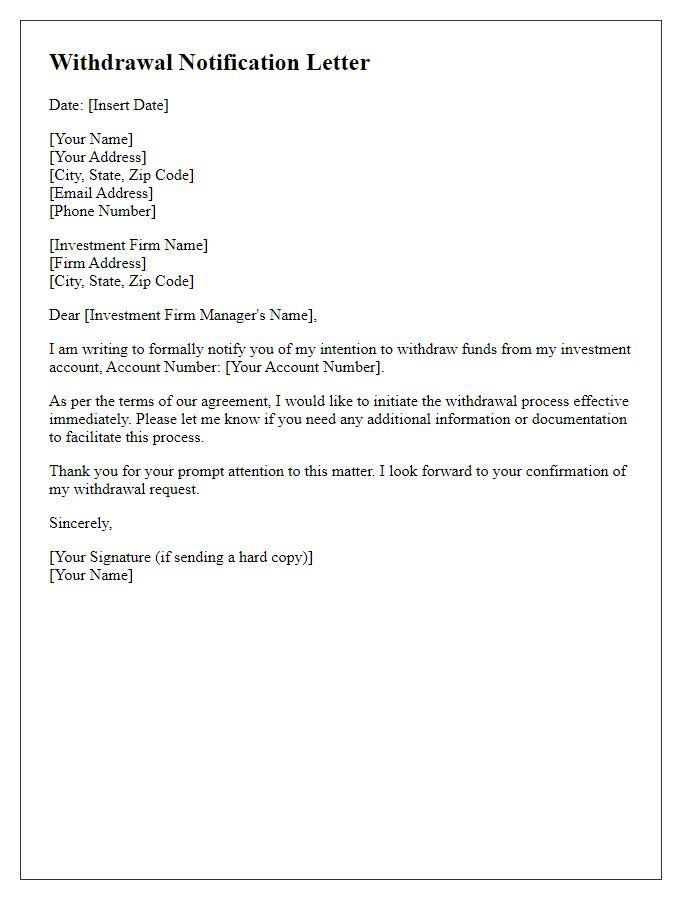

If you're considering withdrawing from your investment account, you might be wondering how to effectively communicate your request. Writing a clear, concise letter can make all the difference in ensuring a smooth process. In this article, we'll guide you through the essential elements to include in your withdrawal request letter, helping you avoid common pitfalls. So, let's dive in and get you on your way to navigating your investment withdrawal with confidence!

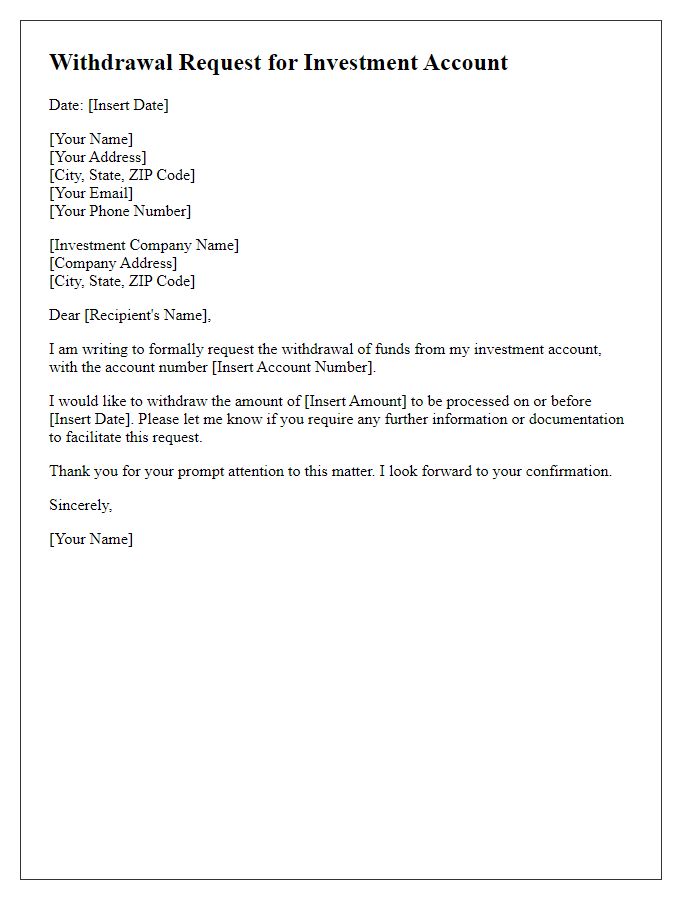

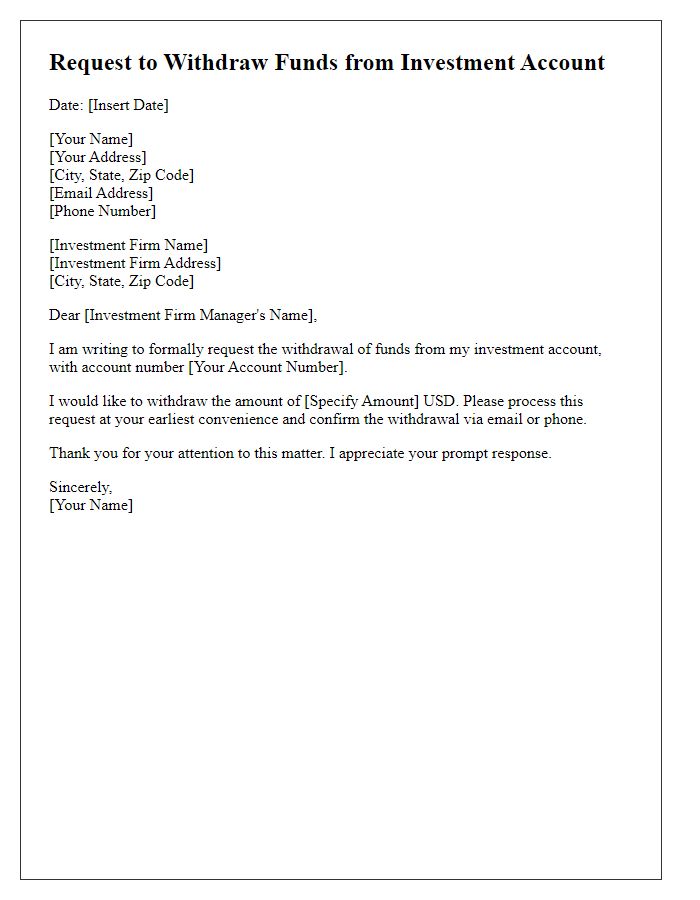

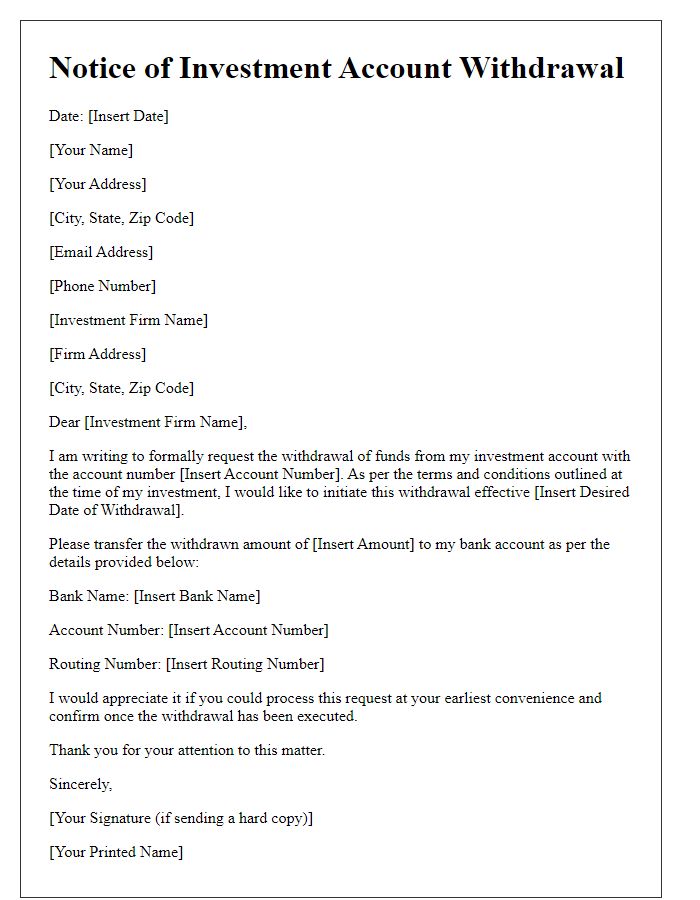

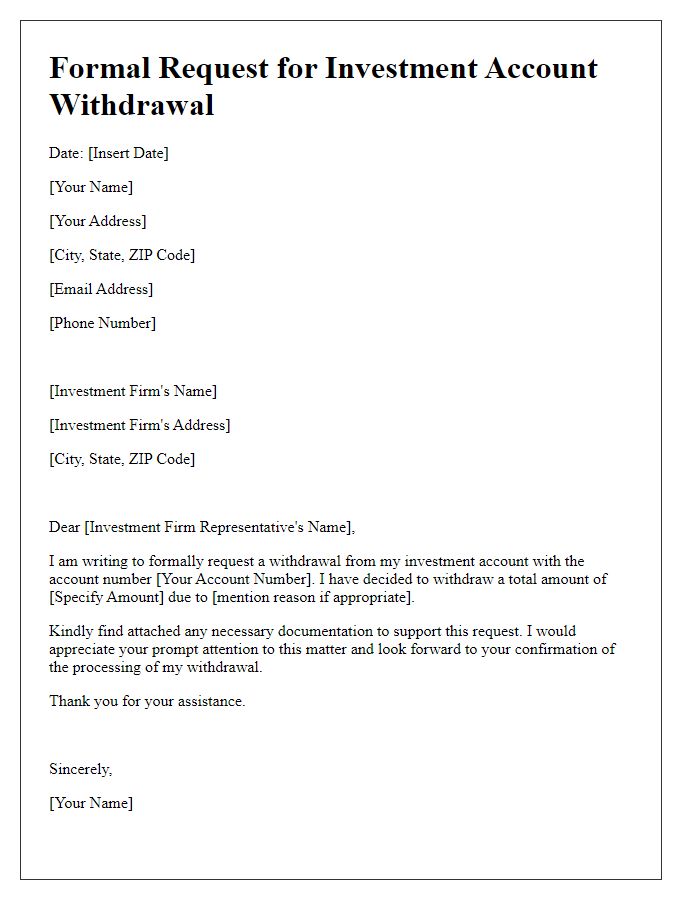

Account Holder Information

Investment account withdrawal requests require precise account holder information for processing. Essential details include the full name of the account holder, as registered with the investment firm, which ensures accurate identification of the account in question. The unique account number, typically a sequence of digits assigned by the financial institution, serves as a critical reference for transaction tracking. Contact details, including the registered email address and phone number, facilitate communication regarding the withdrawal status and any potential issues that may arise during the processing phase. Lastly, the physical address on file is necessary for compliance and verification purposes, ensuring that all legal requirements are fulfilled.

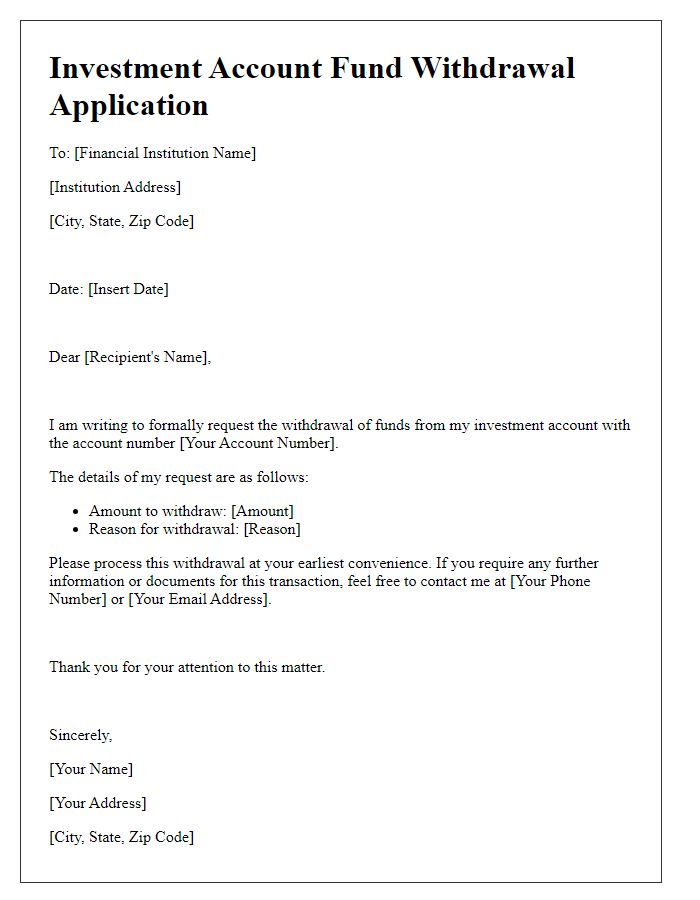

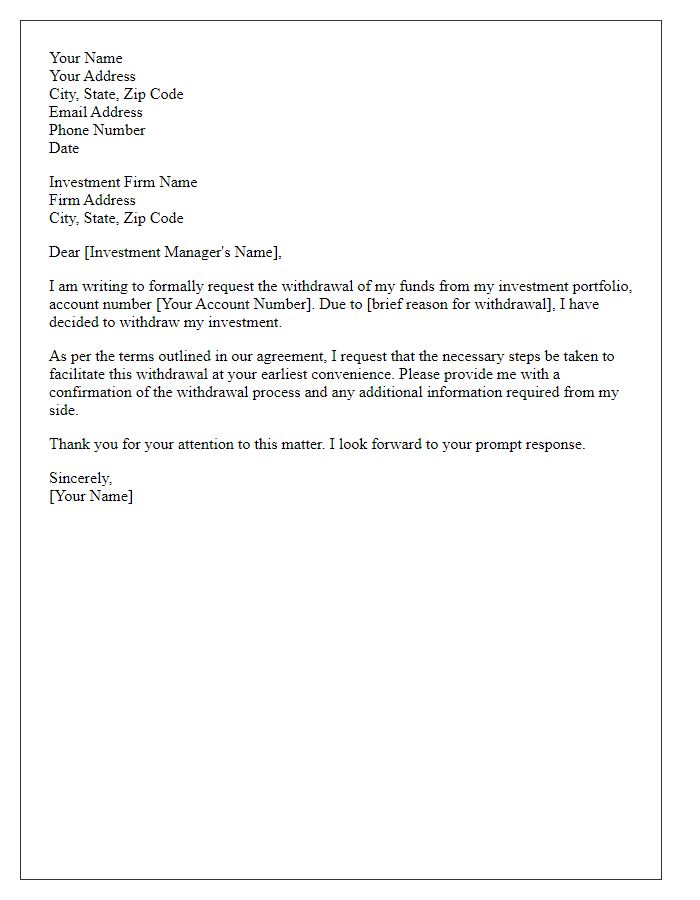

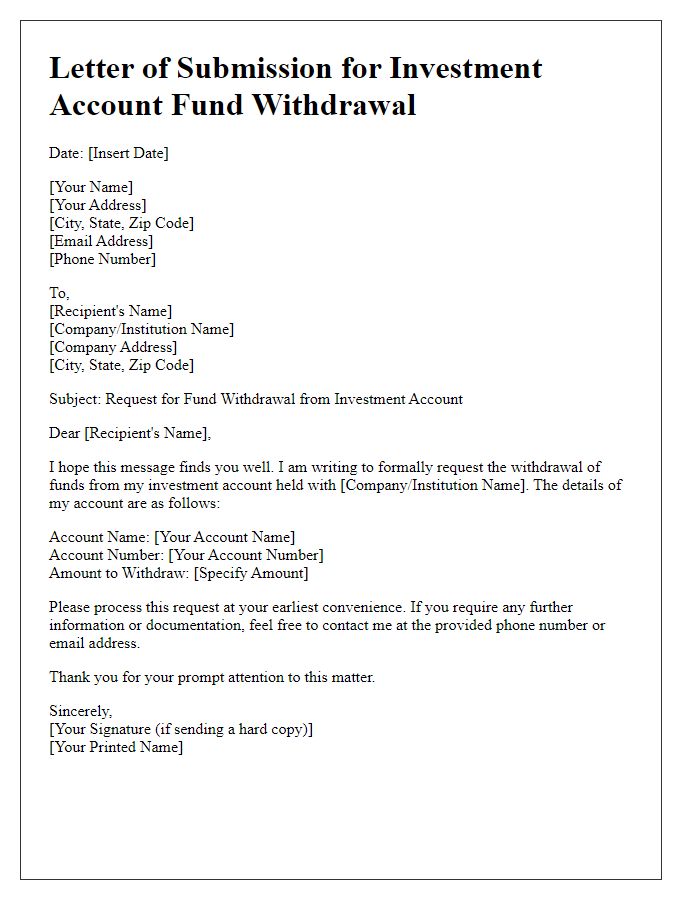

Account Details and Withdrawal Amount

An investment account withdrawal request requires specific details to process efficiently. Essential account information includes the account number (typically a unique identifier), account holder's name (as registered), and contact information (such as phone number or email). The withdrawal amount should be clearly stated, including any specific figures or currency types, such as USD or EUR. Additionally, date of the request and purpose for the withdrawal, such as "emergency expenses" or "profit realization," can enhance clarity. Including preferences for transfer methods, like wire transfer or check, will streamline processing. Submitting this request promptly after determining the desired amount ensures timely access to funds.

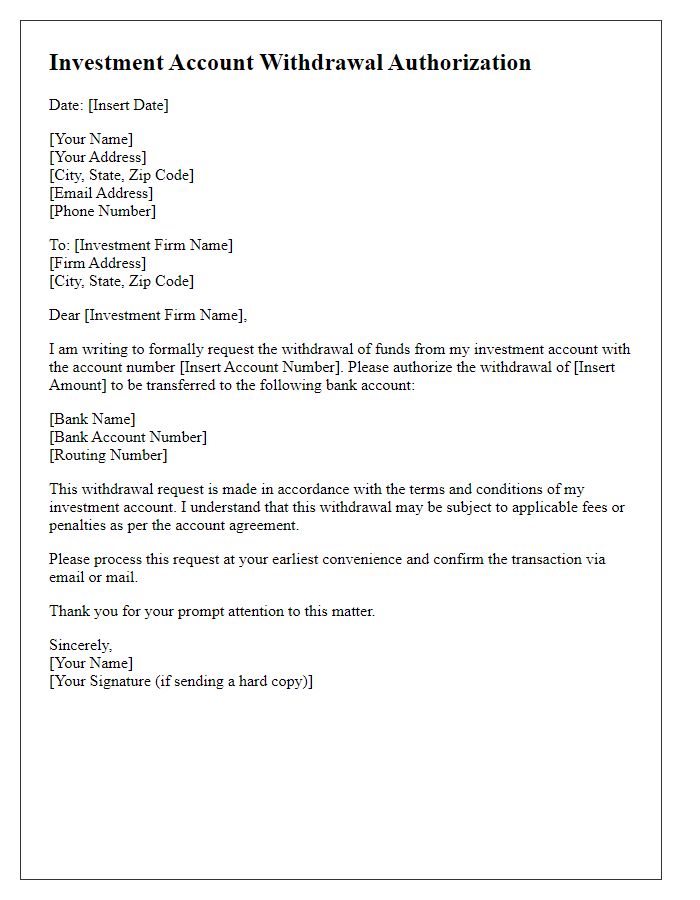

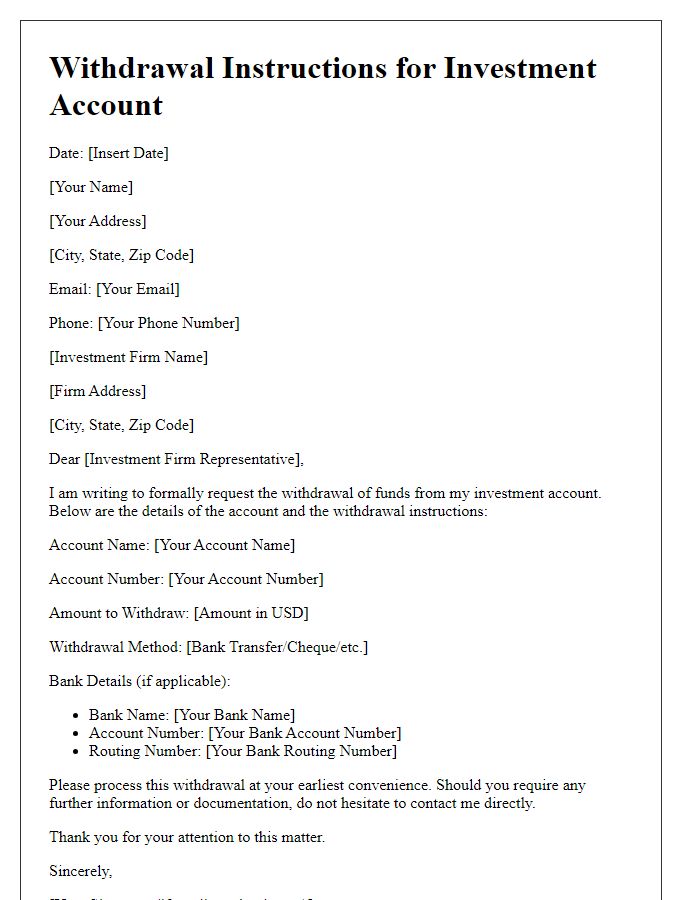

Withdrawal Method and Bank Information

To successfully withdraw funds from an investment account, individuals must carefully select their withdrawal method, which often includes options such as electronic funds transfers, wire transfers, or checks. It is critical to provide accurate bank information, which includes the bank name, branch address, account number, and routing number to ensure seamless transactions. For example, a typical routing number in the United States is a 9-digit code used to identify the financial institution, while an account number uniquely identifies the account holder's specific account within that institution. When documenting these details, ensure clarity and precision to avoid delays in processing the withdrawal request.

Reason for Withdrawal

Investment accounts often undergo withdrawals when investors seek liquidity for personal expenses or diversifying portfolios. A common reason for withdrawal is a significant life event, such as purchasing a home in a competitive market like San Francisco, where the median home price exceeds $1.5 million. Another reason could be a sudden medical emergency requiring immediate funds, such as a critical surgery averaging around $30,000 in costs. Additionally, proactive portfolio management often necessitates reallocating assets, especially in volatile markets, like technology stocks in recent years, which have seen fluctuations of over 30%. These factors drive investors to request withdrawals to ensure liquidity and financial stability during unforeseen circumstances.

Contact Information and Signature

Investing in stocks, bonds, or mutual funds often involves managing funds within an investment account, such as a brokerage account or retirement account. Investors may need to withdraw funds for various reasons, including personal expenses, purchasing property, or funding education. A formal withdrawal request must include essential contact information, such as the investor's name, account number, and phone number. It should also contain a signature to authorize the transaction. Ensuring accurate details helps facilitate a smooth withdrawal process while maintaining account security.

Comments