Are you eager to stay informed about your investments and their performance? In our latest quarterly investment summary report, we break down key insights and trends that can help you navigate your financial landscape. From market shifts to portfolio adjustments, we present the information in a digestible format tailored to your needs. So, grab a seat and read on to discover how your investments have fared over the last quarter!

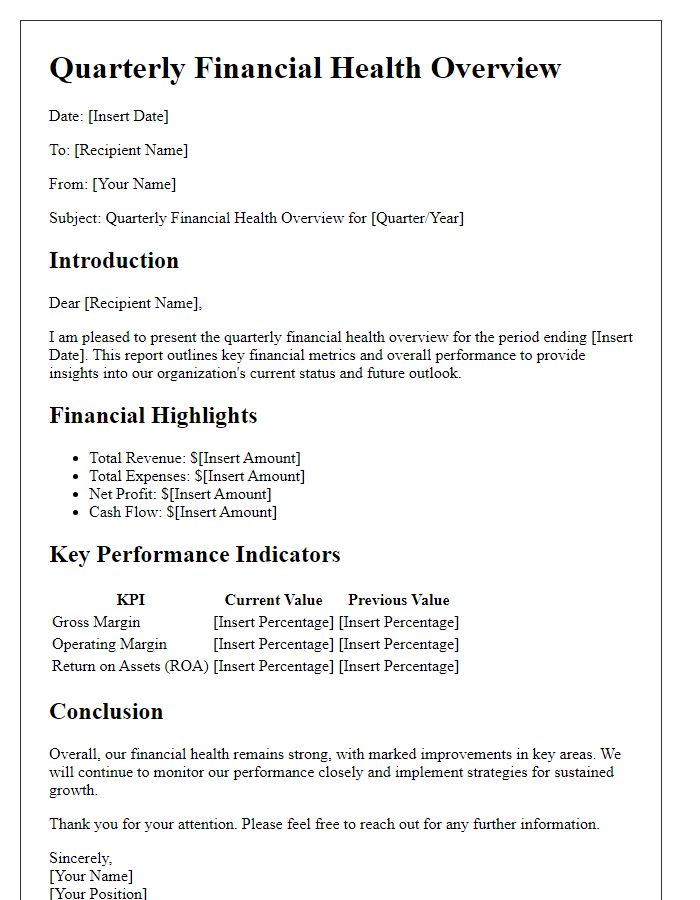

Executive Summary

The quarterly investment summary report provides a comprehensive overview of portfolio performance, detailing key metrics and trends observed during the previous quarter, specifically from July 1, 2023, to September 30, 2023. During this period, total assets under management (AUM) reached $5 million, reflecting a 10% increase from the previous quarter, driven primarily by a robust uptick in technology stocks within the Nasdaq composite index, which surged by 15%. Significant investments in companies such as Apple Inc. and Amazon.com Inc. contributed notably to this growth. Additionally, the average return on investments (ROI) for this quarter stood at 8%, outperforming the benchmark S&P 500, which recorded a return of 6%. Strategic asset allocation adjustments, especially an increased focus on renewable energy sector investments, played a crucial role in enhancing overall portfolio performance, aligning with global market trends favoring sustainable initiatives and the green economy.

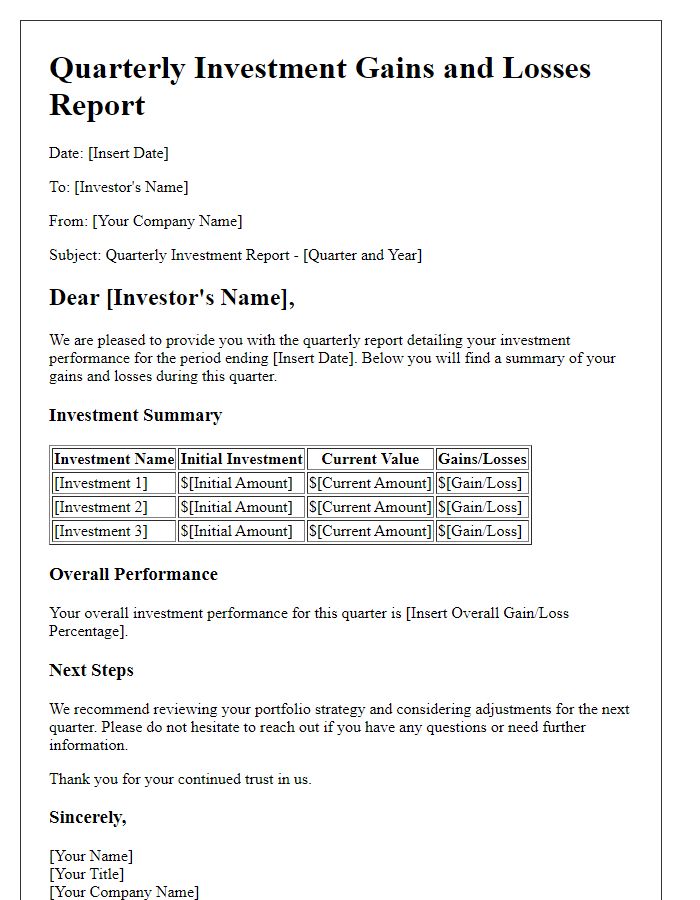

Performance Overview

The quarterly investment summary report provides a comprehensive performance overview, detailing asset allocation strategies and overall portfolio growth. Key metrics include returns on investments (ROI) that reflect performance against benchmarks, such as the S&P 500 or MSCI Emerging Markets, measured over the past three months. Specific sections highlight individual asset classes like equities, fixed income, and real estate, outlining gains and losses in percentage terms. Notable events impacting performance, such as interest rate changes by the Federal Reserve or geopolitical tensions, are discussed in relation to their effects on market volatility and investor sentiment. The analysis also covers sector performances, detailing which industries, such as technology or healthcare, performed best and worst, offering insights into market trends and future investment opportunities.

Asset Allocation

In the first quarter of 2023, the investment portfolio exhibited a robust asset allocation strategy, distributing assets across various classes including equities, fixed income, and alternative investments. Equities, representing 60% of the total portfolio (valued at approximately $6 million), primarily focused on technology and healthcare sectors, driven by growth in companies such as Apple and Johnson & Johnson. Fixed income investments accounted for 30% of the portfolio, incorporating a mix of government and corporate bonds, yielding an average annual return of 4.5%. Alternative investments, which encompass real estate assets and commodities, constituted the remaining 10%, strategically aiming to hedge against inflationary pressures observed in the market. This diversified allocation not only mitigated risk but also positioned the portfolio for potential growth amidst fluctuating economic conditions as noted in reports from the Federal Reserve.

Market Trends

Emerging market trends indicate significant growth in sectors such as renewable energy, technology, and healthcare. Global investments in renewable energy technologies experienced a surge, with a projected increase to $500 billion by 2025. The tech sector remains robust, particularly in artificial intelligence and cloud computing, influenced by major events like the annual CES (Consumer Electronics Show) held in Las Vegas which showcases the latest innovations. Additionally, healthcare investments are accelerating, driven by advancements in biotechnology and pharmaceuticals, particularly in response to the COVID-19 pandemic and its ongoing effects. Notable geographical shifts include increased investment in Asian markets, especially in countries like India and Vietnam, where rapid urbanization and industrialization are creating new opportunities.

Risk Factors and Mitigation

Risk factors in various investments, such as stock market volatility and interest rate fluctuations, can significantly impact portfolio performance. For instance, economic downturns (contraction periods in GDP) can lead to decreased consumer spending and lower corporate earnings, affecting stock values across sectors like technology and energy. Geopolitical events, such as trade disputes or military conflicts, may also introduce uncertainty that influences investor sentiment and market stability. To mitigate these risks, diversification strategies (including asset classes like bonds, equities, and real estate) and strategic rebalancing can be employed to spread exposure. Implementing stop-loss orders may protect against severe declines, while active monitoring of economic indicators (like inflation rates and unemployment figures) facilitates timely responses to changing market conditions. These proactive measures aim to safeguard investments and enhance long-term growth potential in turbulent financial landscapes.

Comments