Are you interested in aligning your investments with your values? Understanding your ethical investment preferences can truly transform the way you grow your wealth while making a positive impact on society and the environment. In this article, we'll explore various ethical investment options and how to choose the right ones for you. So, let's dive in and discover the power of conscious investing together!

Personalized Client Details

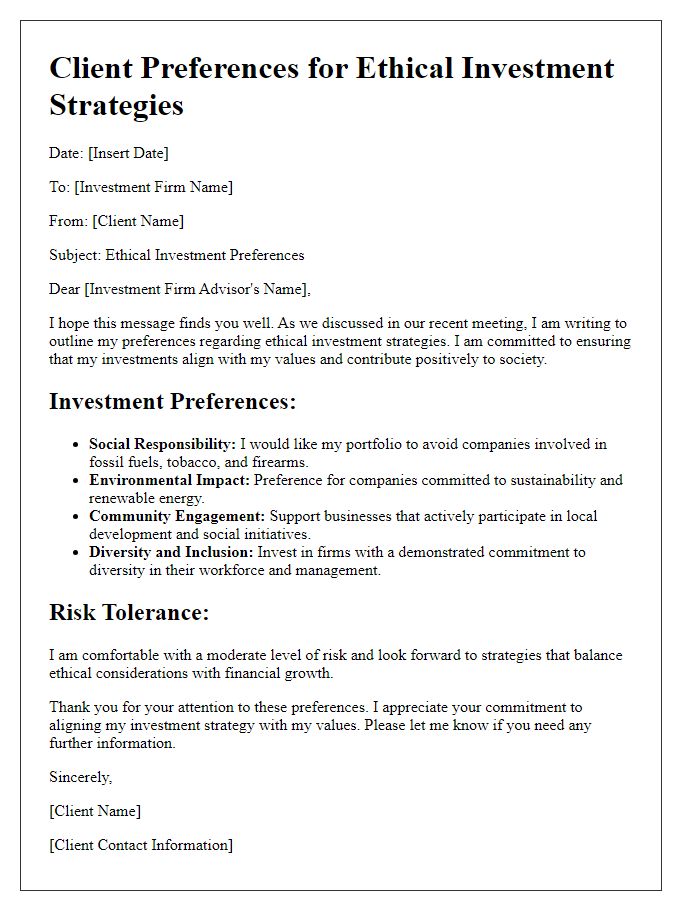

Understanding personalized client details enhances ethical investment strategies, particularly in socially responsible investing (SRI) frameworks. Clients' preferences, including specific sectors like renewable energy or sustainable agriculture, shape investment portfolios that align with their values. Demographical aspects such as age (millennials often favor ESG criteria) and income levels can influence the types of investments chosen. Additionally, geographical location, for example, clients in California may prioritize investments in clean tech, while clients in New York might focus on affordable housing initiatives. These tailored details not only promote client satisfaction but also ensure compliance with evolving regulatory standards governing ethical investments.

Ethical Investment Goals

Ethical investment preferences encompass a range of values, including sustainability, social responsibility, and corporate governance. Investors often seek to align their portfolios with causes such as renewable energy, gender equality, and human rights. For example, a focus on Environmental, Social, and Governance (ESG) criteria allows investors to assess the ethical implications of their investments. This approach can include supporting companies that prioritize carbon neutrality and fair labor practices. In 2021, global sustainable investment reached approximately $35.3 trillion, demonstrating a significant shift towards integrating ethical considerations into investment strategies. Understanding these goals allows financial advisors to curate tailored investment solutions that meet client expectations while addressing societal and environmental impact.

Clear Ethical Criteria and Guidelines

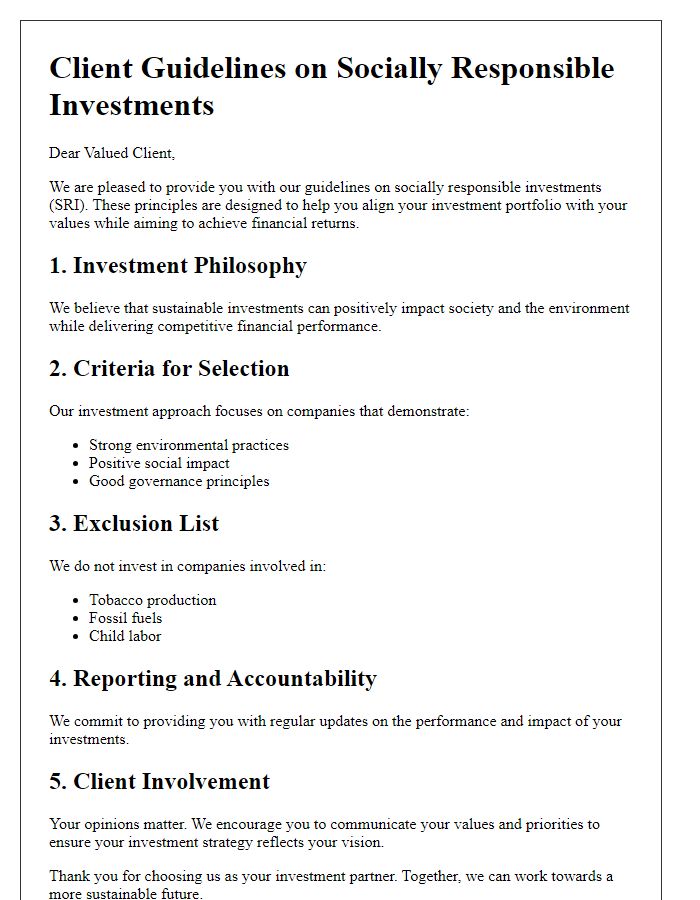

Ethical investment practices involve the consideration of moral principles and social responsibility when selecting investment opportunities. Investors often prioritize criteria such as environmental sustainability, social justice, and corporate governance (ESG factors). Guidelines may include avoiding industries such as fossil fuels, tobacco, or armaments, while promoting sectors like renewable energy, education, and healthcare. Clear criteria help align investment choices with personal values, ensuring that funds support businesses committed to ethical practices. Implementing these guidelines can also enhance portfolio resilience and appeal to a growing market of socially conscious investors.

Transparency in Investment Options

Ethical investment preferences encompass a range of values, emphasizing transparency in investment options, particularly in socially responsible investing (SRI) and environmental, social, and governance (ESG) criteria. Many investors prioritize firms with ethical practices, such as renewable energy companies like NextEra Energy or sustainable agriculture firms such as AppHarvest. Clear disclosure of investment strategies, including details on portfolio composition and adherence to ethical standards, enhances trust and ensures alignment with client values. Furthermore, ongoing reporting on the impact of investments, such as community development or carbon footprint reduction, reinforces ethical commitment. Effective platforms, such as Betterment or Wealthsimple, facilitate client engagement by providing clear insights and options that prioritize both ethical considerations and financial performance.

Follow-up and Communication Plan

Investing ethically can influence portfolio performance, with factors like environmental, social, and governance (ESG) criteria gaining prominence. Understanding client preferences in ethical investment is crucial for tailoring strategies. Regular communication, such as quarterly updates or reports, ensures alignment with values and performance expectations. Engagement in opportunities like sustainable energy funds or socially responsible indices can enhance investment growth while promoting responsible practices. Utilizing platforms that assess ESG ratings helps in selecting viable options, ensuring transparency and adherence to ethical standards. Establishing milestones for evaluations every six months aids in measuring progress and adjusting strategies as needed, fostering a long-term client-advisor relationship.

Letter Template For Client Ethical Investment Preferences Samples

Letter template of client guidelines on socially responsible investments

Comments