Are you thinking about diversifying your investment strategy? Crafting a multi-asset investment portfolio is an excellent way to spread risk and capitalize on various market opportunities. With the right approach, you can tailor your portfolio to align with your financial goals and risk tolerance while potentially enhancing your returns. Curious to learn more about how to create a balanced and effective multi-asset portfolio? Read on!

Investment Goals and Objectives

Creating a multi-asset investment portfolio requires a clear understanding of investment goals and objectives. Key elements include defining risk tolerance, determining time horizon (short-term, medium-term, long-term), and establishing financial targets (e.g., retirement savings, wealth accumulation). Diversification strategy must consider various asset classes, such as equities (stocks), fixed income (bonds), real estate, and alternative investments (commodities, cryptocurrencies). Additionally, ongoing assessment of market conditions and performance metrics is crucial for alignment with the initial objectives. Regular rebalancing ensures the allocation remains consistent with changing market dynamics and personal circumstances. Engaging with financial advisors can provide tailored insights for optimal portfolio performance, ensuring alignment with individual aspirations.

Risk Tolerance and Appetite

Creating a multi-asset investment portfolio requires a thorough understanding of risk tolerance and appetite specific to an individual's financial goals. Risk tolerance refers to the degree of variability in investment returns that an investor is willing to withstand, influenced by factors such as age, income levels, and investment horizon. On the other hand, risk appetite embodies the investor's willingness to take risks, driven by personal preferences, psychological aspects, and market understanding. For instance, younger investors may possess higher risk tolerance while being more open to equities and cryptocurrencies, whereas retirees might prioritize capital preservation through fixed-income securities and real estate. A significant event, like a market downturn, can profoundly impact an investor's willingness to further engage with high-risk assets. Proper analysis of both risk tolerance and appetite will lead to a well-diversified portfolio tailored to withstand market fluctuations and align with long-term financial objectives.

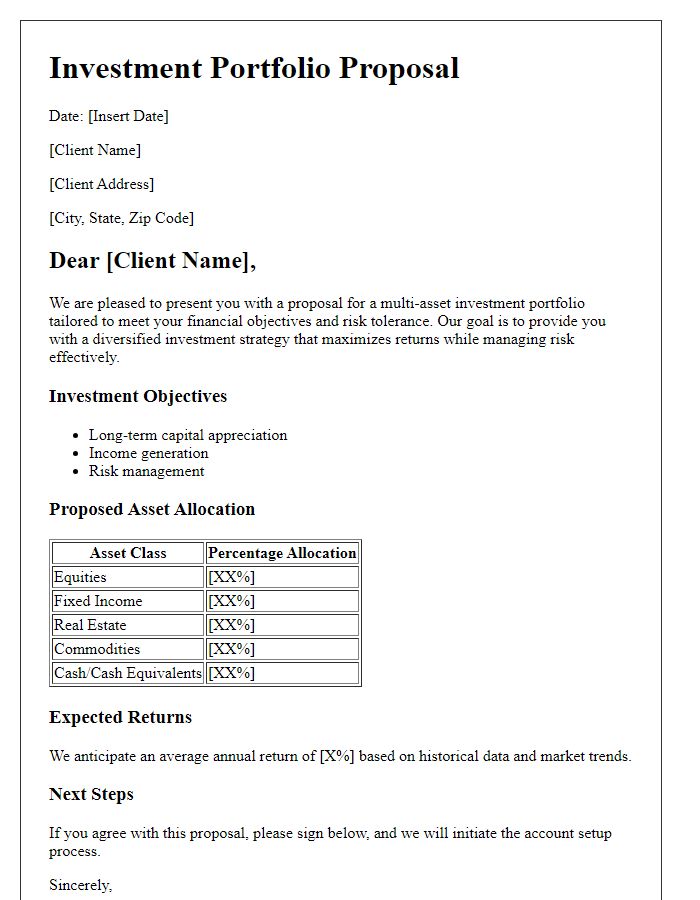

Asset Allocation Strategy

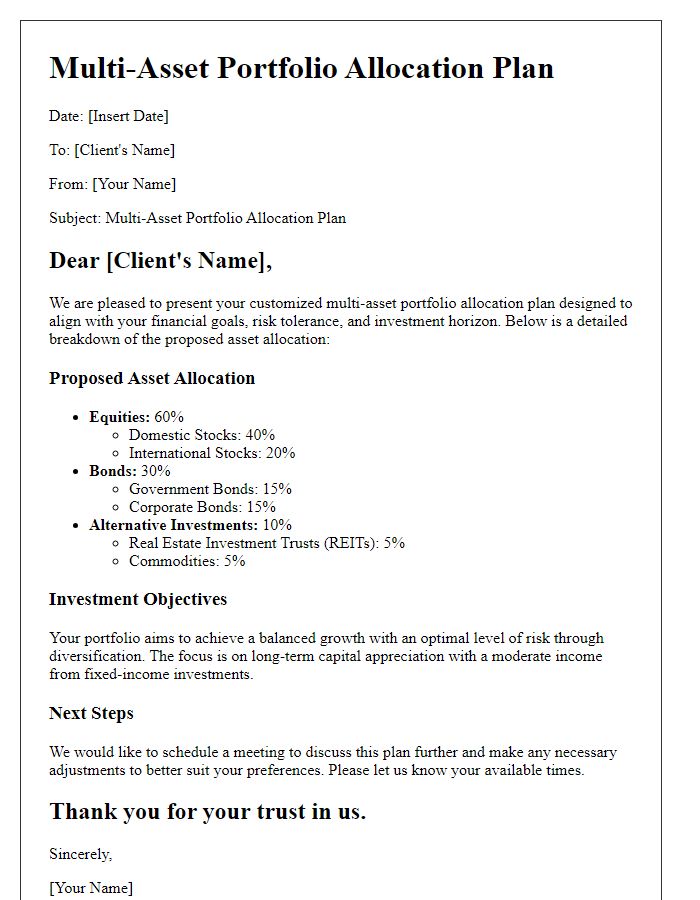

Creating a multi-asset investment portfolio involves strategic asset allocation, aiming for optimal diversification across various asset classes such as equities, fixed income, commodities, and real estate. An effective asset allocation strategy typically considers risk tolerance, investment objectives, and time horizon. For instance, a balanced portfolio may allocate approximately 60% to stocks (high-growth potential but higher volatility), 30% to bonds (stability and income generation), and 10% to alternative investments such as real estate investment trusts (REITs) or commodities like gold for hedging against inflation. Regular portfolio rebalancing ensures alignment with evolving market conditions and personal goals, maintaining desired risk levels while capitalizing on emerging market opportunities. Each asset class plays a crucial role in mitigating risk and enhancing returns, driving the overall performance of the investment portfolio.

Diversification and Rebalancing Plan

Creating a multi-asset investment portfolio requires a well-structured diversification and rebalancing plan to enhance returns while managing risks. A diversified portfolio typically includes various asset classes such as equities (stocks), fixed income (bonds), and commodities (like gold). Each asset class behaves differently under various market conditions, aiding in risk mitigation. Effective diversification aims for correlation reduction among assets; for instance, during economic downturns, bonds may perform better than stocks, balancing overall portfolio performance. Rebalancing is essential to maintain the targeted asset allocation; for example, if equities outperform bonds, the portfolio may drift from the original 60/40 stock-to-bond ratio. Regular rebalancing--ideally quarterly or annually--ensures alignment with the investor's risk tolerance and investment objectives, allowing for adjustment in response to market movements and shifts in asset performance.

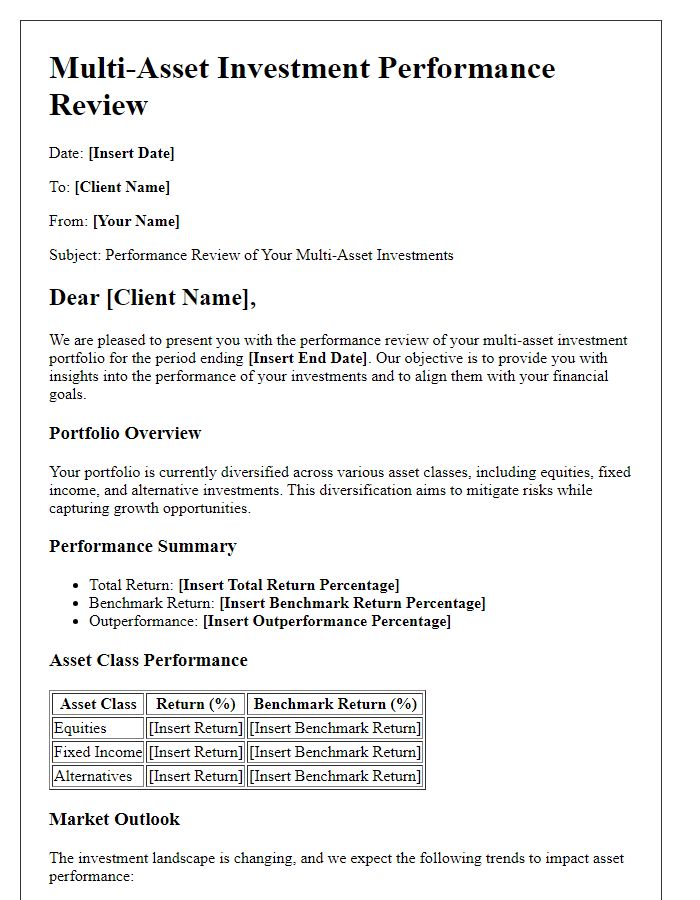

Performance Monitoring and Reporting

Performance monitoring plays a crucial role in the effective management of multi-asset investment portfolios, such as those encompassing stocks, bonds, and alternative assets like real estate or commodities. Regular evaluations of key performance indicators (KPIs), which measure returns, risk-adjusted performance, and market correlations, are essential to ensure alignment with investment objectives. Reporting can take various forms, including monthly performance reports, quarterly updates, and annual reviews, with detailed analytics on performance attribution, noting contributions from different asset classes. Tools like the Sharpe Ratio (a measure of risk-adjusted return), benchmark comparisons, and drawdown analyses provide insights into portfolio strengths and vulnerabilities. Implementing a comprehensive approach to performance monitoring ensures that portfolio managers can adapt strategies promptly in response to changing market conditions, economic indicators, or geopolitical events.

Comments