Hey there! We know that keeping track of premium payments can sometimes slip through the cracks. That's why we're here to help ensure you stay on top of your obligations seamlessly. If you're looking for an easy-to-use letter template to send a friendly payment reminder, you're in the right placeâread on to discover how you can simplify this process!

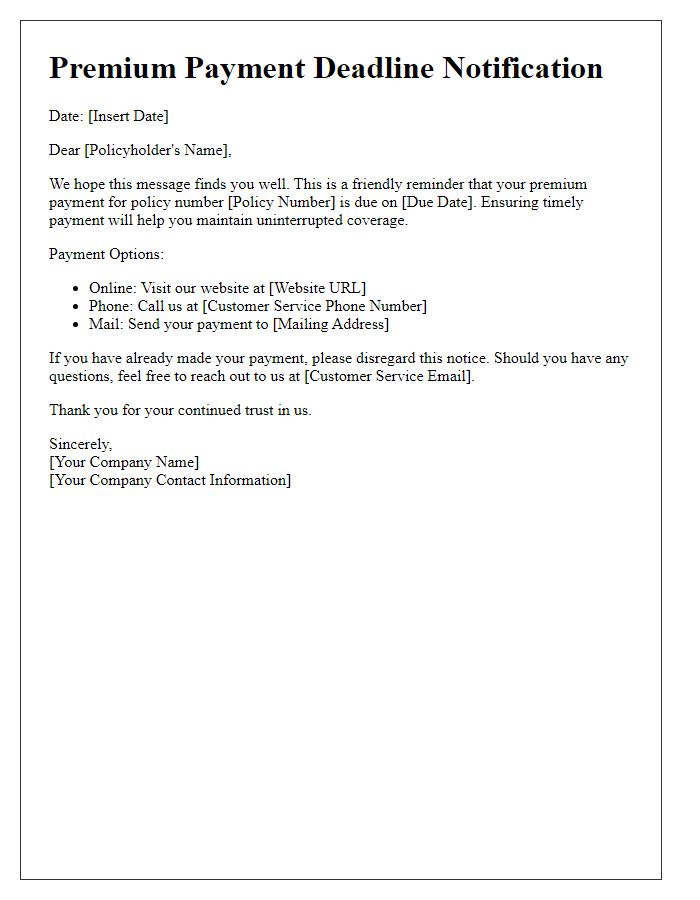

Clear subject line

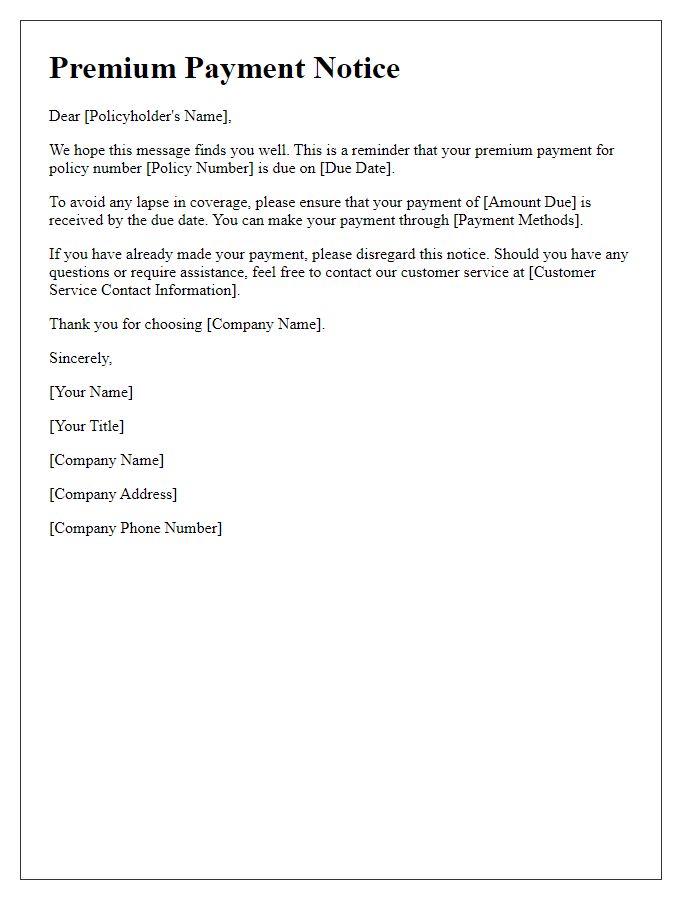

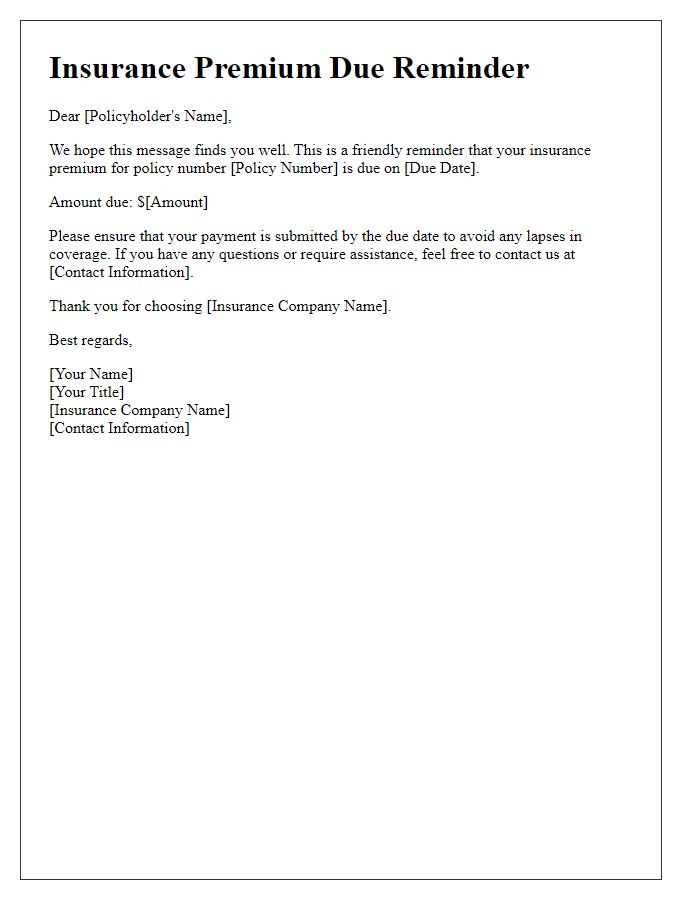

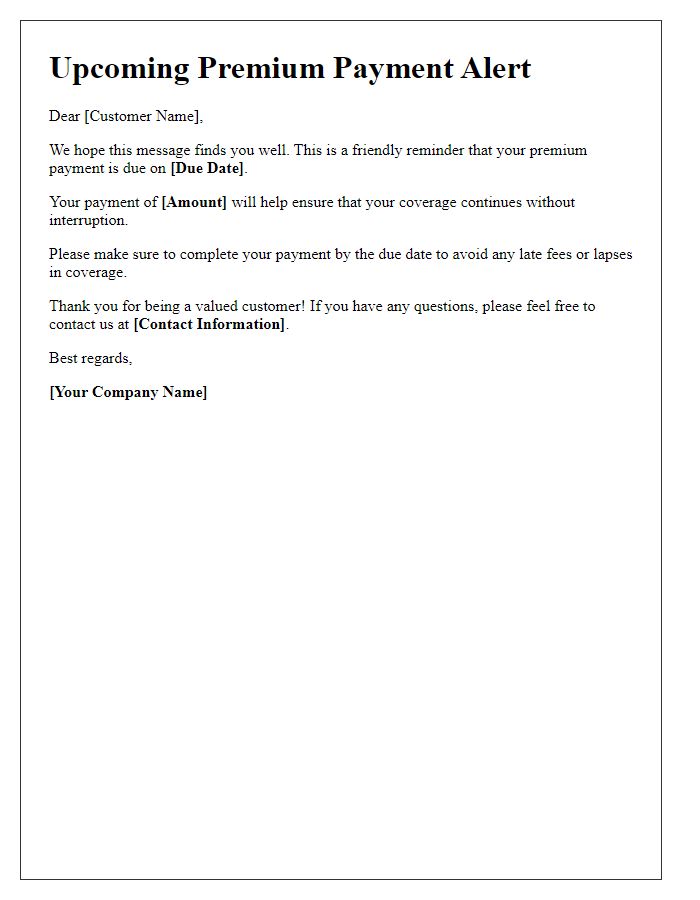

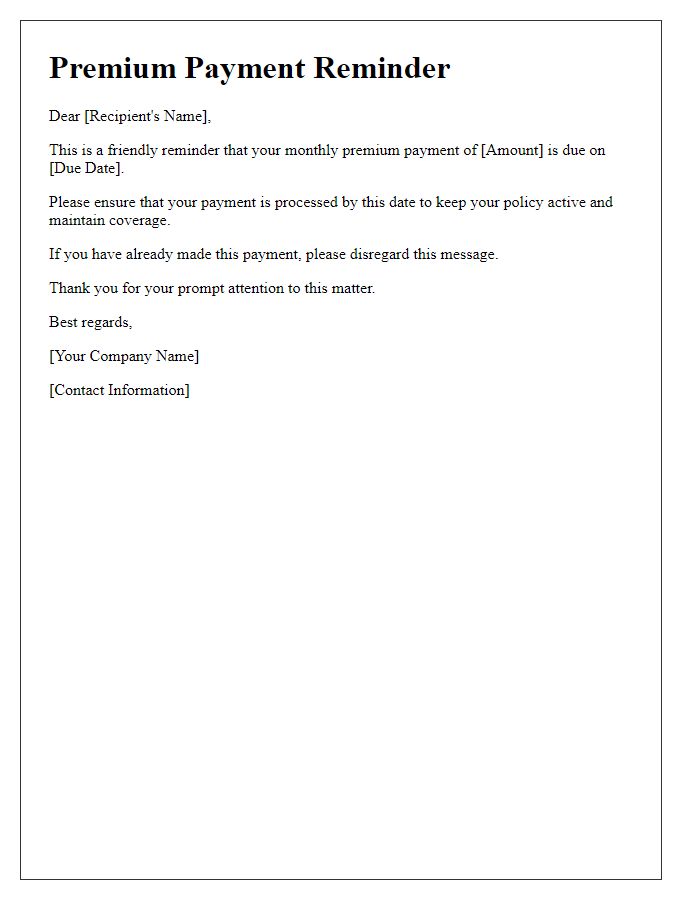

Premium payment reminders are essential for maintaining timely financial obligations within the insurance industry, specifically for policies like health insurance or auto insurance. Companies typically send these notifications via email, using clear subject lines such as "Payment Due - Your Policy Coverage at Risk!" or "Reminder: Upcoming Premium Payment Due on [Date]." These reminders encourage policyholders to complete their payments on time, thereby preventing lapses in coverage that can lead to unexpected expenses or loss of benefits. Including specific details like the premium amount, due date, and policy number enhances the clarity of the communication, allowing the recipient to act promptly.

Personalized greeting

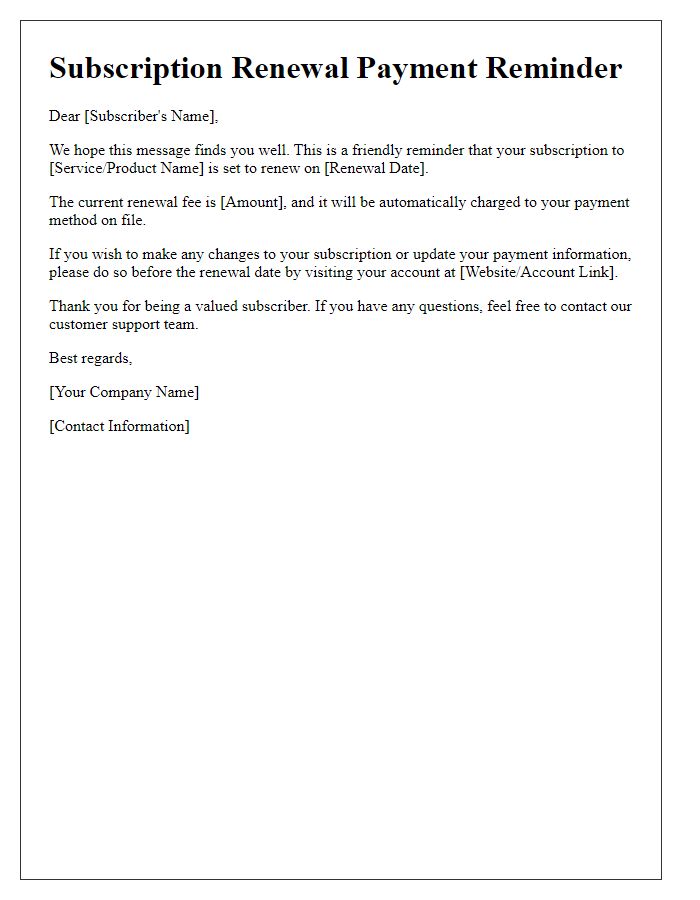

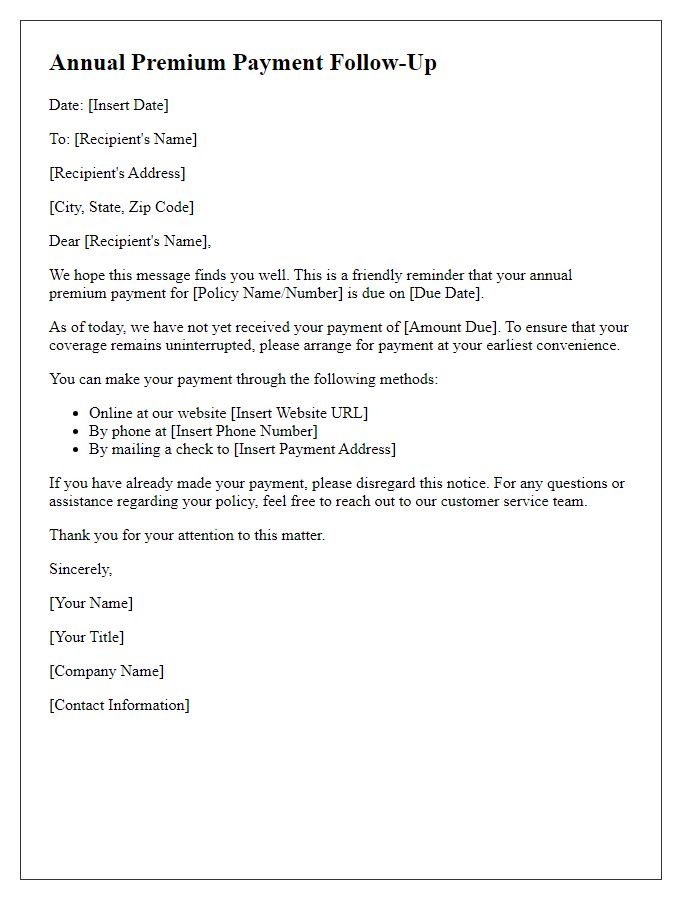

Premium payment reminders ensure timely payment for policies, preventing lapses in coverage. The reminder should include the policyholder's name, policy number, and specific due date. Highlight the payment amount to maintain transparency. Include the payment methods available, such as online payment portals, bank transfers, or checks, emphasizing the ease of completing the transaction. Personalize the message to foster a sense of relationship, using friendly language while maintaining professionalism. This reminder serves as an important communication tool for retaining customer loyalty and ensuring continued coverage.

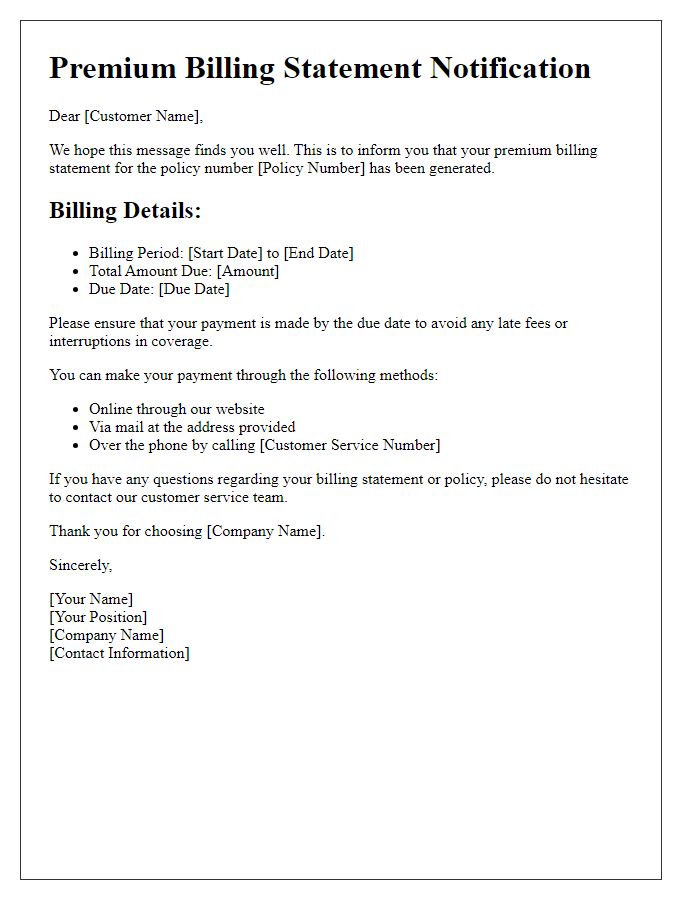

Payment details summary

A premium payment reminder is crucial for maintaining active insurance coverage. For instance, policyholders with life insurance from major providers such as State Farm or MetLife typically receive notifications 15 days before the due date. These reminders may include payment details such as the total premium amount, which can range from $50 to several hundred dollars depending on the policy type. Payment methods might include options like automated bank drafts or online credit card transactions. Creating a clear summary of these details ensures that clients understand their obligations and can avoid lapses in coverage, which could lead to significant financial loss in case of unforeseen events.

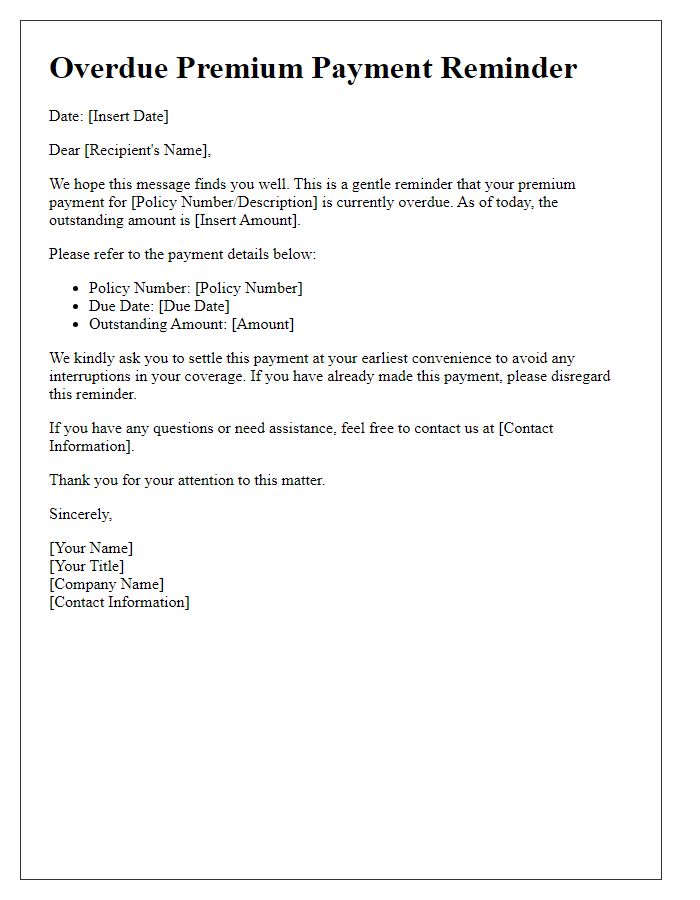

Deadline and consequences

Failure to make premium payments by the specified deadline can lead to significant consequences for policyholders, including the potential lapse of coverage. Policies, such as health insurance or auto insurance, often stipulate a grace period, typically ranging from 10 to 30 days, allowing for late payments. However, after this period, insurers may terminate the policy, resulting in the loss of financial protection in events like accidents or medical emergencies. Additionally, a lapse in coverage could affect future premiums, leading to higher rates due to being categorized as a higher risk. Prompt action is essential to maintain security and avoid any negative repercussions associated with payment delays.

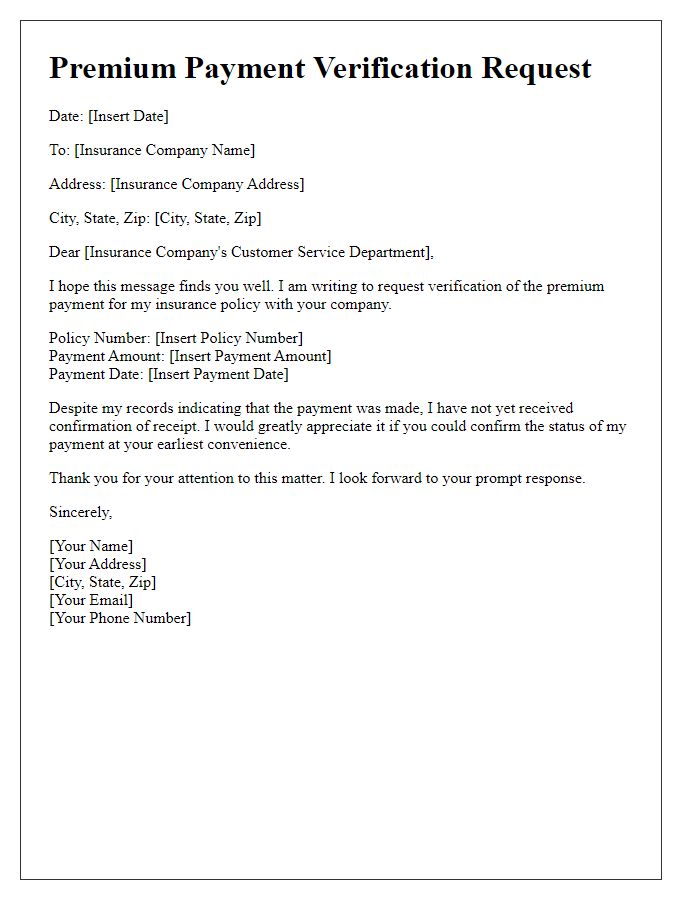

Contact information for assistance

Premium payment reminders ensure timely financial commitment for policyholders. Contact information includes phone numbers, email addresses, and office hours for customer support representatives. This allows clients to inquire about payment methods, due dates, or discrepancies. Providing detailed assistance options, including toll-free numbers or online chat services, enhances customer experience. Effective communication ensures policyholders maintain their coverage seamlessly, avoiding lapses that may affect claims or benefits. Having clear contact options promotes trust and reliability in the insurance experience.

Comments