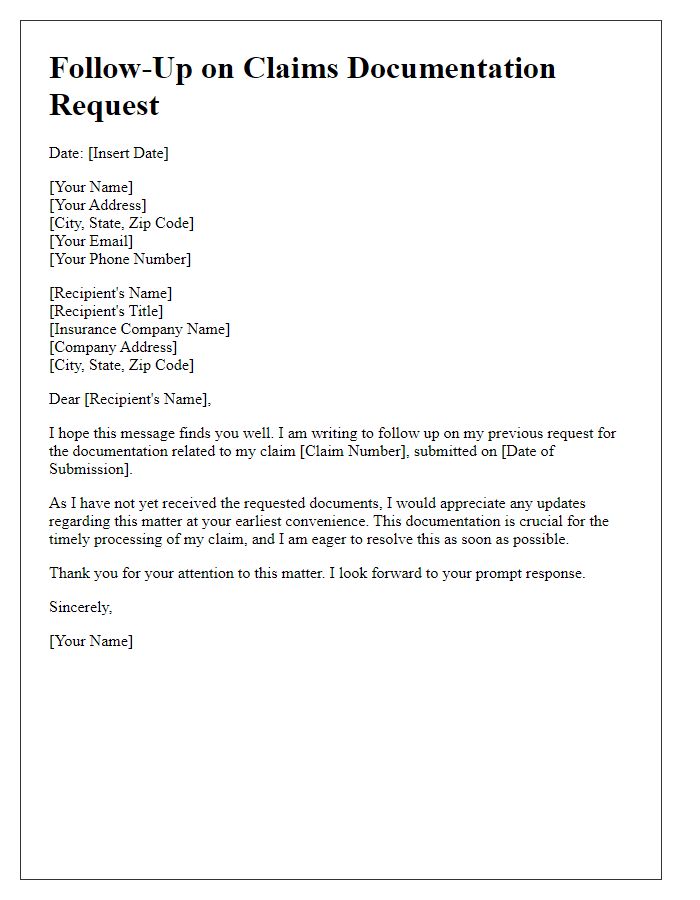

Welcome to our comprehensive guide on crafting a letter for claim documentation requests! Whether you're navigating insurance claims, warranty issues, or other formal requests, knowing how to communicate your needs clearly is essential. In this article, we'll walk you through the key elements to include in your letter to ensure it is both effective and professional. Ready to learn the ins and outs of this important process? Let's dive in!

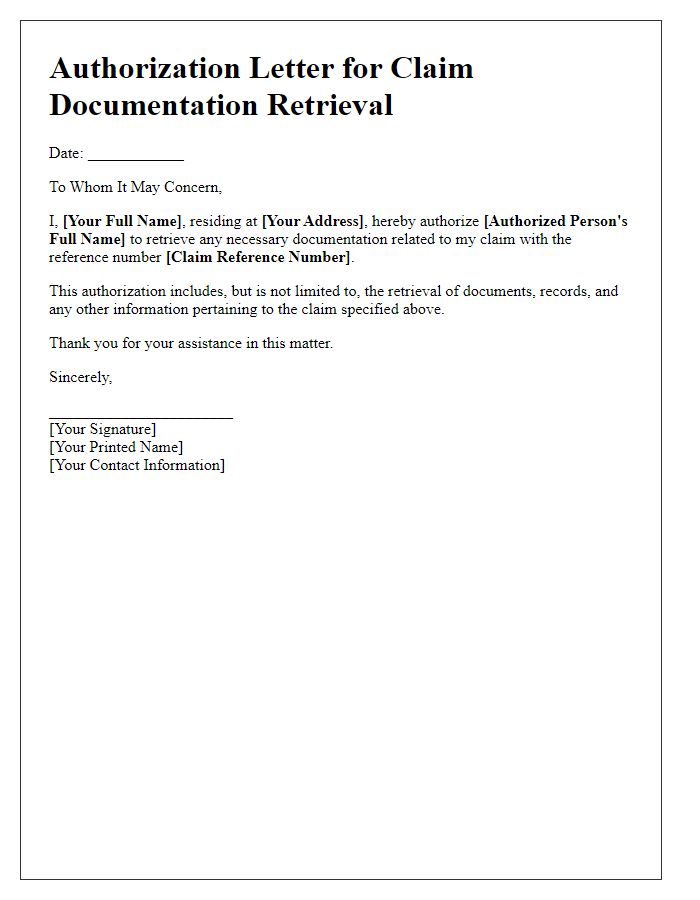

Clear Identification of Parties Involved

In legal claims, clear identification of the parties involved is crucial for accurate documentation and processing. The claimant (the individual or entity making the claim) should provide full legal name and contact information, including address and phone number. The defendant (the individual or entity against whom the claim is being made) must also be clearly identified with their full legal name and contact details. Specific roles in the context of the claim should be delineated, highlighting relationships such as employee-employer, contractor-client, or manufacturer-consumer. Additionally, references to pertinent case numbers, such as those from previous legal proceedings or documentation, enhance clarity. Proper identification can prevent misunderstandings and streamline the claims process, ensuring all parties are notified and involved appropriately.

Concise Reason for Documentation Request

In legal and insurance matters, documentation is essential for substantiating claims. Accurate records, including contracts, receipts, and incident reports, provide necessary evidence for assessing liability and damages. A comprehensive documentation request outlines specific items needed for fulfilling a claim, ensuring clarity and transparency in proceedings. Critical documents might include medical records indicating treatment for injuries sustained, photographs capturing the incident scene, or invoices detailing incurred costs. Such requests facilitate prompt evaluations and resolutions, aligning with legal requirements and organizational policies. Timely provision of requested documentation can significantly expedite the claims process, contributing to effective case management.

Specifics of Required Documentation

Claim documentation encompasses various essential components vital for successful case processing. Items such as the original receipt provide proof of purchase and item details, while photographs of the damaged or lost items serve as visual evidence for claims. Additionally, incident reports detailing the circumstances surrounding the loss or damage deepen the context of the situation. Supporting documents like police reports or witness statements may enhance credibility, especially in cases involving theft or accidents. Financial records may indicate the value of the claim, while correspondence with other parties, such as insurers or service providers, sheds light on prior communications. All requested documentation should comply with the specified format and submission guidelines to ensure streamlined processing.

Deadlines and Timelines for Submission

The deadlines for claim documentation submission are critical to ensure timely processing and approval. For claims related to insurance, the standard submission period typically spans 30 days from the date of the incident. For instance, if a vehicle accident occurs on July 15, 2023, all necessary documents, including the police report, photographs, and medical records, must be submitted by August 14, 2023. In cases such as workers' compensation claims, different states may have varying deadlines; for example, California mandates claims be filed within 30 days following an injury. Timelines for additional follow-ups or appeals often extend to 90 days post-initial decision, with each insurance provider possessing its own unique requirements. It's essential to track these timelines diligently to avoid potential claim denials or delays in benefits.

Contact Information for Further Queries

Contact information for further queries regarding claim documentation should include a reliable and easily accessible source such as a dedicated claims hotline. For instance, a toll-free phone number (1-800-555-0199) allows immediate communication for urgent inquiries. Additionally, email contact (claims@insurancecompany.com) provides a written communication option for detailed questions or document submissions. Office hours (Monday to Friday, 9 AM to 5 PM EST) ensure availability for assistance during standard business hours. Providing a physical address (123 Insurance Lane, Suite 100, Cityville, State, ZIP) allows for mailing of documents or formal correspondence. Utilizing these contact methods streamlines the claims process, enhances customer service, and facilitates efficient resolution of any issues.

Comments