Are you ready to secure your peace of mind with a seamless home insurance renewal? We know how important it is to protect your home and belongings, and our tailored renewal offers are designed to fit your unique needs. With competitive rates and comprehensive coverage, we ensure you won't miss out on the best benefits available. Stick around to learn more about how our renewal process can save you time and money!

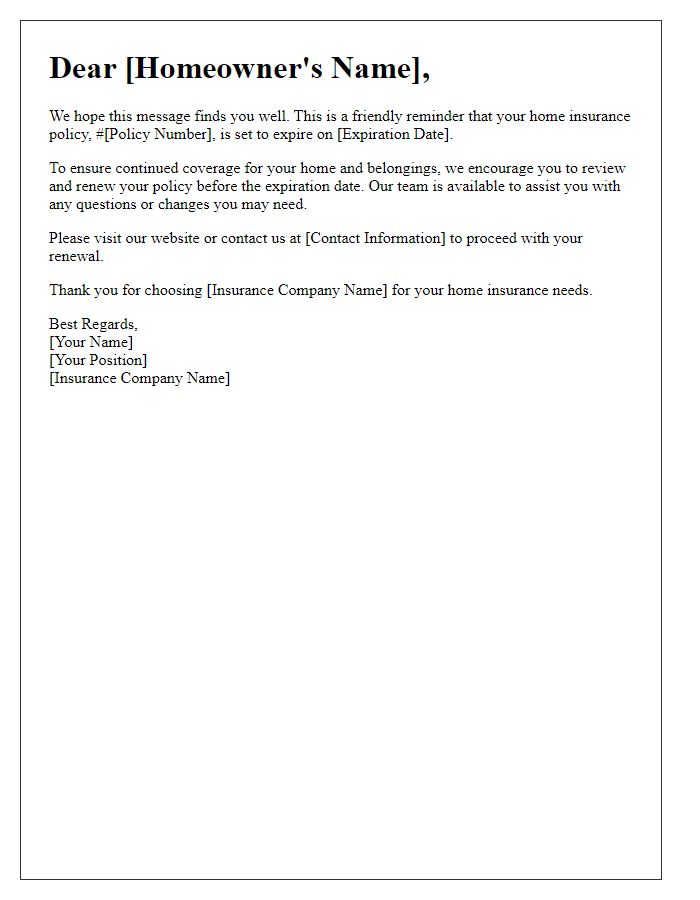

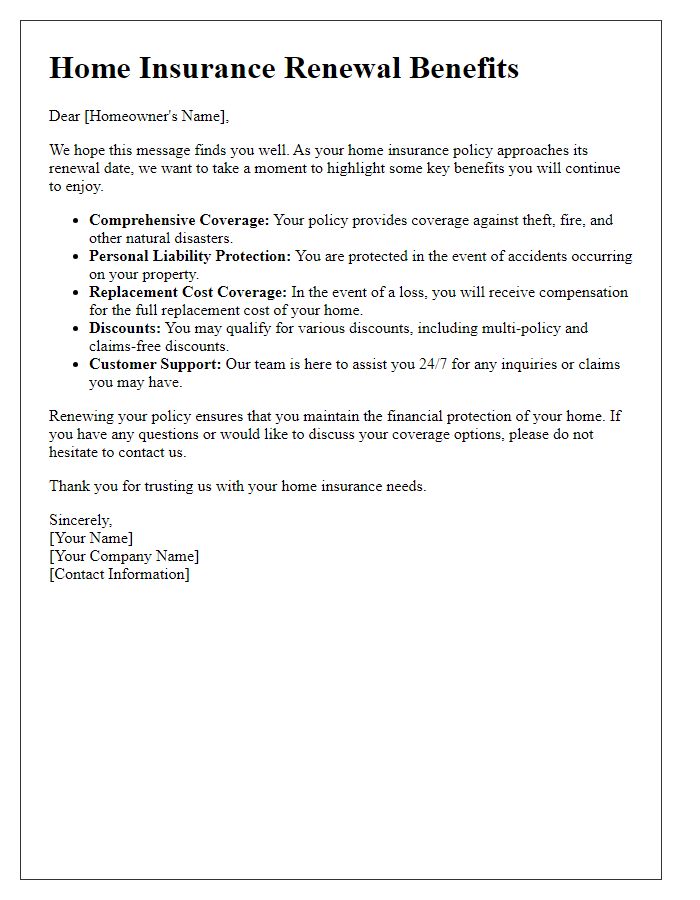

Personalization and customer details

Home insurance renewal notices often include personalized information to enhance customer engagement. This allows customers to easily identify the specifics of their policy, including the coverage amount, which might be $250,000 for dwelling protection. Additionally, the renewal offer may highlight any changes in premium rates, for instance, an increase from $800 to $850 annually, alongside personalized discounts based on claims history or loyalty rewards. Important dates, such as the policy expiration date on December 31, can also be emphasized, reminding customers to review their current coverage needs. Providing a dedicated customer service contact, like a representative named Sarah Brown, offers customers a clear path for inquiries or adjustments. Engaging language and clear formatting help ensure that all critical elements of the renewal offer are easily accessible and understandable.

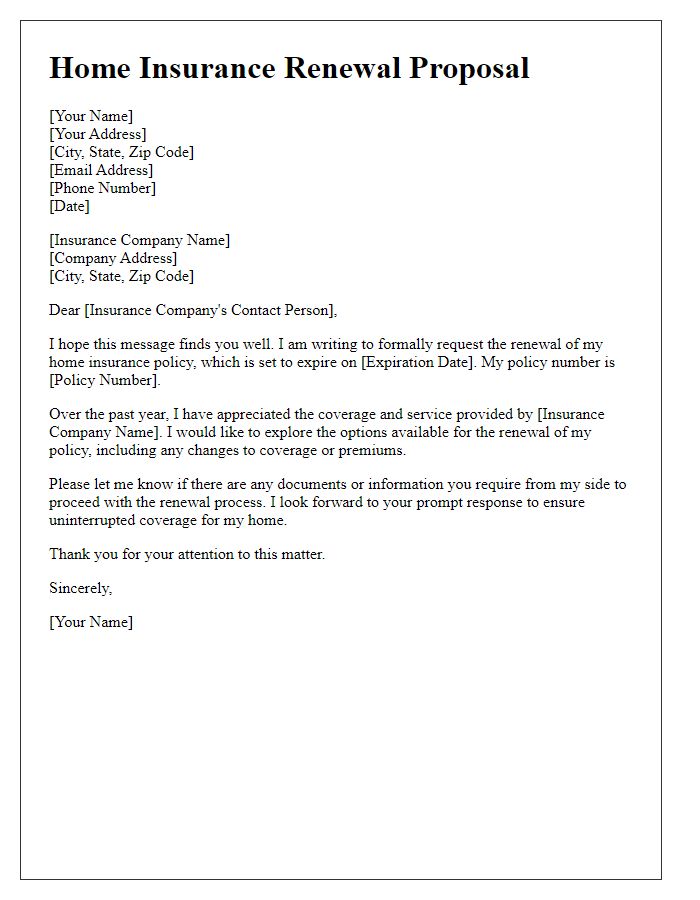

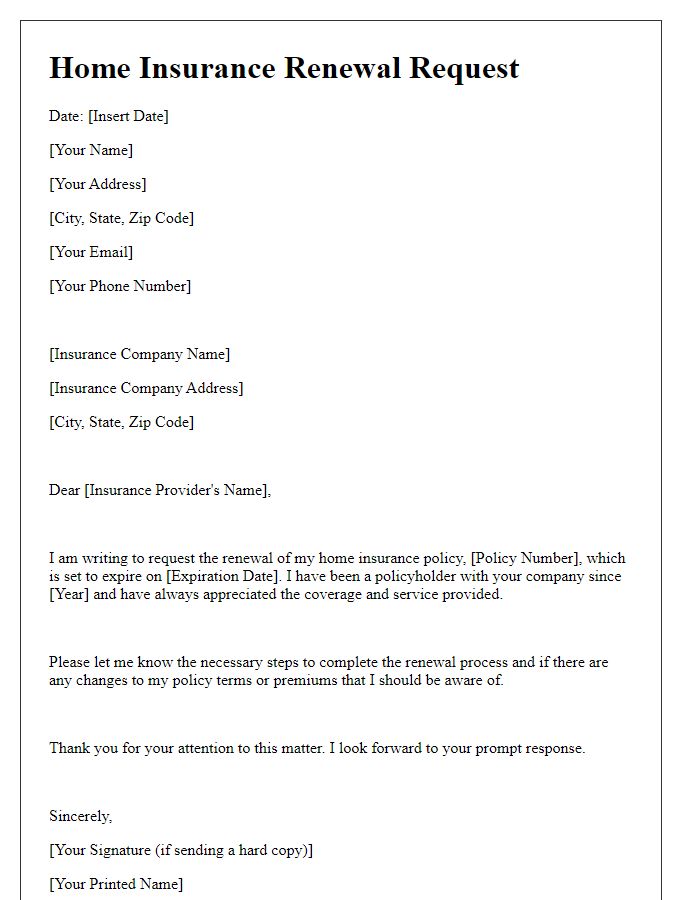

Renewal policy terms and conditions

Home insurance renewal offers typically include terms and conditions that outline coverage limits, premium amounts, deductibles, and factors influencing rates, such as location risk in areas like flood-prone regions or earthquake zones. Policies often provide coverage for structural damage, personal property protection, and liability claims arising from accidents on the premises. Insurers may also state provisions for exclusions, such as damage from natural disasters, and requirements for regular home maintenance to maintain coverage eligibility. Changes in local laws or building codes can further affect the renewal terms, necessitating informed decisions about coverage adjustments. Review notices regarding adjustments in premium due to market fluctuations or claims history, ensuring understanding of the complete policy implications for financial planning.

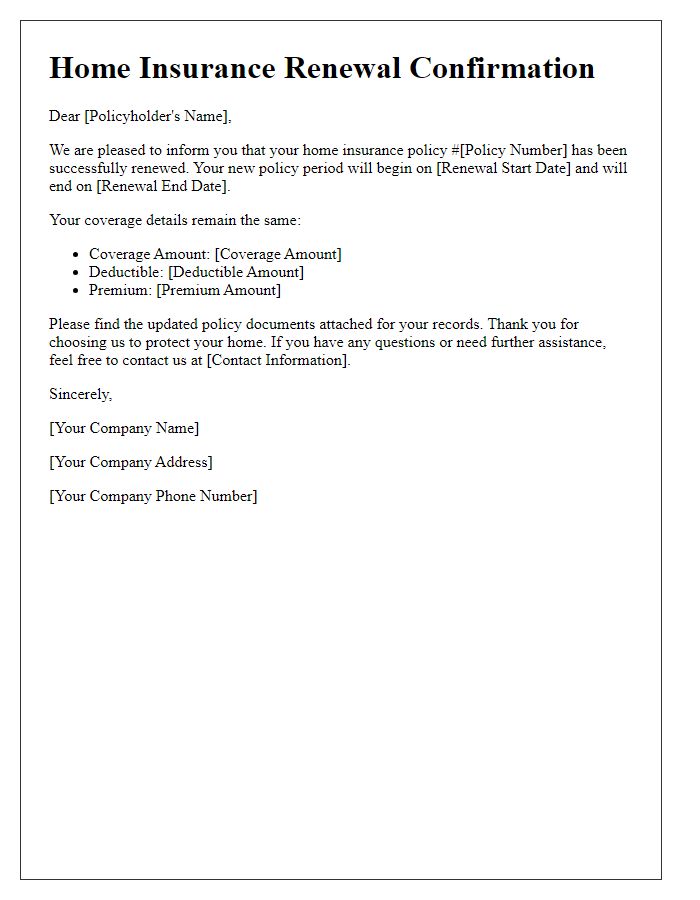

Coverage details and updates

Home insurance policies provide essential financial protection for property owners, safeguarding against risks such as fire, theft, or natural disasters. The typical coverage might include dwelling coverage, personal property protection, liability protection, and additional living expenses for temporary relocation. Policies may vary significantly in terms of limits--often ranging from $100,000 to millions depending on the property's value--and deductibles, which can differ from $500 to $5,000. Updates to policies may result from changes in local regulations, adjustment in replacement costs due to inflation, or changes in the insured's living situation, such as renovations. Important endorsements, for instance, water backup or identity theft protection, might enhance coverage, addressing specific needs that standard policies may not cover. Reviewing the policy annually ensures that it remains adequate, reflecting the current value of the home and its contents, while also considering market trends influencing premium rates, generally fixed annually or semi-annually.

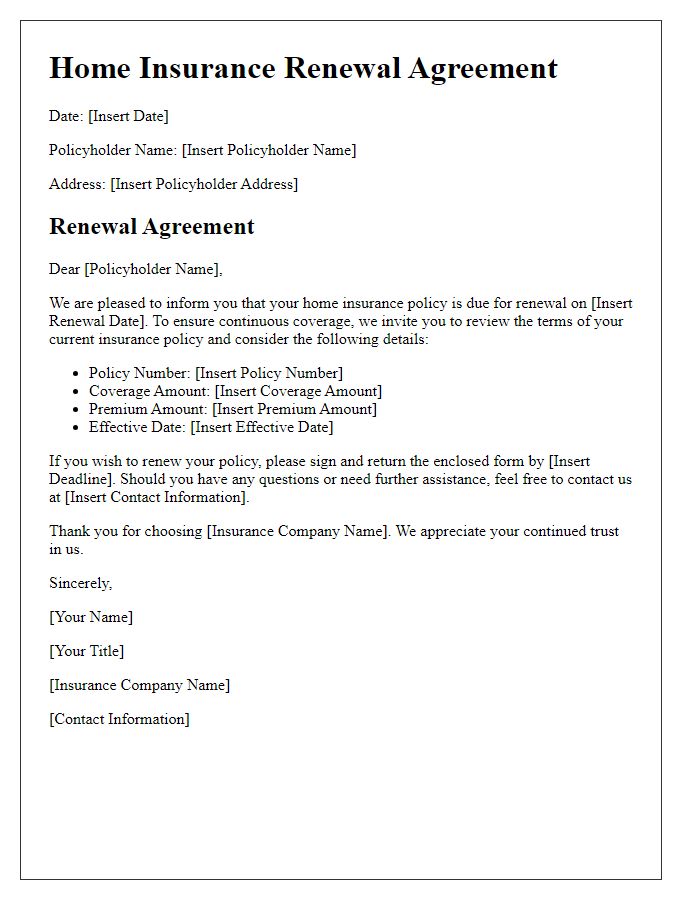

Renewal premium and payment options

Home insurance renewal offers often include essential details such as premium amounts, coverage enhancements, and payment options. For instance, a renewal premium of $1,200 may be offered for comprehensive coverage that includes liability protection up to $300,000, personal property protection valued at $100,000, and additional living expenses coverage in case of home displacement. Payment options can include annual payment in full, quarterly installments of $300, or monthly payments, which may total around $100 per month. It is also important to note any discounts available, such as loyalty discounts for policyholders with a history of continuous coverage or multi-policy discounts for bundling home insurance with auto insurance, making the renewal process more affordable.

Contact information for inquiries and support

Homeowners insurance policies require attention to detail and timely renewal to maintain coverage. Policyholders should carefully review the conditions and terms specific to their home insurance provider, including coverage limits, deductible amounts, and additional endorsements. Inquiries and support for home insurance renewals are typically available through customer service hotlines or dedicated email support. Insurance companies may offer various communication channels, including online chat options and mobile app notifications for policy updates. Ensuring that policyholders have updated contact information for their insurance agent or customer service representatives can facilitate a smooth renewal process, avoiding any potential lapses in coverage that may arise.

Comments