Are you curious about how collateral protection insurance can safeguard your assets? This type of insurance is designed to protect lenders from potential losses due to borrowers neglecting to insure the collateral backing their loans. Whether you're a borrower or a lender, understanding the ins and outs of this insurance can offer peace of mind and security. Dive deeper into the details of collateral protection insurance and find out how it can work for you!

Policy Details and Coverage

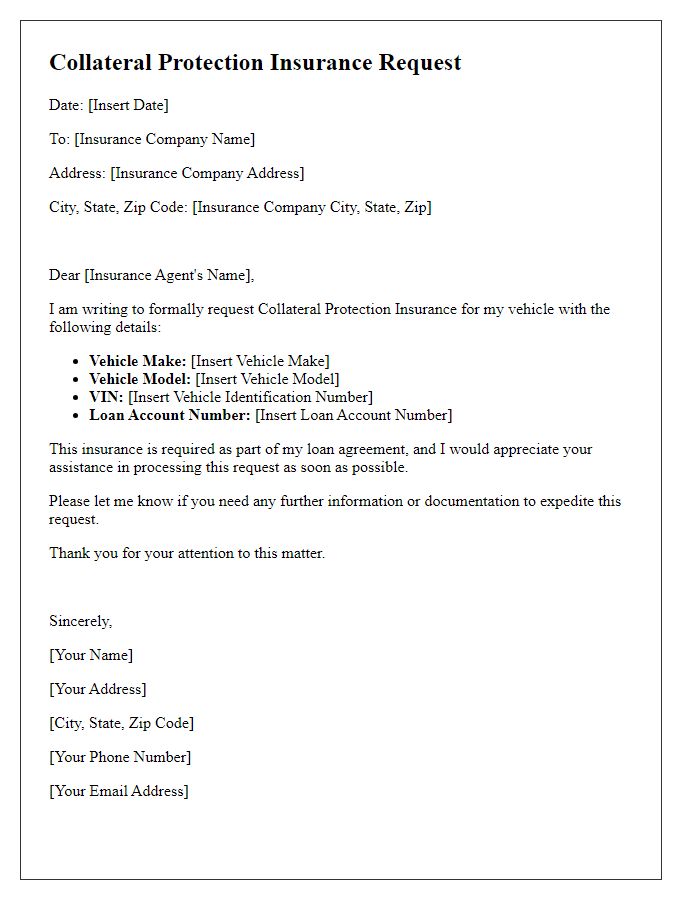

Collateral protection insurance (CPI) is a specialized insurance designed to protect lenders' interests in collateralized loans, particularly for vehicles. This policy typically covers losses due to physical damage, theft, or total loss of the collateral asset, such as automobiles or trucks typically financed through dealerships. Coverage amounts can range significantly, often matching the loan balance, but may vary by lender and specific policy terms. Lenders often require borrowers to maintain CPI if traditional insurance is insufficient or lapses. Premiums for CPI can vary based on factors like asset value and risk assessment, often leading to higher costs given the limited scope of coverage. This insurance mechanism ensures that lenders are safeguarded from financial loss associated with their investments in collateralized assets.

Contact Information

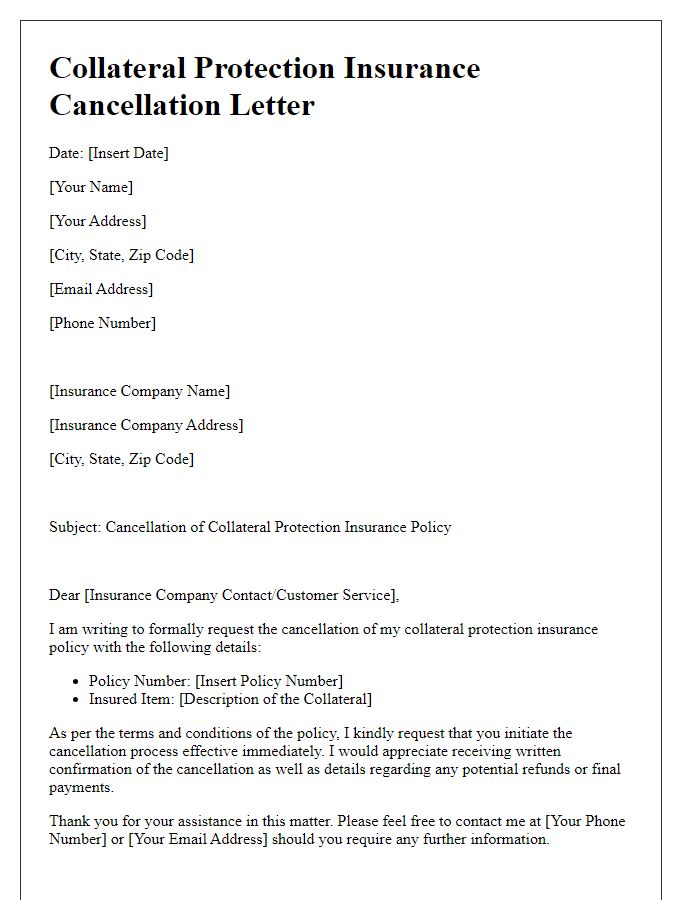

Collateral protection insurance is a type of insurance designed to protect lenders against the risk of potential loss or damage to collateral, typically vehicles or other assets, used to secure loans. This insurance usually comes into play when borrowers neglect to maintain their own insurance policies, thereby leaving the lender exposed. Contact information plays a crucial role, including phone numbers, email addresses, and physical addresses of both the insurance provider and the lender, ensuring efficient communication. This information is vital for claims processing and policy management. Furthermore, knowing the specific representatives or departments responsible for handling collateral protection inquiries can expedite assistance during critical financial situations.

Payment Instructions

Collateral protection insurance (CPI) is essential for lenders to protect their interests in the event of borrower default. Payment instructions should be clear and concise, guiding borrowers on fulfilling their insurance premiums. Typically, lenders will specify various payment methods, such as bank transfers, online payments, or mailed checks. Each option may include specific details such as account numbers, payment addresses, or secure online portals for transactions. It is important for borrowers to adhere to deadlines to avoid lapses in coverage, which can lead to financial losses. Timely payment ensures ongoing protection for collateral assets, such as vehicles or properties, thus safeguarding both borrower and lender interests.

Lender's Rights and Responsibilities

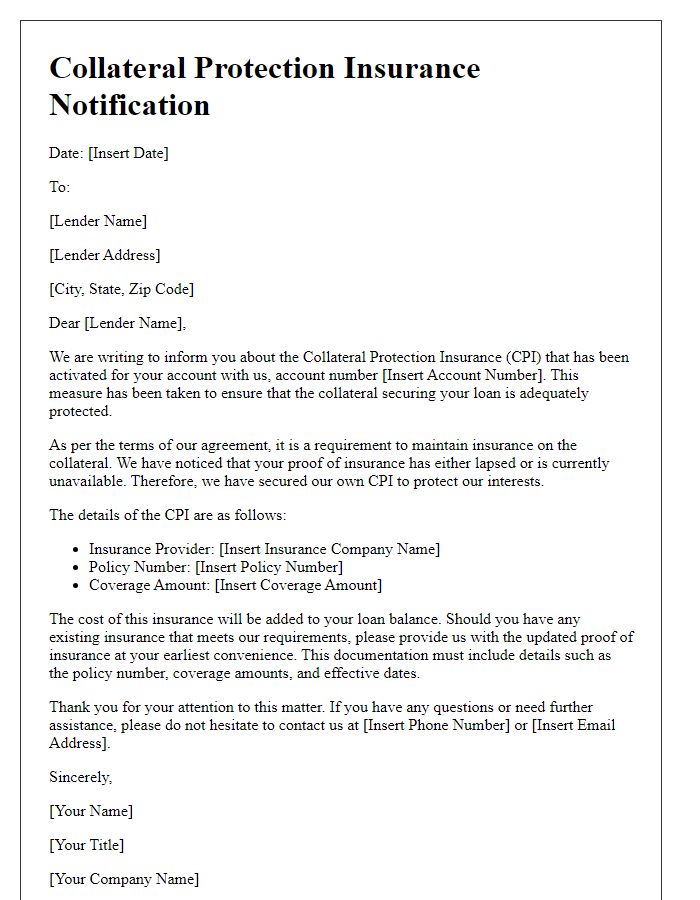

Collateral protection insurance (CPI) is a vital policy providing financial security for lenders, such as banks or credit unions, during the loan lifecycle. Normally, CPI is triggered when a borrower fails to maintain adequate insurance coverage on the collateralized asset, which may include vehicles, real estate, or equipment. Lenders possess the right to secure this insurance to protect their financial interests, ensuring the collateral retains its value in case of damage or loss. Responsibilities include notifying borrowers promptly about insurance lapses, offering clear communication regarding the implementation of CPI, and adhering to state regulations governing insurance practices. Understanding these obligations not only protects lender assets but also fosters trust and transparency in borrower-lender relationships.

Notification of Changes

Collateral protection insurance, commonly known as CPI, serves to protect lenders from potential losses on loans that are secured through collateralized assets. This insurance type typically activates when a borrower fails to provide proof of their own insurance on a financed vehicle, such as a Ford F-150, or any other valuable asset. Lenders, such as banks or credit unions, might initiate CPI after detecting an insurance gap, which can occur when a borrower cancels their policy or allows it to lapse without notifying the lender. Changes in CPI coverage often influence the overall loan terms and may incur additional costs for the borrower. Understanding the specifics of these changes, including premium adjustments and coverage limits, is essential for both lenders and borrowers to maintain financial security and avoid unnecessary escalation of fees.

Comments