Are you facing the challenging situation of an employment insurance termination? Navigating the complexities of this process can be daunting, but you're not alone. In this article, we'll break down the essential steps you need to take to make it as smooth as possible. So, grab a cup of coffee and join us as we explore the ins and outs of employment insurance terminationâkeep reading for valuable insights and practical tips!

Employee Information

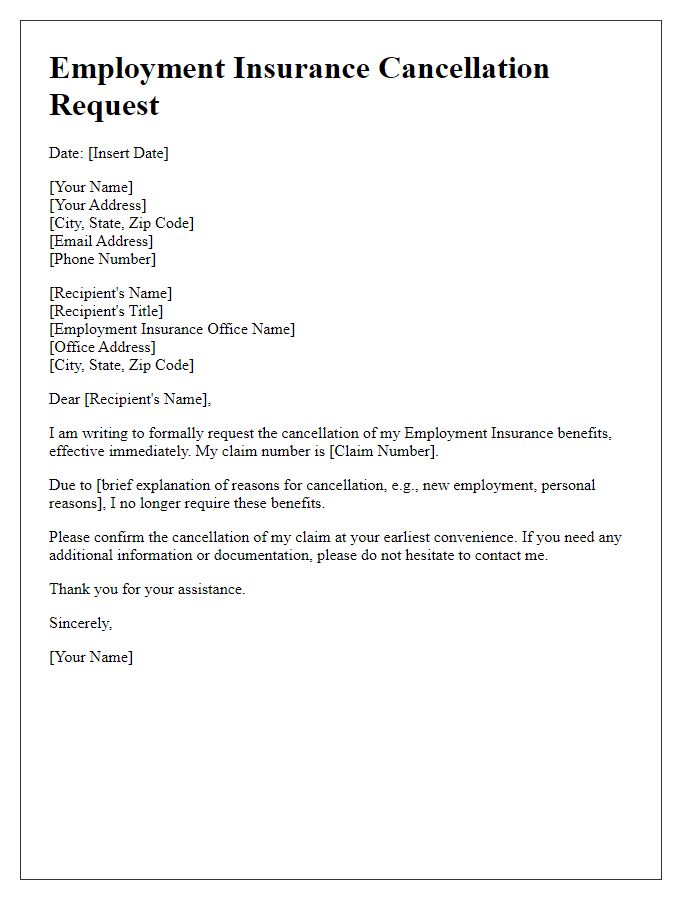

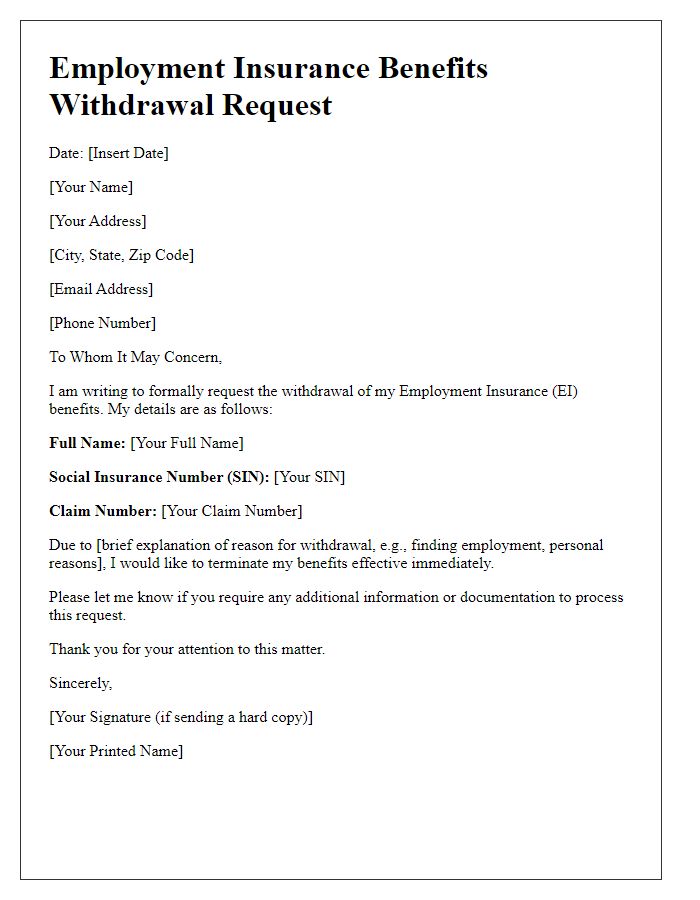

The termination of employment insurance can significantly impact an individual's financial stability, particularly when facing challenges like job loss or reduced hours. Employees may receive formal notices detailing their eligibility, requirements for continued benefits, and specific deadlines. Notifications typically include information such as claimant identification numbers, the employer's legal business name, and the date of the employment termination event. Clarity on reasons for termination, whether due to redundancy or misconduct, will help outline the next steps in the claims process. Understanding rights under relevant legislation, such as the Employment Insurance Act specific to Canada, is crucial for navigating this complex situation.

Termination Date

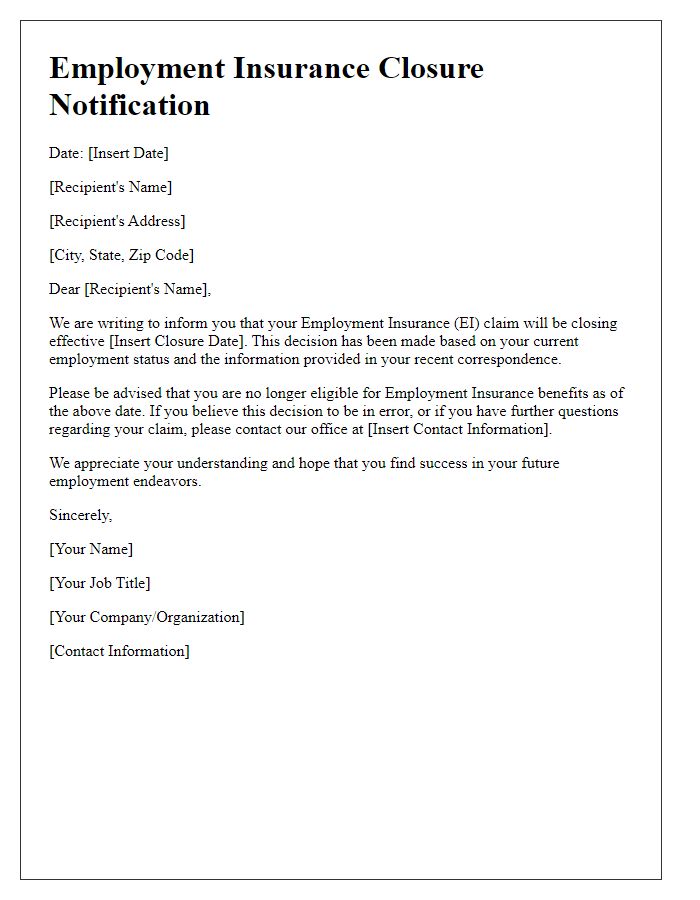

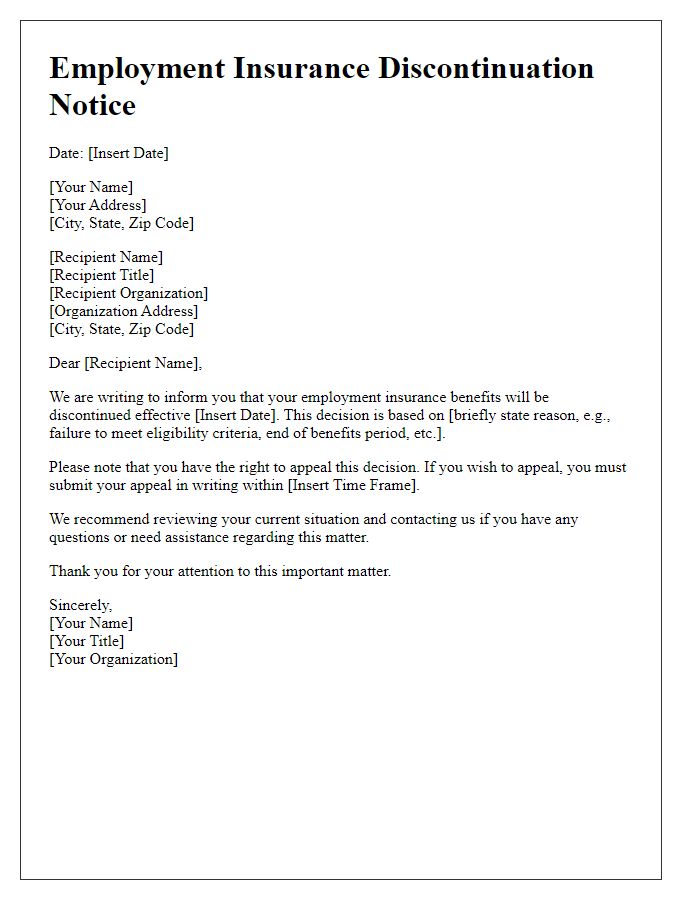

Employment insurance termination occurs when an individual's benefits cease, often due to factors such as a return to work, failure to meet eligibility requirements, or expiry of the benefit period. Termination notifications typically include the effective date, which can significantly impact claimants' financial planning. Claimants should be aware that their last day of eligibility may fall on a date close to their re-employment date. Relevant agencies, such as Service Canada, provide guidelines on how to navigate the termination process and what steps should be taken afterward to possibly reapply for benefits. Understanding the implications of this date is crucial for ensuring financial stability during the transition period.

Reason for Termination

Employment insurance termination occurs when benefits are no longer received by individuals, typically due to reasons such as returning to work, exceeding income thresholds, or changes in eligibility criteria. In many cases, claimants might be required to provide documentation proving re-employment or changes in financial status, reflecting income above allowable limits as outlined by employment agencies. Communication about this termination must be clear and prompt to avoid confusion regarding future claims. Relevant dates, such as the last day of eligibility and the effective date of termination, must be included to ensure proper processing by unemployment offices.

Details of Insurance Coverage

Employment insurance termination can significantly impact an individual's financial stability. Insurance coverage typically includes benefits that provide temporary financial assistance to individuals who lose their jobs through no fault of their own. For instance, in Canada, regular benefits can amount to 55% of the average insurable earnings, up to a maximum cap of CAD 650 per week, varying based on employment history and regional unemployment rates. Coverage generally spans a maximum of 45 weeks, depending on the recipient's accumulated hours of insurance and the unemployment rate in their area. Termination of this insurance coverage may occur due to various factors, including returning to work, failing to meet eligibility requirements, or not actively seeking employment. Individuals receiving notification of termination must understand their rights and the implications on their health and financial wellbeing.

Contact Information for Inquiries

Employment insurance termination often raises concerns regarding future benefits and eligibility. Individuals may need to reach out to specific contact points for inquiries. For instance, Service Canada, the primary government agency handling employment insurance in Canada, provides a dedicated phone line at 1-800-206-7218 for general queries. Additionally, individuals can access online resources through the official website at www.canada.ca/en/services/jobs/training/employment-insurance.html. Local Service Canada centers located across major cities like Toronto and Vancouver also offer personalized assistance for terminating claims or addressing any misunderstandings regarding benefit eligibility. Keeping this contact information handy ensures prompt resolution of any issues that may arise during the transition from employment insurance.

Comments