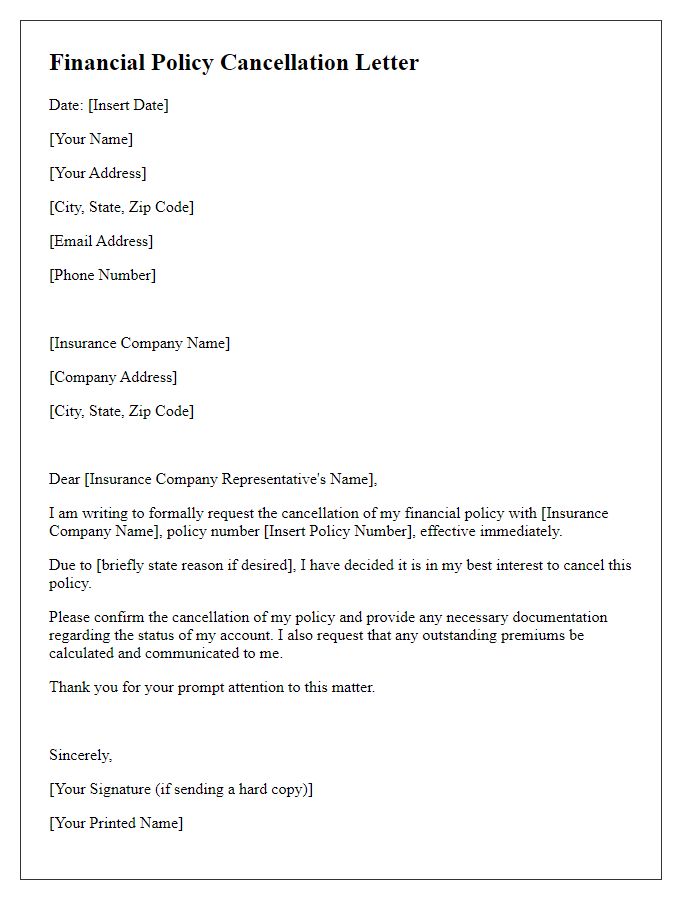

Are you considering canceling a policy but unsure about how to communicate your decision? Navigating through such formalities can be daunting, but drafting a clear and concise cancellation notice is key. Whether it's an insurance policy or a subscription service, making sure you include all essential details ensures a smooth process. If you're curious about how to structure your cancellation letter effectively, keep reading for a comprehensive template that simplifies the task!

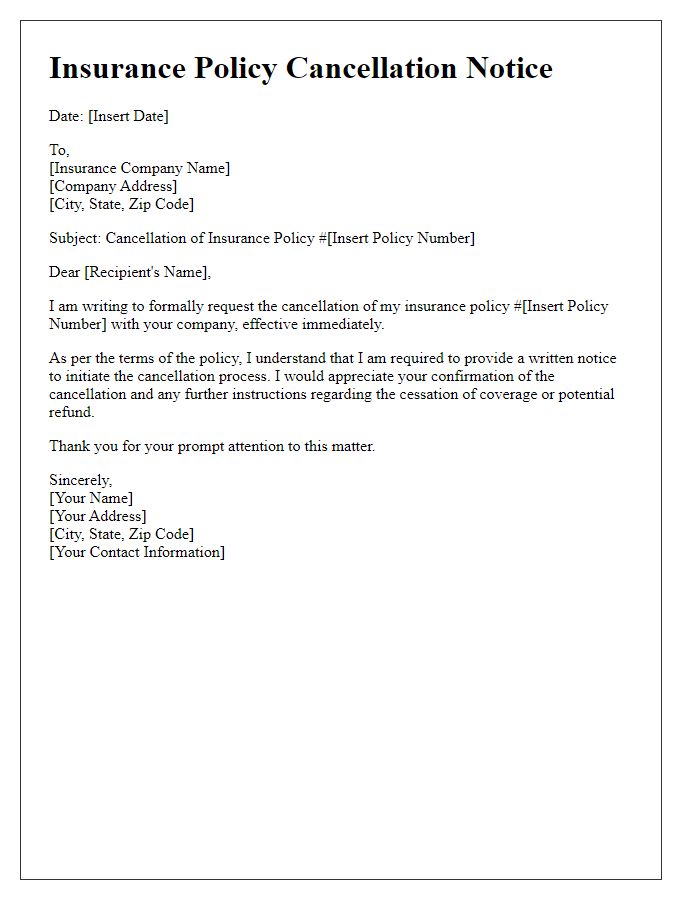

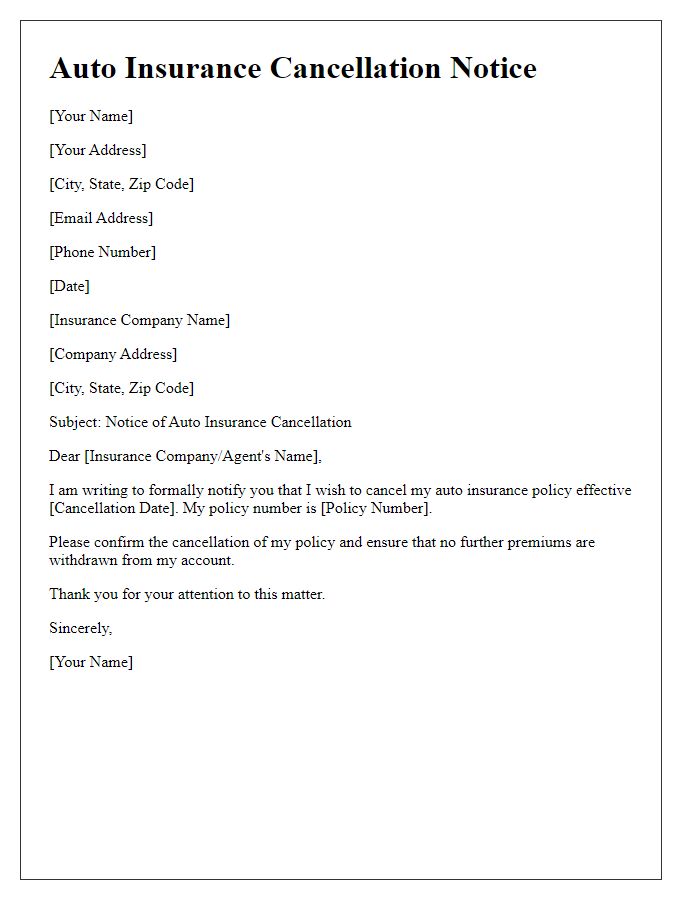

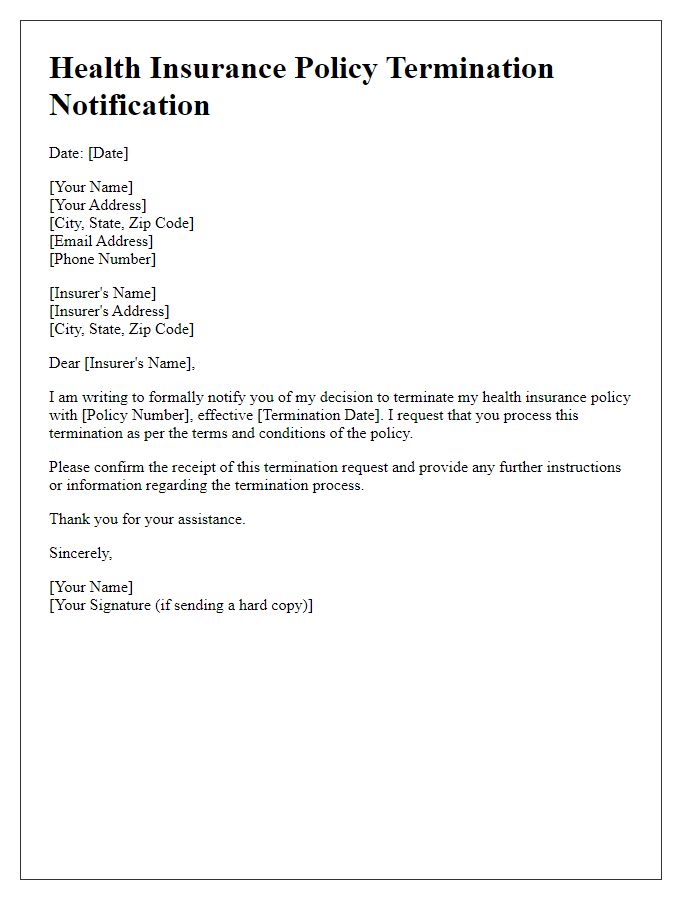

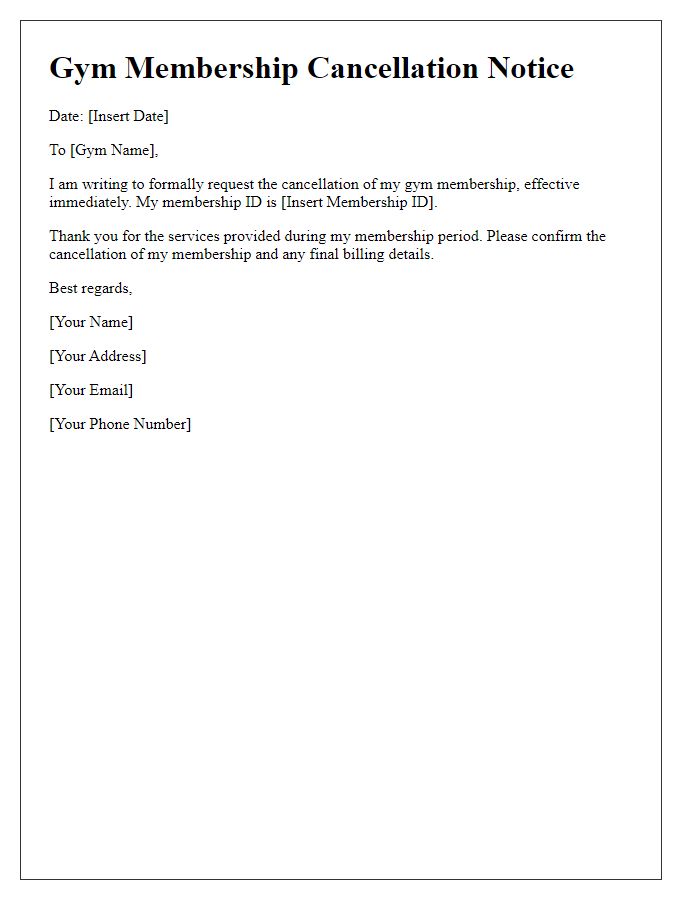

Policyholder Information

Policy cancellation can lead to significant changes in coverage and financial protection. A policyholder (individual or entity holding the insurance policy) may decide to cancel various types of insurance, including auto, health, or home insurance, each with specific implications. The cancellation date must be clearly stated to avoid misunderstandings. Important details such as the policy number (unique identifier for the insurance contract) and effective dates provide critical context. The policyholder should be aware of potential refunds, and penalties, or impacts on future coverage options during this process. It is recommended to communicate the decision with the insurance company promptly to ensure a well-documented cancellation process.

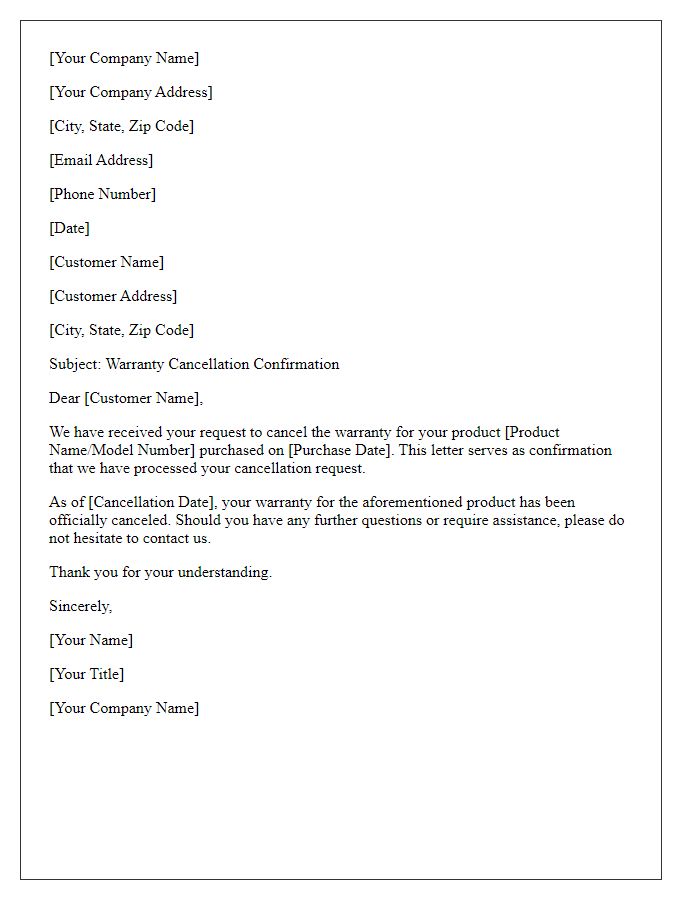

Policy Details

Insurance policy cancellation involves a formal procedure to notify the insurance company of the intent to terminate coverage. Policy details, such as the policy number (unique identifier for reference), the effective date of cancellation, and the name of the insured party, must be stated clearly. Other relevant information includes the reason for cancellation (e.g., relocation, finding a better premium rate), and the specific type of coverage being cancelled (auto, health, home). Additionally, it is essential to review the terms outlined in the original policy document regarding cancellation procedures and potential refunds. Providing a forwarding address for any future correspondence from the insurance provider is also advisable.

Effective Cancellation Date

Policy cancellation notices require clarity and precision. A policyholder needs to understand the effective cancellation date, which is the specific date when the insurance coverage will no longer be valid. For instance, if the insurance policy was issued by a well-known provider like Allstate, a notice could indicate that the effective cancellation date is March 31, 2024. This date marks the termination of benefits and any liabilities associated with the policy, ensuring that the policyholder is aware of the timeline to seek alternative coverage options if necessary. Key details like policy number, cancellation reason, and instructions for further steps might also be included to facilitate a smooth transition.

Reason for Cancellation

Policy cancellation notices often arise from various reasons such as changes in financial circumstances, finding a better deal, or dissatisfaction with service quality. Common financial factors include increased premiums (upwards of 20% in some cases) or the decision to switch to a different provider offering more comprehensive coverage options. Situations may also involve significant life changes, like relocation to a different state or country, impacting policy needs. In some instances, consumers may become dissatisfied due to customer service issues or claims handling experiences, leading to a preference for competitors with better customer satisfaction ratings. Understanding these reasons is crucial for insurance companies to address potential shortcomings and retain clients effectively.

Contact Information for Queries

In case of any inquiries regarding policy cancellation, individuals can reach out via the provided contact information. Customer service representatives are available to assist with questions related to the cancellation process. Emails can be sent to support@insurancecompany.com, and phone support can be accessed at 1-800-555-0199 during business hours, Monday through Friday from 9 AM to 5 PM, Eastern Standard Time. For additional assistance, customers can also visit the company's official website at www.insurancecompany.com, which features an extensive FAQ section and live chat support during operational hours.

Comments