Are you feeling overwhelmed with the process of obtaining pre-authorization for your health insurance? You're not aloneâmany find navigating the complexities of insurance requirements to be a daunting task. In this article, we'll simplify things by providing a handy letter template that can help you secure the approvals you need. So, let's dive in and ensure you have all the tools to make this process smoother and more effective!

Patient's Personal and Medical Information

Health insurance pre-authorization requires comprehensive patient information for evaluation. Patient's full name, such as Jane Doe, serves as the primary identifier. Date of birth, for instance, July 15, 1990, is essential for age verification and eligibility assessment. Medical record number, issued by the healthcare provider, aids in tracking patient history. Primary diagnosis, such as Type 2 Diabetes Mellitus, should be detailed with ICD-10 code E11. Additionally, treatment plan specifics, including medication regimen like Metformin 500 mg, must be outlined. Insurance details, for example, policy number H123456789, enable straightforward communication with the insurer. Contact information, including phone number and email address, is necessary for follow-ups and clarifications. Documentation of past surgeries or chronic conditions enriches the medical context crucial for authorization approval.

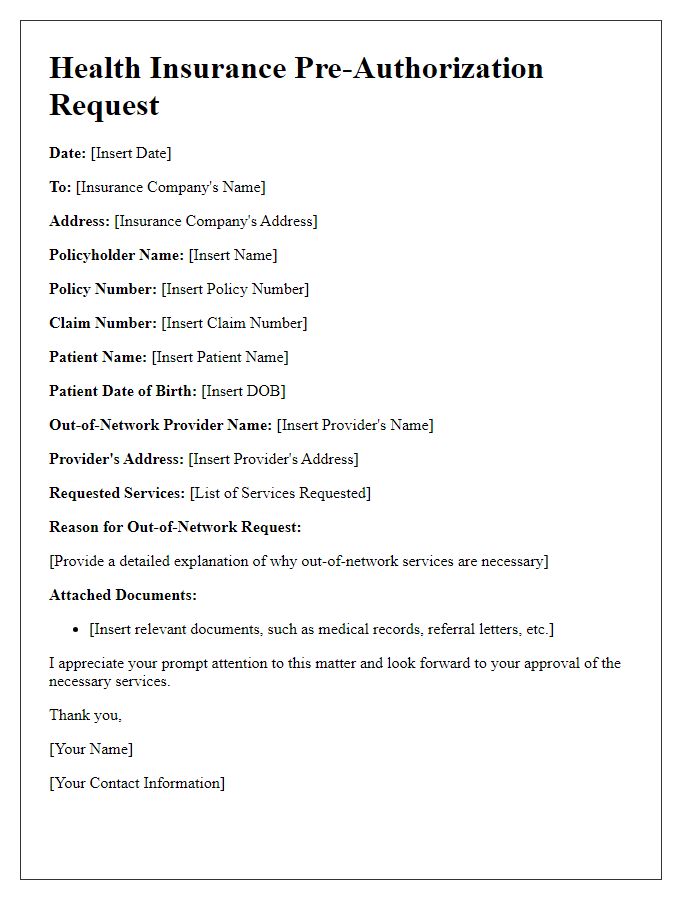

Detailed Description of Services Requested

Health insurance pre-authorization is a crucial process that involves obtaining approval for specific medical services before they are provided. This step ensures that healthcare providers, such as hospitals and specialists, submit detailed documentation to insurance companies outlining the necessity of the requested services, which may include imaging tests like MRIs, surgeries, or specialized treatments. Key details include patient information, ICD-10 diagnosis codes indicating the reason for the request, the CPT codes representing the services sought, and any previous medical history relevant to the decision. Insurance companies often require clinical notes, lab results, and referral letters to substantiate the need for services, thus promoting medical necessity and preventing unnecessary costs. The pre-authorization process typically takes several days, and timely submission of complete documentation is essential for achieving approval and ensuring continuity of care.

Medical Necessity Justification

The pre-authorization process for health insurance often requires a detailed justification of medical necessity for treatments or procedures. This process typically involves specific documents and a thorough explanation of why the requested service is essential for the patient's health. It is critical to include patient demographics, including name, birthdate, and insurance information, as well as the treating physician's details. Documentation should also encompass the patient's medical history, relevant tests, previous treatments, and a clear outline of the proposed treatment plan, supported by clinical guidelines or peer-reviewed studies. Emphasizing the potential risks of not proceeding with the treatment, along with a comprehensive assessment of expected benefits, can further strengthen the justification. This highly detailed submission not only aligns with insurance requirements but ensures that the patient receives timely and necessary care.

Provider's Credentials and Contact Information

Health insurance pre-authorization requires detailed provider credentials and contact information to facilitate claims processing. Key provider credentials include the National Provider Identifier (NPI), a unique identification number for healthcare providers in the United States, which ensures proper recognition by insurance companies. License numbers should highlight the state of practice, indicating compliance with local regulations. Contact information comprises a direct phone number and email address, enabling swift communication regarding pre-authorization requests. The provider's practice name and address must also be included, reflecting the location of services rendered. This comprehensive documentation expedites the authorization process, ensuring patients receive timely medical interventions.

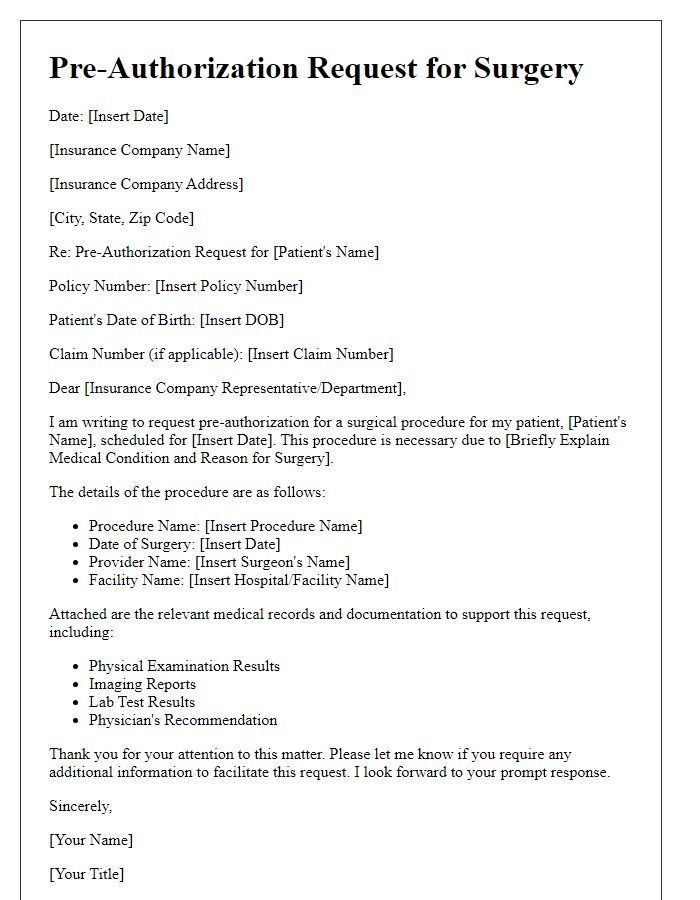

Required Documentation and Attachments

Health insurance pre-authorization requires specific documentation and attachments to ensure a smooth approval process. Essential documents include a completed pre-authorization request form, which outlines the patient's personal information, such as full name, date of birth, and insurance policy number. A detailed clinical summary, provided by the attending physician, should describe the medical diagnosis, necessary treatments, and how these align with the insurance provider's coverage guidelines. Diagnostic test results, like MRI scans or lab reports, must be included to support the need for treatment. Any relevant prior medical history or previous treatment records can further substantiate the necessity of the requested services. Additionally, a copy of the insurance card of both the primary and secondary insurers plays a critical role in verifying coverage. Including these documents expedites the review process, reduces delays, and increases the likelihood of approval for vital medical services.

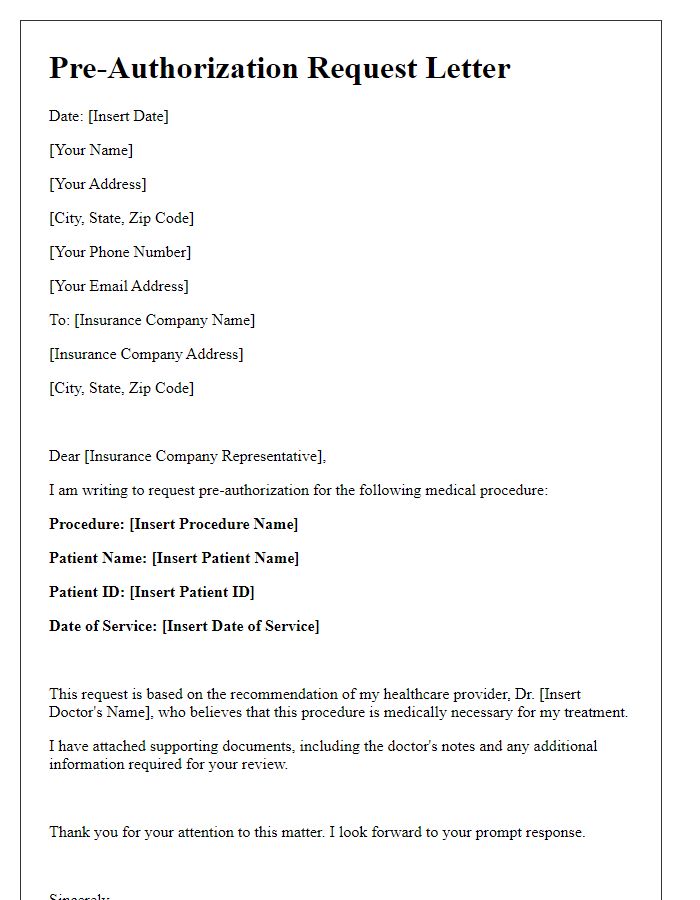

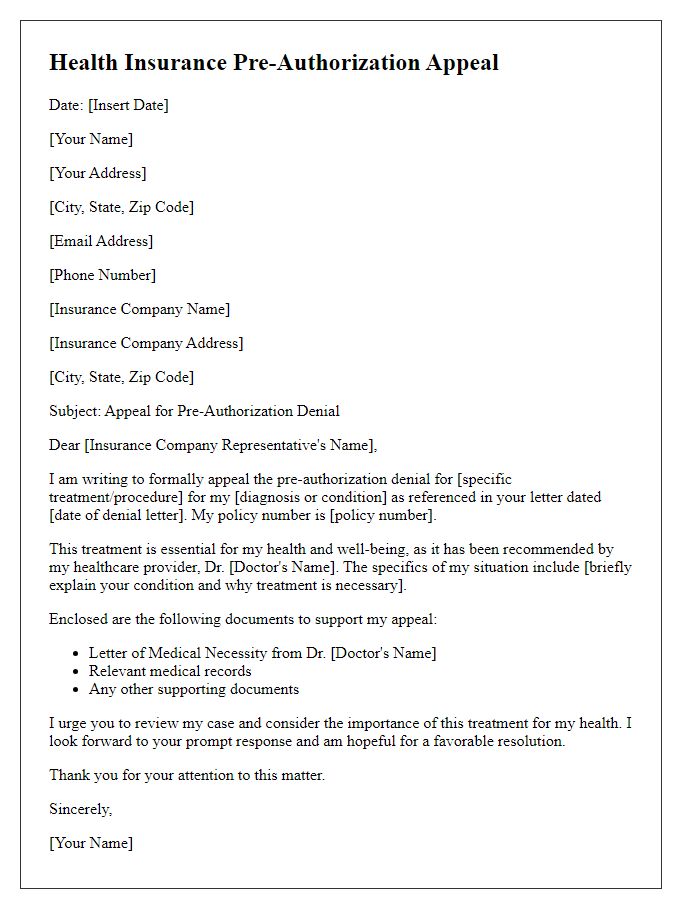

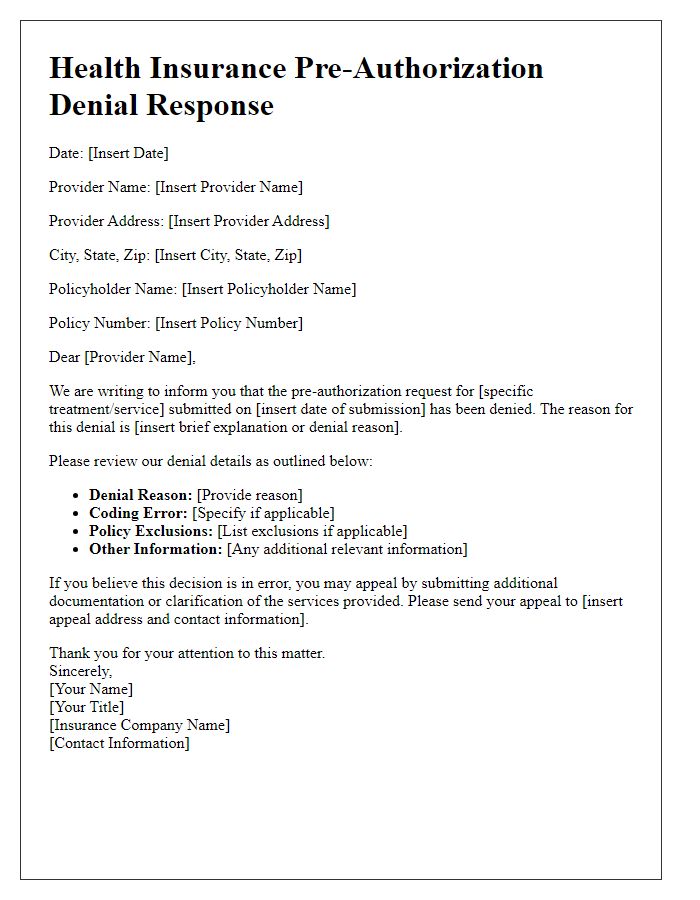

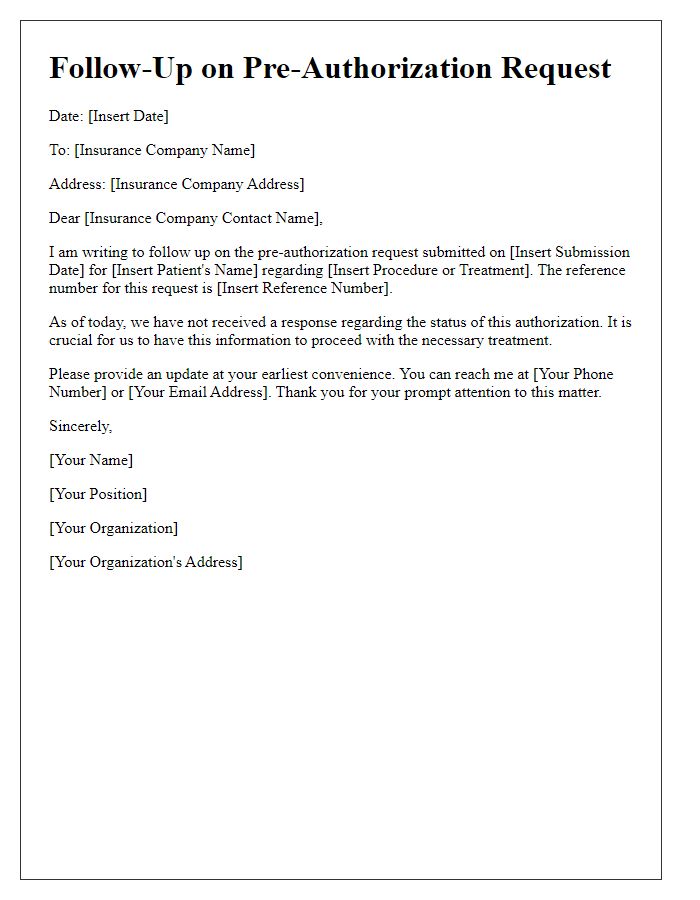

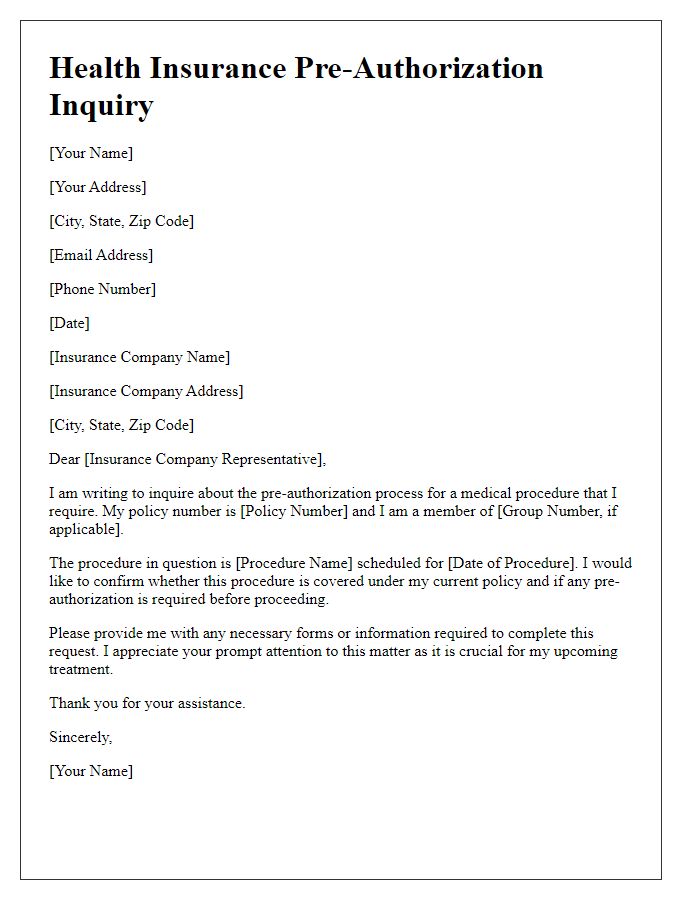

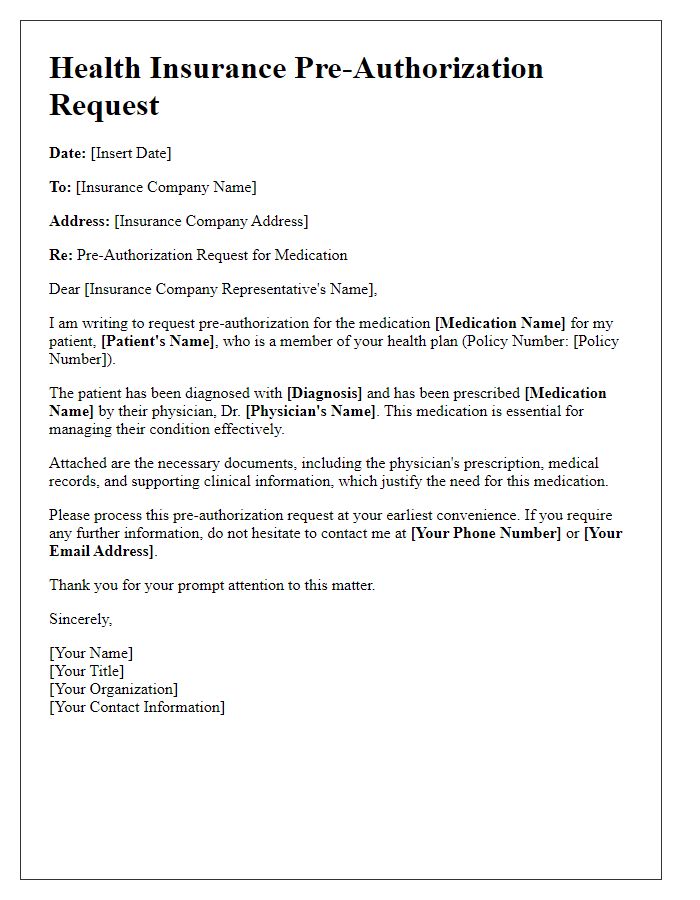

Letter Template For Health Insurance Pre-Authorization Samples

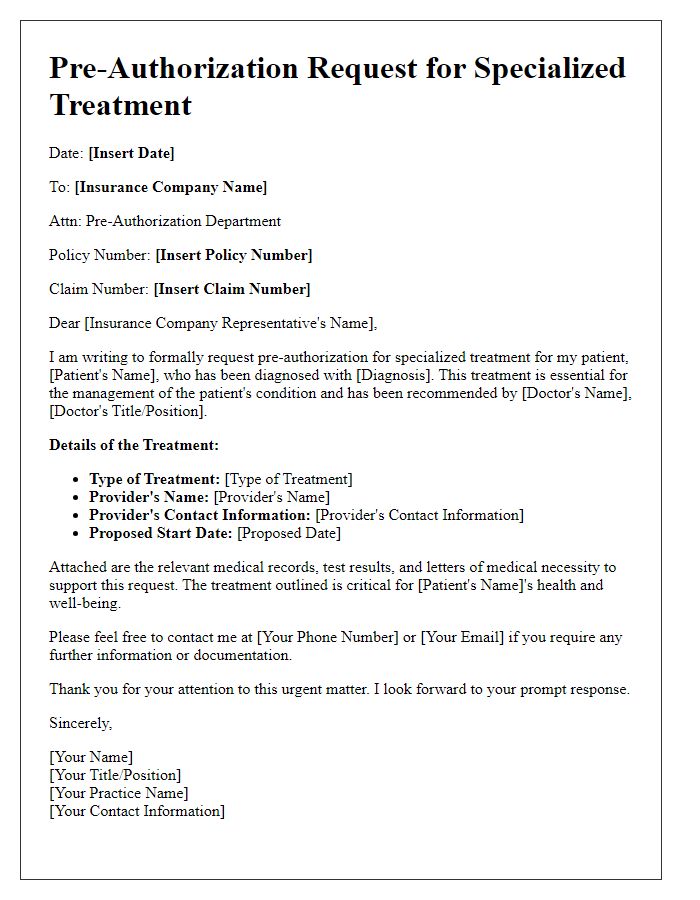

Letter template of health insurance pre-authorization for specialized treatments

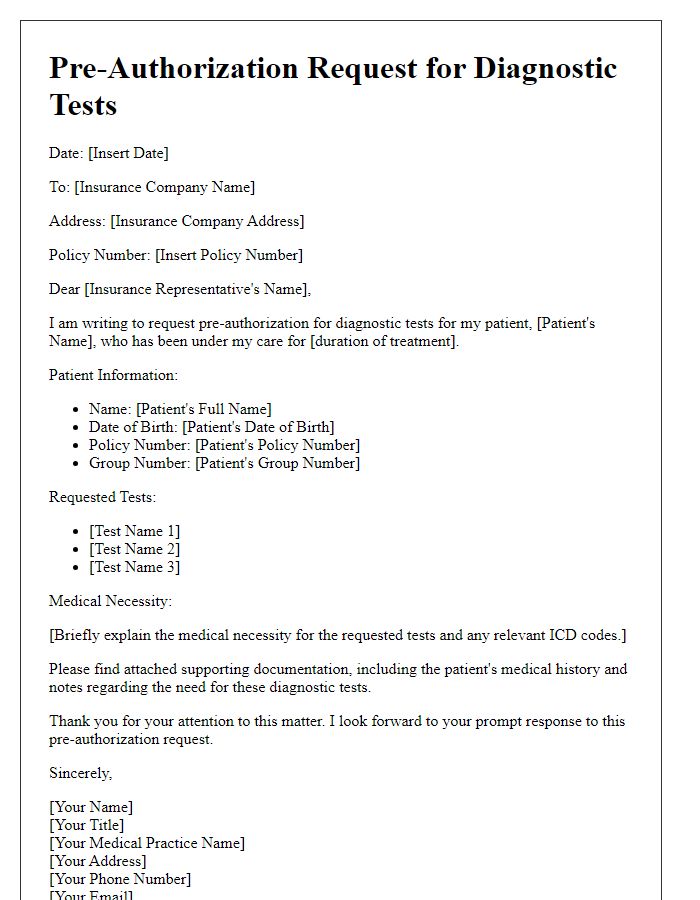

Letter template of health insurance pre-authorization for diagnostic tests

Comments