Have you ever received a letter from your insurance company denying coverage for a procedure or treatment you thought was necessary? It can be frustrating and confusing, leaving you wondering what your next steps should be. In this article, we'll break down the common reasons for coverage denials and guide you through writing an effective appeal letter to address those concerns. Keep reading to discover how you can advocate for your health and potentially overturn that denial!

Policy Terms and Conditions

Coverage denial explanations are based on specific policy terms and conditions, which outline the limitations of insurance coverage. Standard policies often specify exclusions such as pre-existing conditions, which can impact claims related to medical treatments. The maximum benefit limits, often stated in dollar amounts or service frequency, provide another common basis for denial. Time limits for filing claims, such as the requirement to submit within 90 days of service, can also lead to coverage denial. Additionally, lack of documentation, including required medical records or bills, may result in a claim being denied. Each insurance provider may have unique policy stipulations, making it essential for policyholders to thoroughly understand the specific terms outlined in their agreements.

Specific Exclusions

Insurance policies often contain specific exclusions, impacting claims processing. For instance, many plans exclude coverage for pre-existing conditions, defined as any medical issue diagnosed or treated within a designated timeframe, typically six months prior to coverage initiation. Treatment related to experimental procedures may also face denial, as many insurers specify that only FDA-approved treatments are covered. Additionally, certain high-risk activities, such as skydiving or mountain climbing, can lead to exclusions from coverage. Understanding these specific exclusions can significantly influence the outcome of a claim and the overall financial responsibility of the policyholder during a medical crisis.

Coverage Limits

Insurance policies often contain specific coverage limits, which define the maximum amount an insurer will pay for various types of claims. These limits can vary significantly depending on the policy type and may include caps for individual claims, aggregate totals, or specific incidents like property damage or personal injury. For example, a homeowners insurance policy might set a limit of $250,000 for dwelling coverage, meaning that claims exceeding this amount will not be paid in full by the insurer. Understanding these limits is crucial as they directly impact the financial protection available during unexpected events such as natural disasters or accidents. Additionally, certain riders or endorsements can modify these limits, but policies without such modifications will adhere strictly to the stated coverage caps, resulting in potential gaps during claims processing.

Supporting Documentation

Coverage denial explanations often require robust supporting documentation to clarify the reasoning behind the decision. Insurers typically cite specific policy provisions, medical necessity criteria, and evidence-based guidelines when denying claims. Essential documents include the initial claim form, detailed medical records, treatment plans, and any correspondence between the healthcare provider and the insurance company. Additional evidence may encompass peer-reviewed studies or expert opinions that support the medical interventions proposed. When assembling this information, it's crucial to ensure that it clearly addresses the specific reasons for denial, illustrating compliance with the insurance policy requirements. Properly formatted documentation can expedite the appeals process and increase the likelihood of coverage approval.

Alternative Options or Appeals Process

Insurance companies often deny claims for coverage based on specific policy exclusions or insufficient documentation. For individuals seeking to understand their options, numerous alternative avenues exist. Firstly, reviewing the policy document (which outlines covered services and exclusions) is crucial. In many cases, an appeals process allows policyholders to contest denials. This process often requires submitting additional documentation, such as medical records or expert opinions. Deadlines for the appeals process typically range from 30 to 180 days, varying significantly among insurers like Blue Cross Blue Shield or UnitedHealthcare. Engaging with a claims representative can facilitate clearer communication and insight into denied claims, aiding in the preparation for the appeal. Additionally, contacting state insurance regulators can provide guidance and support for navigating disputes with insurance providers.

Letter Template For Coverage Denial Explanation Samples

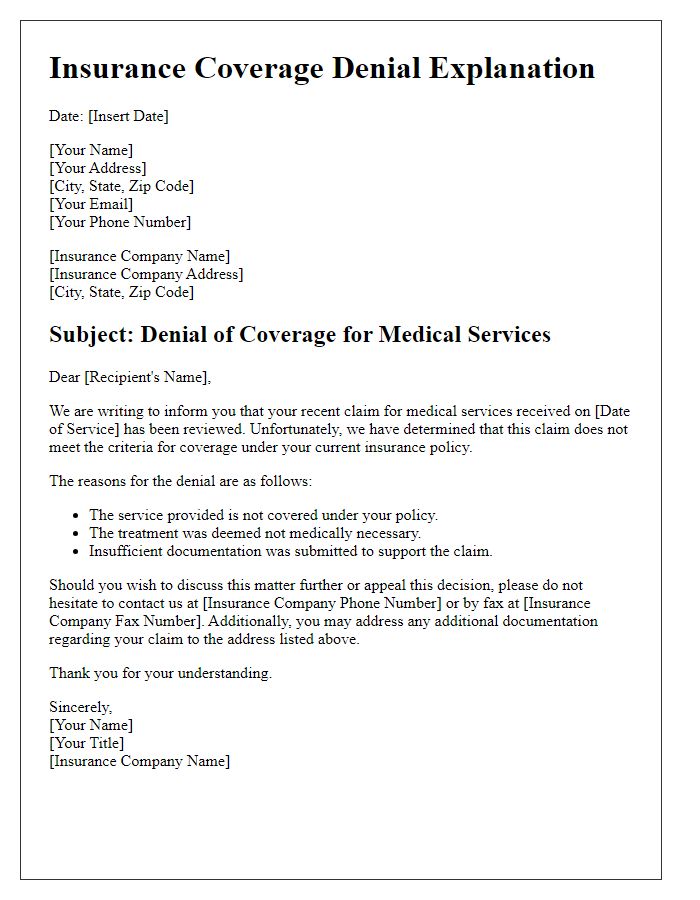

Letter template of insurance coverage denial explanation for medical services.

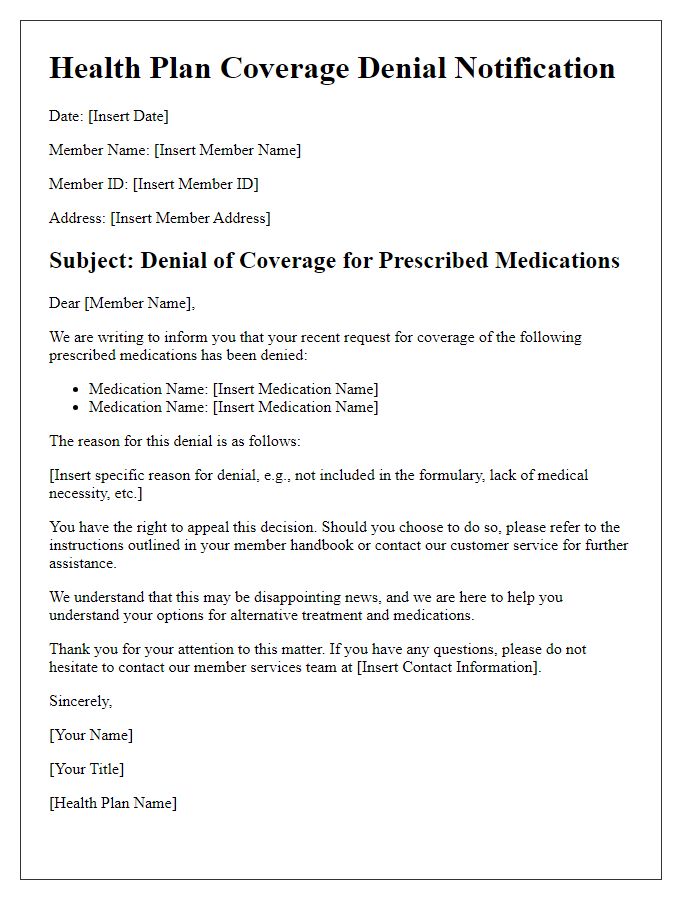

Letter template of health plan coverage denial explanation for prescribed medications.

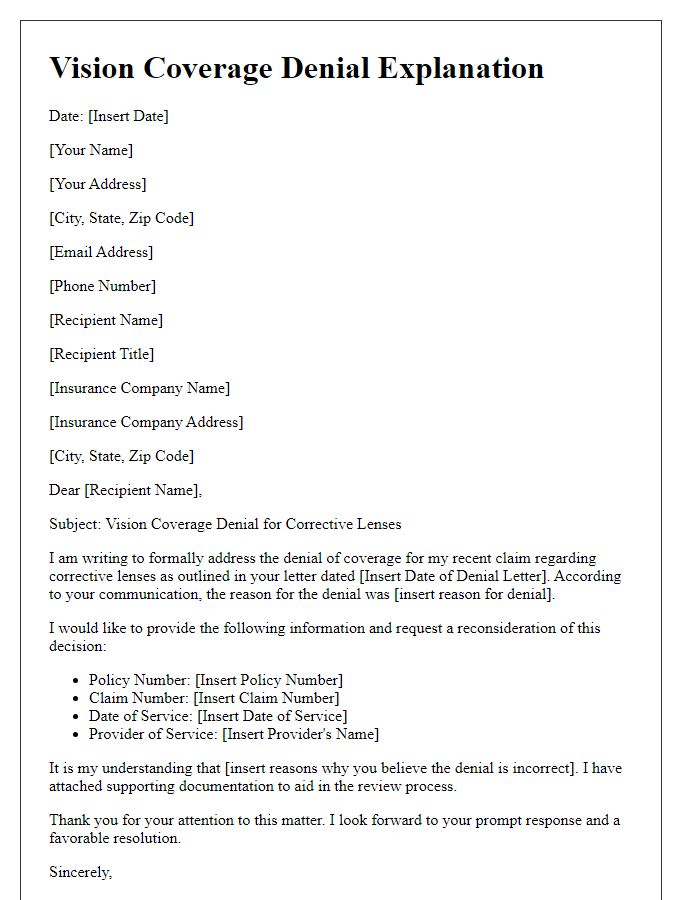

Letter template of vision coverage denial explanation for corrective lenses.

Letter template of policyholder coverage denial explanation for out-of-network providers.

Letter template of claims department coverage denial explanation for pre-existing conditions.

Letter template of employer-sponsored insurance coverage denial explanation for mental health services.

Letter template of Medicaid coverage denial explanation for essential health benefits.

Letter template of Medicare coverage denial explanation for home health care.

Comments