If you find yourself needing to navigate the accidental death claim process, it can feel overwhelming. Understanding the necessary steps and documentation required is crucial to ensure you receive the support you deserve during such a challenging time. In this article, we will break down the process into manageable parts, offering practical tips and insights to help you along the way. Join us as we explore this important topic in detail and empower you with the knowledge to move forward.

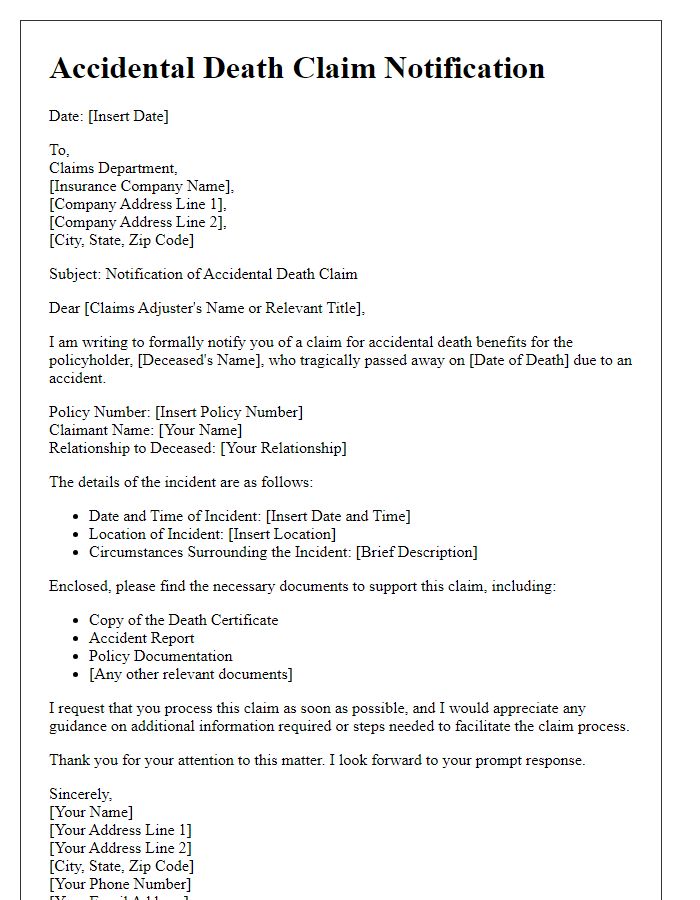

Policyholder's Information

Accidental death claims initiate a sensitive process requiring precise documentation from the policyholder, who holds the life insurance policy. The policyholder must provide detailed information including their full name, which identifies them in the insurance records. Date of birth is crucial for verifying the policyholder's identity, while the insurance policy number uniquely links the claim to the correct policy. Contact information, including a phone number and address, allows the insurance company to reach the policyholder for further communications. Additionally, the policyholder should include a description of the accidental death incident, specifying the date, time, and location, which greatly assists claims adjusters in their investigation. Documenting the relationship to the deceased, when applicable, helps clarify beneficiary rights and entitlements under the policy terms.

Incident Description

The tragic incident occurred on July 15, 2023, involving a motorcycle accident in Denver, Colorado. At approximately 5:30 PM, a 35-year-old male motorcyclist collided with a passenger vehicle at the intersection of Broadway and Colfax Avenue. Witnesses reported that the motorcycle was traveling at a high speed before the impact. Emergency response teams arrived on the scene shortly thereafter, but despite their efforts, the motorcyclist succumbed to his injuries at Denver Health Medical Center within an hour. The police investigation indicated that the driver of the passenger vehicle was making a left turn when the collision took place, leading to questions regarding traffic signal compliance at the heavily trafficked intersection. This incident highlights the dire consequences of traffic accidents and the need for enhanced safety measures in urban environments.

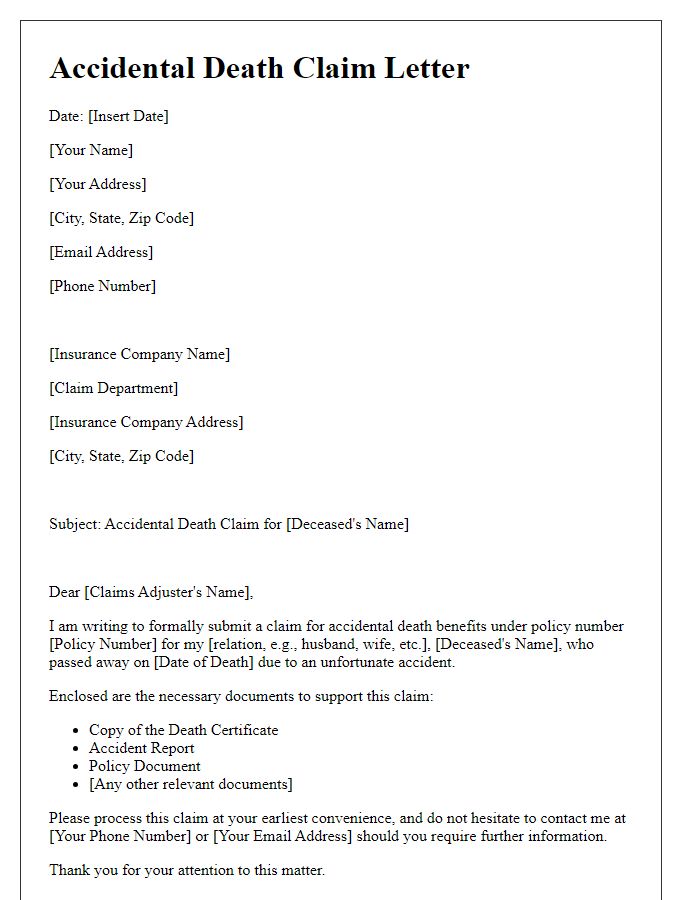

Required Documentation List

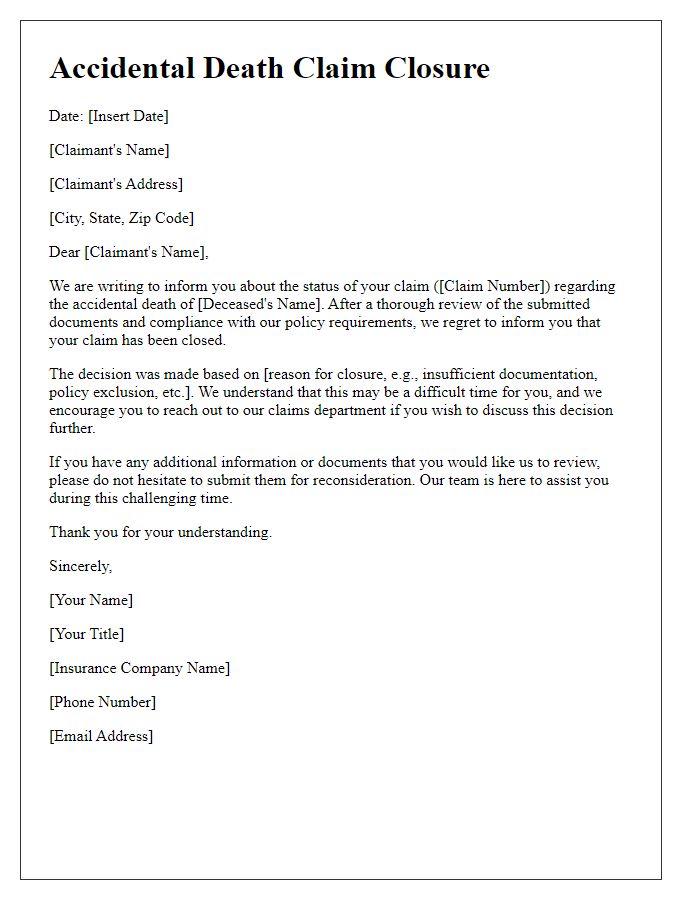

The accidental death claim process requires specific documentation to ensure a smooth and efficient evaluation by the insurance company. Essential documents include the original death certificate, which must detail the cause of death and be issued by a licensed medical professional or government authority, such as the Vital Statistics office. Additionally, the policyholder's insurance policy, including all terms and conditions, should be provided for reference. A completed claim form, often available on the insurer's website or through their customer service, is essential for processing. An accident report, typically filed by law enforcement, can verify the circumstances surrounding the incident. Finally, identification documents of the claimant, such as a government-issued ID or Social Security number, must be submitted to establish the claimant's eligibility for the benefits. This comprehensive documentation aids the insurance company in making timely and fair decisions on the claim.

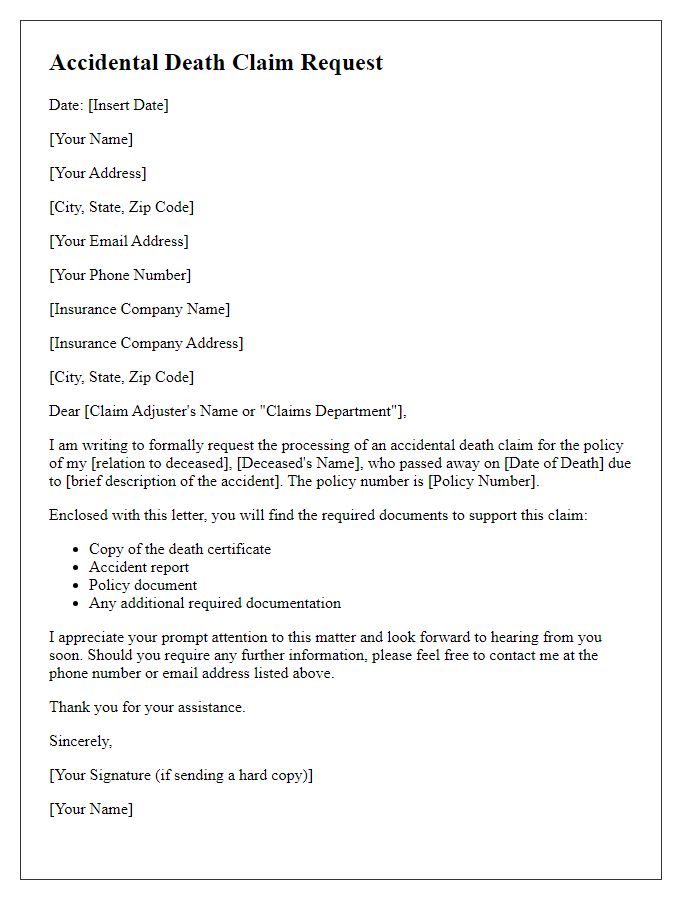

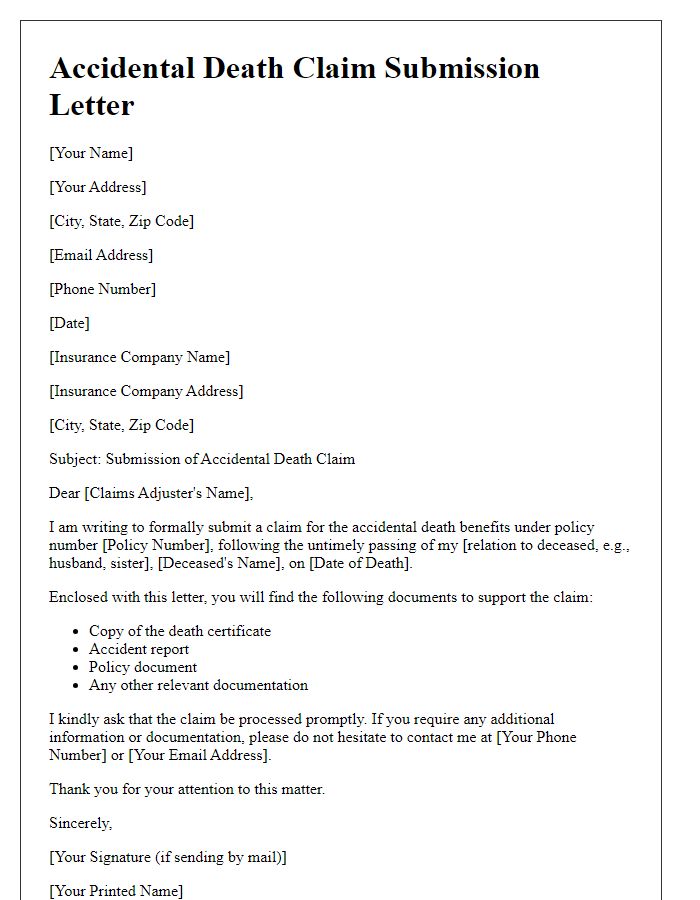

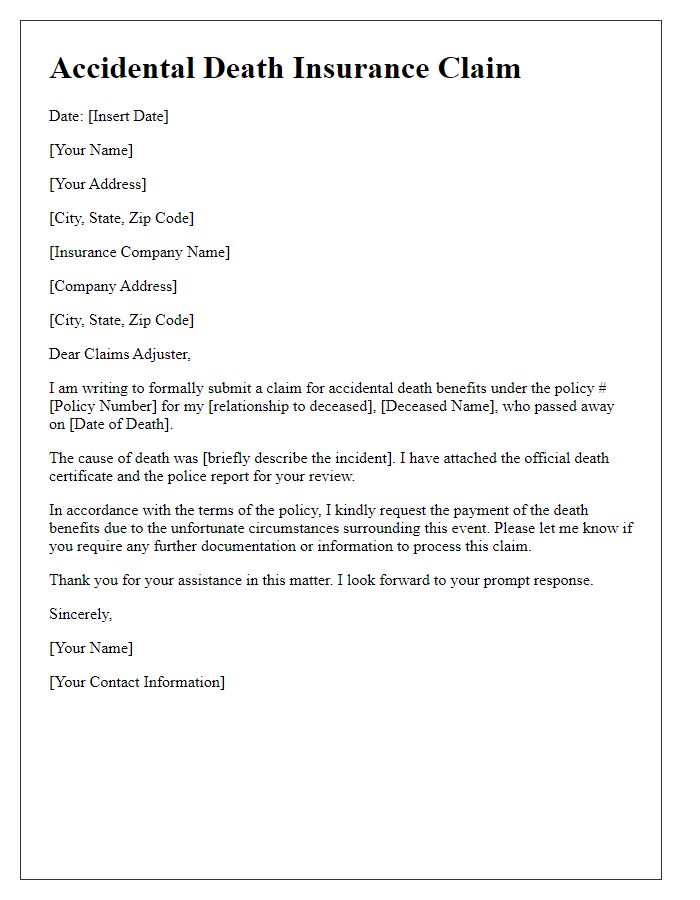

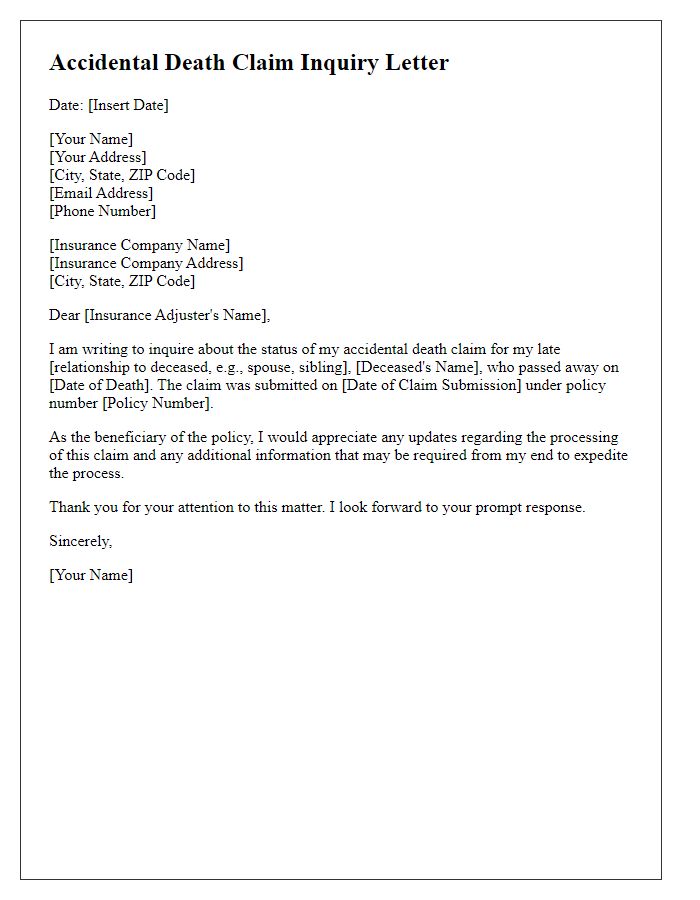

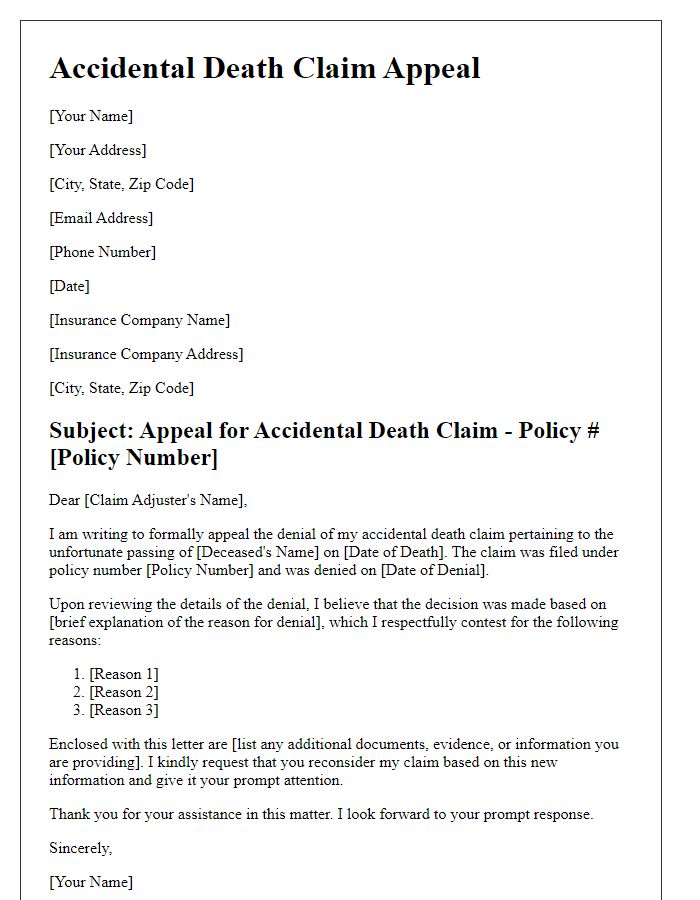

Claim Submission Instructions

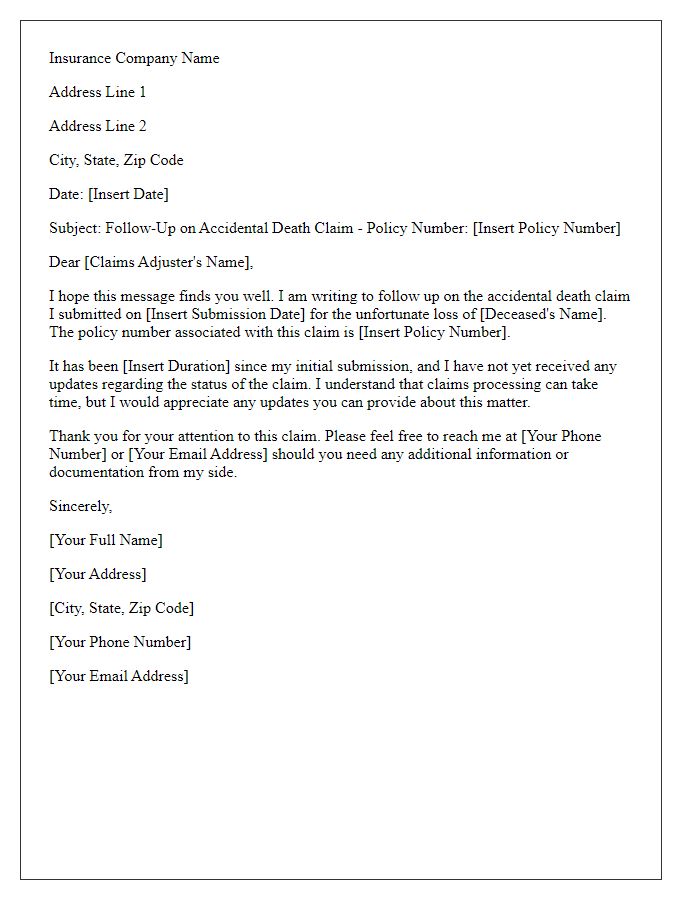

Accidental death claims require precise documentation to ensure proper processing. The claimant should gather key documents such as the deceased's death certificate, typically issued by the local government or hospital, and any police reports from the accident scene. Insurance policy information is essential, including policy numbers and coverage details, often found in the original insurance documentation. Additionally, identification of the claimant, such as a driver's license or passport, will help verify the relationship with the deceased. Submit these documents to the insurance company's claims department, often specified on the policy information, either via postal mail or designated online portal. Keep copies of all submitted documents for personal records, and follow up within a specified timeframe, usually 30 days, to confirm receipt and seek updates on the claim status.

Contact Information for Assistance

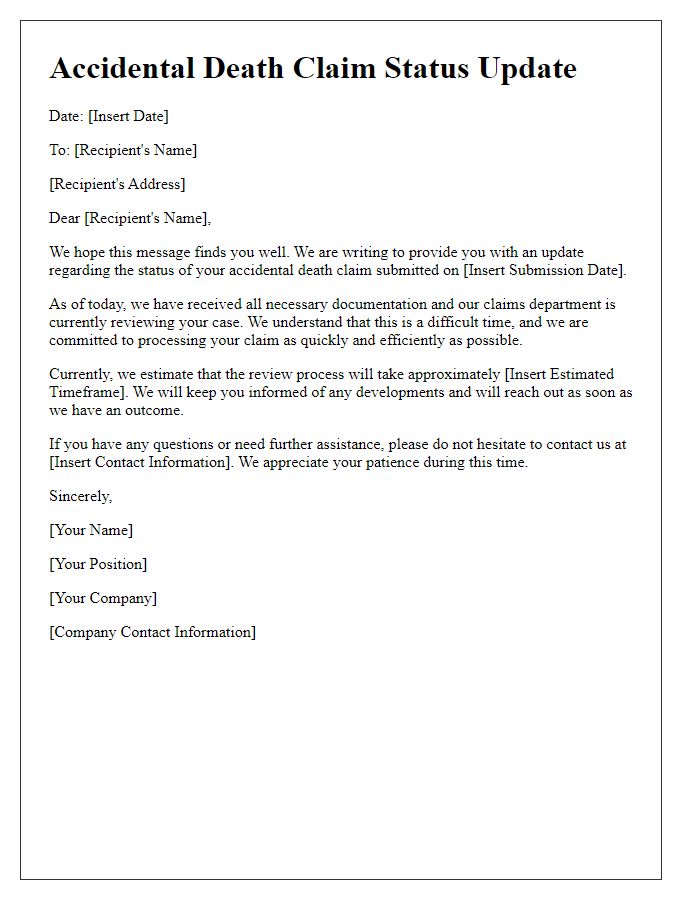

Accidental death claims require detailed documentation for processing through insurance providers. Essential documents include the death certificate, police report from the incident location (e.g., a specific street or event center), and the insurance policy number for verification. Contact information for assistance typically encompasses a dedicated claims hotline (often found on insurance cards or company websites), email addresses for claims department personnel, and physical addresses for mailing documents. Documentation must be managed with precision to ensure timely handling. Be aware that claim processing times can vary widely, often estimated between 30 to 90 days depending on the insurer's requirements and complexity of the case.

Comments