If you've ever found yourself wondering how to navigate the intricacies of filing an income protection insurance claim, you're not alone. Many people feel overwhelmed by the paperwork and requirements involved, but it doesn't have to be a daunting task. In this article, we'll break down everything you need to know about crafting the perfect letter template for your claim, ensuring you cover all the necessary details. So, let's dive in and simplify the process togetherâyour peace of mind is just a read away!

Policyholder Information

A letter template for income protection insurance claim requires essential details about the policyholder, the individual who holds the insurance policy. This section includes the policyholder's full name, contact information, and policy number, which serves as a unique identifier for the insurance contract. Providing accurate and current details ensures smooth communication between the claimant and the insurance provider. Additionally, including the policyholder's date of birth and address can help verify the identity and facilitate quicker processing of the claim. Proper formatting and clarity in presenting this information enhance the effectiveness of the claim submission.

Claim Details

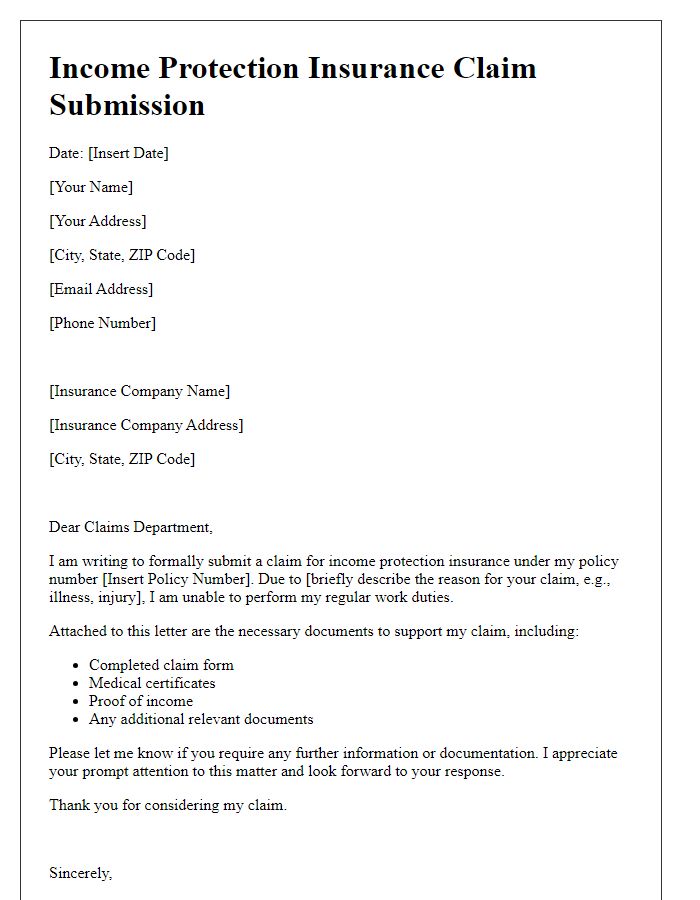

Submitting an income protection insurance claim involves detailed documentation of the policyholder's situation, including crucial elements such as the claim reference number, the policy number, and specific dates of the incident leading to the loss of income (e.g., medical conditions or accidents). This process typically requires medical reports from licensed healthcare professionals, demonstrating the inability to work, and any relevant financial statements outlining lost earnings during the recovery period. Clear identification of the insurance company involved, along with their claims department contact details, ensures prompt processing. It's vital to attach signed declarations confirming the accuracy of the information provided, as the claims review board may need to validate each component for approval.

Medical Documentation

A letter template for an income protection insurance claim requires precise and comprehensive medical documentation to substantiate the claim. Essential details include diagnosis from a qualified healthcare professional, treatment plans outlining prescribed medications or therapies, and any relevant medical history that illustrates the condition's impact on daily functioning. Clear and accurate information is crucial for insurance assessors to evaluate the claim effectively. Including supporting documents, such as medical certificates or test results, enhances the credibility of the claim. Organized documentation streamlines the processing of the claim, thereby facilitating a timely response from the insurance provider.

Employer Verification

An effective income protection insurance claim requires detailed employer verification. Employers must provide essential documentation, including employee payroll records, job title, and average earnings. Specific dates, such as employment start date and absence due to illness or injury, should be clearly outlined. Accurate information on the nature of the employee's duties and typical working hours strengthens the claim. All statements must be signed and dated by an authorized representative to ensure authenticity. Submission of this verification supports the claim process, facilitating timely assessment and potential approval of benefits for the affected individual.

Contact Information

Income protection insurance claims require specific contact information to ensure prompt processing. Policyholders must provide full name linked to the policy, policy number (unique identifier for reference), current residential address (to verify identity), and up-to-date phone number (for communication purposes). Additional contact email addresses may enhance communication. It is crucial to include details of the insurance provider such as company name (e.g. Zurich, AIG), mailing address (physical correspondence location), and name of the claims department representative, if known. Including these elements ensures accurate handling of the claim and expedites any necessary follow-up actions.

Letter Template For Income Protection Insurance Claim Samples

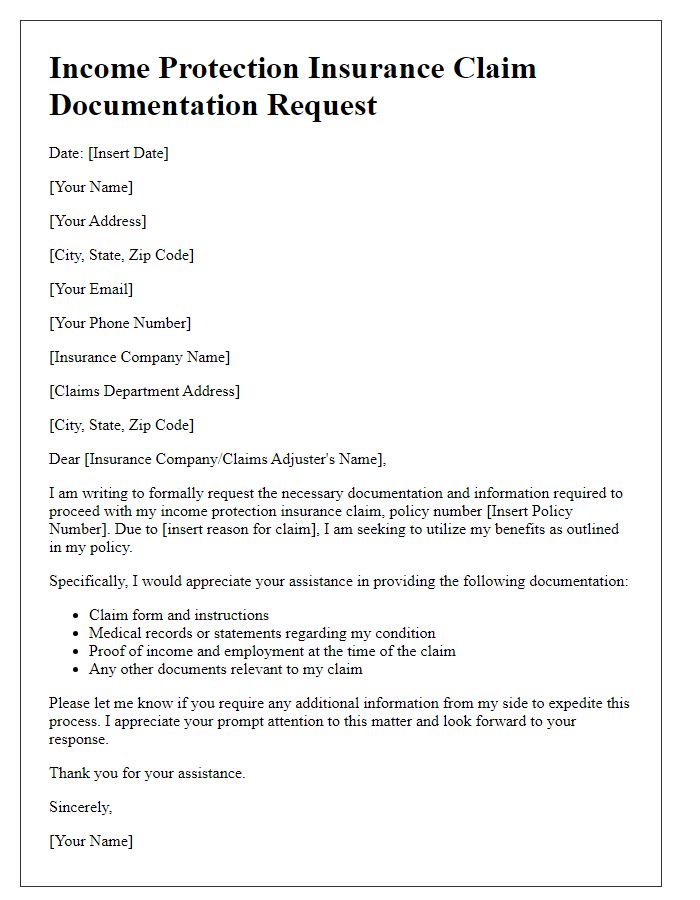

Letter template of income protection insurance claim documentation request.

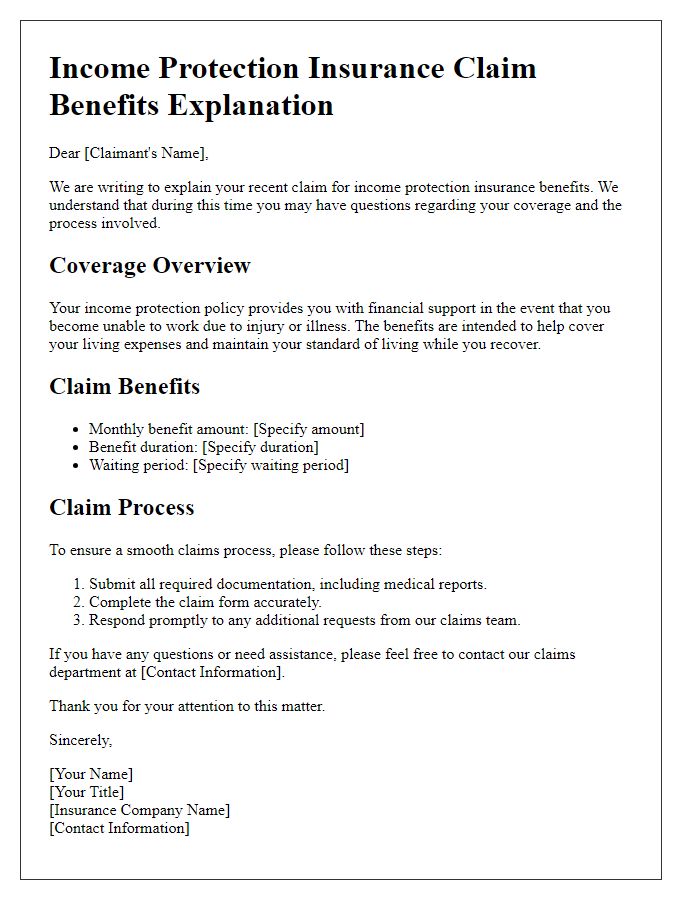

Letter template of income protection insurance claim benefits explanation.

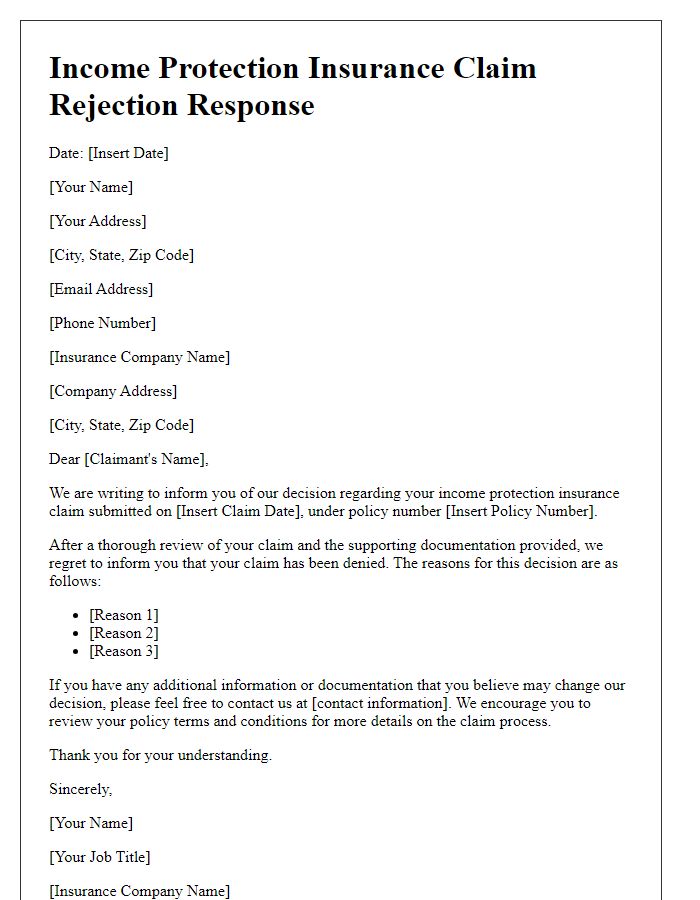

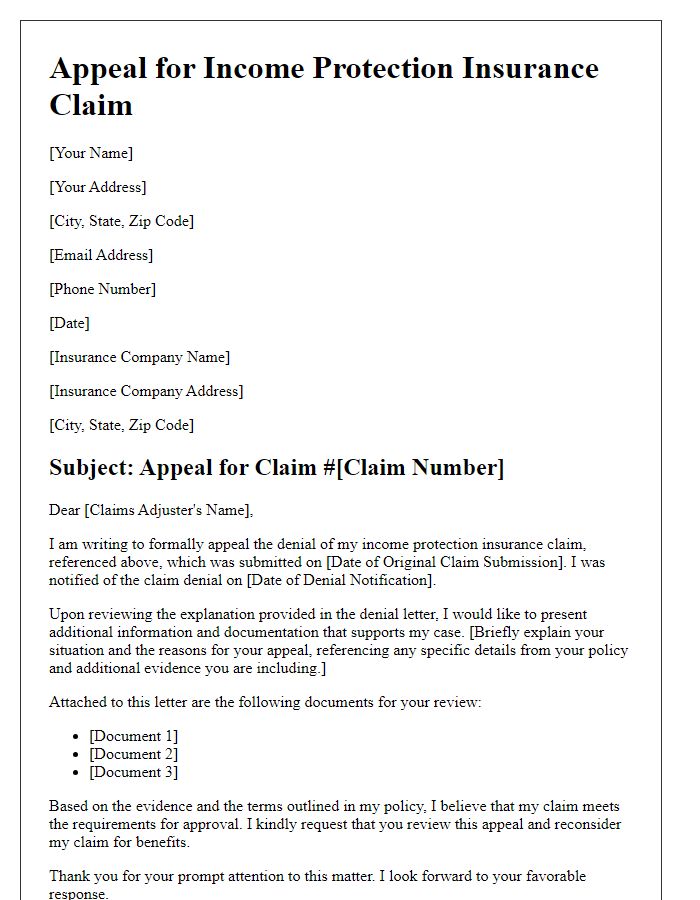

Letter template of income protection insurance claim rejection response.

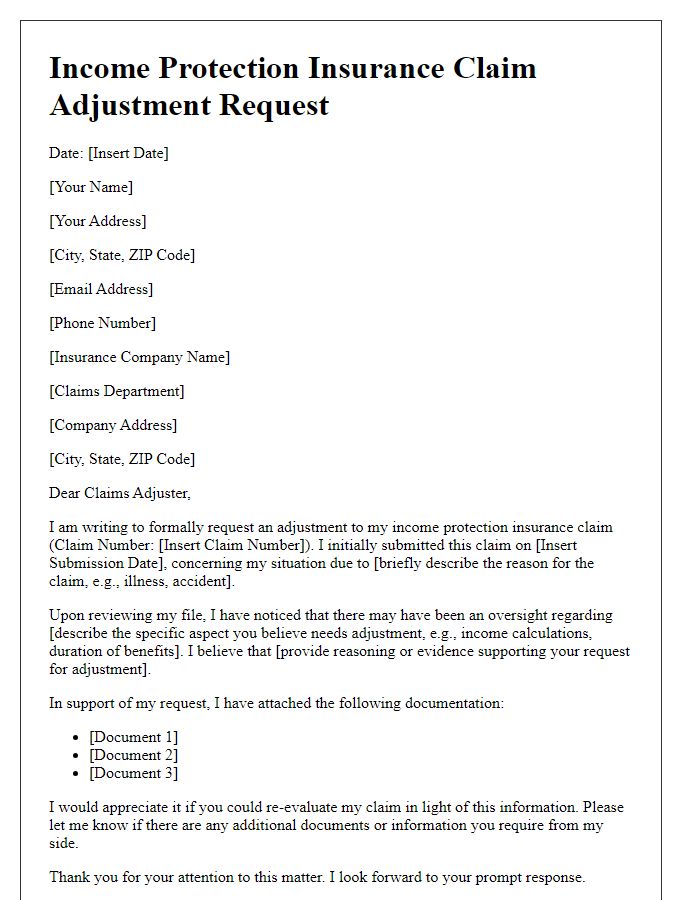

Letter template of income protection insurance claim adjustment request.

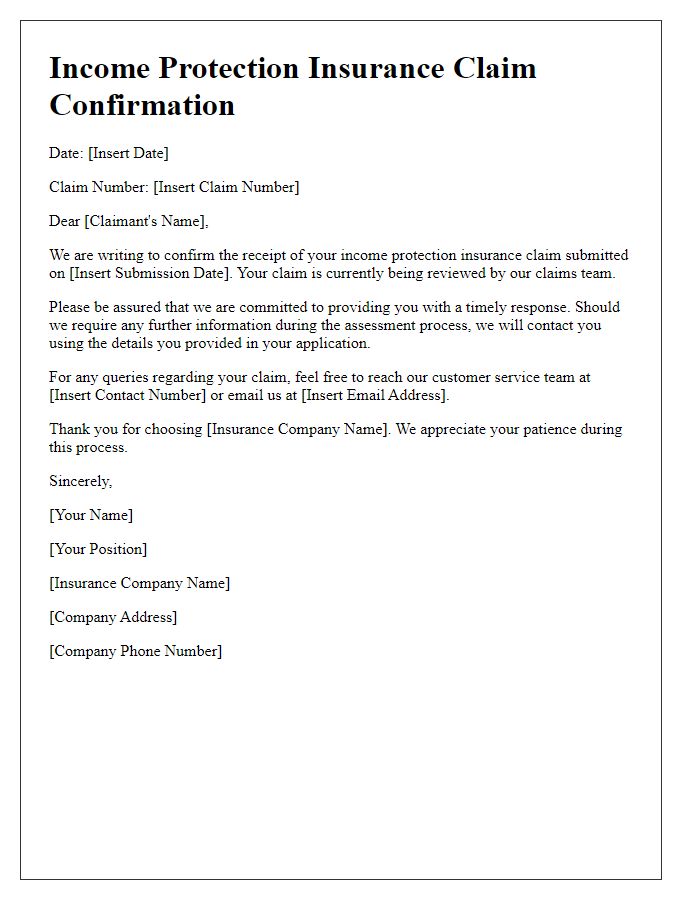

Letter template of income protection insurance claim confirmation notice.

Comments