Hello there! We understand that navigating the world of insurance can be a bit overwhelming at times, and we're here to help simplify the process for you. Whether you're looking for clarity on coverage options or need assistance with a claim, our team is dedicated to providing the support you need. So, if you're curious to learn more about how we can assist with your insurance inquiries, keep reading!

Personalization

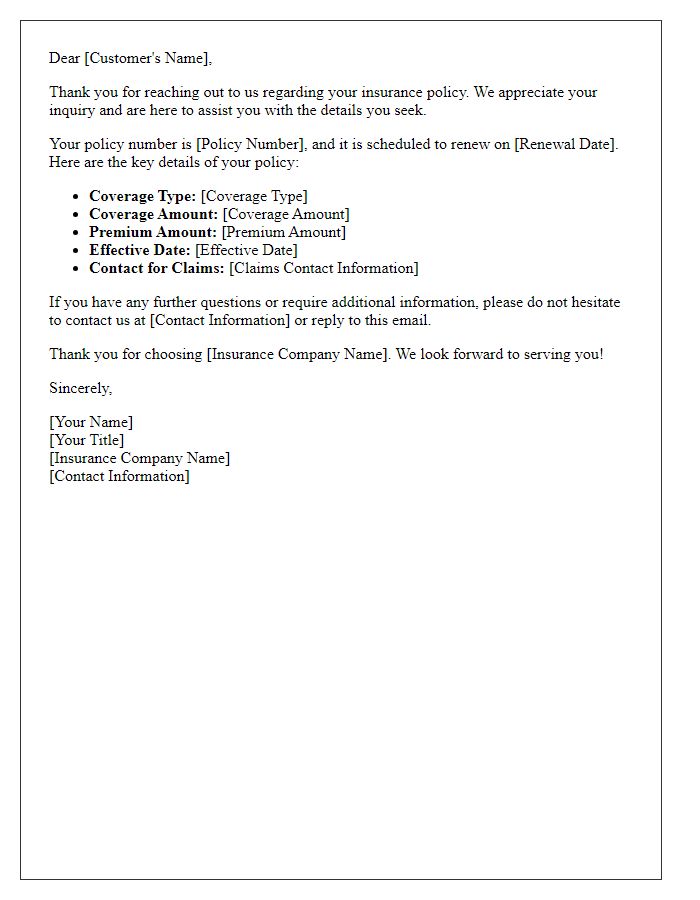

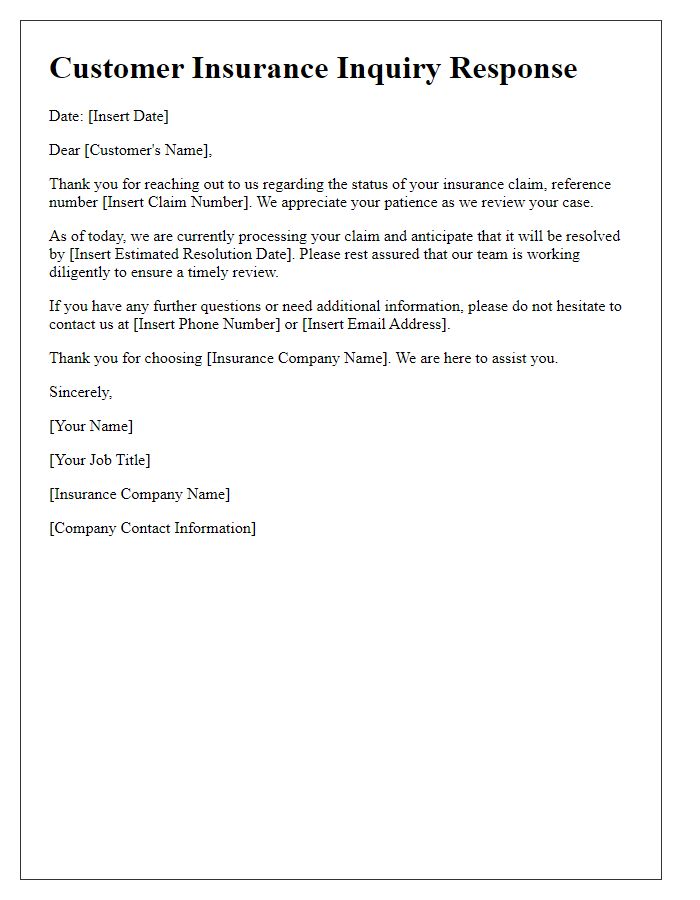

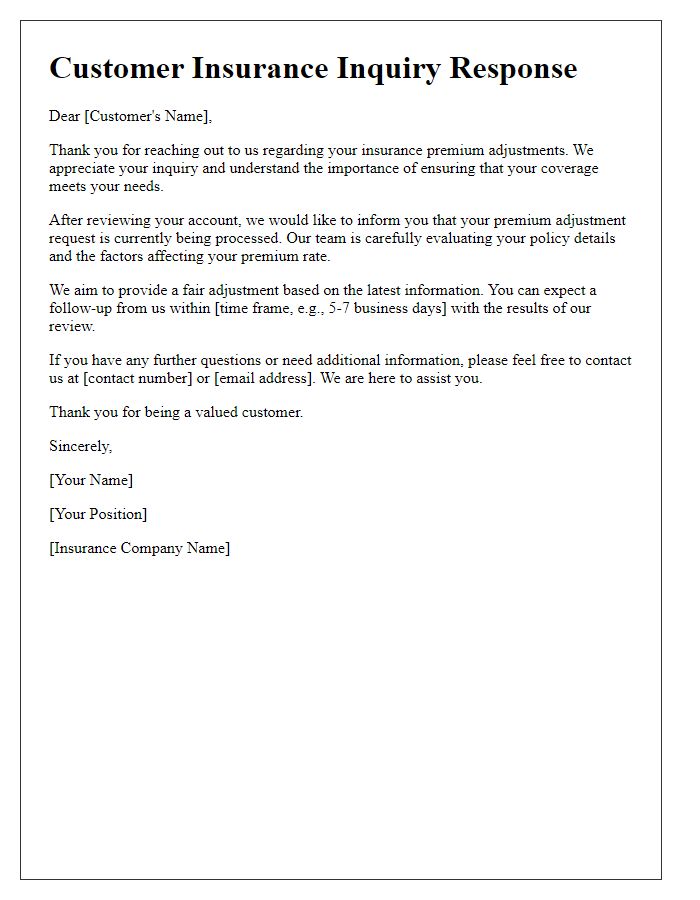

An insurance inquiry response must reflect personalization for customer satisfaction, enhancing trust and engagement. A client's name can create a welcoming tone, like "Dear [Customer Name]." Including specific details about their insurance policy, such as policy number or coverage type, establishes relevance. Acknowledging their unique situation, like "I understand your concern regarding the recent claim," shows empathy. Providing clear, tailored information about next steps, such as "You can expect a detailed response within 3-5 business days," sets expectations. Encouraging further questions fosters an open communication channel, inviting clients to feel comfortable seeking additional information, reinforcing the personalized approach in customer service.

Clarity and Conciseness

Insurance inquiries often involve specific details regarding coverage options, policy requirements, and claim procedures. Clear and concise responses are essential for effective communication between insurance agents and customers. Customers frequently seek information about the terms of their policies, such as coverage limits, deductibles, and exclusions. Accurate information regarding premium costs, payment options, and renewal dates is also critical. Additionally, agents must provide straightforward instructions for filing claims, including necessary documentation and timelines. Effective use of structured responses and bullet points can help simplify complex insurance jargon, enhancing customer understanding and satisfaction.

Contact Information

In the realm of customer service, providing accurate contact information is essential for effective communication. Phone numbers, typically formatted with area codes, should be easily accessible, enabling customers to reach support teams quickly. Email addresses must be monitored diligently, ensuring timely responses to inquiries related to insurance policies, claims statuses, and coverage options. Including physical addresses for office locations, such as regional or headquarters offices, enhances transparency and encourages customers to engage with representatives directly when necessary. Maintaining updated contact information not only builds trust but also fosters a seamless customer experience.

Relevance and Accuracy

In an insurance inquiry response, providing relevant information and maintaining accuracy are critical for customer satisfaction. Insured individuals often seek clarification on policy details, claim processes, and coverage options. Specific references to policy numbers and dates of incidents improve the clarity of the response. Utilizing precise terminology related to insurance, such as "deductibles," "premium," and "coverage limits," enhances understanding. The inclusion of contact information for the claims department or a dedicated representative ensures customers can easily follow up with additional questions. Accuracy in addressing each inquiry--whether about existing claims or potential coverage changes--builds trust and reinforces the company's commitment to excellent customer service.

Closing and Call to Action

When finalizing a professional response to a customer insurance inquiry, expressing appreciation is crucial. Highlight the importance of their questions regarding coverage options, claims process, or policy details. Encourage the customer to reach out for further questions or concerns. Reinforce your commitment to providing exceptional service. Include specific call-to-action steps, such as inviting them to contact you directly via phone at 1-800-123-4567 or to visit your online portal for detailed policy information. Thank them again for their inquiry, reinforcing the value you place on their interest in your insurance services.

Letter Template For Customer Insurance Inquiry Response Samples

Letter template of customer insurance inquiry response for policy details.

Letter template of customer insurance inquiry response regarding claim status.

Letter template of customer insurance inquiry response for premium adjustments.

Letter template of customer insurance inquiry response on coverage options.

Letter template of customer insurance inquiry response for renewal reminders.

Letter template of customer insurance inquiry response about benefits explanation.

Letter template of customer insurance inquiry response for service feedback.

Comments