Hey there! If you've ever found yourself in a bind with unpaid insurance premiums, you're definitely not alone. It's crucial to understand the potential consequences that come with letting these payments slip through the cracks, from policy cancellations to lapses in coverage. In this article, we'll explore what you need to be aware of and how to reclaim control of your insurance situation. So, let's dive in and uncover the details!

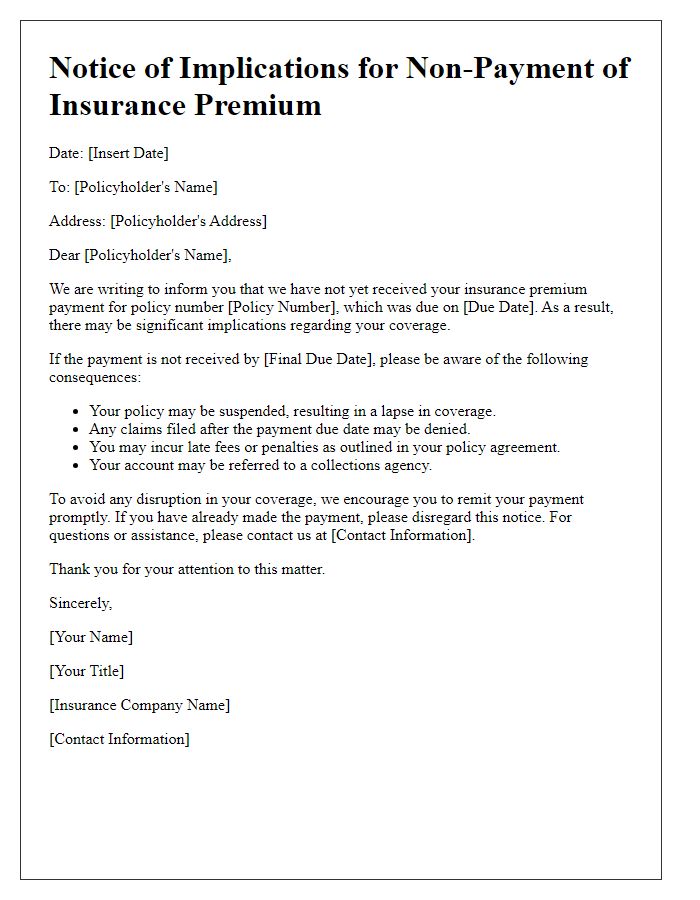

Policy Cancellation Notice

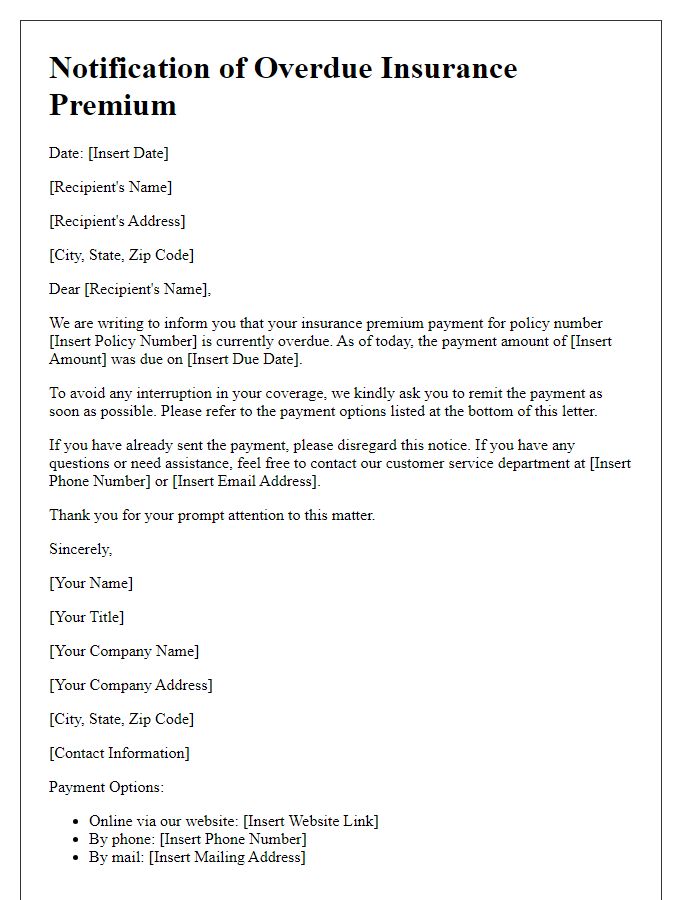

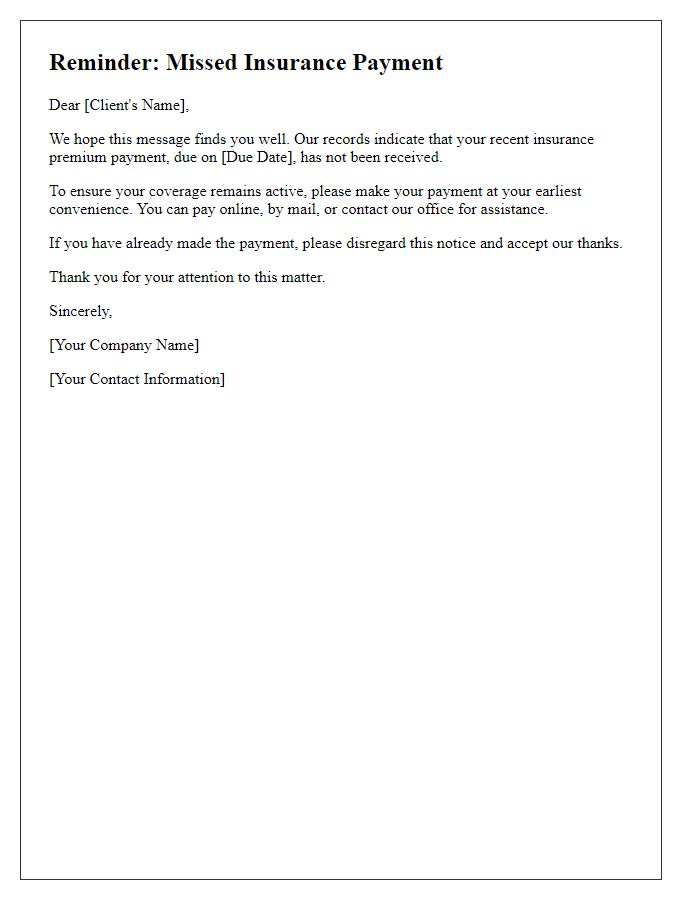

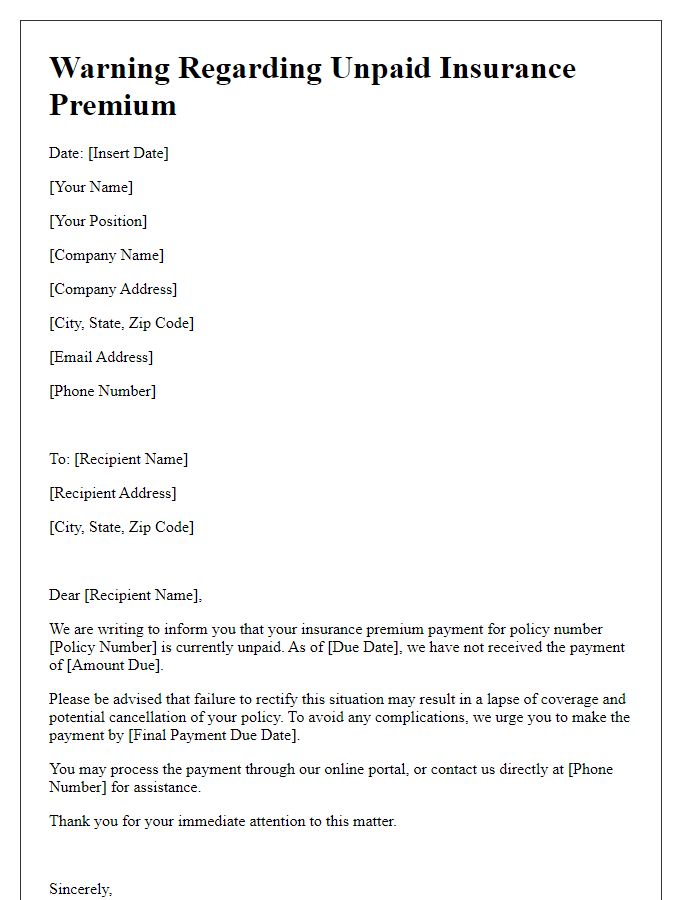

Unpaid insurance premiums can lead to significant consequences for policyholders, notably the cancellation of coverage. Insurance policies, such as auto and homeowners insurance, typically require timely premium payments, often on a monthly basis. When payments remain overdue for a specified grace period--usually ranging from 10 to 30 days--insurance providers may issue a Cancellation Notice. This document informs the policyholder about the impending cancellation, detailing the specific amount owed and the due date for payment. If the premium remains unpaid, the policy can be canceled effective immediately, leaving the insured exposed to potential liabilities. Furthermore, cancellation can adversely affect future coverage options and increase premiums when seeking renewal or new policies with different insurers.

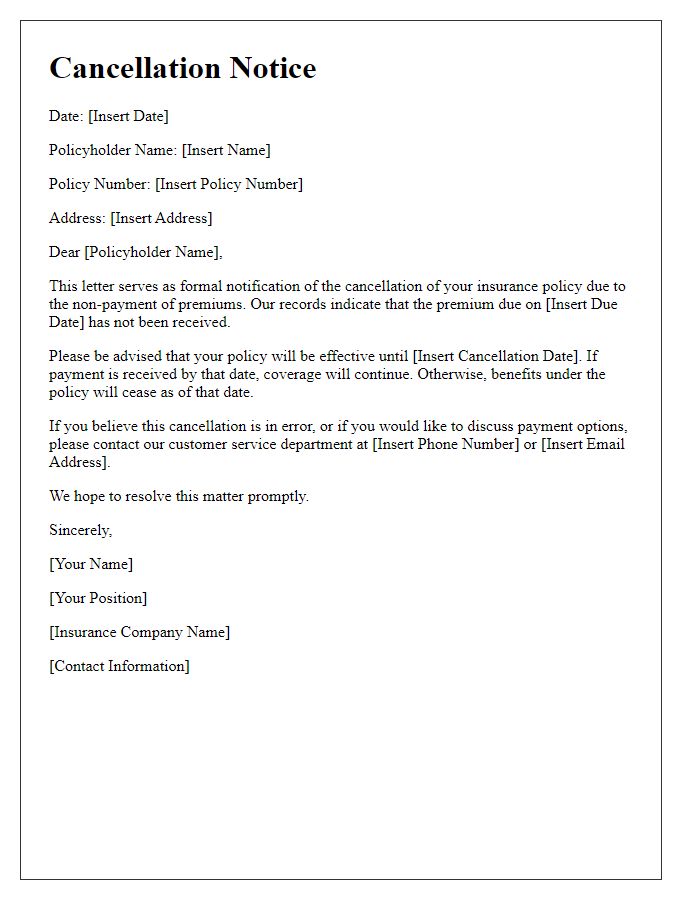

Reinstatement Procedures

Unpaid insurance premiums can lead to severe consequences for policyholders, including potential policy lapses resulting in the loss of coverage. Insurers typically allow a grace period, often ranging from 10 to 30 days, for overdue payments before cancellation. When policies lapse, reinstatement procedures vary by insurance company but often require the policyholder to remit the unpaid premium along with any applicable late fees. In some instances, insurers may mandate a written request for reinstatement, alongside proof of insurability, influencing the approval process based on underwriting criteria. Additionally, specific policies may impose restrictions or exclusions on claims made during the period of non-payment, further complicating the reinstatement process. Maintaining regular communication with the insurance provider can provide vital insights into the reinstatement obligations and potential penalties associated with unpaid premiums.

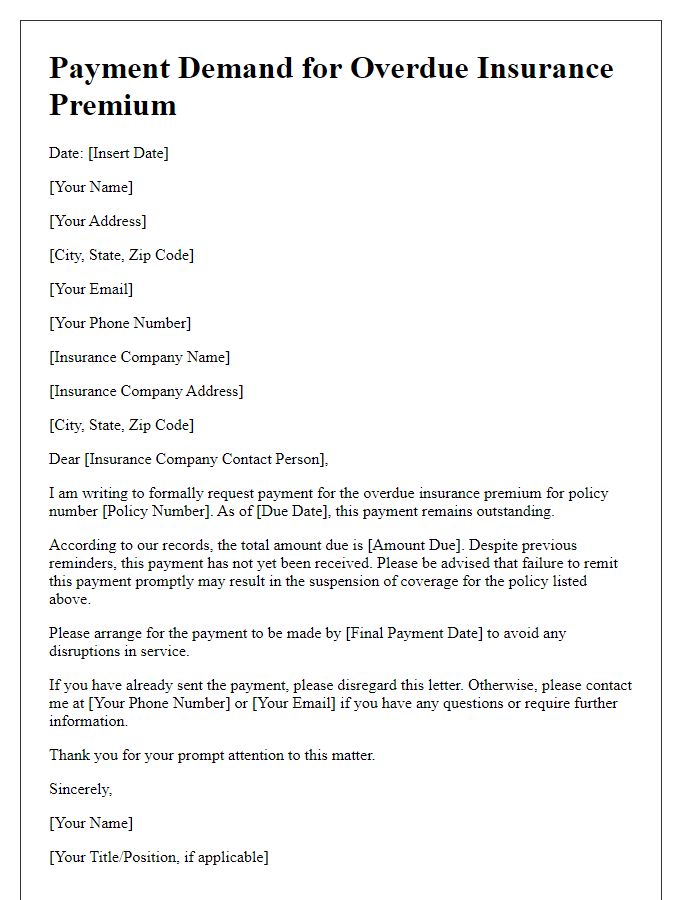

Late Payment Fees

Delayed payments for insurance premiums can lead to significant financial penalties. Insurers often impose late payment fees, which can range from $25 to $50 or more, depending on the policy and the provider. These charges accumulate with each subsequent missed payment, causing the total amount due to escalate rapidly. Additionally, failure to pay premiums on time may risk policy cancellation, leaving individuals without essential coverage such as health, auto, or homeowners insurance. This lapse in coverage can expose policyholders to substantial financial liability in case of accidents or emergencies, making timely payment critical for maintaining protection and avoiding costly consequences.

Impact on Coverage Benefits

Unpaid insurance premiums can lead to significant consequences for policyholders, such as the potential suspension or cancellation of coverage benefits. When premiums remain unpaid for an extended period, typically 30 days or more, insurers like State Farm or Allstate may initiate a grace period, providing a final opportunity for payment before service interruption. Failure to remit payment during this time can result in the voiding of claims and loss of protection, particularly for critical coverage types such as health, auto, or homeowners insurance. This situation may expose individuals to financial risk, especially in emergencies or significant incidents, underscoring the importance of timely premium payment to maintain policy effectiveness. Additionally, a lapse in coverage can lead to increased premiums or difficulty obtaining new policies in the future, as insurers often view non-payment as a red flag.

Communication Channels for Resolution

Unpaid insurance premiums can lead to severe financial consequences for policyholders, such as the potential cancellation of coverage. Policyholders may face risks like uncovered losses, requiring out-of-pocket expenses for damages or liabilities. Common communication channels for resolution include direct calls to customer service representatives, email correspondence with claims departments, or online chat options available on insurance company websites. Additionally, some companies provide mobile apps that enable policyholders to manage payments, check policy status, and seek assistance regarding unpaid dues. It is critical for policyholders to understand their grace period, typically ranging from 10 to 30 days, to avoid penalties or lapses in coverage. Persistently engaging these channels ensures that concerns are addressed promptly.

Comments