Have you recently encountered the exciting milestone of your life insurance policy maturing? It's a significant event that marks not only the completion of a crucial financial commitment but also opens up new avenues for future planning. Understanding what to expect during this process can significantly ease any concerns and help you make informed decisions about the benefits you'll receive. Join us as we dive deeper into the essentials of managing your life insurance maturity and explore your best options moving forward!

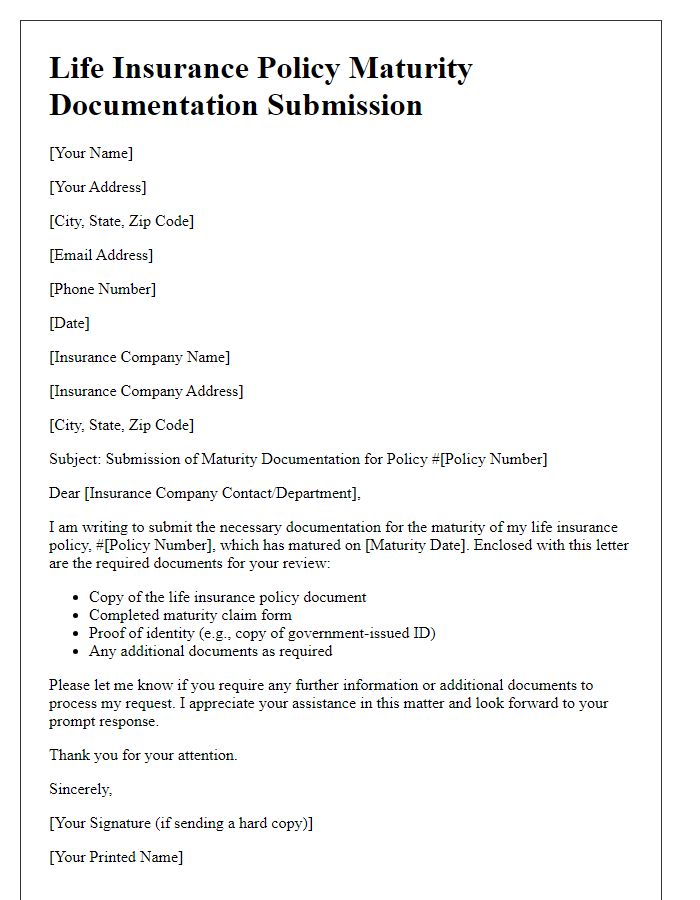

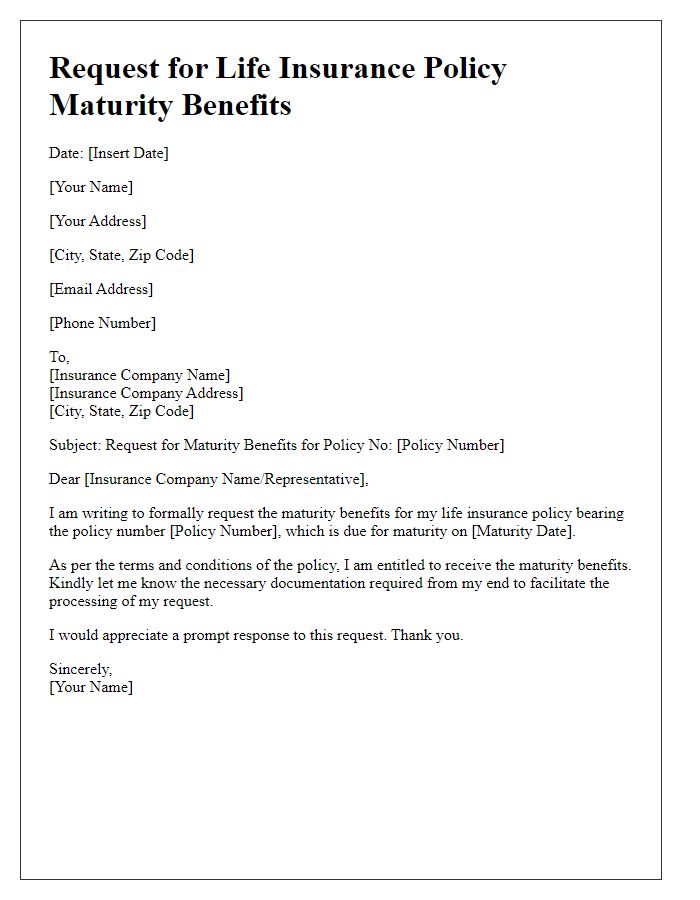

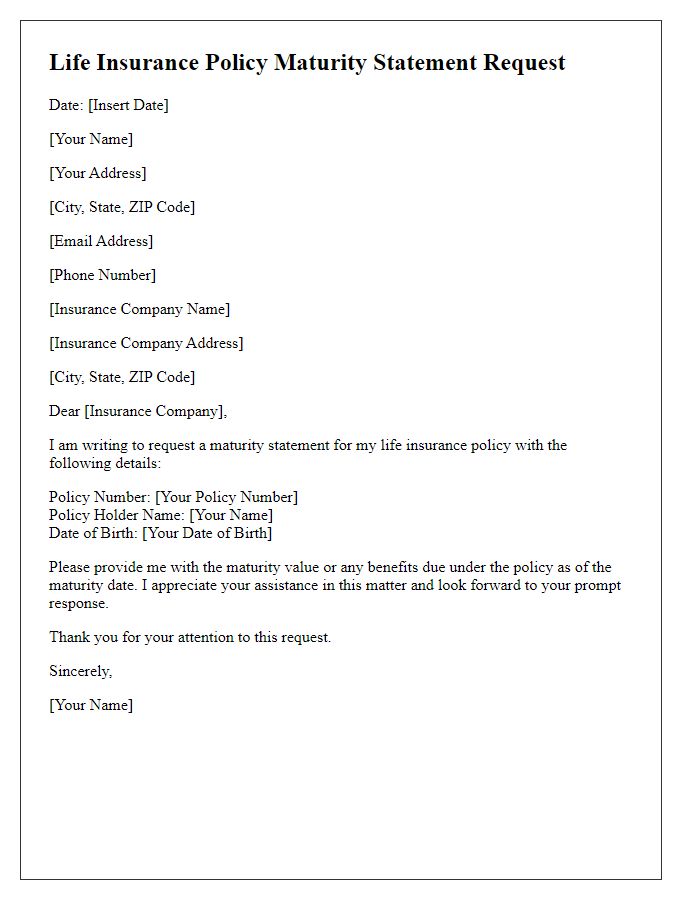

Policyholder's full name and contact information.

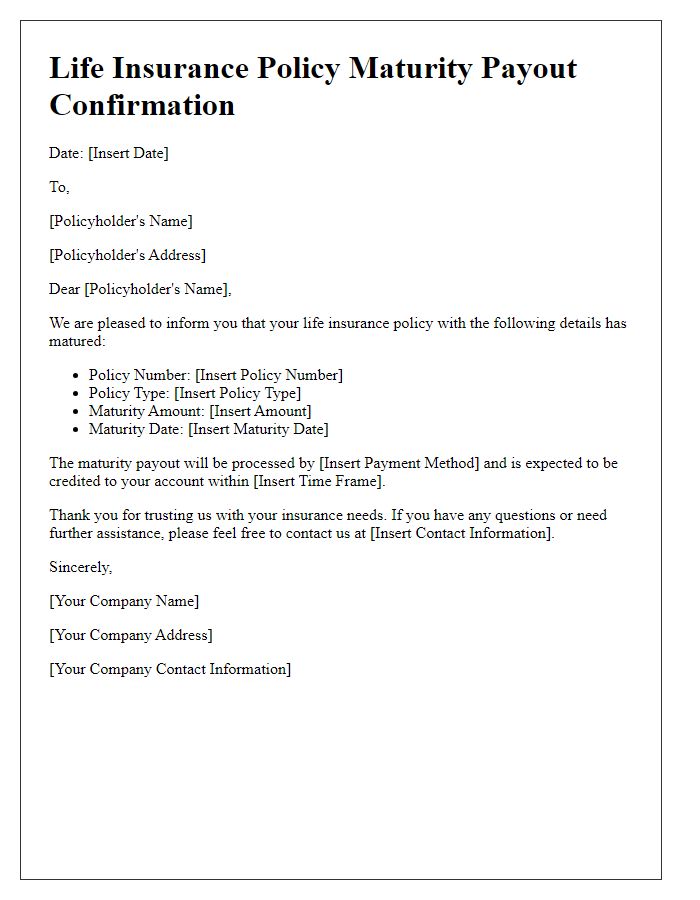

Life insurance policy maturity marks an important milestone for policyholders like John Smith, who resides at 1234 Elm Street, Springfield, IL 62701, with a contact number of (555) 123-4567. Upon reaching maturity, the policyholder may receive a lump sum payment, potentially amounting to $50,000, depending on the terms of the insurance contract. This payment can provide financial security for beneficiaries or serve as a vital resource for retirement planning. Additionally, maturities often coincide with significant life events, such as the end of a business cycle or entering a new life stage, offering ample opportunities for investment or savings. Understanding the maturity details ensures policyholders maximize their benefits.

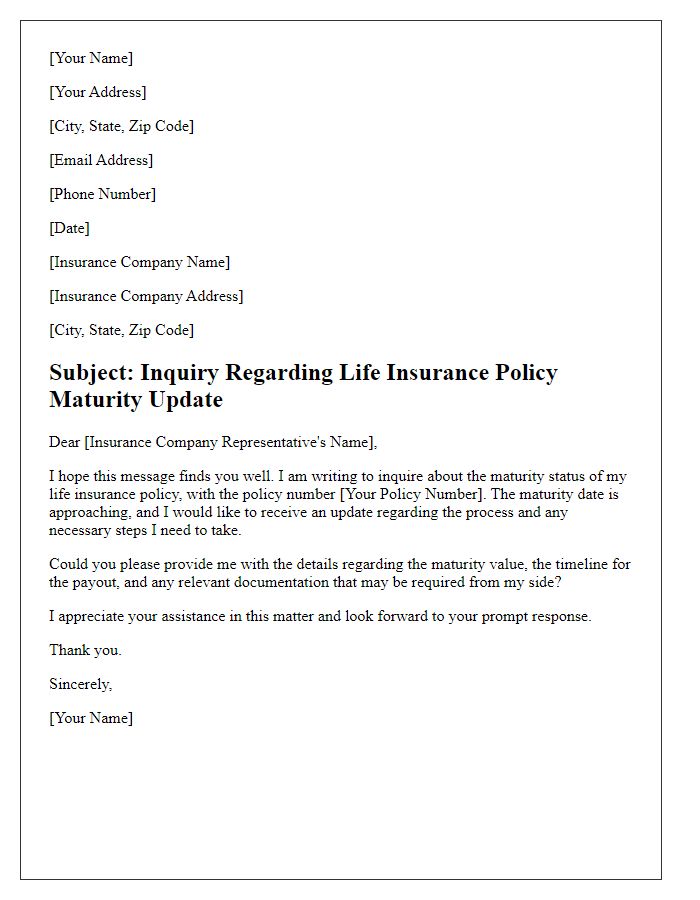

Policy number and maturity date details.

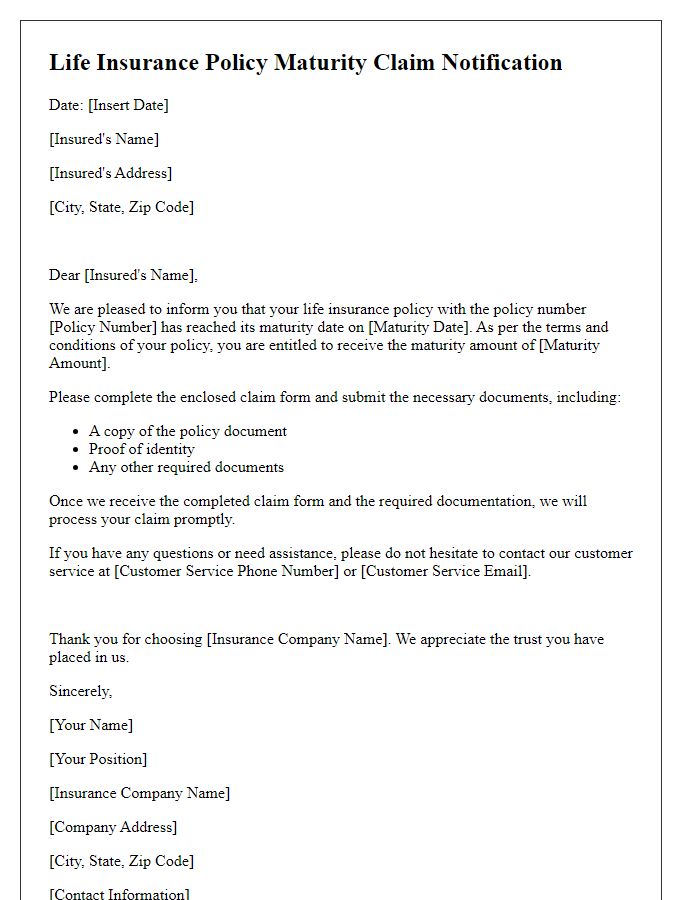

Upon reaching the maturity date of a life insurance policy, such as Policy Number 123456789, which matures on December 31, 2023, policyholders receive a payout. This payout is typically calculated based on the sum assured plus any bonuses accrued over the policy's lifespan. For example, in a traditional whole life policy, if the sum assured is $100,000 and accrued bonuses add another $20,000, the total amount payable would be $120,000. It's essential to review the terms of the policy, as conditions may vary by insurance provider, such as ABC Insurance Company. Claim processes often require completing forms and providing identification proof in specified locations or online portals.

Benefit amount and settlement options.

Insurance policy maturity occurs when a life insurance policy reaches its predetermined end date, allowing the policyholder to receive benefits. The benefit amount, determined by the original coverage and any accrued bonuses, can vary significantly based on the policy type. For instance, whole life policies may offer substantial lump-sum payments, while endowment policies accumulate cash value over time. Settlement options for benefit disbursement include lump-sum payments, which provide immediate access to the funds, or structured payouts, which involve monthly installments over a specified period. Additional choices may include life income options, ensuring ongoing payments during the policyholder's lifetime. The decision regarding settlement options impacts tax implications as well as financial planning for beneficiaries, especially following policyholder events such as retirement or unexpected passing. Understanding these parameters is crucial for maximizing the financial legacy intended for loved ones.

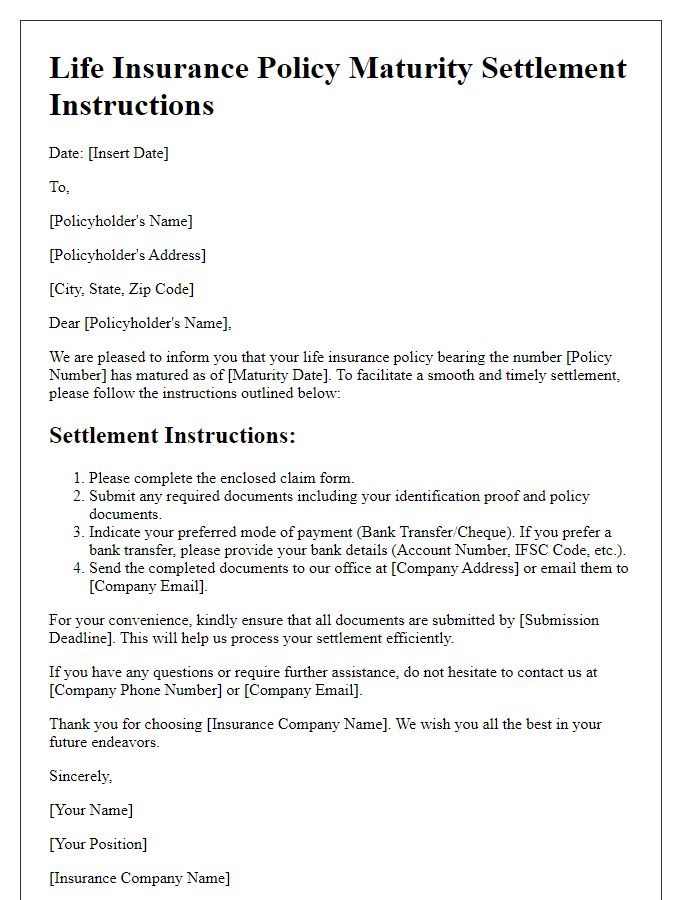

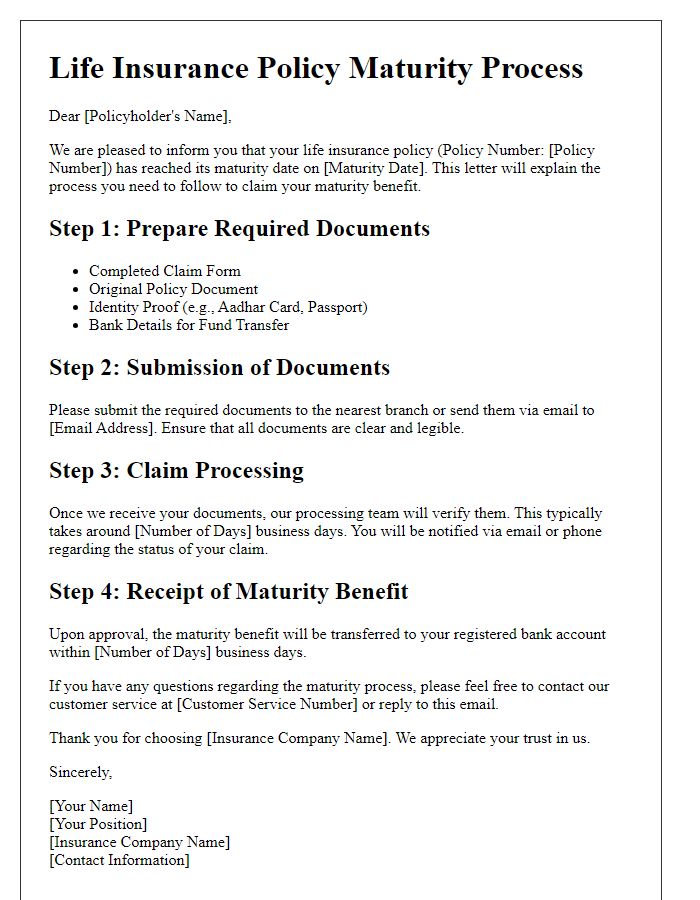

Instructions for claim or fund disbursement.

A life insurance policy reaching maturity requires precise instructions for claim or fund disbursement. Policyholders must submit a completed claim form, which includes personal identification details, the policy number, and the date of maturity (often noted as the end date of the policy term). Essential documents may include the original policy document, a government-issued ID, and bank account information for fund transfer. Claims typically must be filed within a specified period post-maturity, often 30 to 90 days, depending on the insurance company's policies. Contacting the customer service department of the insurance provider for clarification or assistance can help facilitate the disbursement process smoothly. Timely submission ensures that benefits are received without unnecessary delays.

Contact information for assistance or inquiries.

Life insurance policy maturity signifies the end of a specified term, generally 10, 20, or 30 years, resulting in significant financial benefits for policyholders. During this phase, beneficiaries may receive death benefits or maturity benefits, depending on the type of policy (e.g., whole life or term life). Policyholders must address inquiries related to their policy maturity to the life insurance company using designated contact information, usually provided in a policy document. Common channels for assistance include customer service hotlines, emails, and online portals, ensuring prompt resolution and clarity on payout procedures and options available upon maturity. Such contact information (like phone numbers or email addresses) typically appears on official correspondence or the company's website, guiding policyholders through the maturity process effectively.

Letter Template For Life Insurance Policy Maturity Samples

Letter template of life insurance policy maturity settlement instructions

Letter template of life insurance policy maturity documentation submission

Comments